Amidst a sea of red in the crypto market, Ethena (ENA) is flashing green, surging almost 20% in the last 24 hours. Traders are scrambling to understand the catalyst behind this sudden defiance of gravity. Is it a hidden technical breakthrough, a whisper of institutional adoption, or simply a well-timed surge of bullish sentiment? Whatever the reason, ENA is the rebel yell of the crypto world right now.

Whispers are swirling around ENA. Whales are stirring, wallets are emptying on exchanges, and the charts are screaming ‘bullish.’ Forget calm seas; a tidal wave could be building. Is ENA about to explode?

Whales Are Gobbling Up Ethena

Whale alert! Forget the FUD, smart money is loading up on ENA. Nansen data reveals a massive 8.15% surge in whale holdings over the past week. That’s nearly $2 million pouring into ENA, signaling strong confidence and a potential price surge on the horizon. Is this the dip you’ve been waiting for?

Ethena price and whale accumulation pattern: Nansen

This surge defies the stagnant market, a silent tremor hinting at colossal confidence. Whales are awake, strategically loading up for an imminent, earth-shattering shift.

At the same time, exchange balances are falling. Over the past week, 1.07 billion ENA tokens have left exchanges.

Ethena (ENA) is staging a quiet retreat, migrating from the bustling exchange floors to the hushed solitude of private wallets. This exodus hints at a strategic hold, a collective decision to buckle in for the long haul. Exchanges, now with dwindling ENA reserves, brace for calmer seas, as the threat of sudden sell-offs recedes.

ENA’s vanishing act: whales are on a buying spree, silently draining exchange liquidity. Bullish signals are flashing.

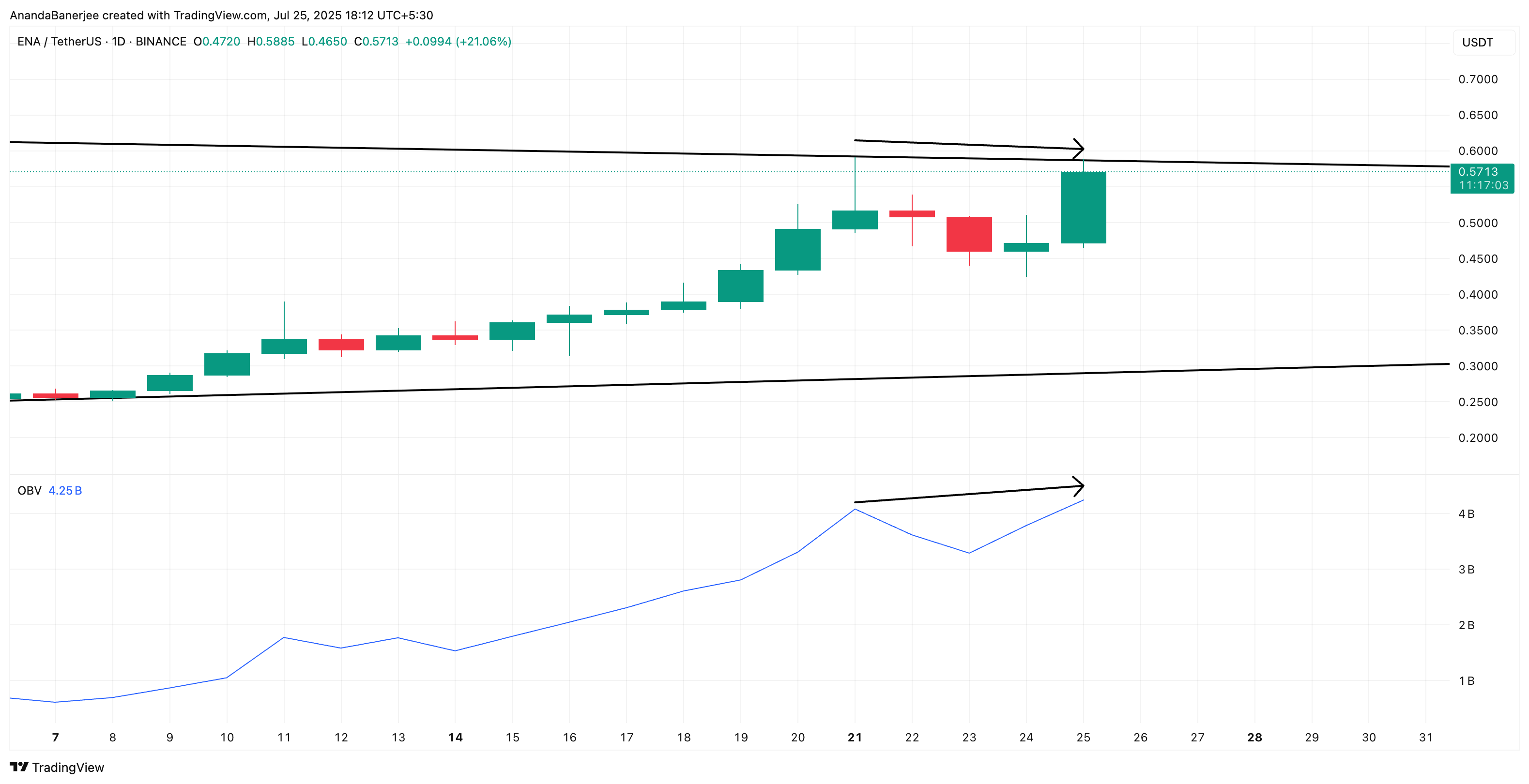

OBV Divergence Hints at Momentum Building Underneath

But here’s where the plot thickens. While ENA’s price action hinted at weakening momentum with a lower high, the On-Balance Volume (OBV) was secretly building strength, forging a higher high. This bullish divergence – a whisper from the market – suggests a hidden surge of buying pressure lurking beneath the surface. The volume screams, “Buyers are here, and they’re ready to pounce,” even if the price hasn’t caught on yet.

ENA price and OBV divergence: TradingView

ENA hovers near $0.57, trapped within a tightening wedge. But don’t let the stagnant price fool you. Beneath the surface, something’s brewing. The On-Balance Volume (OBV) is hinting at a surge, breaking upward, a silent signal that buyers are stealthily accumulating, poised to pounce the moment ENA breaks free.

“Whispers of divergence hint at an impending surge. Pair that with the whales stirring, and it paints a picture: accumulation is not just coming, it’s already happening.”

On-Balance Volume (OBV) tracks whether volume is flowing into or out of a token, helping spot hidden trends.

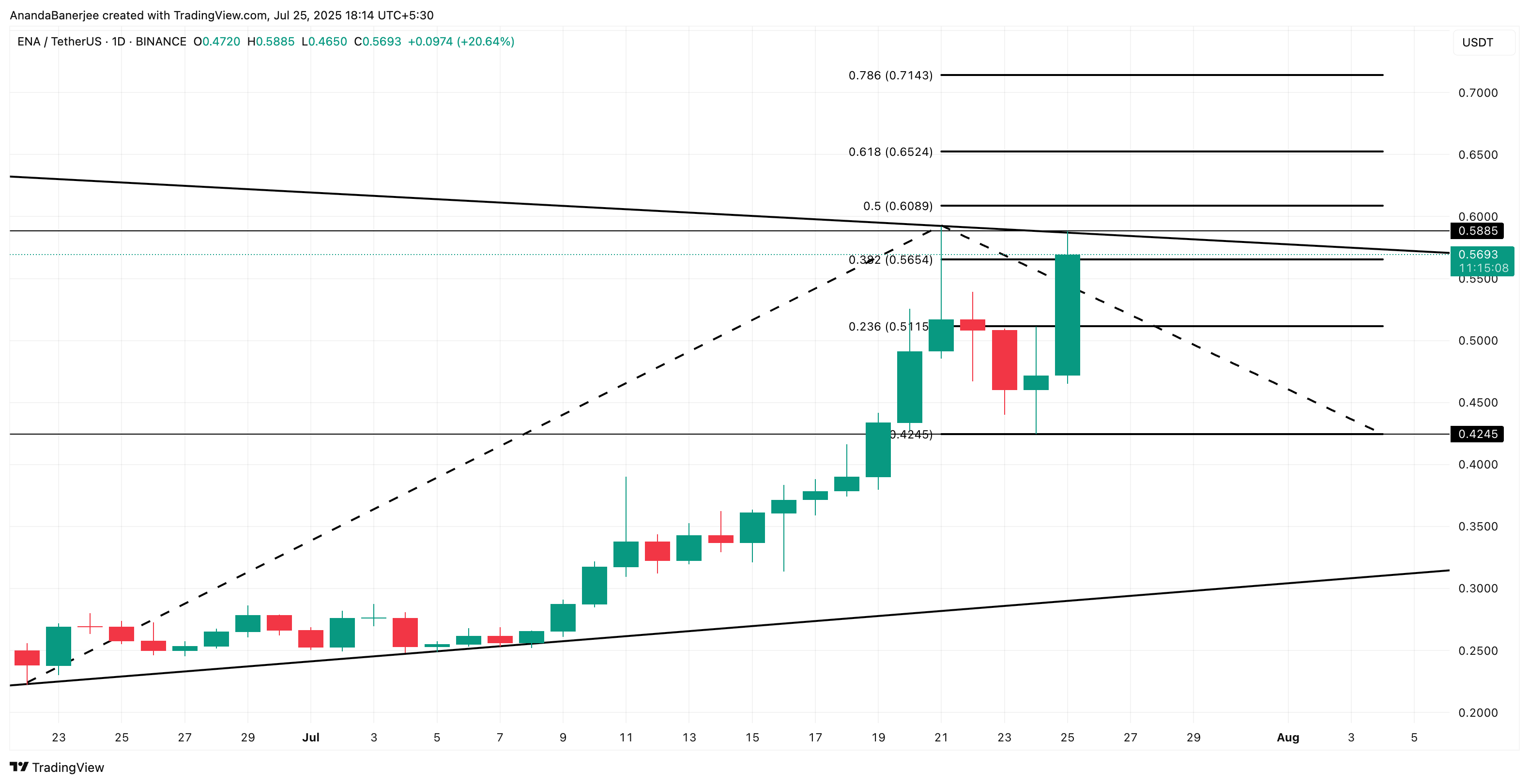

The Wedge Breakout Could Ignite the Next Leg for ENA’s Price, But $0.60 Is Key

ENA’s been flirting with a breakout since late June, trapped inside a tightening wedge. But here’s the kicker: we’re not just relying on basic pattern recognition. A trend-based Fibonacci extension paints a potential roadmap, illuminating key price targets if ENA decides to finally make its move.

ENA’s Fibonacci dance began at $0.22, soaring to a $0.59 peak. Yesterday’s dip to $0.42 was a mere prelude. Now, it’s staging a dramatic comeback, poised on the brink of a breakout.

ENA price analysis: TradingView

Forget pennies; keep your eyes glued to the $0.60 mark. This isn’t just a number; it’s the 0.5 Fibonacci extension – a key that could unlock serious gains. We’ve already seen a surge past the $0.58 wedge, but $0.60 is the real test. Conquer that, and we’re talking a potential sprint towards $0.65, then $0.71, and maybe even a moonshot beyond. Fueling this fire? Whale-sized backing and surging volume – the perfect ingredients for a breakout.

But here’s where the magic trick could vanish. Should ENA stumble and fall back below $0.51, the bullish spell breaks. The ascending wedge dream dissolves, potentially unleashing a bearish pullback.

Thanks for reading Ethena (ENA) Pumps 20% On A Dull Day—Charts Hint at More Upside