According to derivatives exchange Deribit, there is still a lot of interest and capital in crypto derivative markets (high Bitcoin options volumes) but risk has been carefully managed so that it could explain the recent price movements of Bitcoin.

Bitcoin trading near $90,000 right now “looks very clearer when you see it through positioning rather than just price” said the Coinbase-owned derivatives exchange on Wednesday.

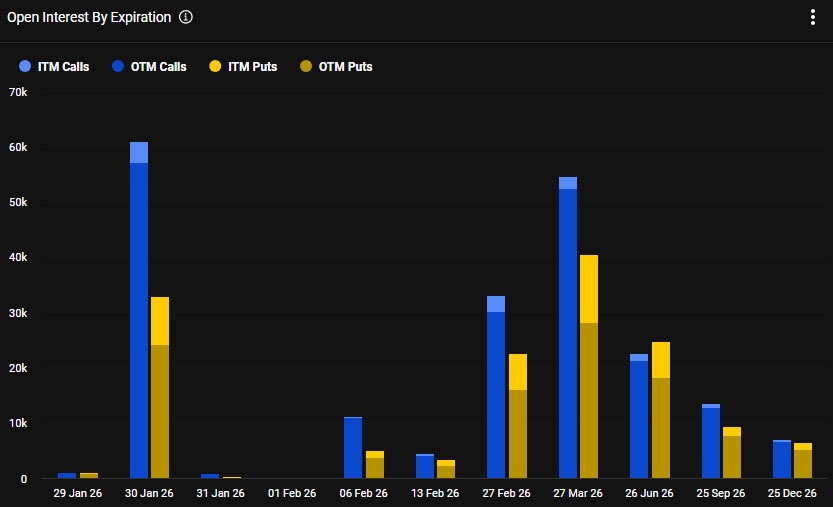

A concentrated options open interest (OI) around current strike prices for the large Jan seems to be a reason behind Bitcoin (BTC) stuck. It also added 30 expiry, it added .

This means a “significant share of market exposure is structured through options rather than outright leveraged futures,” they stated.

“Traders are involved, but they’re using hedges and structured trades, not just directional leverage.”

As of mid November, Bitcoin has traded a range-bound channel since the beginnings support around $85,000 with resistance approximately 95%; and oscillation between both levels.

Capital is present, but risk is managed

High options volume in near-term expiries, especially puts (shorts), suggests traders are taking risk and price movements tend to be more sensitive to hedging flows than external news, Deribit explained.

They said ‘Rallies may be able to compete with supply from risk reduction, dips can find buyers adapting exposure and momentum often has to work harder to expand.

”It’s not an interest-less thing here. Capital is also here, as is the case with . But risk is being expressed with tighter control, short-term price behavior is shaped by positioning mechanics as it has been described in new headlines. , ” and.

At the moment, total Bitcoin options OI (or the notional value of contracts that are yet to expire or be closed) is about $38. CoinGlass 7 billion, which has been steadily rising this month and is also a steady rise for s.

Large month-end Bitcoin options expiry looming

The coming Friday will see an end-of-month Bitcoin options expiry worth around $8.4 billion in notional value, according to Deribit.

put/call ratio of is 0. 54, meaning there are almost twice as many long contracts expiring as shorts. Most contracts expire at a loss, Max pain, is $90,000 and OI is most concentrated around the $100,000 strike price.

Bitcoin options OI by expiration. Source: Deribit

Thanks for reading Crypto options activity is keeping Bitcoin stuck near $90K says Deribit