Hedera Hashgraph’s HBAR is making a comeback, gaining over 6% and potentially reviving an $8 billion market capitalization of its own. A flurry of activity has 19% higher rise in trading volume, reaching almost $176 million in numbers, allowing investor attention and involvement to surge again. Is this just the beginning of the sustained rally?

HBAR’s sitting at the crux. BBTrend is calling it “bear,” with the bulls just the tiniest bit awake. RSI and EMAs are whispering about a big power change, and that golden cross might just be around the corner. Everybody’s got their attention locked on those resistance levels-a break through is a rocket launch, and a no-go is abort land.

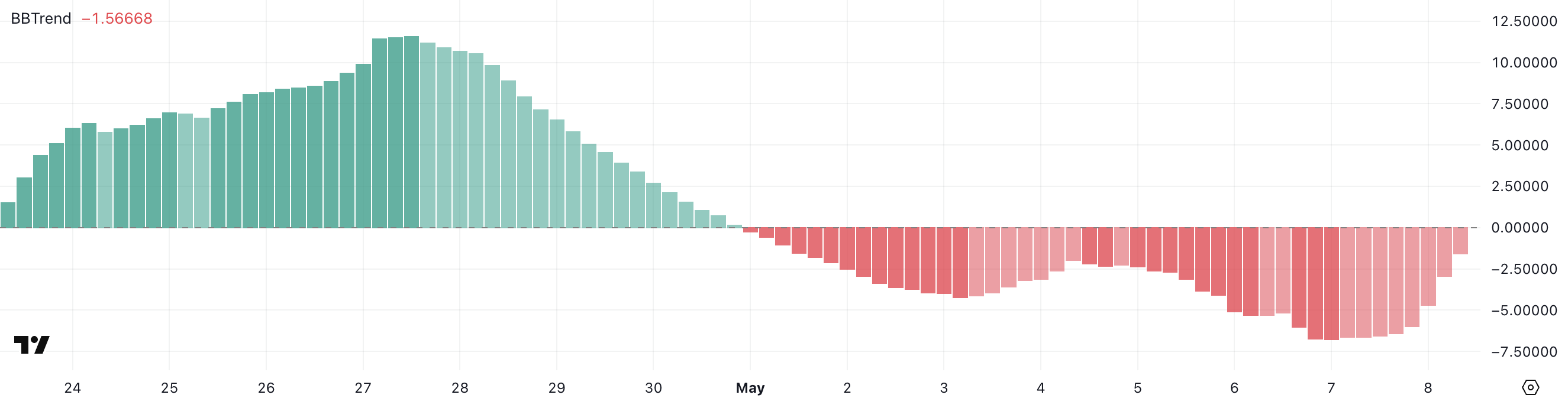

Hedera BBTrend Remains Negative Is the Worst Over?

Hedera investors, prepare to be rocked! According to the BBTrend indicator, bearish territory has been seen ever since May 1. It plunged to a chilling low of -6.76 yesterday, the lowest in one month. With a slight recovery today, all signs are pointing to caution. Will this be a temporary respite, or will HBAR experience a full-scale correction?

“The market has been caught in a current undertow pulled down by a never-ending bear trend. The tide of selling seems to be now on its way out, but the general direction remains south.”

Is the market whispering some secrets that you simply cannot snap your way around? BBTrend, an ingenious enhancement of the Bollinger Bands, lets you gaze at the hidden power and direction else incoming trend. The marker is like a steer that points to potential profitable moves by cutting through the haziness of where the price action is headed.

HBAR BBTrend. Source: TradingView.

Since the market’s pulse lies +1 and above it, bulls are running strongly in an upward move. Below -1 are the bear forces, grinding down prices with intent. Between +1 and -1 lies an indecisive wilderness where markets either consolidate or simply lack the urge to pick a direction.

BBTrend for HBAR is clawing its way from the depths of yesterday, still languishing at minus 1.56. Will this be a little respite before the next plunge, or will the bears finally loosen their grips on Hedera?

“The BBTrend is flirting with a breakthrough! A surge past -1 could be the lifeline for the market, hinting toward a price resurrection or at least a much-needed break from the relentless downward crush.”

Hedera Approaches Overbought Zone After Strong Rebound

Hedera Relative Strength Index (RSI) has surged to 66.2, up sharply from 31.41 just two days ago.

HBAR’s ascent is a phoenix rising from the ashes of oversold territory, now riding a tidal wave of bullish fervor.

Defensive buying shows an explosive reversal-among other things, the bullish may take over and erase his losses. Watch for the potential ceaseless breakout if the given momentum can be sustained.

HBAR RSI. Source: TradingView.

Imagine a market teetering on the edge. Is it about to plunge or bounce back? The Relative Strength Index (RSI) whispers clues. This momentum indicator, ranging from 0 to 100, behaves just like a seismograph for the market. When the line drops under the 30 mark, tremors signal that the asset has been oversold and is all set for an upward rebound. On the other hand, if the line climbs above 70, warnings blare that it is an overbought territory, and one should prepare for a price correction. Following the RSI may well be your next smart move.

HBAR has grown stronger because of a bullish trend. Chart readings between 50 and 70 confirm the rising strength. At the moment, the RSI is at an enticing 66.2, flirtatiously close to being overbought and yet not there. This momentum else will push HBAR to higher peaks.

However, traders should watch for any signs of exhaustion if RSI crosses 70 in the coming sessions.

HBAR Next Move: 38% Rally or 33% Correction Ahead?

Tension is building on the Hedera coiled spring! A golden cross quietly beckons as short-term momentum threatens to burst through long-term resistance. Could HBAR be taking off?

A golden signal is blinking: Hedera is preparing to lift off now. Confirm the crosses; crack resistances $0.191 and $0.199 and prepare to surge to targets of $0.215 and then $0.258. Bullish momentum is building-up; will you be joining this ride?

A rally to those levels would represent a potential 38% upside from current prices.

HBAR Price Analysis. Source: TradingView.

However, if HBAR fails to break through the $0.19 resistance zone, it could face a pullback.

$0.175: The initial barrier to be tested. Knowing that, a down-slide can be expected if this support breaks. Then $0.160 with $0.153 project as the floors, but only if the bears really take hold of the ball game.

HBAR could fall as low as $0.124 in a strong downtrend, marking a possible 33% correction.

Thanks for reading Hedera (HBAR) Eyes Bullish Momentum as Bearish Trends Begin to Fade