Goldman Sachs emerges as major player in crypto investments with increased acquisition of BlackRock shares.

Key Takeaways

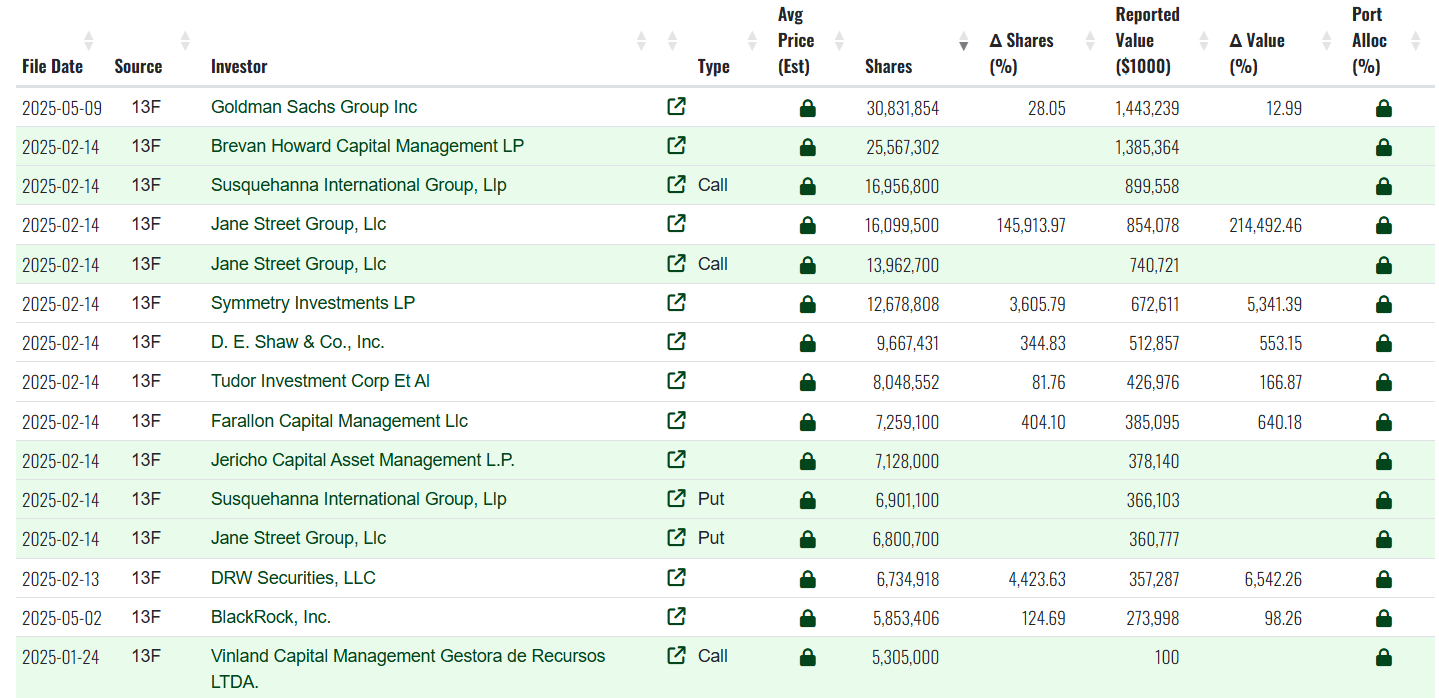

- Goldman Sachs increased its stake in BlackRock’s iShares Bitcoin Trust to 30.8 million shares worth over $1.4 billion.

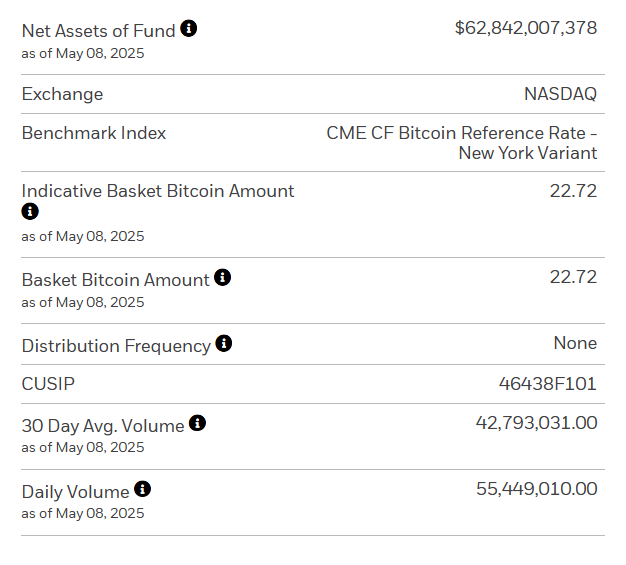

- IBIT leads Bitcoin ETFs with approximately $62.8 billion in assets under management.

Goldman Sachs is going full swing on Bitcoin. According to a recent SEC filing, the investment giant pumped up its stake in BlackRock iShares Bitcoin Trust (IBIT) by a staggering 28%. As of March 31st, Goldman Sachs holds 30.8 million IBIT shares, up from 24 million previously. Such a sizable acquisition entails an elite-level Bitcoin investment of over $1.4 billion, thereby communicating astronomical confidence from institutional circles in the leading cryptocurrency. The increased position in IBIT was first brought to attention by MacroScope and tracks well with growing acceptance of Bitcoin in traditional finance systems.

Back in February, Goldman Sachs plunged into the madness of Bitcoin ETFs with an action-filled investment of $1.5 billion. Within their basket of digital gold was $1.2 billion in BlackRock’s IBIT and $288 million in Fidelity’s FBTC. Fast forward to the latest filing: Goldman seems to be holding steady in its FBTC stake, in a sign of sustained-if perhaps cautious-interest in the crypto landscape.

IBIT giant players are into it. Fintel data reveals one investment bank as the supreme institutional holder with Brevan Howard sitting pretty behind it, commanding the ownership of over 25 million shares, representing a staggering $1.4 billion stock. The big power players Jane Street, Symmetry Investments, and D.E. Shaw & Co. are well on their way, too.

Goldman Sachs is hedging on both sides of the Bitcoin ETF game. According to a recent filing, the investment behemoth is following a complex strategy, which involves a bullish call option position on IBIT, BlackRock’s Bitcoin ETF, of $157 million, hoping for a price surge, while countering the bullish bets with put options worth $527 million, expecting a downturn. They’re also shorting Fidelity’s FBTC with $84 million worth of put options, per MacroScope. It is really a multi-million-dollar put, straddling the market such that Goldman is enabled to gain either way in the Bitcoin ETF swing.

In an extraordinary twist of events typical of Wall Street, these options were nowhere to be found in the filings. Did Goldman trim quietly off its position, or did those big bets simply disappear in their expiration?

IBIT remains the largest Bitcoin ETF, with approximately $62.8 billion in assets under management.

Barely beginning in January, this fund has already become an investor magnet, with over $44 billion poured into! And in this single week itself, another $674 million nearly has been harvested, making it practically irresistible, according to Farside Investors.

The ETF’s shares rose $1.04 during Friday’s trading session, reaching $58.66, according to Yahoo Finance data.

Thanks for reading Goldman Sachs doubles down on BlackRock’s Bitcoin ETF boosting holdings to $14B in Q1 2025