The global cryptocurrency market suffered a severe decline on January 21, 2025, when its total market capitalization lost an estimated $150 billion in just 24 hours. watchers first reported this dramatic incident, which saw Watcher report on. Guru, who sparked shockwaves through digital asset markets around the world, sent traders and institutions alike to urgently analyze. Thus, as such this one-day decline is one of the most important capital outflows in recent crypto history, highlighting how volatile it is for its asset class. In addition, the scale of loss requires a thorough study of theunderlying catalysts and possible implications.

Crypto Market Cap Crash: Analyzing the $150 Billion Decline

The $1billion loss in crypto market cap is a significant percentage drop from previous valuation levels, according to the reported $150 billion loss of its value. This incident is compared to other notable market corrections, so we can compare this event with context-sensitive . Similarly, in the May 2021 crash (about $500 billion loss over a week), and November 2022 FTX collapse caused ‘200 billion drawdowns’. Thus the January 2025 incident, which has a rapid concentrated event is best known for its speed. It confirmed the plunge, which affected nearly all major assets, with Market data from top aggregators such as CoinGecko and coinMarketCap. The market leader, Bitcoin (BTC), usually dictates more general sentiment. Similarly, major altcoins such as Ethereum (ETH), Solana (SOL) and Cardano (ADA) were at least moderately declined in the same way; often steeper. The slack-off is not an issue isolated to one project, but this widespread sell-Off suggests that there’s more systemic risk-down approach than just another problem.

Immediate Catalysts and Market Triggers

There were several competing factors that probably came together in order to trigger the sharp sell-off. Analysts point to largely shifting macroeconomic expectations, especially in the context of . The hawkish signals or stronger-than-expected inflation data from central banks can quickly reduce investor appetite for high risk assets such as cryptocurrency. In addition, many large liquidations in the derivatives market oftenexacerbate downward moves. The cascade of selling pressure is created when leveraged long positions are closed forcibly shut down as prices fall. Furthermore, in addition to the on-chain data that can reveal movements of large holders (known as “whales”). Large buy order is usually preceded with major sell orders, ” Significant transfers to exchange wallets. Finally, regulatory news from key jurisdictions (e.g. the United States or the European Union) can immediately affect market sentiment. The combination of these elements made a perfect storm for the crypto market capcap.

Historical Context of Cryptocurrency Volatility

The defining feature of cryptocurrency markets is Volatility. This event, which was held on January 2025, is a historical pattern of sharp corrections after periods of expansion. The 2017 bull run, for example, reached a peak before an 80% market cap decline over the next year. Likewise, the 2021 cycle saw several drawdowns of more than half for large assets. They often correlate with broader financial market stress, especially in important ways. Crypto markets slid with traditional equities in the 2020 COVID-19 crash, but recovery was faster than usual for crypto markets — although it had been more difficult to recover from this disaster. This historical perspective is important for investors to have a long-term view of this investment. But while drops are severe, they are not unprecedented,” it demonstrates. Market structure has also evolved under the term “Market Structure”. New dynamics have been a result of the rise of institutional custody, regulated futures products and spot Bitcoin ETFs. They may help reduce volatility in the long term, but also play a role in big capital rotation in short term.

Recent Major Crypto Market Cap Declines

| Date | Approximate Loss | Primary Trigger | Recovery Timeframe |

| — | — | — | — |

| May 2021 | $500B+ | China mining ban, ESG concerns | ~5 months |

| Nov 2022 | $200B+ | FTX exchange collapse | ~8 months |

| Jan 2025 | $150B | Macro pressures, derivative liquidations | TBD |

The Role of Derivatives and Leverage

Crypto markets are highly complex derivatives of complex financial derivative, and have a deep connection with modern crypto markets. The high leverage platforms that provide perpetual futures contracts increase both gains and losses. In the January 21 sell-off, data from Coinglass showed liquidations of more than $2 billion in less than 24 hours. They were largely long positions betting on price increases, predominantly. Such a liquidation engine drives rapid price discovery down the road, fueling this process of finding prices. They create a feedback loop of selling when positions are automatically closed. Consequently, activity in derivatives market tend to drag spot market prices lower. It also helps explain how the losses in crypto markets can be so abrupt and severe compared to traditional assets. Regulators repeatedly label this use of leverage as a systemic threat. Nevertheless, it remains one of the core elements in crypto trading history, meaning that volatility events will likely return to their normal counterparts.

Impact on Investors and the Broader Ecosystem

A $150 billion crypto market cap loss has a profound impact on the immediate aftermath of it, which is multifaceted. portfolio values are likely to drop dramatically, triggering emotional selling for retail investors. Such incidents are examples of risk management frameworks and custody solutions for institutions, which test risk control framework. It also strains projects within the ecosystem to be a project that is under pressure from Projects in the same area. Unfortunately, as users withdraw assets, total value locked (TVL) drop in decentralized finance(DeFi), protocols often sees a decline of the entire amount that is typically associated with DeF). On the other hand, non-fungible token (NFT) trading volumes and floor prices typically drop significantly. The transaction and gas bill-based network activity, known as network traffic (i.e. A paradoxically, bear markets can promote innovation paradoxally from a development perspective. Teams often focus on building basic technology rather than marketing. In addition, funding conditions are strained (especially in the case of venture capital-backed startups) and can be tighter. It is a key part of the long-term health of ecosystems that can weather these storms and continue to develop utility-driven applications.

- Portfolio Revaluation: All investors must reassess their asset allocation and risk exposure.

- Liquidity Stress: Exchanges and protocols manage sudden spikes in withdrawal requests.

- Regulatory Scrutiny: Policymakers often increase oversight following major volatility events.

- Media Narrative Shift: Coverage turns from innovation and adoption to risk and speculation.

Expert Analysis and Market Sentiment Indicators

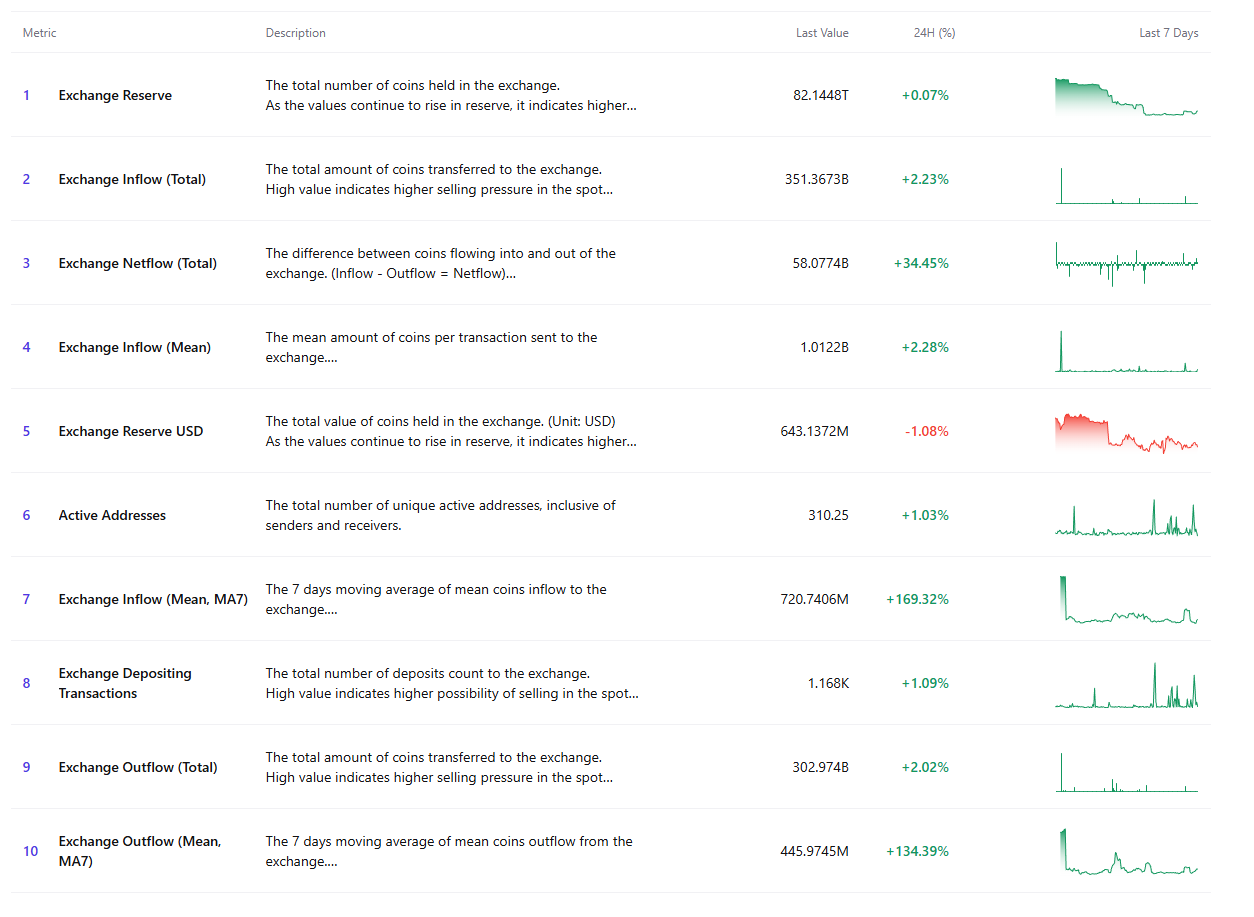

Market analysts provided measured commentary after the crash, which led to market analyst analysis of . Many emphasized that short-term price action should be separated from long-time network fundamentals. The companies such as Glassnode often analyze on-chain data to determine whether selling is based on short-term speculators or long-lasting holders. Investor behavior is reflected in the way metrics such as the MVRV ratio or exchange net flows are used. In addition, sentiment measures like the Crypto Fear & Greed Index typically enter into ‘extreming fear’ territory at such times. For many years, this has also offered an alternative to the contrarian buying opportunity for patient investors. But experts caution against “catch a falling knife” and recommended disciplined dollar-cost AP strategies during periods of high volatility. However, the consensus remains that it is better to know what underlying technology’s value proposition means than reacting to daily price swings.

Conclusion

A powerful reminder of the digital asset market’s volatility is that it has lost $150 billion from the total crypto market cap on January 21, 2025. This was a result of ‘the inter-related macroeconomic pressures, derivatives market liquidations and changing investor sentiment. While severe, historical precedent suggests that the market has recovered from similar and larger drawdowns. These periods are also a time of test conviction and risk management for participants, as well as the use of . In the end, it will be a long-term path of cryptocurrency that is less dependent on single-day price action and more to the continued development of scalable, useful blockchain infrastructure. The crypto market cap will likely be a headline-grabbing figure, but its daily fluctuations are just one part of’very much larger, evolving story about technological finance’.

FAQs

Q1: What does a $150 billion loss in crypto market cap mean for Bitcoin?

As the largest cryptocurrency, A1 Bitcoin, which is typically a leading source of market moves, A1 (the most common example) leads to this type of currency. Such a large crash on the market is almost certainly one of the most dramatic declines to Bitcoin’S price and Market dominance that affect investment portfolio, as well as sentiment overall. ** ** .

Q2: How does this January 2025 crash compare to previous ones?

The $150 billion single-day loss is smaller in absolute terms than the multi-year crashes of May 2021 ($500B) or November 2022 (as compared to $200B), while serious, according to **A2 “The severity of this case is that it has been less severe.” Its key feature is the speed of decline, concentrated in less than 24 hours. *****

Q3: Should investors sell their crypto after such a crash?

The **A3 Investment decisions should be based on individual strategy and risk tolerance, not reactive panic. Analysts have argued that when it is extremely fearful to sell at a loss, many analysts suggest the best way to focus on one’s long-term thesis and allocation should be considered. *****

Q4: What usually happens after a major market cap crash?

**A4 Markets often go through consolidation or continued volatility,’ . They have Historically been at the bottom of their search and began to recover, although it can be weeks or years depending on more general conditions. ** **

Q5: Does a falling crypto market cap affect blockchain technology development?

**A5 While funding may tighten, core development often continues to develop a strong foundation. The history of Bear markets has seen significant technical building periods whereby teams are primarily focused on the fundamentals rather than price-driven marketing. ****

Btw **Disclaimer**********The information is not trading advice, Bitcoinworld. co-phraser,. in is not responsible for any investments made based on the information provided on this page. Before investing in any way, we strongly recommend independent research and/or consultation with a qualified professional. ** **

Thanks for reading Crypto Market Cap Plummets: $150 Billion Evaporates in a Single Day of Market Turmoil