ETHICO is trading in a positive but still corrective phase, with its price above the main higher-timeframe demand zones and persistent supply under the declining daily moving averages.

The more general structure suggests that the aggressive selloff from the highs has shifted into a basing and mean-reversion phase rather than completing bullish reversal, while on-chain activity points to gradually improving participation rather (not euphoric risk-taking) as well as progress.

Ethereum Price Analysis: The Daily Chart

The ETH continues to oscillate around the declining 100-day moving average on daily timeframe, and is below the 200-hour moving Average (putting the asset in a properive regime). Nevertheless, the asset has repeatedly respected the $2,700 area as the main demand zone (a deeper structural floor around the range of $2.100–$2,300). This is a market for the $3,500 resistance band that used to be primarily distributing zone and has now become an important part of the market.

Despite the fact that the $2,700 support area is closed on closing basis, the medium-term structure can be seen as a large consolidation within ‘long term bullish trend’ but lack of reclaim for the daily 100-day and 200-hour moving averages and the overhead supply zone reinforces the view that this is still recovering leg inside broader range rather than beginning of an impulsive trend expansion.

ETH /USDT 4-Hour Chart

In the 4-hour chart, there is a clear pattern of higher lows since December drop that forms rounded accumulation patterns with the most recent swing lowanchored in the $3,000 area. In the $3,300–$3,400 range, this price has been alternating between this support level and resistance zone where sellers once again captained the latest advance and caused a pullback in the last 24 hours.

The short-term configuration continues to favour another attempt at the $3,300–$3,400 supply cluster as long as the market respects the curved higher-low structure and is above the $3,000 region. Meanwhile, a sustained break below the $3,000 level would signal that the corrective leg is expanding and will open the way toward its critical $2,800 support zone.

On-Chain Analysis

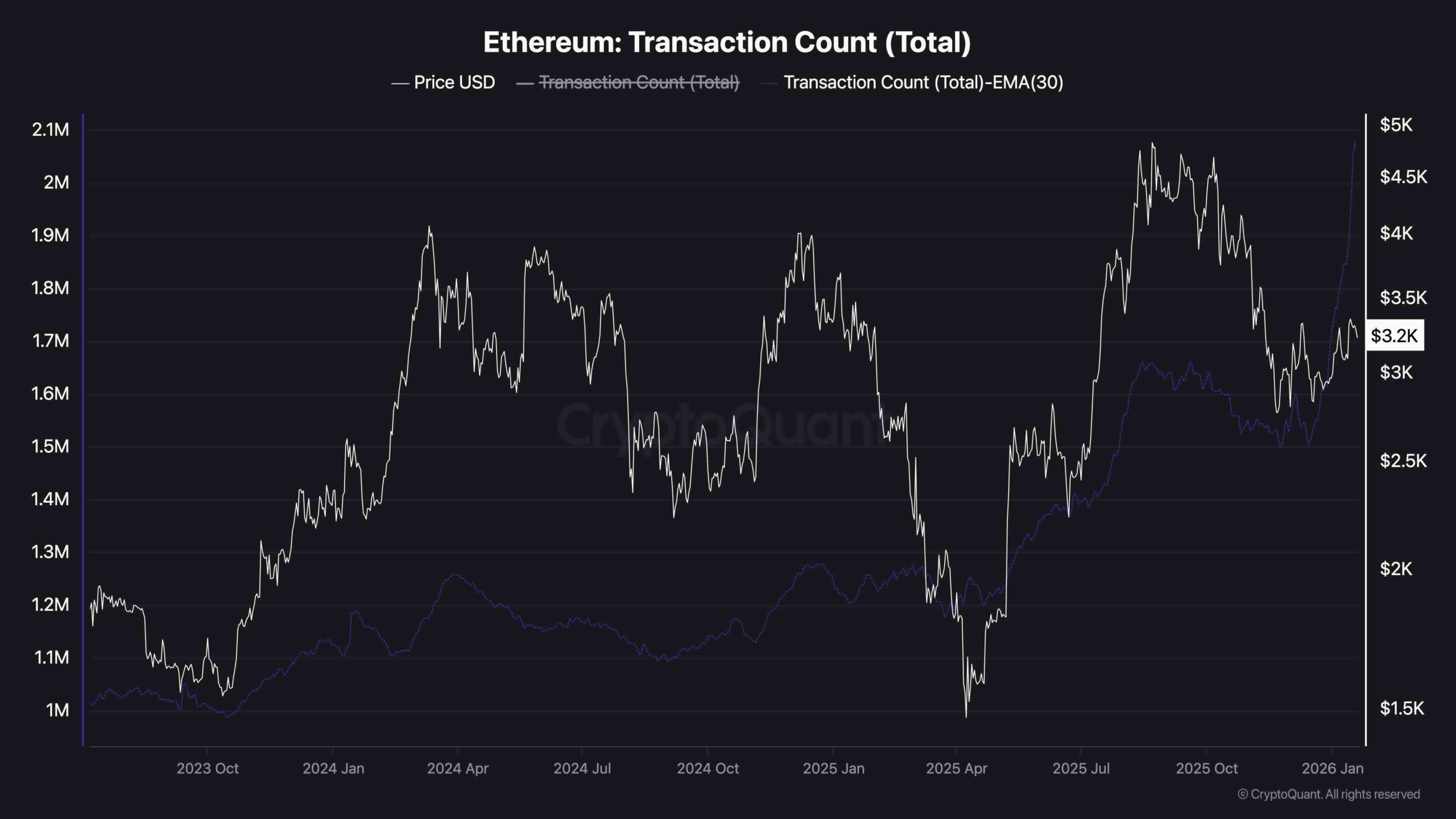

The total Ethereum transaction count and its 30-day EMA are trending up on-chain, with values above 2 million in the past cycle peak.

The distinction between a growing transactional activity and recovering price profile is consistent with’restoring fundamental demand’ network usage is increasing but price has not yet fully reflected that improvement, – i.e. configuration often associated with early or mid-stage stages of n new growth leg; this pattern tends to be the case of “new” (or even middle stage) decline in relation to market size).

Similarly, high transaction counts near resistance can coincide with periods of increased rotation and short-term profit-taking; confirmation in the form of sustained reclaim above the $3,400 resistance band would be required before this on-chain strength could be validated by a fully established bullish trend.

Thanks for reading Ethereum Price Analysis: What Comes Next for ETH After Rejection at $34K?