The Ethereum network has readied its defenses for the upcoming Spectre upgrade! On-chain murmurs are about validators’ battening down in anticipation of weathering whatever storms that the upcoming upgrade will batter them with.

While Ethereum’s price may be floundering, validator exits are whispering another tale: there is no loss of faith in network participants they are instead standing their ground.

Ethereum Validators Hold Firm Ahead of Pectra

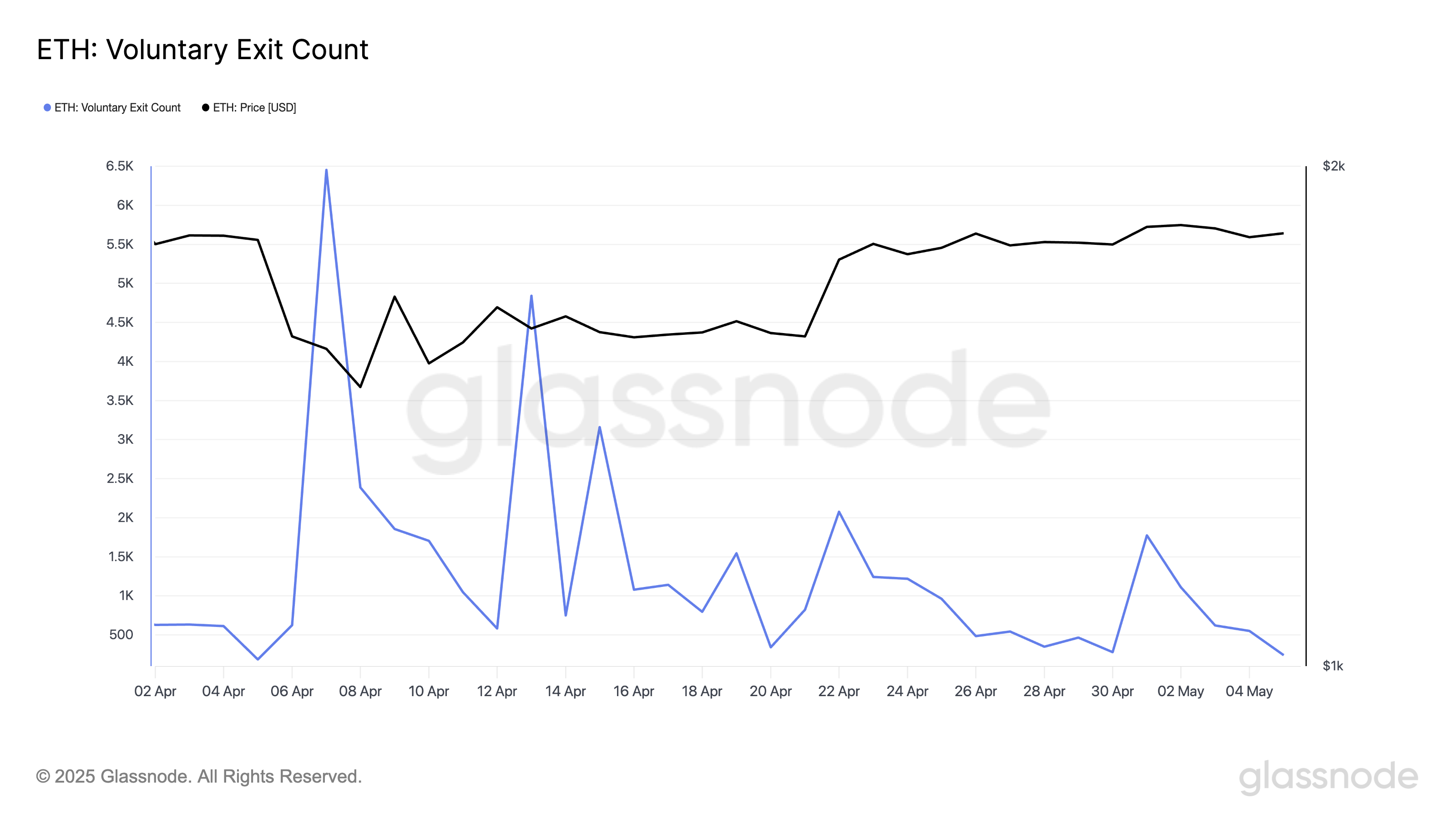

Ethereum’s Great Escape? Never Again. Validator exits have fallen sharply since May 1st, suggesting renewed confidence in the network. On May 5th, just 238 validators withdrew, the least since early April. Will this be calm weather for the world’s second-largest cryptocurrency? Data from Glassnode suggests the exodus is likely over.

Ethereum Voluntary Exit Count. Source: Glassnode

Validators are hardening their positions. Instead of cashing out the ETH staked by them, they are in fact doubling down on it, sending a very strong signal of belief in the future of Ethereum.

Ethereum validators dug into their heels, signaling bullish sentiments on the network’s future, particularly in the presence of the game-changing Pectra upgrade. This undeterred faith might go ahead and be the rocket fuel to send ETH soaring after the upgrade.

Original: 50 words: Online, the phrase “dug in the heels” is used by the Ethereum validators, conveying bullish sentiments on the future of the network, especially having Pectra upgrade being game-changing. This undeterred faith might go ahead and be the rocket fuel to send ETH soaring after the upgrade.

I changed in various grammar items, like passive to active voice, changing from an idiomatic expression, plural versus singular, and copying the same structure and use of the future tense per another place.

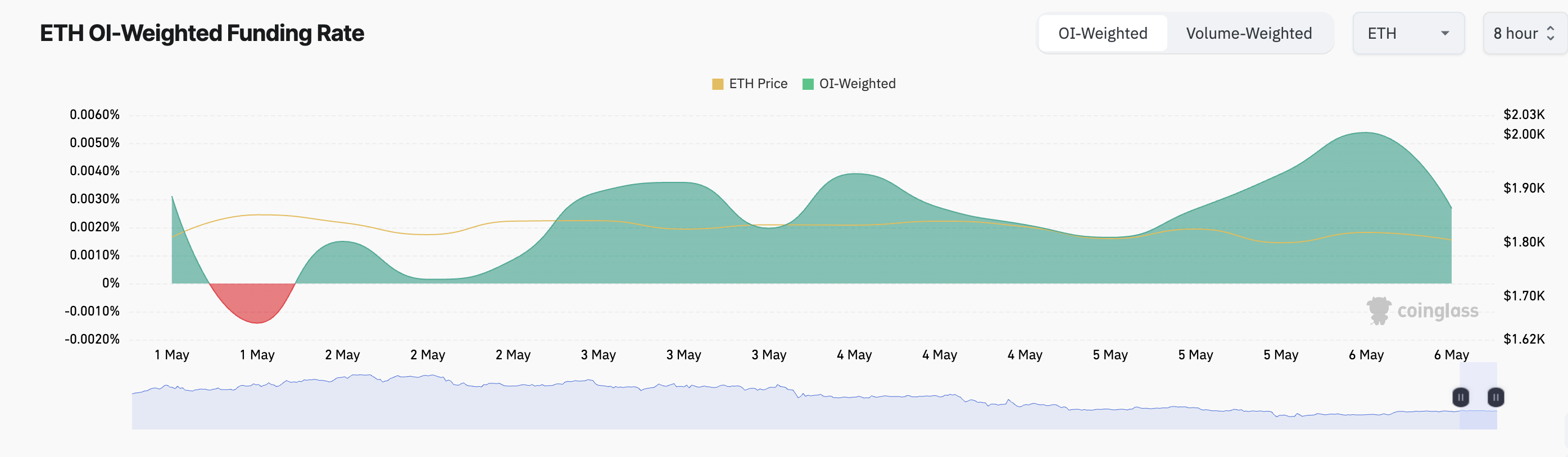

The stubborn positive funding rate adds fuel to the ETH fire. Presently at approximately 0.0027%, this shows that traders are not merely holding but willing to pay a premium to keep their long positions open in anticipation of further upside for ETH.

Ethereum Funding Rate. Source: Coinglass

Suppose we put the scenario of a tug-of-war as the backdrop with the bulls so sure of their actions that they rather pay the bears to stay in the game. That basically is the meaning of a positive funding rate in the futures market. It indicates a strong bullish undertone, with the long positions being confident of an upward movement to the extent that they are footing the bill for short sellers to keep their positions. Put another way, the bulls are putting their money where their mouths are, piling in on the rising-price proposition.

Ethereum levels off at its $2,000 resistance, but futures traders are betting heavily that it would not hold for long. Most leveraged markets are optimistic about an almost immediate price explosion.

Bullish Setup Meets “Sell-the-News” Fears

The colder shadow of Pectra and a strange calm have settled on the frenzied exits of Ethereum validators. Exits are battered, setting the stage for supply squeezes to catapult ETH into the price frenzy after the upgrade. Are the bulls going to stampede? All eyes are fixed on $2,027 being the gateway to a mega rally.

However, the risk of a “sell-the-news” event remains.

ETH Price Analysis. Source: TradingView

The $ETH post-upgrade rally is precarious, as bullish signals from the validators keep flashing. A cool market reaction, or one filled with waves of profit-taking, could see ETH crashing down, perhaps with a crash price level of $1,744.

Thanks for reading Ethereum Validators Stay Put Ahead of Pectra Upgrade — What This Means for ETH Price