After a relentless slide, the market whispers about a comeback. Zoom in, and you’ll catch the barely imaginable ray of revived buying pressure. Open interest and volume are rising slowly but surely, as embers before a flame. The wider picture remains uncertain; technicals, however, depict a market coiling: set to spring. Look for confirmation in volume and momentum; if these ignite, the breakout can be explosive.

Early Market Shifts Point to Stabilization

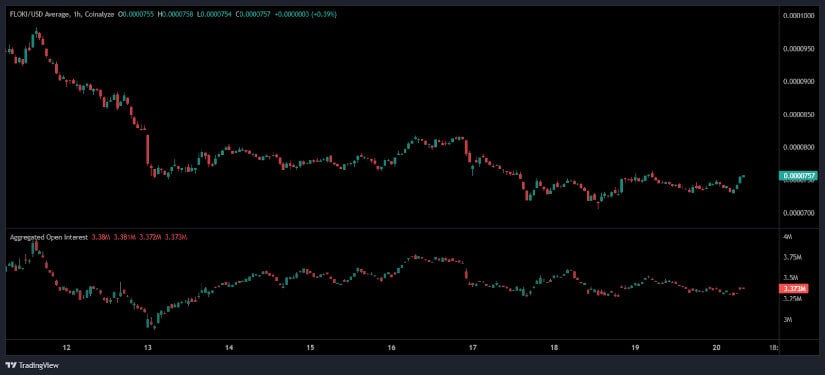

From the 1-hour chart, much of the story is a gross exaggeration of a freefall. Imagine FLOKI tumbling from the neverland of above $0.00009500 toward the perilous $0.00007000 floor. An unrelenting stream of crimson candles marked the descent-profoundly lower highs by every candle-was a scream of sell frenzy. But near the $0.00007000 precipice, the panic somewhat softened. The candles began to shrink into whispers-a very tender word for tranquility-that may hint at buyers lurking in the midpoint of shadows, able to catch the falling knife.

Source: Open Interest

Getting steady on its rooster, the 1,2 degree began to tiptoe sideways and put in higher lows, like hopeful little footprints in sand. A subtle yet loud shift whispered through the market, having taken place in less than 10 hours before it reached a ceiling of resistance at $0.00008000. There it held, denying the price the enemy of its desperate desire to recover. Yet in spite of this frustration, the entire underlying market structure seems to whisper that something is brewing underneath-the-building; a quiet accumulation, perhaps? All that stands between them and an explosive rise is a volume surge past resistance.

And, as the tide turned, it gave an insight behind the curtain with respect to open interest levels. In the first plunge, a dramatic exodus would see open interest collapse, shaken-out traders going for the exit. But as the market found itself on a foothold around 3.373M, a strange calm came in. The calm was not just a pause; it was the ambiance of cautious optimism to breathe in an uncertainty of a possible rebound. Now, what if the open interest and price start inching upward in tandem in what could very well be the initial moves of a bullish resurgence?

Volume Growth and Price Reaction Support Breakout Signals

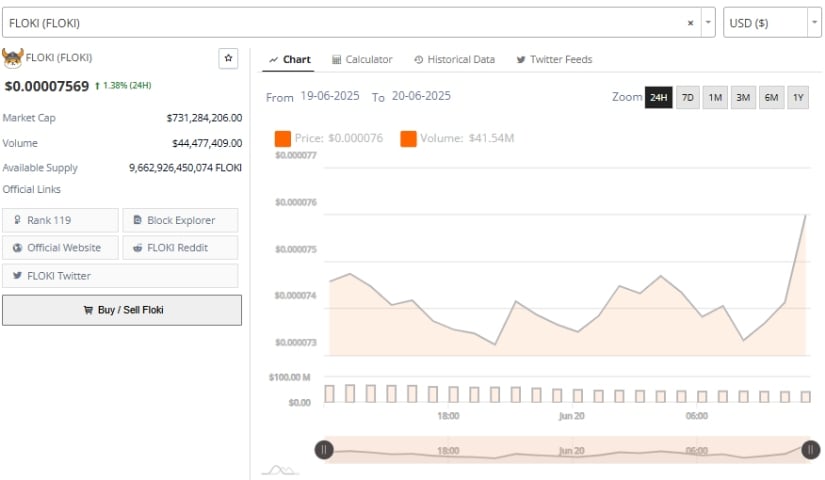

In the zoomed-out view of the 24-hour price action, Floki looked like a tightly coiled spring. For almost the entire day, it was enticed into a microscopic dance between $0.00007470 and $0.00007500-their little moment of zenful calm. But, below, gentle tremors betrayed some shifts. Like a sneaky tide, the higher lows started creeping in, hinting at slightly growing demand that may manifest into a breakout in the near future.

Source: Brave New Coin

Last act of the session saw the market eruption! A breakout of huge proportions had the price shoot up to $0.00007569, with trading volume erupting to more than $44 million. This is no minor hiccup; a tremor suggests it may possibly escape from the shackles of its previous holding pattern. Will the volume-backed breakout push this coin into a fresh rally one or two days down the road? Keep watching; the setup couldn’t be more perfect for a breathtaking climb.

Floki Inu maintains a market cap of $731 million, placing it on the resilient scorer’s corner despite price security during its disheartening drawdown. Activity measures volume and points price in tight ranges. Is all this exhilaration due to a phoenix rising from ashes, or will it just be a spark? Should this momentum be translated into a solid uptrend or just fossilized as an ephemeral gamble?

Floki Price Prediction: Technical Indicators Reflect a Wait-and-See Market

The daily charts seem to have plotted a far distant peak for Floki at $0.00020688. It has been an unfaltering death march of a downtrend, recorded by a series of lower highs and valleys. Yet, the freshest candles tell a somewhat different story: a very tentative support could be forming near the $0.00007500 level. But don’t let your guard down yet: these bullish touches are still a long way off. Buyers are wary, keeping their trigger fingers dry, quite reluctant to make a full-blown reversal commitment.

Source: TradingView

Is it ready to jump, or rather, has it settled into calm pacing? Perhaps the Relative Strength Index could whisper some clues, but standing at 41.37, it may as well be a secret. Almost not in an oversold territory, almost nowhere near ringing the bulls loud, it rather implies holding, waiting. Hold on for the ride as everything is up for grabs in the next strike.

A brief flicker of bullish divergence hinted toward an upward surge and was finally extinguished like a mirage. Now, a darker omen hangs heavy: a whisper of bearish divergence tells the story of exhaustion as the price strains upward, and the RSI tells another story of drying strength. The market isn’t climbing; it’s just pausing.

The MACD histogram is flatlining, whispering close to zero, in the proximity of MACD lines standing in the shadow of the signal line. An indecisive market caught amid a tug-of-war. The bears are easing their hang on the price, but the bulls haven’t yet rushed in. Should prices stand-up to break through the May resistance ceiling, a much bigger spur of upward action should be expected, initiated by an upswing in volume and sheer momentum.

The spring has been coiled, building tension inside compression walls. A rumour of a surge makes a few rounds, but the market holds a breath. Will it be an explosive breakout? Keep eyes peeled, charts and trades will tell the tale. Patience, Vikings.

Thanks for reading Floki Price Prediction as Consolidation Phase Sets Stage for Possible Uptrend Continuation