Key Notes

- Coinbase sees December as the start of a crypto recovery.

- The exchange highlighted that liquidity is improving as Fed cut odds reach 92%.

- Bitcoin may be undervalued, according to analysts, following the November crash.

Buckle up, crypto traders! Coinbase just dropped a bombshell report: global liquidity is surging like a Bitcoin bull run as December kicks off. The real kicker? The odds of a Federal Reserve rate cut by December 4th have skyrocketed to a staggering 92%. Translation: risk assets, like your favorite digital currencies, are poised for a serious bounce. Get ready for liftoff.

A surge in our proprietary global M2 money supply index points to a sustained recovery through late 2025. This resurgence fuels anticipation that a weakening dollar will unleash significant market gains across the board.

Coinbase braced for an October reset and a November slump, but the exchange is betting on a December comeback.

It’s beginning to look a lot like a recovery.

Is Crypto Primed for a December Comeback? All signs point to yes. A surge in liquidity, a whopping 92% chance of a Fed rate cut (as of Dec 4), and strengthening macro tailwinds are fueling speculation that crypto could be gearing up for a powerful year-end rally.

Here’s why: • Liquidity is recovering • The supposed “AI bubble” hasn’t burst… pic.twitter.com/CpbfijdKWQ Coinbase Institutional 🛡️ (@CoinbaseInsto) December 5, 2025

Federal Reserve Policy and Bitcoin’s Undervaluation

Coinbase Institutional signals a potential sea change: The Fed’s bond market return hints that quantitative tightening’s endgame is approaching. Monetary policy’s next act is about to begin.

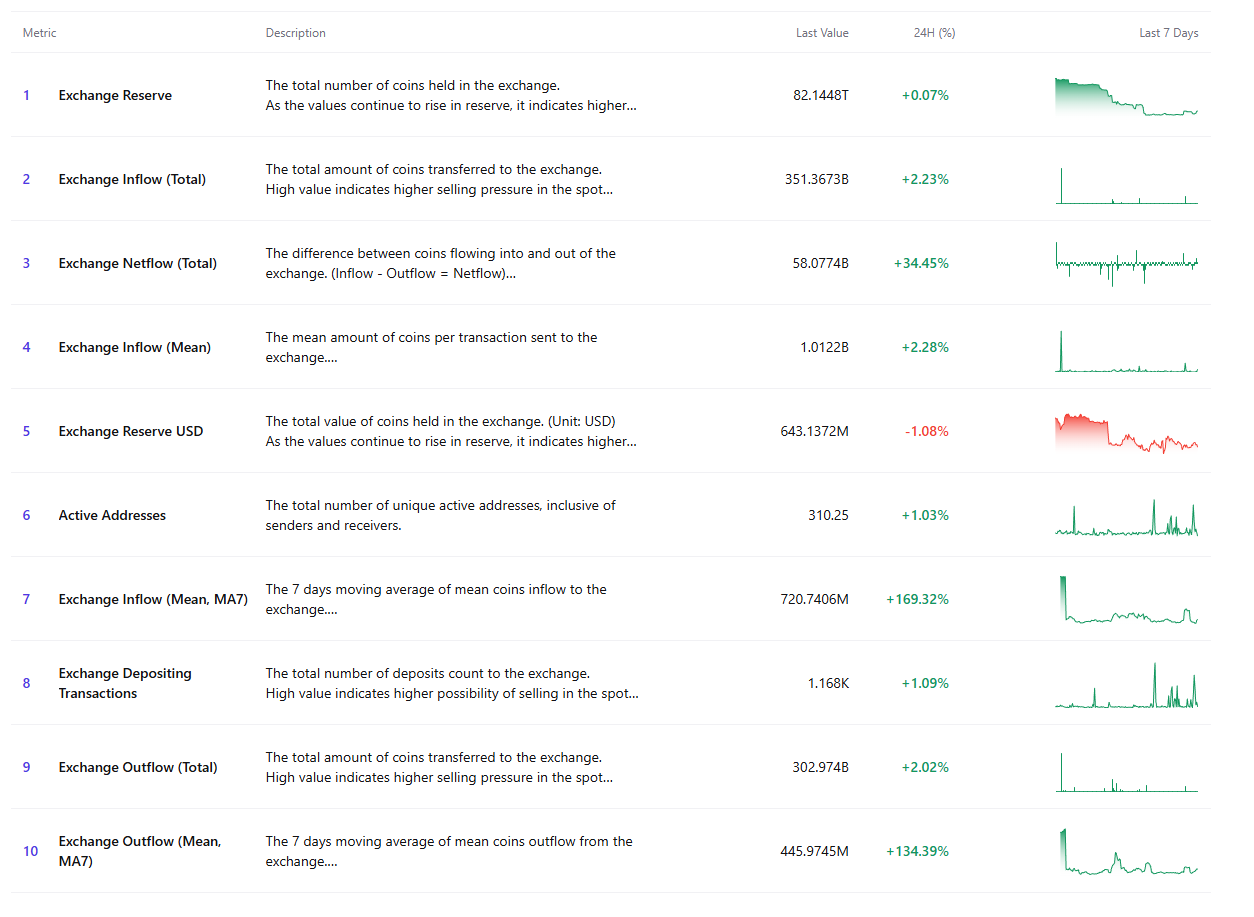

Bitcoin’s fortunes may be turning as liquidity strains ease. A recent report highlights Bitcoin’s November plunge, plummeting more than three standard deviations below its 90-day trend. In stark contrast, US equities remained relatively stable. This divergence suggests Bitcoin’s potential for a rebound as market pressures subside.

However, amidst the gloom, a flicker of hope emerges: seasoned investors, typically steadfast in their holdings, strategically released portions of their crypto, while digital asset products, for the first time this year, dipped below their intrinsic worth. Could these contrarian signals be the harbingers of a December rebound?

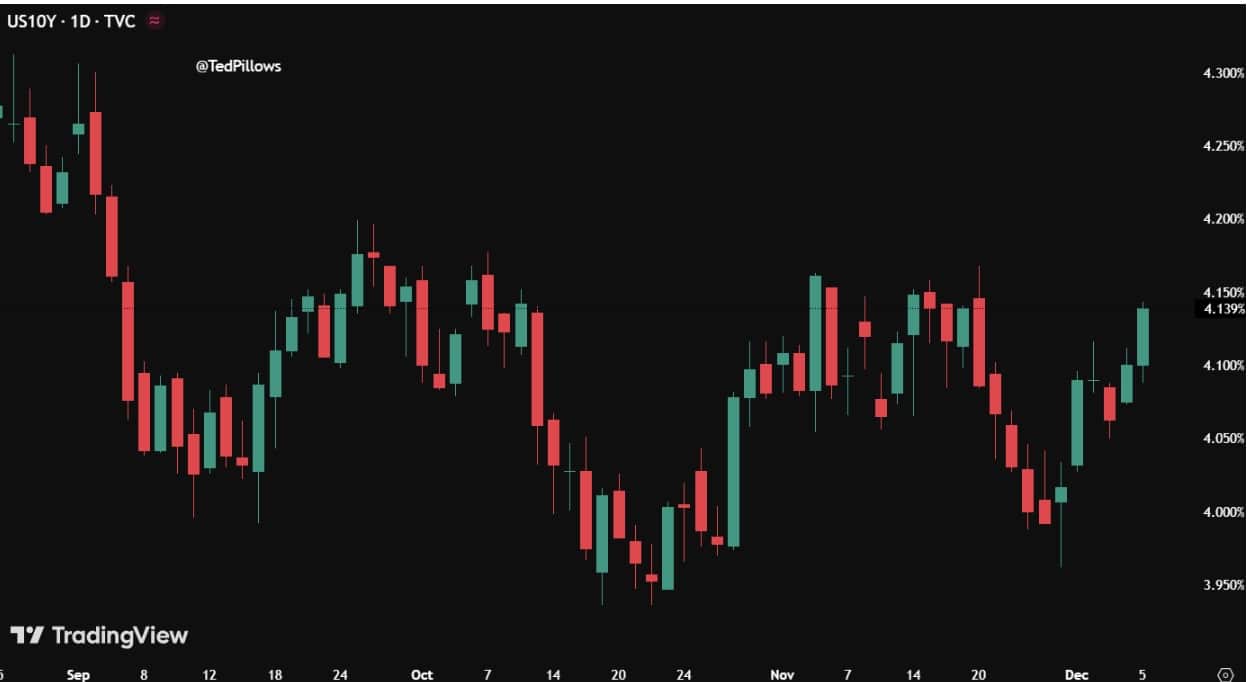

Forget summer flings; the US 10-year bond yield is hinting at a hotter autumn. Analyst Ted Pillows is sounding the alarm, forecasting the biggest weekly surge since June 2025. Rate cuts by the Fed should be popping champagne, but instead, yields are stubbornly glued above 4%. Pillows warns: this defiance spells trouble for anyone betting on a smooth ride in riskier investments.

Source: Ted Pillows

Shifts in Altcoin and Stablecoin Signals

Is stablecoin dominance hinting at an altcoin surge? Altcoin Vector’s data suggests a fascinating dance: when USDT reigns supreme, could a capital shift towards riskier altcoins be the next act? Historically, USDT peaks have foreshadowed a rotation back into the altcoin arena.

The divergence between Stablecoins dominance and Alts is a clean risk-on/risk-off signal:

🔹Risk-off: USDT dominance rises while alts fall, classic capital-preservation. 🔹Risk-on: alt dominance rises while USDT drops, liquidity shifts toward risk. Every time stablecoin… pic.twitter.com/UjmTs2qXjV Altcoin Vector (@altcoinvector) December 4, 2025

Stablecoins, recently flexing less muscle, coupled with altcoins stubbornly holding their ground, whispers a potential market pivot: once Bitcoin finds its footing, expect a rush back in.

If that rotation continues, altcoins may follow a familiar pattern of fast acceleration as liquidity turns toward risk.

At Coinspeaker, our commitment is simple: clear, unbiased crypto news. Think of this article as your compass – pointing you in the right direction with the latest insights. However, choppy waters and sudden squalls (market volatility!) are common. Always verify information independently and consult a financial advisor before charting your investment course. Consider this guidance, not gospel.

Thanks for reading Crypto Recovery in December: Coinbase