Earlier today, over 40 million ENA tokens were unlocked, sparking widespread expectations of a sharp price pullback.

Although the anticipated downfall in the market failed to materialize, the token stood on its feet. Now, JunkyardSquare seems poised to break new records on a wave of burgeoning bullish sentiment.

Traders Pile Into ENA as 40 Million Tokens Unlock

The Monday morning session in the crypto market was washed by a $12 million tidal wave, created by the imposal of 41 million ENA tokens into the market around 7:00 a.m. UTC, according to Tokenomist.

This huge-scale token unlock from Ethena released a flood of ENA upon the market, yet its price hardly flinched in the last 24 hours, dipping just below 1%. This price resilience is a statement indeed; bullish ENA holders are apparently absorbing the newly issued supply, thus averting a potential price crash.

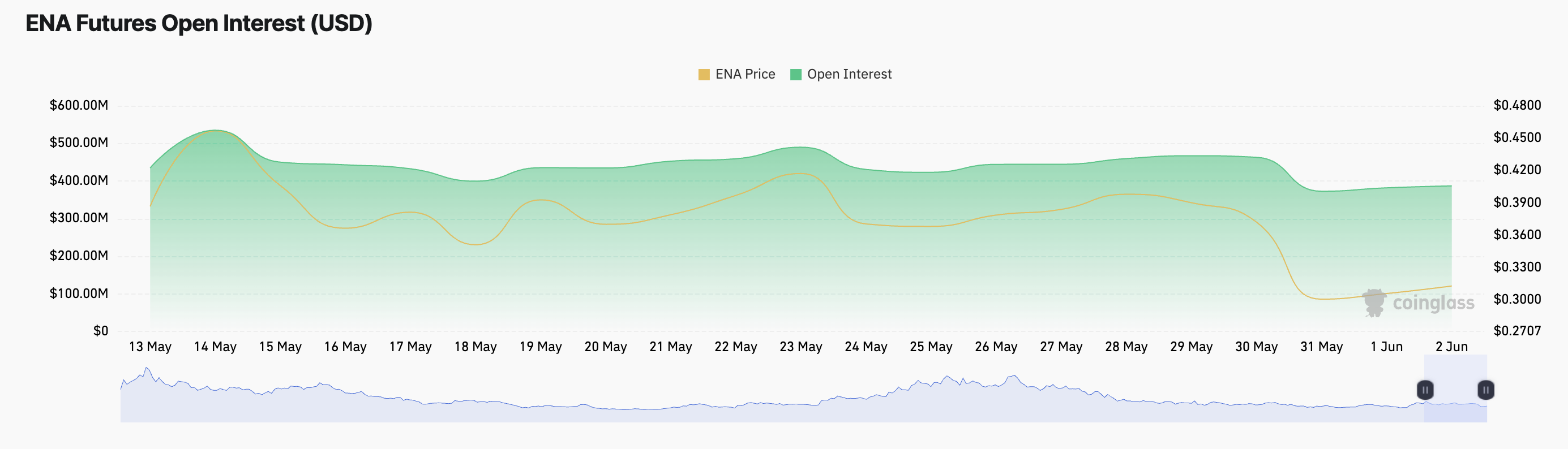

The ENA futures market shows a lot of blazing activity. Open interest just has witnessed a 2% uptick to a gargantuan $387 million, a sure indication that more traders are flaming the already-hot arena.

ENA Open Interest. Source: Coinglass

Open interest is the heartbeat of the market. Put simply, it’s all the open futures or perpetual swap positions contracts yet to be settled. When open interest starts rising, it means new money is entering the market and traders are not merely curious; they are putting up a massive stake. An increase in open-interest levels will go together with increased conviction in the market direction.

With open interest rising sharply on ENA, stronger market sentiments are unveiling themselves. Traders are loading up for a second round, expecting this one to turn into a phoenix-like rise or an unusually calm landing following the token unlock: Are they right, or are they walking into a trap?

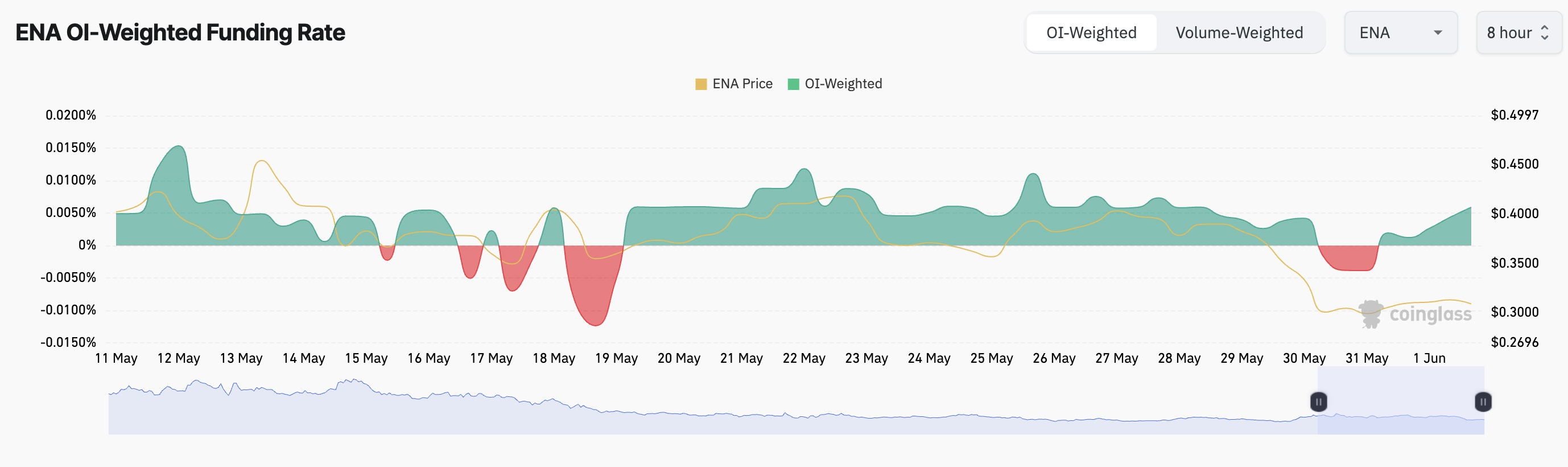

With an interest rate of 0.0059%, a bullish story is being told by the ENA fund. In other words, longs are in demand, meaning that traders pay a premium price for longs, highlighting the strong market confidence.

ENA Funding Rate. Source: Coinglass

Think of a seesaw that is trying to get balanced. The perpetual futures market is that seesaw, and the funding rate is the fulcrum. Funding rates oscillate like tiny tides between the holders of long and short positions. Historically, if the “long” side of the seesaw gets too heavy (namely, with positive funding rates), those who want prices to go up would compensate the “short” side so that the price of the futures remains aligned with the price of the underlying asset (spot price). Consider it as a heartbeat of the market working in balance.

ENA’s Next Move: Support Retest or Rally Toward $0.41?

ENA hovers at a mere 30 cents, a heartbeat above its 24-cent safety net. If the bulls do indeed ramp up their charge, a rush towards 37 cents shall be expected, where money awaits.

If this resistance breaks, it could propel ENA’s price to $0.41.

ENA Price Analysis. Source: TradingView

However, if selloffs gain momentum, ENA’s price decline could deepen to $0.24.

Thanks for reading Ethena (ENA) Shrugs Off 40 Million Token Unlock as Bulls Step In