Solana, Ethereum’s most significant rival, leads among cryptos with the highest dApp (decentralized application) revenue.

June saw Solana’s dApp ecosystem explode, raking in over $146 million. Solana isn’t just playing the dApp game; it’s dominating, leaving Ethereum and BNB in the dust.

Table of Contents

- Solana vs. Ethereum comparison

- Solana price analysis

- Solana ecosystem updates

- Expert commentary

Solana vs. Ethereum comparison

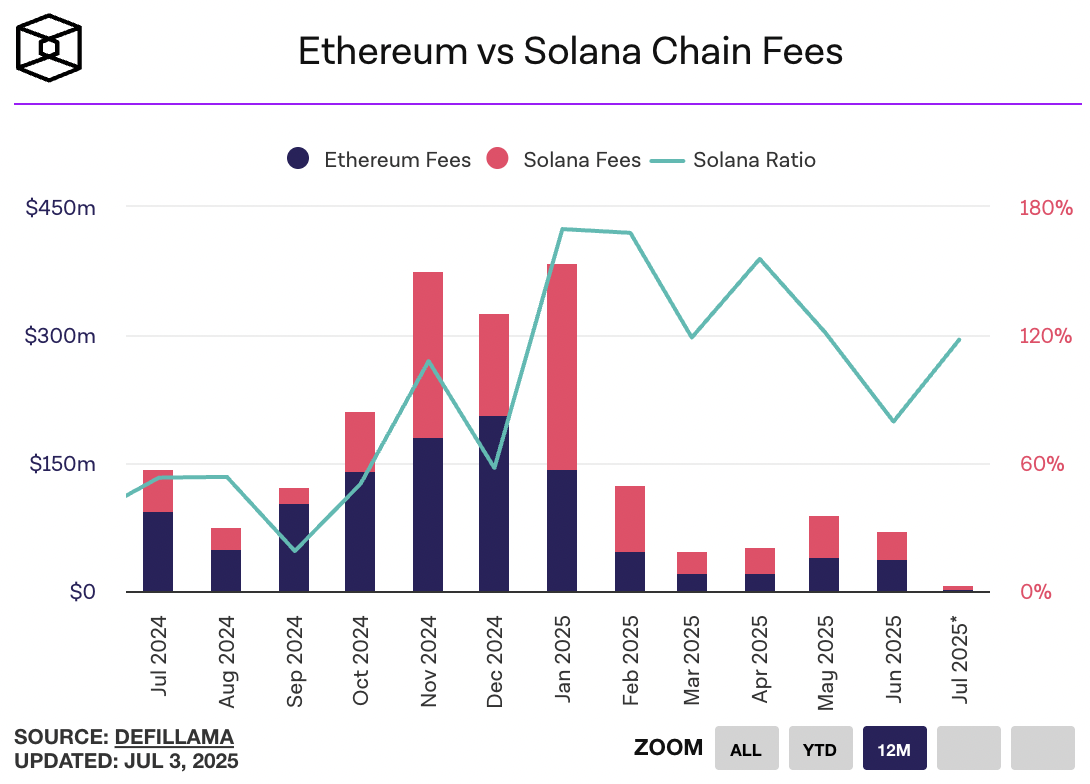

Since mid-2024, a fierce battle has raged in the smart contract arena. Two platforms have been locked in a relentless duel, trading blows in DEX volume, revenue generation for dApps, total value locked (TVL), and overall DeFi dominance. The crypto world watches with bated breath as each contender vies for the crown.

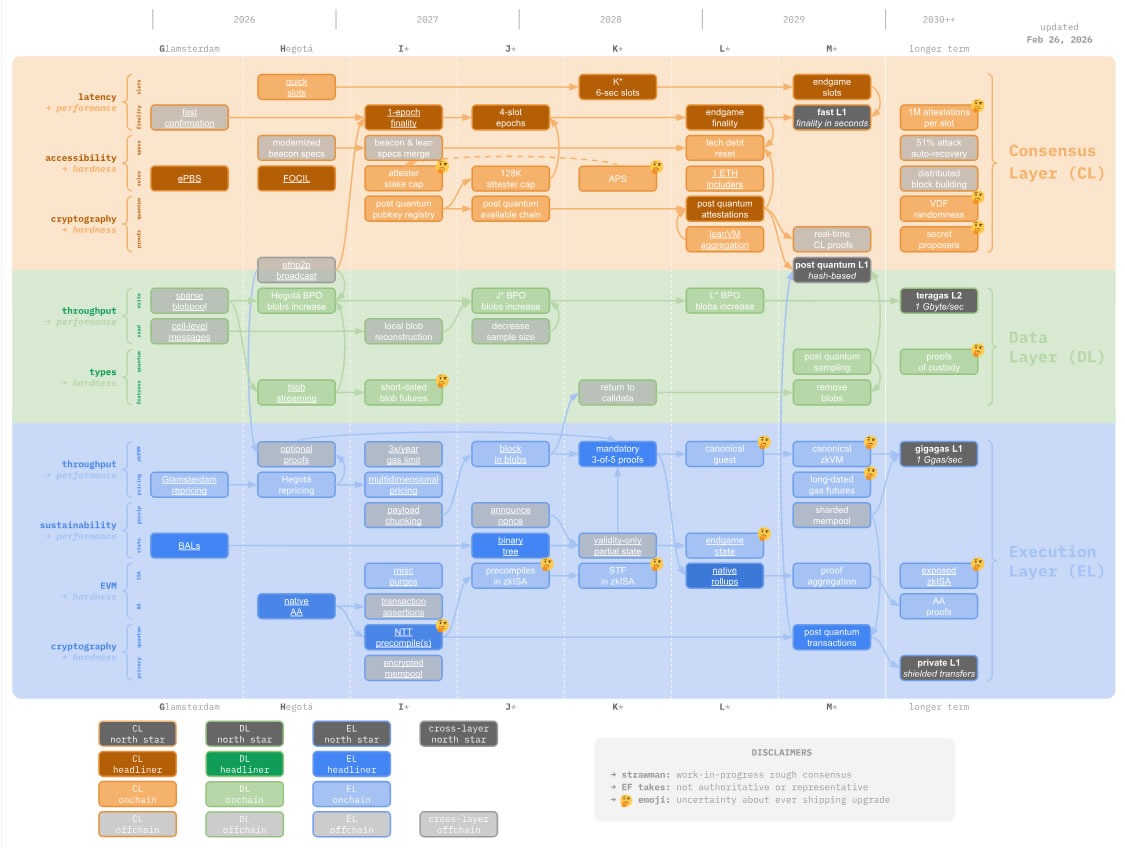

Solana’s DEX dominance isn’t fading – it’s solidifying. Since October ’24, SOL has been the undisputed king of decentralized exchange volume. Fast forward to 2025, and even with July’s numbers still trickling in, Solana’s crushing it. Think $5.78 billion in volume versus Ethereum’s $4.7 billion. The DEX crown? Firmly planted on Solana’s head.

Ethereum v. Solana DEX volume | Source: TheBlock

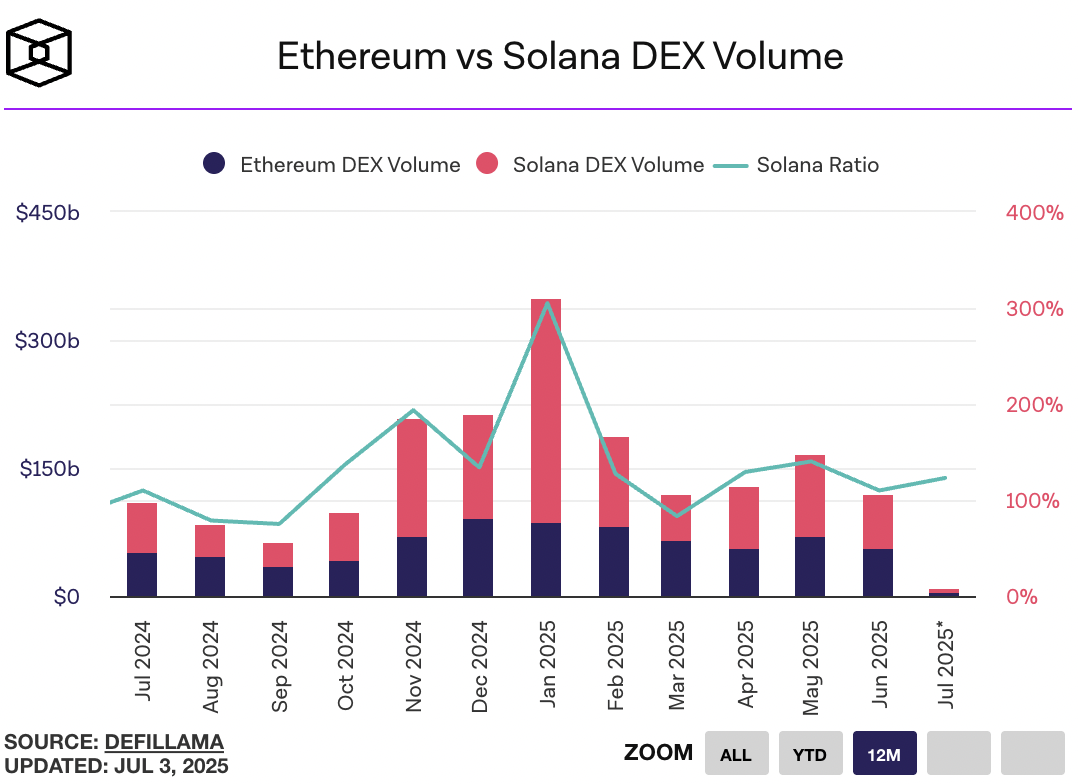

Solana leads in the fees collected by the two blockchains, from dApps and protocols running on their platforms.

Since November 2024, a tectonic shift has been occurring in the blockchain landscape. For seven straight months, until June 2025, Solana relentlessly outperformed Ethereum, not in speed or hype, but where it arguably matters most: transaction fees. The data, surfaced by TheBlock, paints a clear picture: Solana has been consistently lighter on the wallet than its heavyweight competitor.

Ethereum v. Solana chain fees | Source: TheBlock

Solana clocked $146 million in revenue from dApps in June 2025, consistently outperforming competitors for over a year.

Forget memecoins. The real story on Solana is dApps. They’re fueling a whopping 41% of the chain’s revenue. That’s a huge slice of the pie, especially when you stack it up against titans like Ethereum and BNB. Solana isn’t just playing; it’s building a decentralized empire.

You might also like:

Solana captures 95% of tokenized stock trading volume in massive DeFi pivot

Solana price analysis

Solana’s coiled spring: A daily standoff above $140. The SOL/USDT duel hints at a power surge. A 15% breakout could launch SOL into orbit, targeting the $170 resistance ring. Will it break free?

Solana’s bulls are bracing for a potential liquidity grab around $140 should a market correction hit. Eyes are glued on the upside though, with a sprint towards $200 feeling inevitable. Beyond that, a formidable sixteen-month-old resistance looms at $218.40 (R2), a barrier Solana must shatter to truly ignite.

Solana’s poised for takeoff. RSI and MACD, the market’s momentum maestros, are singing a bullish tune, suggesting SOL’s upward trajectory has serious staying power. Beneath the surface, a strong undercurrent propels its price higher.

SOL/USDT daily price chart | Source: Crypto.news

“Solana’s bulls are eyeing $150 – a daily close above could ignite a breakout. But beware the weekend: a dip below $148 might trigger a liquidity grab.”

You might also like:

Solana captures 95% of tokenized stock trading volume in massive DeFi pivot

Solana ecosystem updates

Solana’s star is rising in the Bitcoin universe. Q2 2025 saw Bitcoin trading volume on the platform explode to record heights, eclipsing Ethereum and cementing Solana as the new go-to destination for BTC enthusiasts. Adding fuel to the fire, Solana just unveiled the champions of its Colosseum hackathon via X, signaling a hotbed of innovation.

10,000+ participants. 1,412 product submissions. Aspiring founders from 140+ countries.@Colosseum has announced the winners of the Solana Breakout Hackathon, the biggest startup competition in crypto!💥pic.twitter.com/6W0Y85atOU

Solana (@solana) July 2, 2025

Imagine Visa and Mastercard slashing transaction costs by a staggering 99%! That’s the promise rippling through the crypto world after a smart contract chain revealed its calculations: Solana’s blockchain could be the financial revolution’s secret weapon. For holders, this isn’t just news; it’s rocket fuel. Bullish sentiment is soaring as a tantalizing glimpse of mass adoption comes into sharper focus.

Visa and Mastercard processed $64 billion in revenue from 400 billion transactions last year. Imagine those same transactions powered by Solana. The fee? A mere $400 million. That’s a 99% cost cut for merchants – a game-changer. –@FoundationCap

just use Solana. pic.twitter.com/mEExDuvocc Solana (@solana) July 3, 2025

Expert commentary

Ryan Lee, Chief Analyst at Bitget Research, told crypto.news in an exclusive interview:

Solana’s poised for a surge, fueled by its booming DeFi and NFT scene and whispers of a staking ETF. Imagine Solana soaring to $400, even $500 in a bull run! However, the crypto wild west is still risky. More realistically, external market storms could keep it grounded around $300-$350. Navigate carefully, adventurer – volatility remains the dragon guarding the treasure.

Lee maintains a bullish outlook on the Ethereum competitor heading into the third quarter of 2025.

Read more:

‘Prove your dad is your dad’: OKX defends aggressive compliance rules

Thanks for reading Ethereum loses to rival Solana in dApp revenue: Will SOL rally to $200 in July?