The heartbeat needs a little speed. After a recent dip, Hedera Hashgraph showed some signs for life. A rising tide lifts all ships and as the market winds now change in favor, hence bullish sentiments are rallying for HBAR. Keep a close watch.

Poor-hours is whispered about: technical indicators show that the pulse in the token is quickening, acting on an increasing demand. Is this the prelude to a price revival?

HBAR Gears Up for Rebound as Bulls Take Charge

HBAR Hints at a Comeback: Are Bulls Back in Charge?

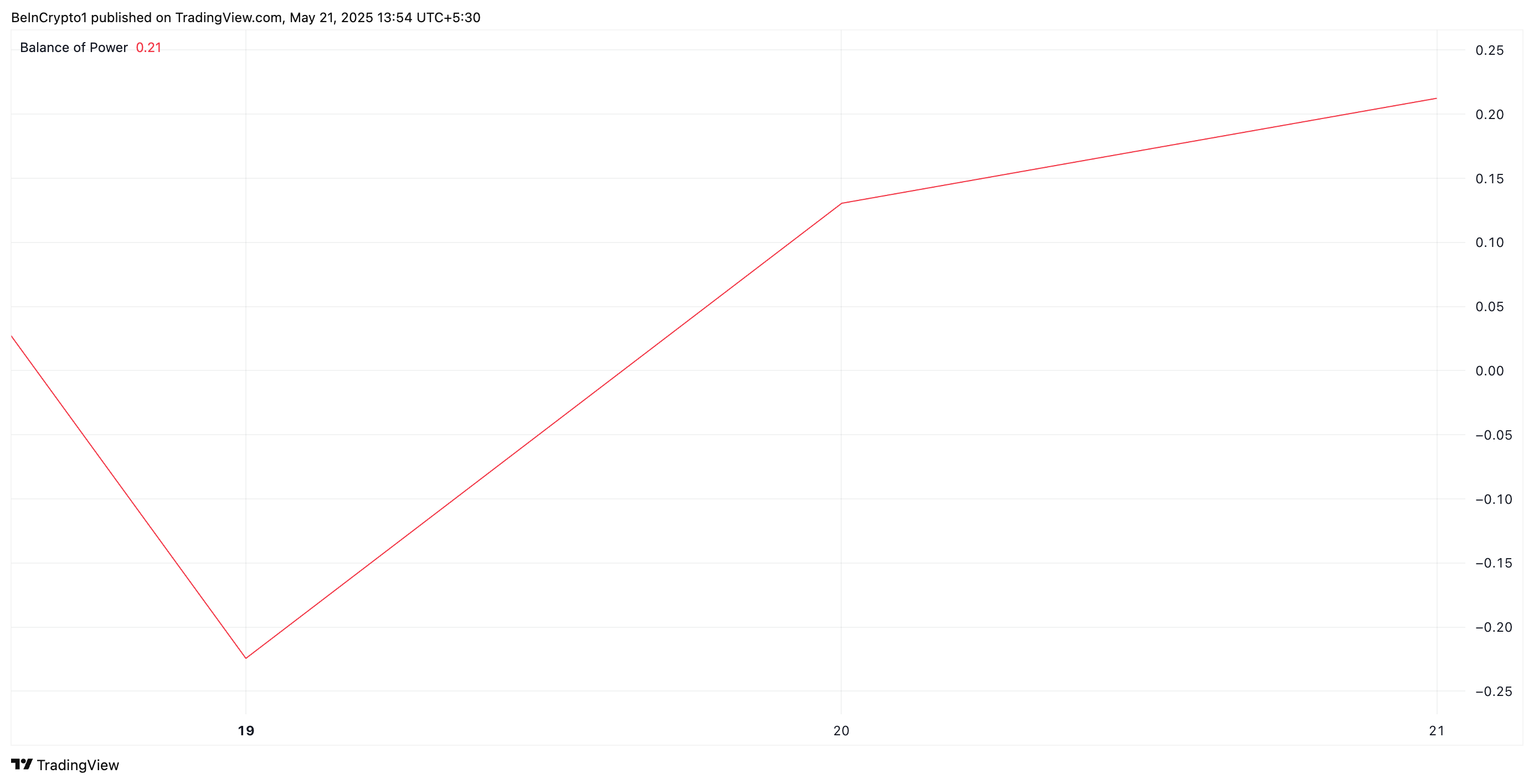

HBAR is waking up; whispers of recovery are continuing, fueled by a buying surge. The Balance of Power or BoP indicator is indicating a market domination by one party-a green signal. After weeks of bearish influence, now come the bulls, racing the BoP all the way into positive territory. At 0.21 and climbing, HBAR’s BoP is currently sitting pretty, suggesting increasing pressure from the buyers. Just is this a sustained rally or a mere temporary relief remains to be seen, but the signs are truly interesting.

HBAR BoP. Source: TradingView

Here, bulls are flexing their muscles, wresting the price action from the gruesome claws of the bears. Such dominance paves for a promising trajectory, which may have been the sustaining factor that allowed the rampage to continue.

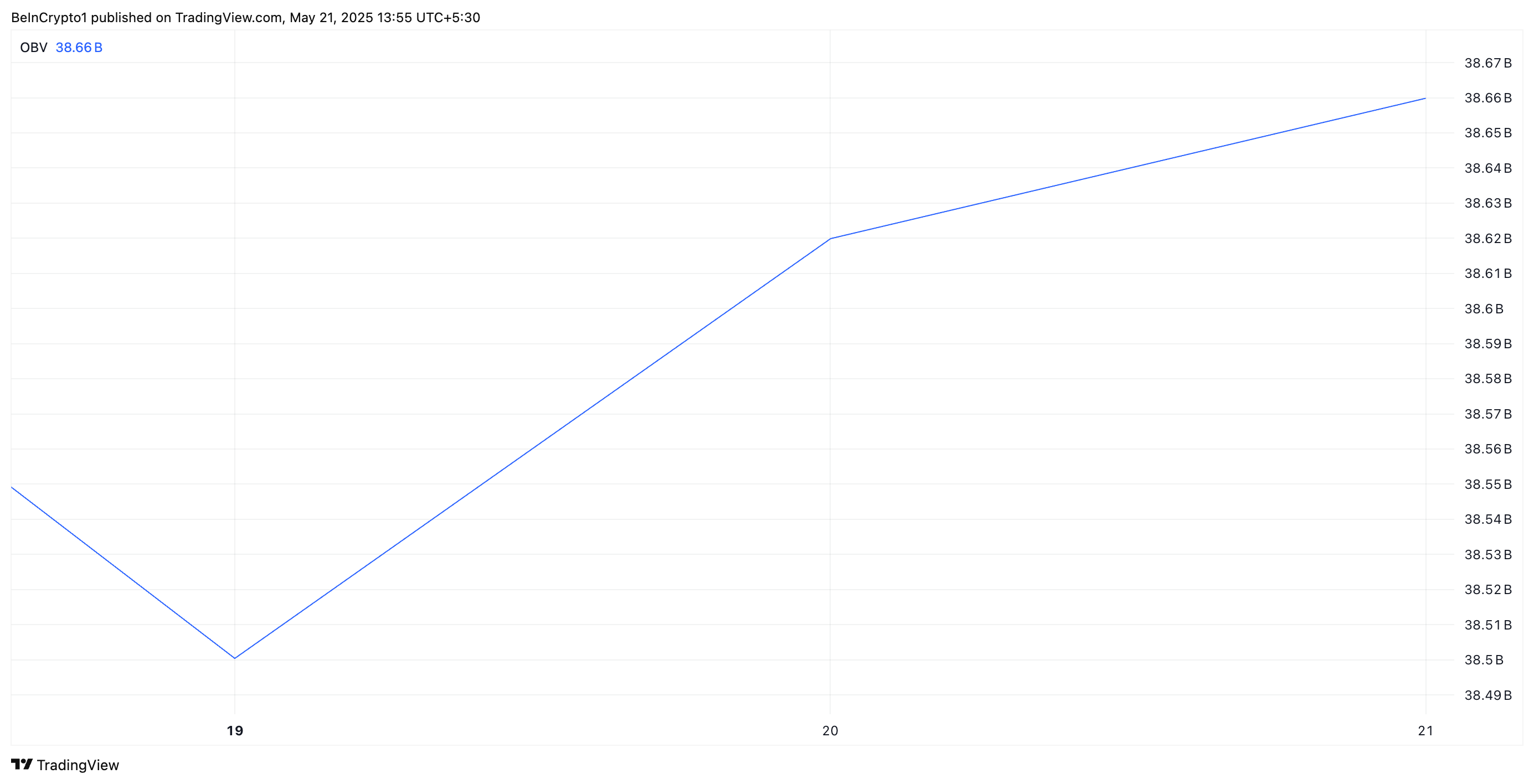

HBAR’s On-Balance Volume (OBV) is actually soaring; at present, it stands at a weighty 38.66 billion. This upside path is not a fleeting moment but rather an indicator of bulls running wild in the HBAR arena, thereby creating genuine positive vibrations within the market.

HBAR OBV. Source: TradingView

Unlock Hidden Market Momentum with OBV! In the minds of traders, volume is like fuel that drives price trends. Thus, On-Balance Volume is the indicator that acts as your view of the pressure exerted by buyers or sellers. Think of it this way: when OBV heads up high, it sends the message that more autoclaves are picking up volume on price rise days, which means that demand is swelling and a price explosion could be in the offing. Read the OBV-the indicator that shows strength hidden beneath the market!

Technical Indicator Signals Buyers Are Regaining Control

HBAR’s relative strength index is not just ascending; it is like a rocket getting ready to take off. It is hovering at 52.53, and its acceleration signals that buyers are gaining the upper hand. In buying pressure, this could be the fuel that forges ahead more powerfully with HBAR’s climb. The bulls are attacking, and the RSI is the shout of war.

Is a stock running too hot or about to pop? An early warning system is provided by the Relative Strength Index, widely known in its abbreviated form as the RSI. Price momentum mirrors a speedometer with values oscillating from 0 to 100. When an overbought signal is given, the price momentum has a reading exceeding 70. This ominous sign indicates a possible sell-off. Sell-off moments might include being in the oversold arena or with some bounce back in support; a reading below 30 is seen as such an opportunity. Try to use the RSI to catch points of interest just ahead of the majority.

There seems to be some brewing excitement in HBAR. A resurgence bull is observed by the Relative Strength Index, suggesting a price surge in the coming days. If the bullish strength holds, watch out for HBAR breaking through the $0.20 barrier with a potential rally to $0.23. The bulls are strengthening and set to rewrite the destiny of HBAR.

HBAR Price Analysis. Source: TradingView

But beware, should sellers seize control, HBAR’s current place could crumble. Preparations are made for a possible fall below $0.19, and if it is indeed the bears who will lead the dance, a downhill freefall to $0.12 is on the cards.

Thanks for reading HBAR Shakes Off Recent Losses as Surging Demand Signals Possible Breakout