Ki Young Ju of CryptoQuant has just dropped quite a bomb, alleging that advanced market indicators are now there for well over 500 altcoins! The lights are on, if you will, in the formerly foggy world. Charts create the volume, frequencies race to the heart, and order sizes are all laid out before the trader. There’s even the abuser Cumulative Volume Delta (CVD). This is not an update; it is a quantum change-a svegliare di nuovo-the more professional altcoin arena wherein more than ever are the data-oriented traders.

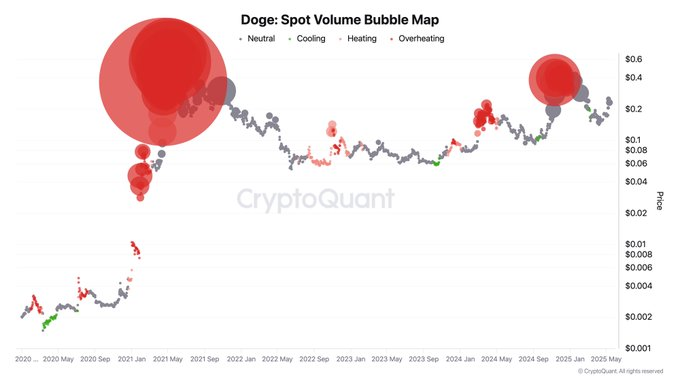

Dogecoin’s Volume Reveals Market Sentiment

Ki Young Ju dropped an immediate Dogecoin bombshell! His latest chart dissects Dogecoin spot volume into four trading seasons: neutral, cooling, heating, and the dreaded overheating. And here is where the whole thing gets interesting: History rhymes. According to Ki Ju’s data, past “heating” phases set the stage formajorDogecoin price explosions, directly hinting at the meme coin mania of early 2021 and 2025. Translation? Keep one eye glued on this chart, boys and girls, as it might well be the key to the next mad dash of Doge.

Is Dogecoin to crash or moon? Learn how to figure out its immediate move. These indicators are an essential sentiment compass through the crashing waters of Dogecoin price action. Cryptic historical volume trends give an investor the power to predict the next volatile attack.

Source: X

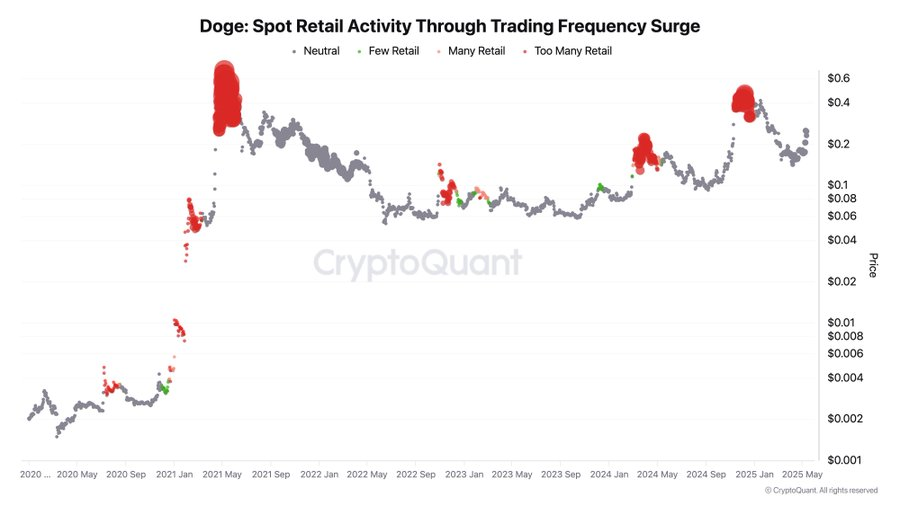

Retail Traders’ Role Examined Amid Liquidity Concerns

Could retail traders be the unsuspecting exit liquidity for crypto whales? Ki Young Ju poses this provocative question: Are small-time traders unwittingly supporting large institutional players? Imagine a downturn in the crypto market; big players, i.e., institutions, progress to sell off large volumes, triggering a price drop. Enter retail investors, buying while prices are down. Are these guys buying the dip or just giving away the exit for the institutions to cash out further without crashing the market? That is a powerful thought; are retail investors actually supporting the crypto ecosystem, or just facilitating institutional exit?

Source: X

The minds of retail traders orchestrate Dogecoin prices. Our chart reveals this colorful ballet in which the places they choose to trade act as the ebb and flow of that trade frequency-the pace or rhythm of investor excitement.

Dogecoin’s price does little without retail investors wagging their tails. The retail activity chart screams a pattern: with the increase in frequency of Trading, Dogecoin followed its movement in price. Just a classic case of FOMO: The pack jumps in during bull runs, chasing gains long after the initial surge. Are they riding the wave? Or are they drowning?

Related: Bitcoin Losing Dominance? Altcoins May Be Ready for a Breakout

Ever wonder how the so much so-called “smart money” is always an inch ahead? Well, here’s the explanation: Retail traders will often jump on the bandwagon, chasing the market down its tail. In the meanwhile, institutional investors, lurking in the shadows, identify opportunitiesbeforethe entire crowd rushes in, obtaining the best prices. If you can master this timing difference, you will learn how to avoid whiplash from the markets and enter the hidden realm of cunning, more profitable trades.

Or something like that.

Investing involves risk. The content in this article is simply informational, thus it should not be regarded as financial advice. Coin Edition will not be held responsible for any losses sustained after acting on the information supplied. Do your own due diligence and engage a qualified financial advisor before making any investment decisions.

Thanks for reading CryptoQuant’s Ki Young Ju Announces Advanced Trading Tools for Altcoin Traders