2025: The crypto sector hemorrhaged billions. This has been a modern gold rush-turned-bloodbath, with crime of incalculable scale in the cybersphere. No pickaxes or sledgehammers here. Hackers write malicious codes themselves, emptying cryptocurrency wallets faster than ever. Losses in just the first three months amounted to an eye-popping $1.6 billion – a 131% increase over 2024, which in itself was a staggering figure. From a centralized exchange heist to DeFi’s decentralized nightmare, there is no safe vault on the internet. Welcome to the new age of digital piracy where fortunes disappear in a mere stroke of a keyboard.

Q1 2025 Crypto Hack Statistics and Market Impact

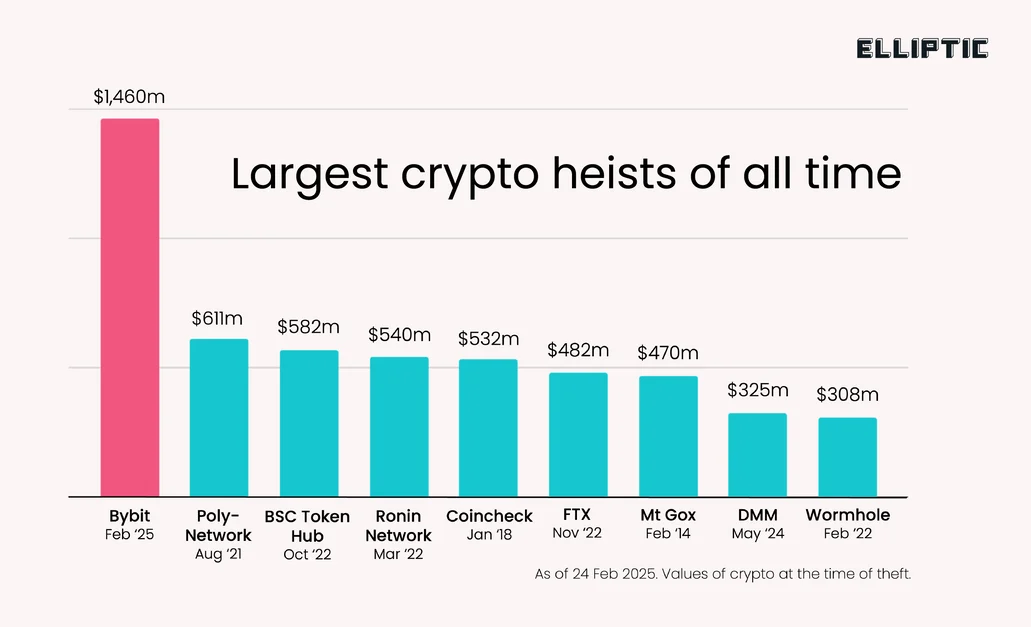

Protect your precious crypto! As much as a huge $1.63 billion disappeared in the first three months of 2025, thanks to the blockchain bandits, gave PeckShield. The cruelest sting, maybe, was the $1.46 billion theft from Bybit, which accounted for an unheard-of 92% of all crypto losses. I mean, a single breach amounts to Q1 being a quarter of carnage.

Source: Peckshield

The start of the year was not easy: Crypto heist was $87 million in January alone. February was ground zero for a sharp spike created by the Bybit exploit. March posed a little glimmer of hope, down to $33 million in stolen funds due to asset recovery programs. But the shadows deepened: More than 60 hacks struck during Q1, an increase over last year’s digital battlefield.

The wild west of finance with a cruel bite hit Abracadabra.Money for $13 million and left Zoth, a real-world asset protocol, nursing wounds of $8.4 million. While this crime wave gripped the crypto world, some platforms fought back: 1inch, lately nicknamed bounty hunters of old, retrieved 90% of the stolen funds, proving that even nabbing bandits is possible in DeFi.

Bybit: The Largest Crypto Heist in History

February 21, 2025: a date engraved in infamy in the annals of cryptocurrency. There was a Portal-cum-digital-heist-at-a-scale-before-unheard-of when Bybit was despoiled of $1.46 billion worth of Ethereum with nary a trace. Malicious software had drifted through the company’s defenses, activated under the radar during what should have been just a common transfer of funds between a cold wallet that was secured and a slightly less secure warm wallet. It was a ghost in the machine, bypassing every security system and creating chasms in Bybit’s fortifications. Meantime, the exchange piped in to try calming its users down, but the breach just opened up a huge rift in the crypto world while bringing to forefront the age-old never-ending battle of security vs. innovation.

Source: Elliptic

When hacking attacks hit Bybit, Ben Zhou did not flinch. He had already promised full reimbursement for the affected users; in order to keep his promise, he provided funds internally and through loans from strategic partners, thereby building the exchange’s financial strength. But not just a mere containment, Bybit set up a bounty program, giving an attractive 10% of recovered funds to anyone willing to help in retrieving the stolen funds. The blockchain forensics experts at Elliptic traced the trail of finances back to the all-too-well-known Lazarus Group of North Korea, a state-sponsored criminal group allegedly channeling their stolen proceeds into military coffer.

North Korean Hacker Activity and Global Response

The breach event at Bybit is merely the tip of the iceberg. Behind the scene, the shadowy North Korean Lazarus Group maneuvers to pull strings in yet more significant crypto thefts. They have taken more than $6 billion in digital gold since 2017 and used stolen Bitcoins to bankroll an outlaw regime. What does this implicate? Highly technical shell-type operations involving decentralized exchanges and mixers to cloak themselves and become nameless in the blockchain.”

During this time, there are thunderclouds of a shadowy cyber war brewing in the sky. North Korea’s cyber heists, primarily cryptocurrency thefts, will be hotly debated at the G7 summit in Alberta, Canada, in June 2025, according to Bloomberg. Forget about missiles and tanks. The real threat lies in a keystroke. The U.S. Justice Department feels that these stolen digital assets are money laundering for funding North Korea’s weapons programs, thereby making geopolitical and Wild-West-within-digital-finance worlds blur.

Other Hacks in Early 2025: AdsPower, Phemex, and Moby: CCN Report

A crypto heist of $4.7 million took place in January 2025, with AdsPower-the anti-detect browser provider-as the focal point. The hackers did not try to brute force the firewalls; they slipped in under the guise of a legitimate browser plugin. A Trojan horses replaced the real one, The backdoor was opened to digital vaults of the users. The prize was private keys in the attackers’ hands, providing access directly to the crypto wallets. By the time the catastrophe was grasped, five wallets had been emptied, leaving behind far too many digital footprints and the heavy multi-million dollar question of: Who is the next one?

On January 23, 2022, the crypto exchange Phemex suffered a catastrophic $85 million heist, orchestrated by hackers believed to be state-sponsored and leveraging weaknesses in Phemex’s hot wallet in triggering a platform-wide emergency. Withdrawals were stopped as Phemex scrambled to limit the damage, only for a full-scale security investigation to ensue, thus leaving the program in limbo and the crypto community rattled.

It was a chilling beginning of the year for Moby, a DeFi options platform surfing the Arbitrum wave: a $2.5 million heist due to a compromised private key! But this isn’t just one more DeFi disaster story. Enter the whitehats, the digital knights riding to the rescue, clawing back $1.5 million from the abyss. Moby still took hits as the Crime unfolded but the same also brought into relief DeFi’s emerging Achilles’ heel-private key security-and spotlighted the crucial, often unsung roles ethical hackers play in this digital Wild West.

April 2025: Phishing Dominates Losses Amid Multiple Breaches

April was filled with marauding criminals. More than $357 million were stolen in 18 major crypto hacks, a terrorizing example of how unregulated the Wild West really is. Phishing was the main culprit. These poison attacks raked in a staggering $327 million, showing that a sophisticated con is still more harmful than a sophisticated code exploit. An unfortunate American victim learned this lesson in pain after losing a king’s ransom – 3,520 Bitcoins – to a top-class social engineer.

Even when the storm of crypto heists raging all around continues, faint flickers of hope emerge. Loopscale, a decentralized lending protocol, recovered an almost unimaginable 90% of $5.8 million within 48 hours owing to its shrewd tactics of having offered the hacker a 10% bounty. April was no exception; MorphoLabs came under another exploit for $2.6 million, brutally reminding of vulnerabilities still lurking. The kind of breaches March saw for a staggering $28.8 million looks bleak: Attackers are sharpening their tools and never really falling behind, notwithstanding their defenses getting stronger by the day.

Cetus DEX Exploit: Over $200 Million Drained

Looming May 2025: Cetus arose as a whirlpool for the colossal size of $223 million, the nook of an alleged exploit. The speculators were lucky enough to empty the vault, essentially rendering the exchange a ghost town. The on-chain data was almost screaming foul play-transaction volumes broke away from an average one-day record of $320 million to reach an astronomical $2.9 billion! On a race against time to stem the bleeding, Cetus managed to freeze $162 million of the booty and halted smart contracts, hoping to stop the hemorrhage.

An icy cyberattack has swept across the SUI network, with shattered crypto dreams luring its path. The blockchain cybersecurity firm called Hacken has confirmed that $63,000,000, channeled through the Ethereum bridges, is now gone into the digital shadows. The audacious robbery culminated when a gargantuan 20,000 ETH was transferred to a freshly created wallet, presumably under the control of the people behind it.

The assault left SUIdenominated pools and assets crippled. Lombard Staked BTC and the unprepossessing AXOLcoin were the hardest hit, their values having plunged in a bloodbath on the market. In order to contain the damage, network validators are now cooperating to freeze transactions emanating from the attackerlaid lairs of his own, buying time for a counteroffensive. The community, whether crypto or not, is on pins and needles, with the fate of SUI tipping in balance.

Coinbase Data Breach: Insider Threat and Customer Data Compromised

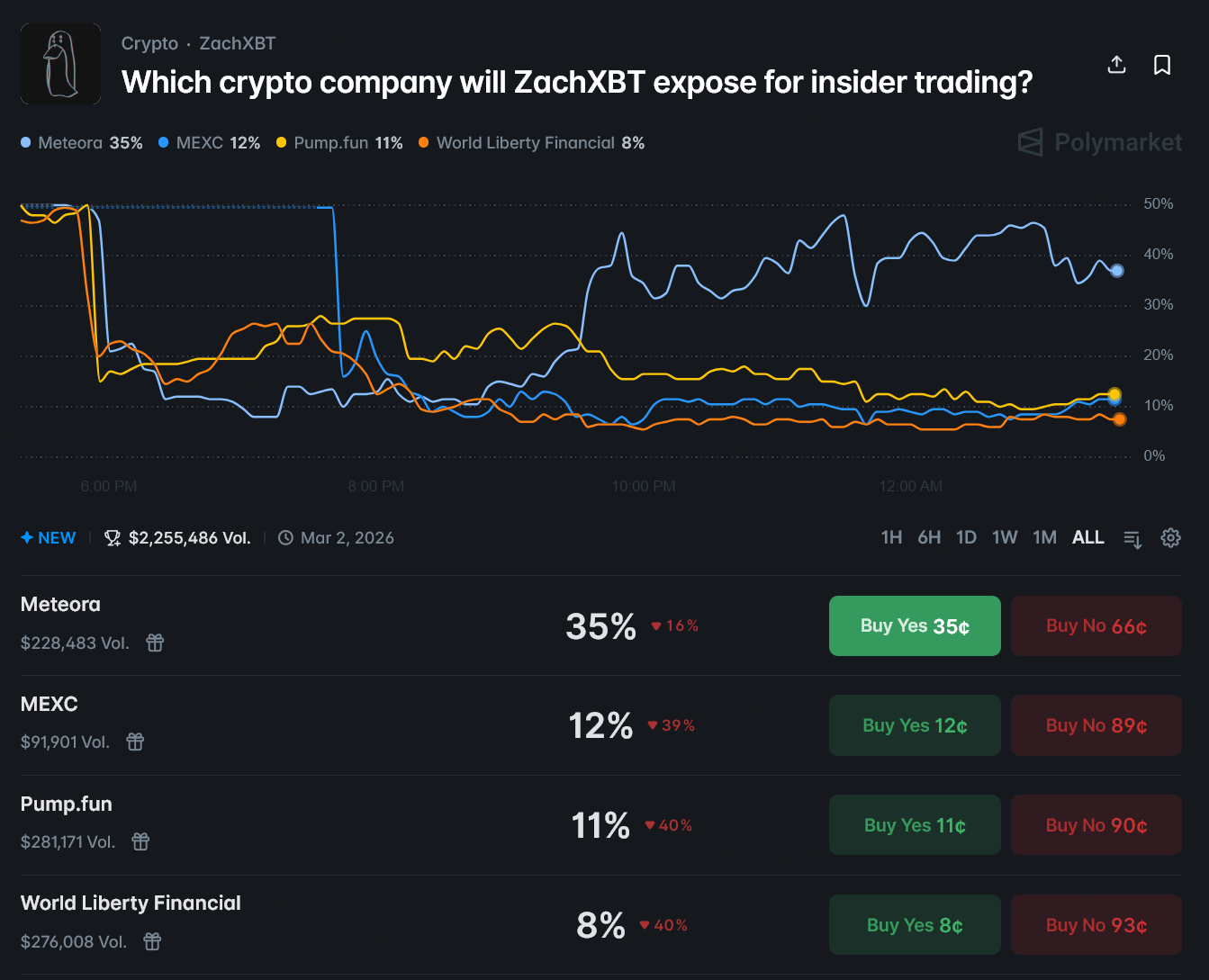

In May 2025, a chilling betrayal transpired within the company. It was not some faceless hacker but, rather, an insidious inside job. Crypto investigator ZachXBT exposed on X an unsettling revelation: foreign Coinbase employees, lured by ill-intentioned actors, betrayed the company. With the data at their hands, these internal evil doers leaked that much-needed information about the users: names, addresses, ID photos, phone numbers, and partially obscured bank information. Up to 69,000 Coinbase users found out they were the victims of this heinous act by people whom they trusted to keep them safe, who exposed their digital lives.

In an unprecedented case of extortion, the shadowy hackers demanded $20 million, and Coinbase stood firm. Only if these masterminds can prove this money to be an extortion were they right. The ransom was dishonored, and paradoxically, the company placed a reward for the capture of the perpetrators! What is good news is that no login information, security codes, or crypto wallets were compromised in this incident. For those unfortunate few whose users had been scammed in related cases, Coinbase pledged to reimburse users and began bolstering the withdrawal process with direct multi-factor authentication and stronger ID verification.

Measures and Industry Responses to Rising Crypto Crime

This may well be the first season of digital justice. If a platform suffers a loss from theft, it uses every technical wizardry in its arsenal with the most enticing incentives to get the thief to give the stolen gains back. No more cat-and-mouse games; it is now, carrot-and-stick! The approach is simple: turn the hackers into heroes-for-cash. Loopscale and 1inch set the precedent in bounty programs, showing that an aptly timed reward is better than the best code. Meanwhile, exchanges fortify their treasure chests by introducing withdrawal allow-lists and making hard ID checks on VIP withdrawals. The message: Steal, but at your own risk. It just might be your only scape-goat.

The cybercrime incidents are witnessing an increase; hence, an unprecedented collaboration among law enforcement agencies is occurring as companies proactively report breaches to share crucial information. Blockchain detectives are now burning the trail by dissecting public ledgers to trace the pilfered crypto and expose complicated money-laundering schemes. The crypto terrain remains a battlefield, with the first half-2025 painting a bleak picture of continued threats.

The crypto-world is now under siege, with Bybit, Cetus, Coinbase et al.- titans felled by pinpoint breaches coursing through fatal flaws. The attackers zoom past at warp speed, window of vulnerabilities forging quickly into blasts as soon as blows drop. Some plinths clawed back stolen booty and fortified their walls, but this scratch is a fight, not a victory. To win, exchanges, white-hat hackers, and watchdogs must join hands. By sharing intel and watching nonstop, we can just about choke off the pipeline through which illicit funds flow and save the user from the storm.

Thanks for reading Crypto Security Under Siege: A Look at 2025’s Biggest Digital Heists