As user numbers decline and funding slows, the once-hyped web3 gaming sector appears to be approaching a potential crossroads.

Blockchain gaming faced a brutal Q2 in 2025. Daily players plummeted by 17%, and over 300 gaming dApps flatlined. The crypto winter bit deep, with investment sinking to a two-year nadir. Yet, even as the icy winds howled, gaming titans like Sega, Ubisoft, and FIFA continued their march into the web3 frontier.

While the market stumbles, savvy developers and forward-thinking brands are already laying the groundwork for the next boom, betting big on the enduring power of innovation.

Fragility struck Web3 gaming in early 2025, exposing vulnerabilities in nascent projects, according to DappRadar analyst Sara Gherghelas’s unsettling Q1 findings.

Web3 gaming: a graveyard of broken dreams. Ambitious MMORPGs crumble, play-to-earn promises ring hollow, and digital battlefields fall silent. The exodus is real. Funding dries up, player counts plummet, and the grim reaper of unsustainable tokenomics claims its digital victims. The gold rush is over; now, only ghosts remain.

Sara Gherghelas

While Bitcoin and select blue-chip cryptos like Ethereum and Solana weathered the storm relatively unscathed, the broader crypto market bled profusely. Forget a dip – it was a digital bloodbath. Delphi Digital’s data paints a grim picture: AI frameworks were decimated, shedding a staggering 84% of their value. Agent-based projects weren’t far behind, collapsing by over 70%. Even the usually resilient memecoins took a 51% hit, and gaming infrastructure crumbled, losing more than half its worth. In contrast, Bitcoin merely flinched, dropping a comparatively minor 5%, while Ethereum and Solana, bruised but not broken, retreated by roughly 25% each. The divergence highlights a brutal flight to safety amidst market turbulence.

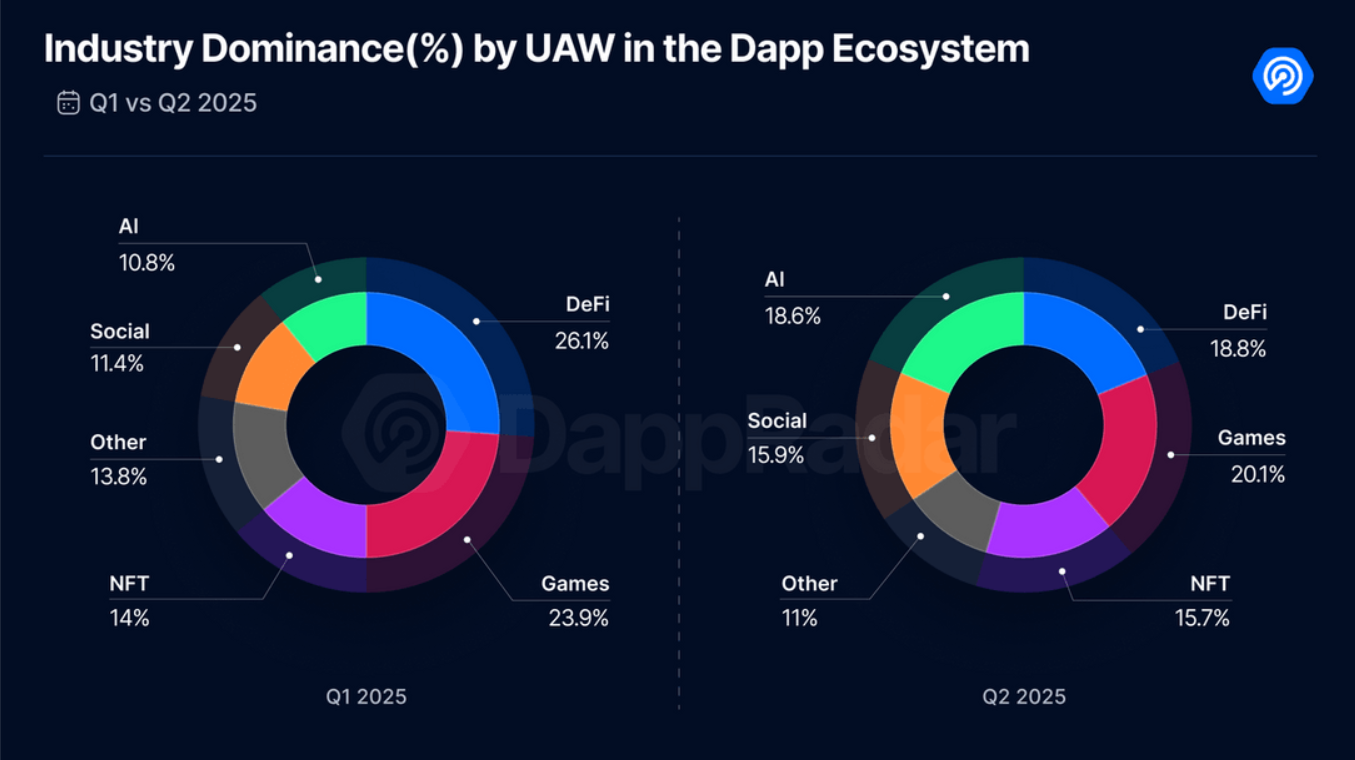

Industry dominance percent by UAW in the dApp ecosystem | Source: DappRadar

Remember the crystal ball gazing last year? Binance’s survey painted a bullish picture for AI tokens and memecoins, forecasting market dominance by 2025. Fast forward, and the reality is a stark contrast. The anticipated surge fizzled. Instead, these sectors became bloated, victims of hype outpacing genuine utility. Web3 gaming experienced a similar fate. The initial allure of “play-to-earn” proved unsustainable, leaving many early models crumbling under the weight of long-term viability.

Not over yet

Behind closed doors, a revolution may be brewing. Just months ago, Immutable’s Robbie Ferguson dropped a bombshell: Billion-dollar gaming giants, some publicly traded, are warming up to the idea of launching their own crypto tokens. A year ago, this was unthinkable. Now, the winds of change are clearly blowing.

Ferguson predicts 2025 will be a blockchain game development supernova, squeezing years of innovation into months. The result? A surge in polished, captivating blockchain games, and token economies that finally offer real value and utility to players.

Q2 wasn’t all gloom for gaming. Daily users dipped to 4.8 million, a low since early 2023, but sparks of brilliance ignited on specific chains. DappRadar’s data paints a vibrant picture: opBNB blazed the trail in active wallets, while WAX throbbed with activity, dominating transaction counts and hinting at intensely dedicated players. Emerging forces like Aptos, Sei, and SKALE also pulsed with fresh gaming energy.

“Off the Grid” isn’t just on the radar; it’s blazing trails. Powered by GUNZ, a custom Avalanche subnet, this game is generating serious buzz. Even in its testing phase, intrepid players are already diving headfirst into its mainnet, a testament to its irresistible pull.

You might also like:

The global gaming renaissance will die a premature death without Europe | Opinion

But the GameFi graveyard is growing. DappRadar reports a chilling statistic: over 300 games, vibrant with on-chain life in Q1, went silent in Q2. Did they succumb to the crypto winter? Did they simply fade away, unable to adapt? Or did they migrate to new digital realms, abandoning their old contracts? As Gherghelas points out, this rapid turnover is a stark reminder of the volatile, experimental nature of this burgeoning industry.

Once-promising blockchain gaming ventures are crumbling like digital castles in the sand. Remember the Ember Sword hype? Extinguished, choked by funding woes. Nyan Heroes, once purveyors of pixelated heroism, now lie in token value ruins. Realms of Alurya’s magic faded when a critical grant vanished. Mojo Melee’s warriors traded their swords for AI film tools, a stunning strategic retreat. Even the undead couldn’t cheat fate: The Walking Dead: Empires shuffles off this mortal coil at the end of July.

The metaverse: a land of paradoxes. While NFT trading volume took a 26% nosedive this quarter, the sales counter surged an impressive 54%. Translation? The metaverse is buzzing with activity, even as prices take a tumble. It’s a buyer’s market in a world still under construction.

The metaverse pulse quickens: Yuga Labs throws open the doors to Otherside 24/7, beckoning explorers to an always-on adventure. Not to be outdone, Animoca’s Mocaverse is forging its own path with a Layer 1 chain, championing digital identity and data sovereignty. Meanwhile, Pixels dials back expansion, sharpening its gameplay core – whispers abound of “Pixels Pals,” a mobile offshoot promising pocket-sized fun later this year. And The Sandbox? They’re not clowning around, having unleashed a 40-experience season and now partnering with Cirque du Soleil for a metaverse spectacle that bends reality.

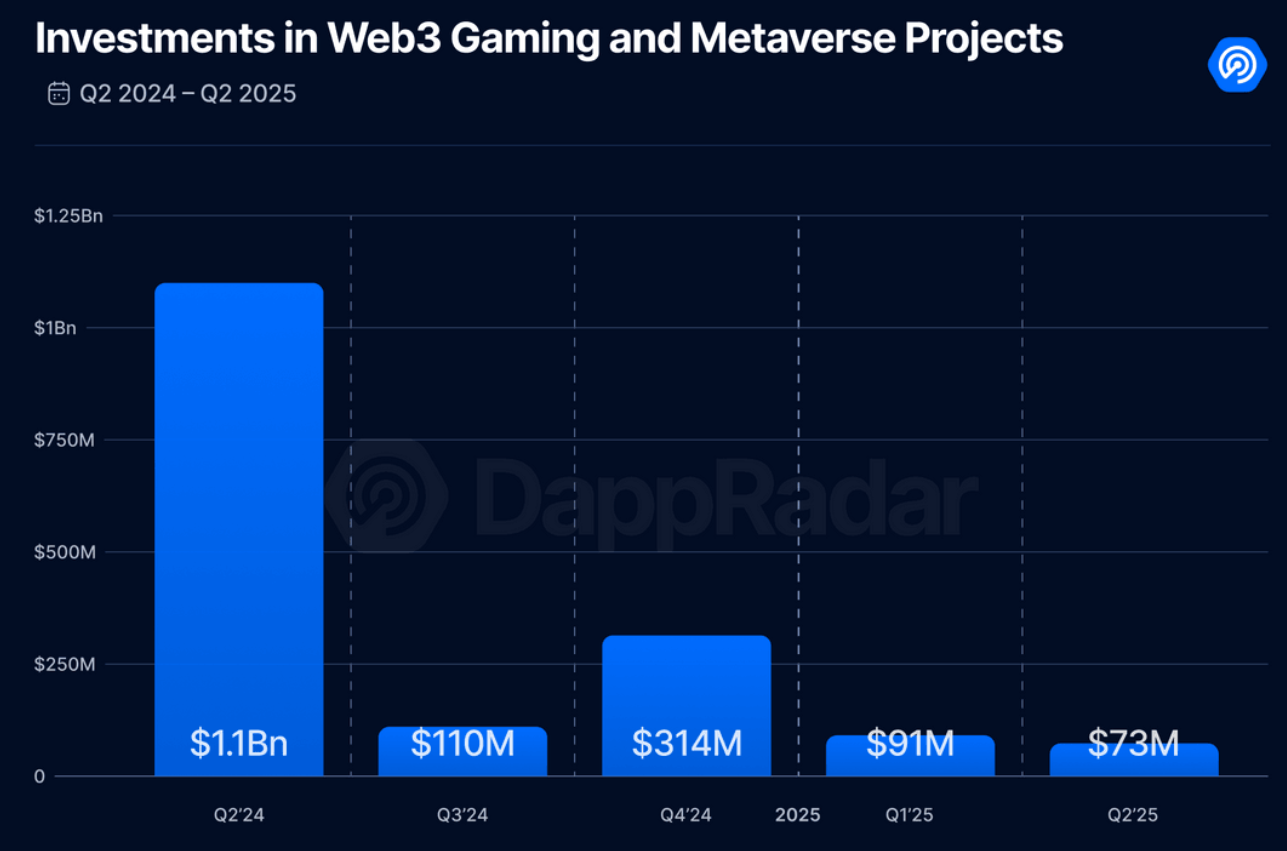

Investments in web3 games by quarters since early 2024 | Source: DappRadar

VC funding for blockchain gaming is in a deep freeze, plummeting 93% year-over-year to a mere $73 million in Q2. But look closer: the ice age isn’t hitting everyone equally. Investors are still strategically placing bets, but they’re backing shovels and pickaxes, not necessarily the finished gold. Infrastructure is king. Ultra hauled in a cool $12 million to supercharge its publishing platform, while MagicBlock pocketed $7.5 million to forge a cutting-edge, real-time gaming engine on Solana. Even Cooking.City is heating things up with a $7 million infusion to build a token-rewarding culinary game. The message is clear: build the picks and shovels for the next gold rush, and you might just strike it rich.

Forget the fleeting frenzy of ’21 and ’22. The real game now? Solid foundations and unwavering commitment. The dazzling hype is fading, but beneath the surface, the bedrock for what’s next is quietly being built.

Read more:

Soneium layer 2 launches gaming incubator to support projects and drive ecosystem adoption

Thanks for reading Crypto games are struggling in 2025 but big brands aren’t giving up