This is a segment from The Breakdown newsletter. To read more editions, subscribe.

“To believe a nation’s wealth hinges solely on the influx of gold and silver through trade is to mistake the glint of a coin for the gleam of true prosperity. Foreign commerce offers riches far beyond mere bullion.”

Adam Smith

Capitalism, it is sometimes said, is how we take care of people we don’t know.

The hands that till your soil, raise your walls, and stitch your seams belong to strangers.

Americans might be surprised to learn that Vietnam is home to many of their countrymen. Yet, gratitude seems to be in short supply. The White House Council of Economic Advisors chair, Stephen Miran, recently lauded a new trade deal with Vietnam as “fantastic” precisely because it’s “extremely one-sided,” a statement that subtly underscores a complicated and perhaps underappreciated relationship.

This is a Hunger Games worldview that I wish I could talk him out of.

Dear Mr. Miran: Vietnam doesn’t have to suffer for Americans to prosper!

Just the opposite, in fact.

The entire point of free-market capitalism is that exchanging goods and services is a positive-sum activity.

Adam Smith illuminated a fundamental truth: every willing transaction creates a win-win. If it didn’t, the deal would never be struck.

Humanity possesses an inherent drive to trade, a fundamental urge to swap one possession for another. This simple act, repeated across communities, fuels prosperity for everyone.

Extracting “extremely one-sided” trade deals, by contrast, makes both sides poorer.

Miran’s “deal” is a phantom – all promise, no substance. Bloomberg reports Vietnam hasn’t even signed on the dotted line, suggesting it’s less a negotiation and more a monologue delivered to an empty room.

This week, the president dusted off an 18th-century quill, firing off missives to Japan and Brazil that felt more like royal decrees than trade negotiations. In phrases seemingly plucked from a history book, he peddled access to “the extraordinary Economy of the United States, the Number One Market in the World, by far,” reviving the quaint, if baffling, tradition of randomly capitalized nouns. The letters, steeped in self-importance, presented one-sided deals, leaving many wondering if these were invitations or ultimatums.

The diplomatic note to Japan dripped with thinly veiled resentment, decrying a relationship “far from Reciprocal” (their emphasis, not ours!). The core grievance? America, it seemed, felt like a generous uncle perpetually footing the bill, sending more dollars eastward than ever flowed back.

Smith challenged the conventional wisdom, arguing that trade wasn’t about amassing gold and silver, but about something far more profound: enriching lives by making goods and services accessible to everyone.

To judge trade relationships solely by the flow of money is to assume that trade is a zero-sum activity.

Sadly, this Hunger Games outlook appears to be one of the few areas of bipartisan agreement.

Stefanie Stantcheva, writing in The Economist, dismantles the notion of zero-sum thinking as a partisan issue, revealing it as a mindset that transcends traditional left-right divides.

Forget cozy assumptions: City slickers, brainy academics with PhDs, and the under-30 crowd? Turns out, they’re the ones most likely to see life as a cutthroat competition where someone’s win always means someone else’s loss, according to a groundbreaking study.

Even PhDs don’t read Adam Smith anymore, I guess.

The market’s shrug is almost unnerving. Up nearly 7% this year, it’s as if the economic turbulence is just background noise to Wall Street’s relentless climb.

Adam Smith, were he here, might warn us: treat global trade as a battlefield, and prepare for mutual defeat.

Hunger Games had a happy ending, after all, but only because they stopped playing the game.

Let’s check the charts.

Something is happening:

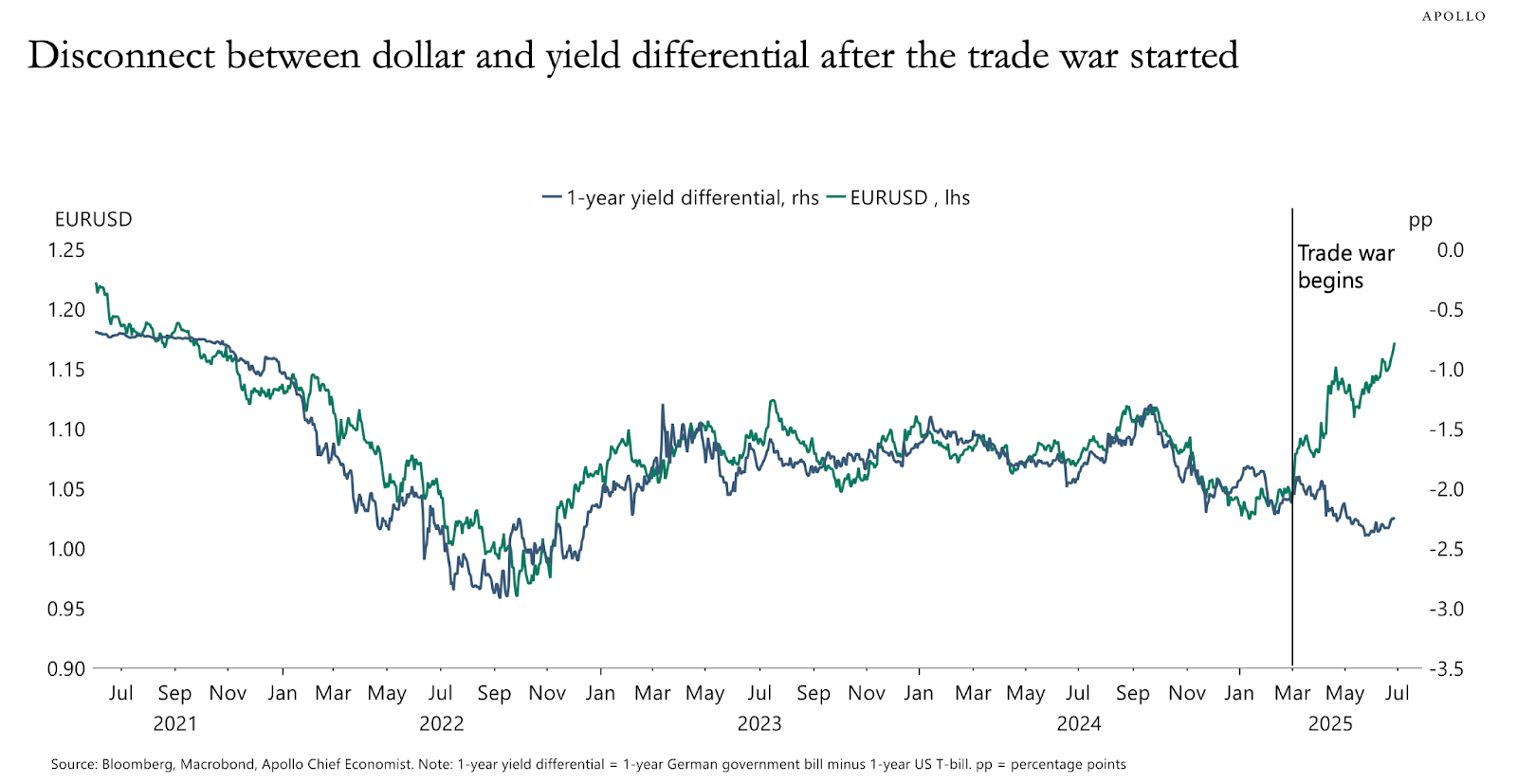

Forget interest rate differentials. The euro-dollar seesaw now dances to the tune of tariffs. While stocks shrug off trade wars, currency markets are sounding a different alarm, suggesting the future value of your euros and dollars hinges less on central bank policy and more on the looming shadow of trade barriers.

Try to keep up:

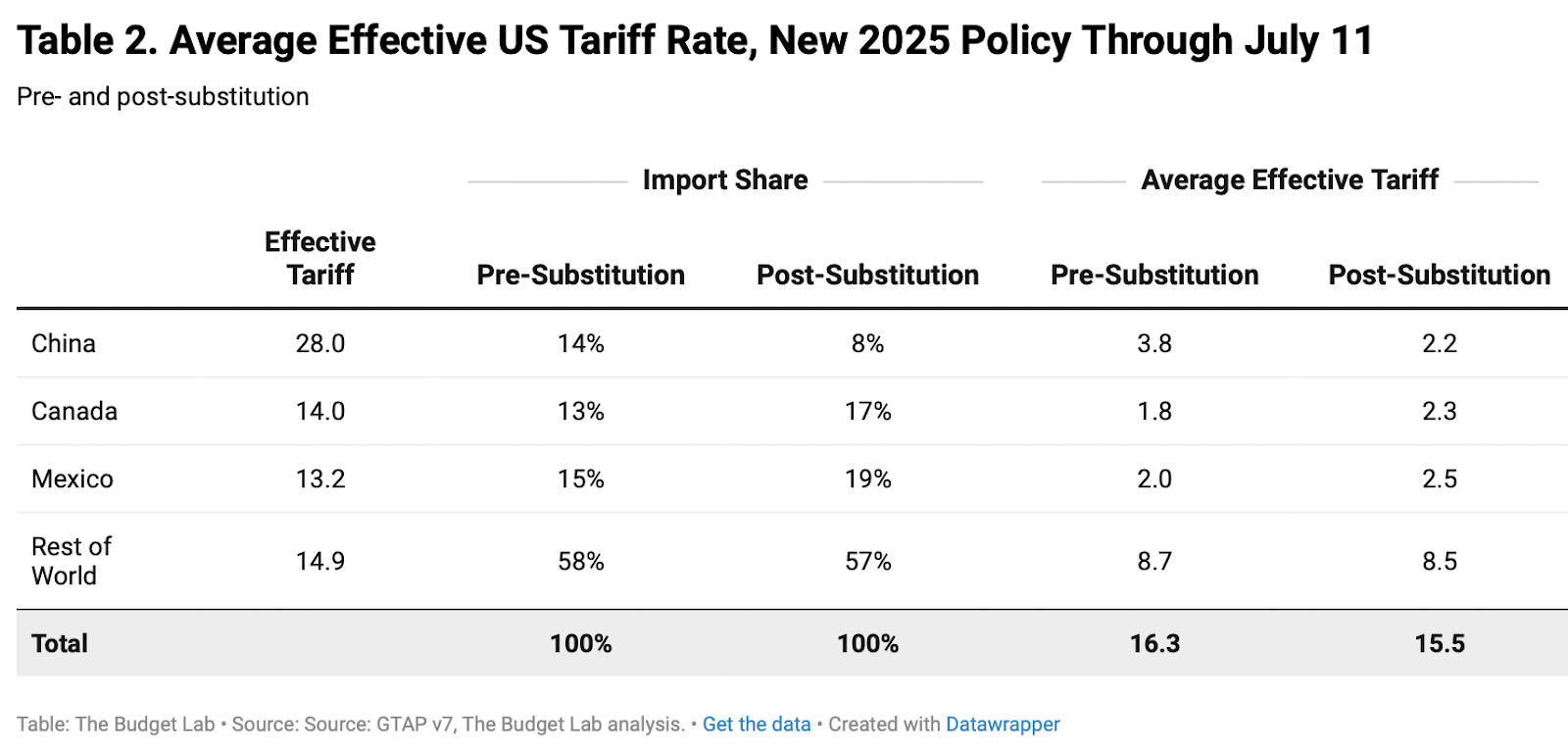

Yale’s Budget Lab just dropped a bombshell: Trump’s tariffs,right now, clock in at a 16.3% effective tax (before the scrambling starts). But hold on tight – that number’s a ticking time bomb. Tomorrow? It’ll likely be a whole new, and probablyhigher, story.

Tariff cheat sheet:

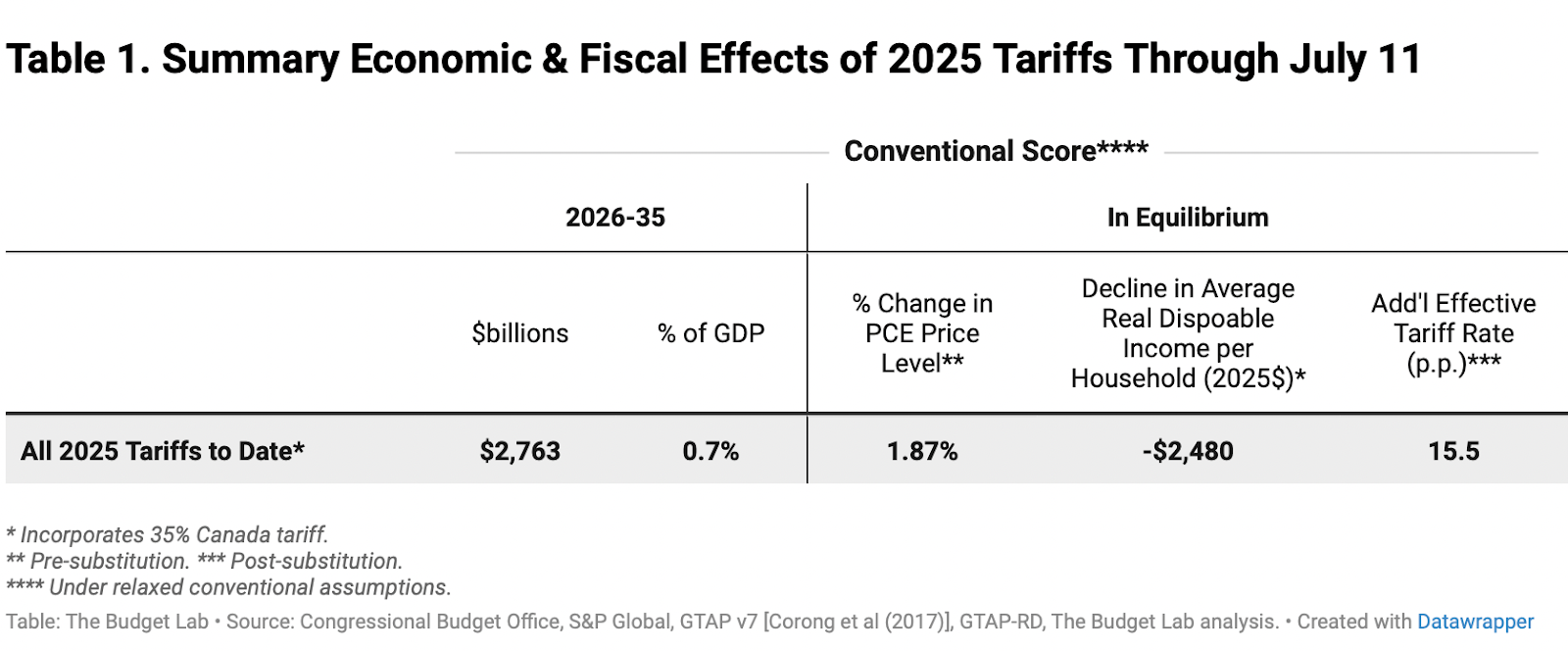

Yale’s economists aren’t just ivory tower theorists; they’re number-crunchers with a grim forecast for your wallet. Their models predict tariffs will bleed American households dry, to the tune of $2,480 a year. Apparently, someone at Yale dusted off their Adam Smith.

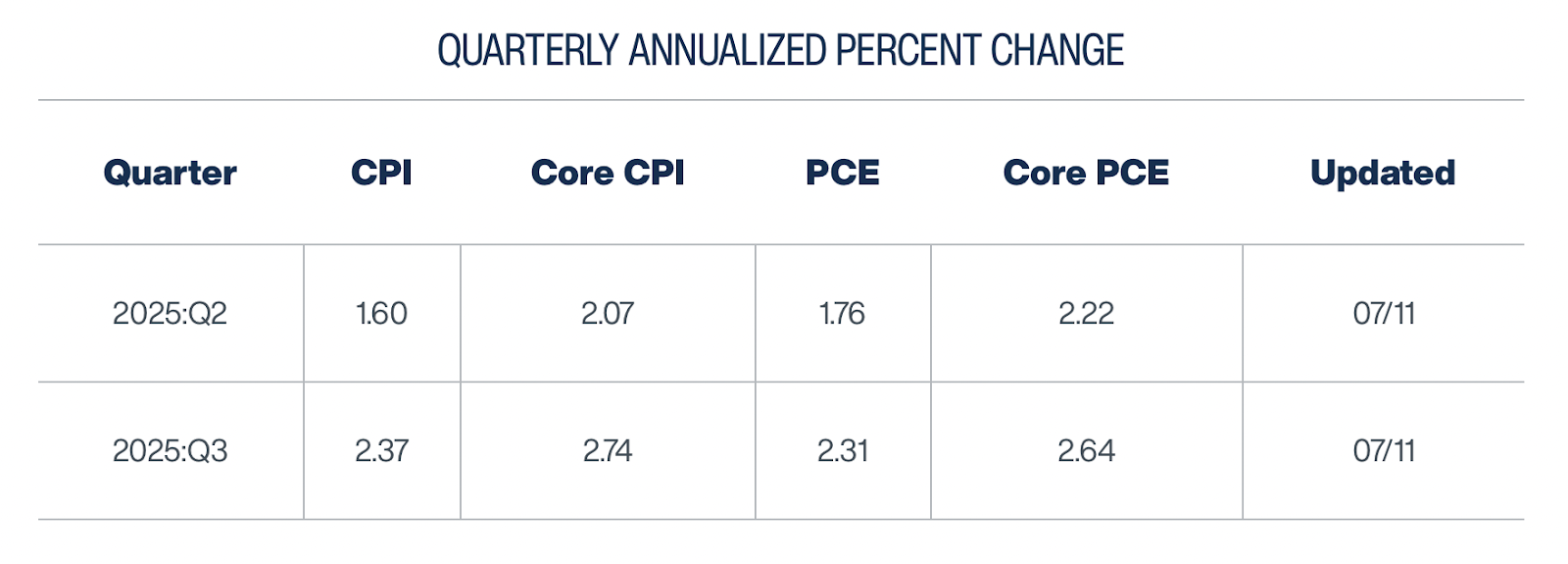

Is inflation due for a trend change?

Inflation’s summer surprise? CPI’s cooled for four straight months, but the Cleveland Fed’s forecasting a heatwave – nearly 0.8% hotter inflation in Q3. Will next week’s CPI report confirm the chill, or signal a fiery resurgence? All eyes on the numbers.

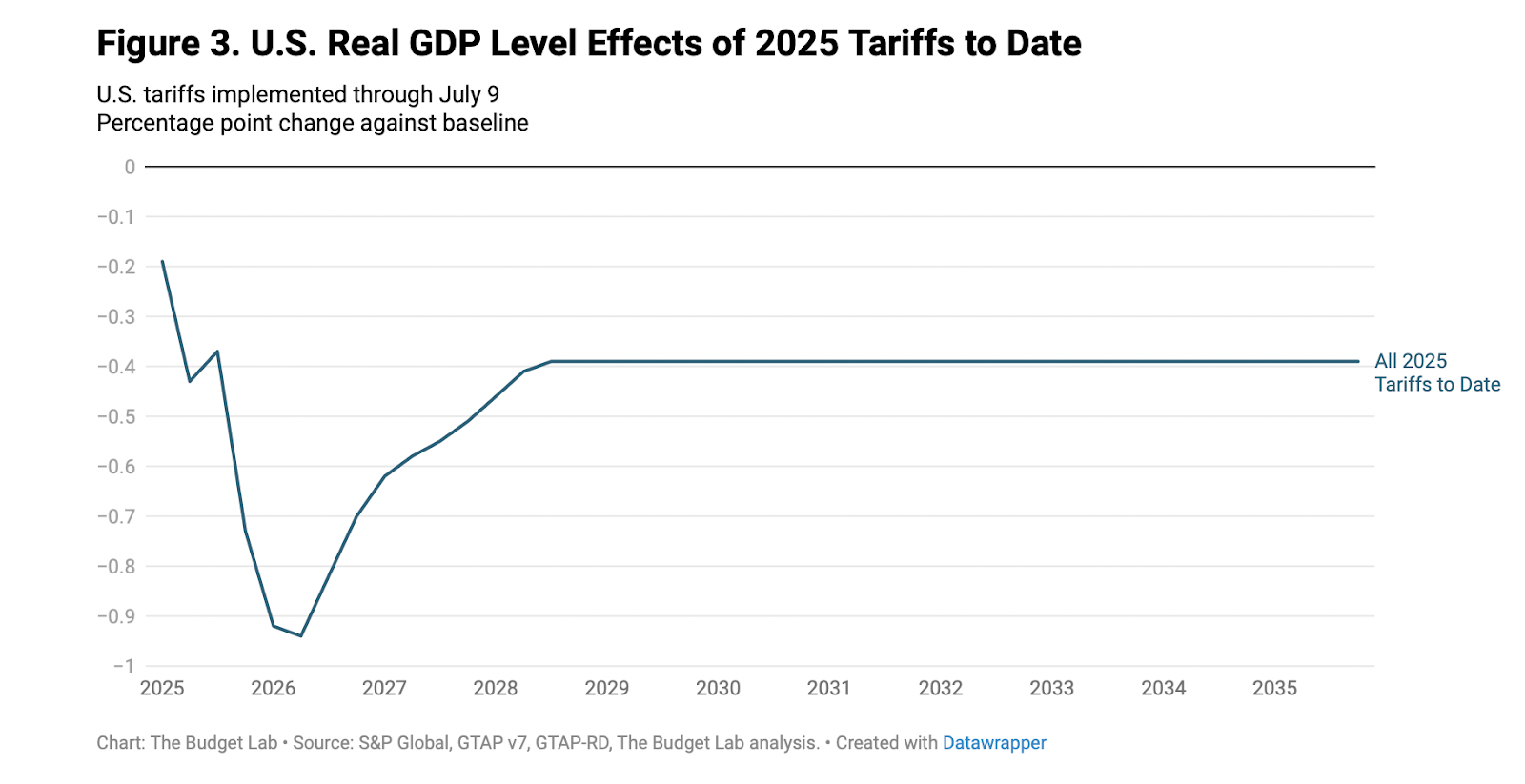

Shrinking the economy:

Tariffs: a slow burn on the US economy. Budget Lab forecasts suggest a 0.8% GDP hit by 2026, but the real sting? A permanently stunted economy, forever trailing 0.4% behind its potential. Imagine a future where America’s economic engine is perpetually misfiring – that’s the long-term legacy of these trade barriers.

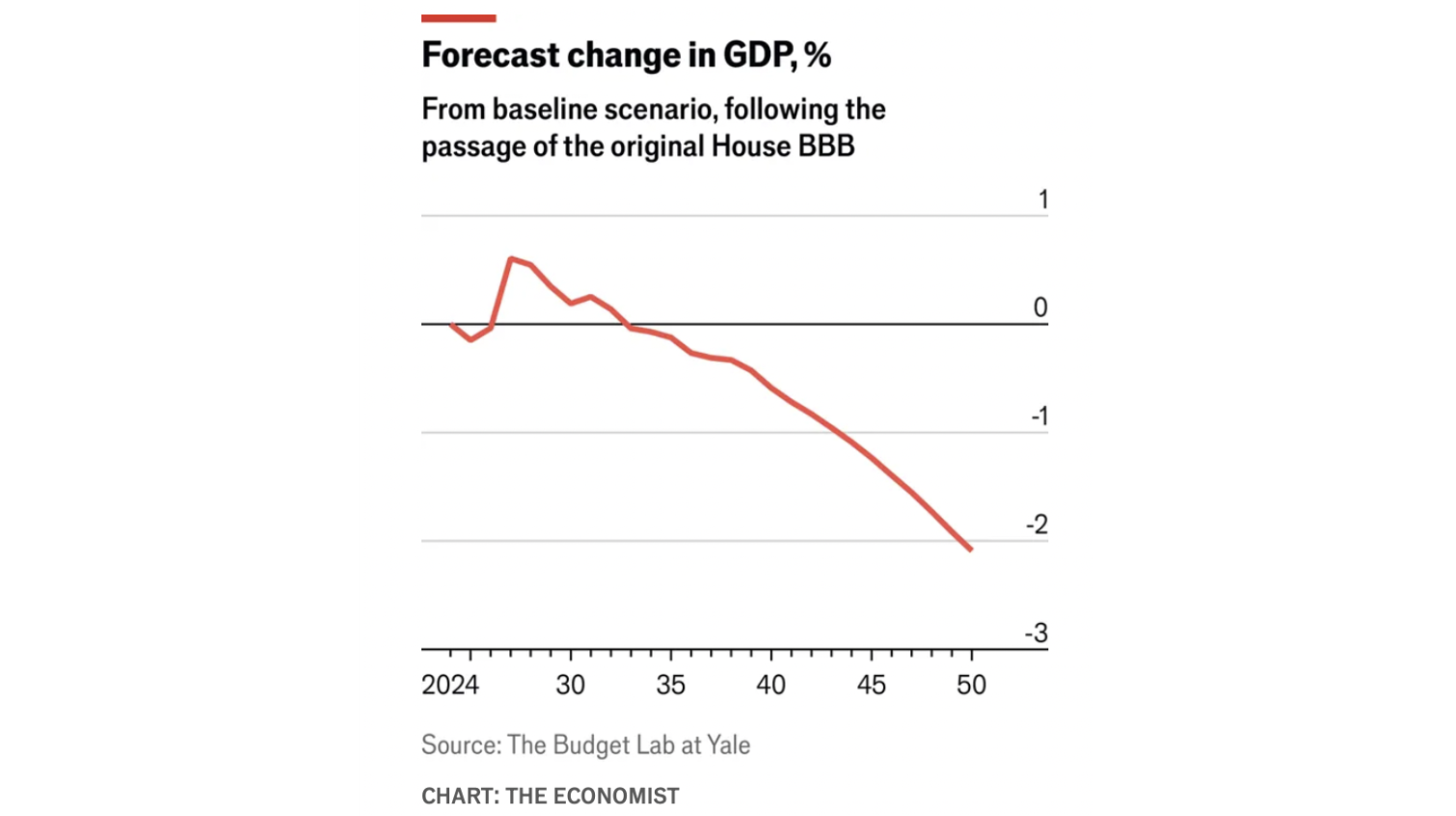

Shrinking the economy, part two:

The Economist, crunching Yale’s data, paints a stark picture of the future: the “big beautiful bill” is projected to shrink the US economy by 2% in 2050. Don’t let that seemingly small number fool you. 2050 isn’t some distant sci-fi dream; it’s a mere blink – less than 15 years – away. Prepare for impact.

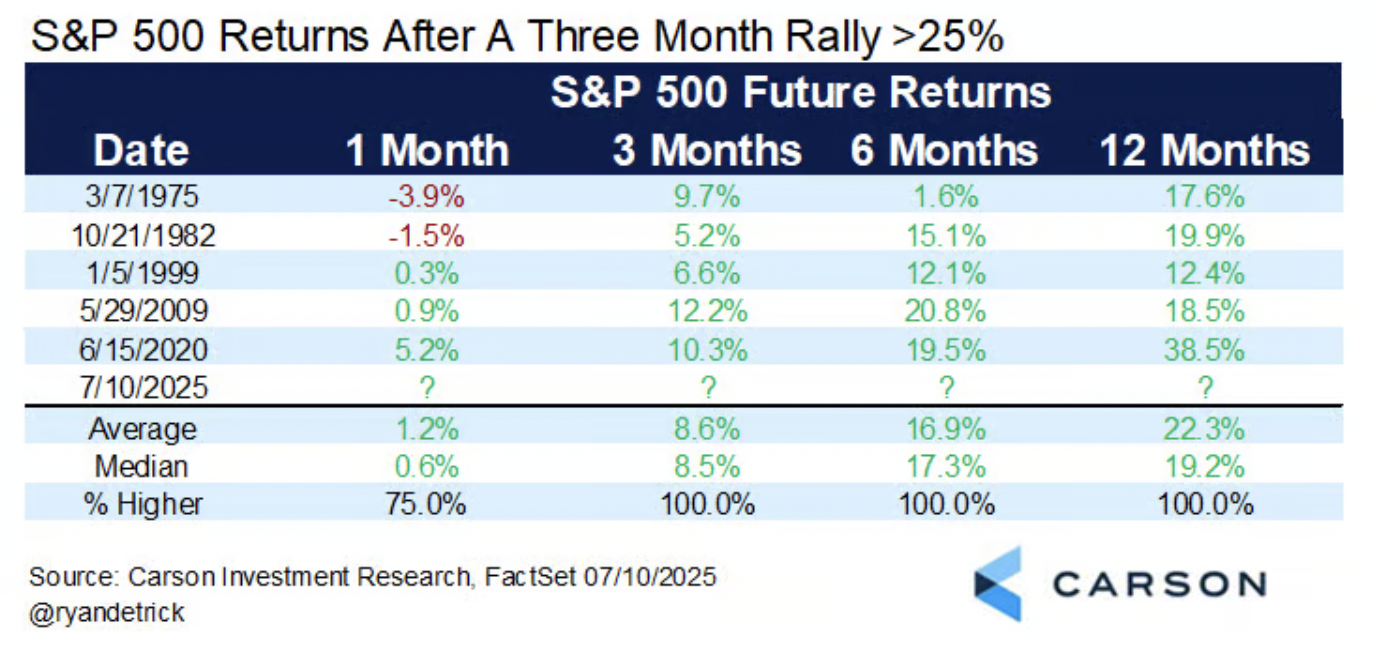

In case you missed it:

The market’s on a tear! According to @ryandetrick’s data, rallies like this havealwaysled to higher highs in the subsequent three, six, and twelve months. A mathematical certainty, you say? Well, hold your horses. This crystal ball is based on a sample size of…four. So, while the odds might seem stacked in your favor, maybe skip mortgaging the mansion just yet.

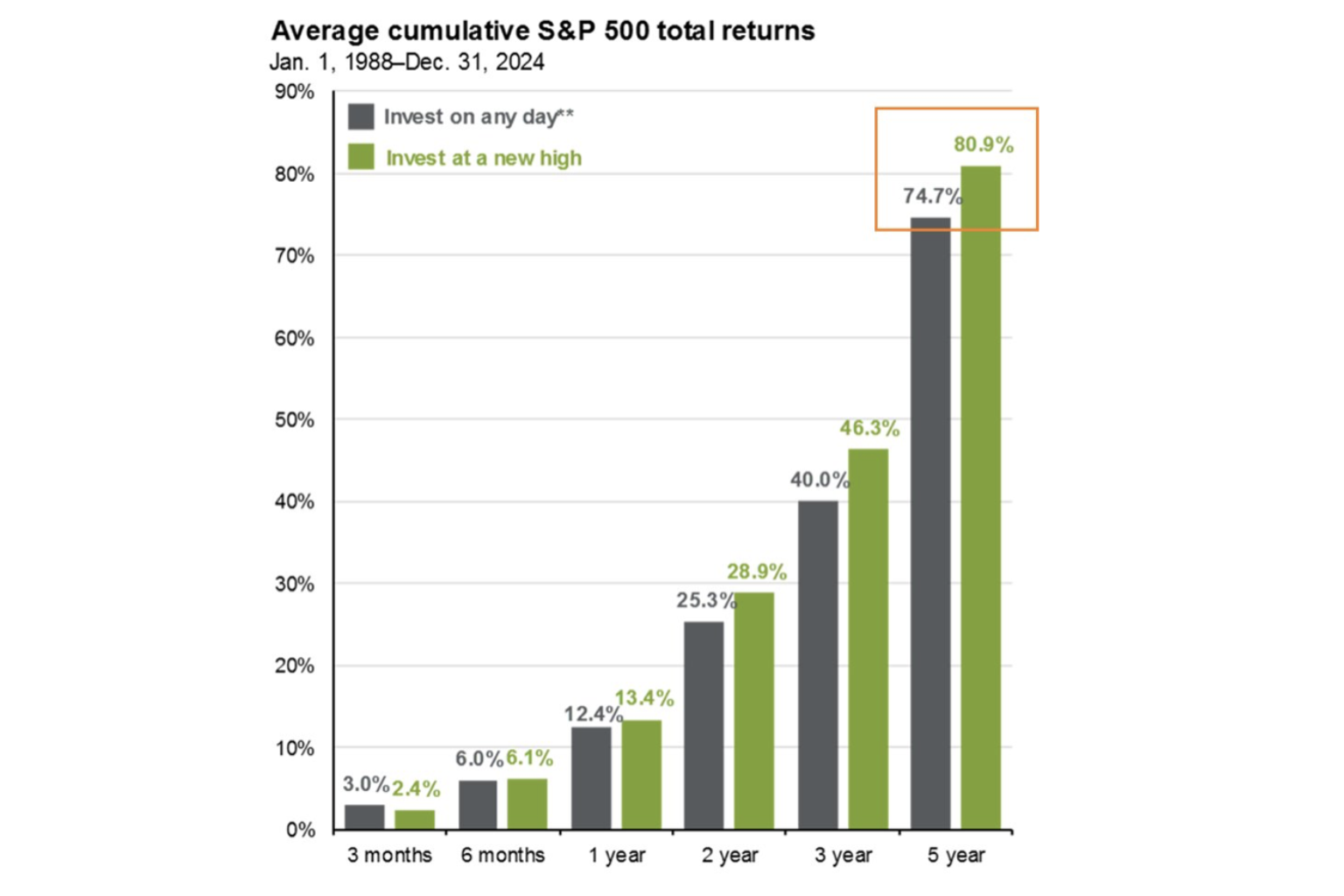

My favorite chart:

“I have a knack for buying at market peaks, which is why I find Mike Zaccardi’s data so fascinating. It defies logic: Investing in the S&P 500onlywhen it hits record highs somehow outperforms a more scattershot approach. Maybe there’s still a chance for my investment strategy after all.”

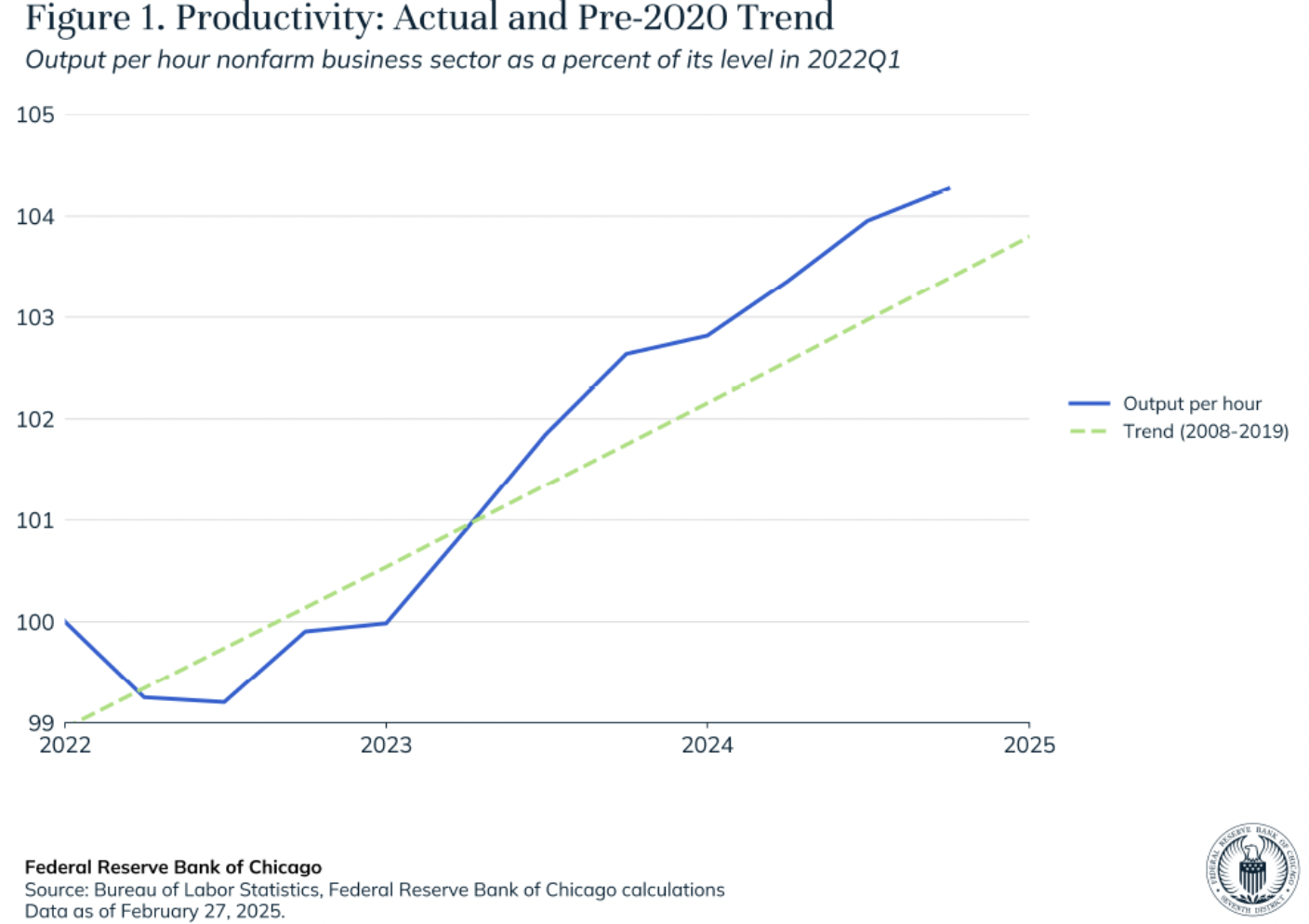

Doing more with more:

Thanks for reading Friday charts: The rise of zero-sum thinking