The asset remains under pressure, but recent price behavior and trading metrics suggest a potential base could be forming.

Say what you will about the market’s engine–it sputters and falters while some slight glimmers of hope flicker in the dashboard. All eyes are glued to volume and open interest, looking for the telltale sign of the next spike. A cautious breath is being held, depending upon whether the market can find itself back above the support line. That might finally be the moment when the climb will begin.

Hourly and Daily Structure Shows Stabilization After Extended Decline

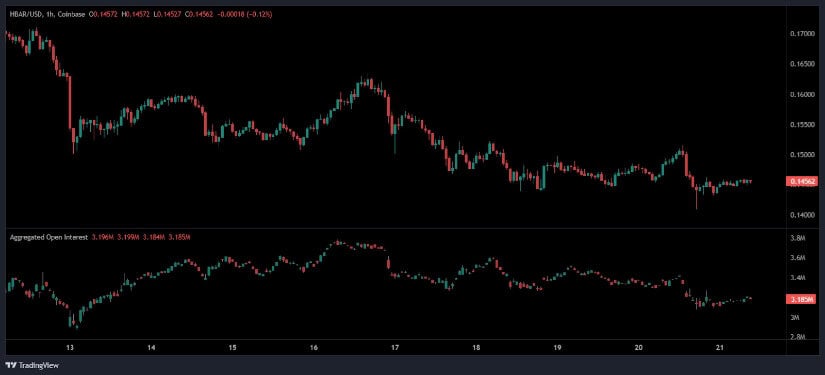

The hourly chart from June 13-21 actually lends credence to a bearish kind of interpretation of the picture. Imagine the sort of rollercoaster mashing down from $0.17 to $0.15 in a gargantuan free fall. It was too much for the ride to take, settling instead into a monotonous sideways crawl and a flatline in volatility. There was a brief instance on June 16 in which blood seemed to stir, giving rise to an impulse up to $0.155, but the sellers much ‘ugly’ed them away. Since June 17 the trend has again trended downward to near $0.14, which is a rather unpleasant place for any HBAR bulls to contemplate.

Source: Open Interest

Thus, the exodus seemed complete: price crashed to lower and lower levels, open interest emptied, and the whole scenario meant bulls running for their lives. What a shame; the capital fled, leaving no one to actually transact. Then came hope. Between late June 20 and early June 21, a slight price movement from $0.13 to $0.146 witnessed that ever-so-slight shy rising of open interest. Not a loud noise, just a mere whisper. Is this the silent accumulation before the storm? Are smart investors putting their bets into a possible comeback? All eyes are merged on the arena, waiting for this one.

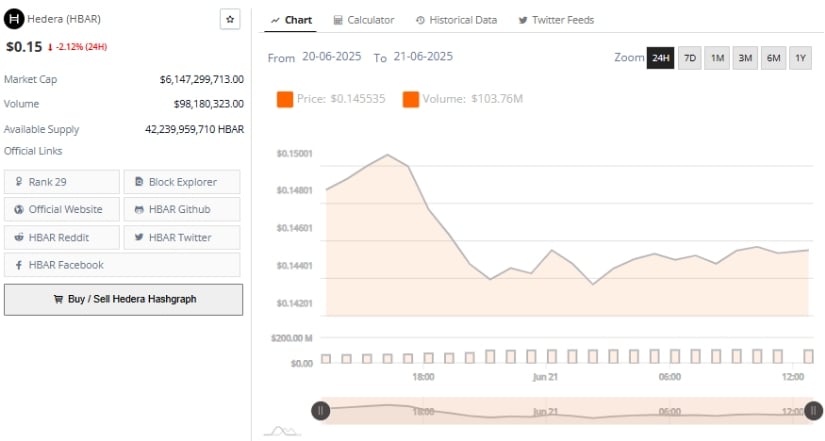

Source: Brave New Coin

The 24-hour chart of Hedera paints the picture of a swift upward breakout. June 20 saw a hopeful fight towards the $0.15001 price tag, followed by a slow decline. The trading volume was roaring during the rally but then it started to diminish as the price retreated- a clear indicator that bulls did not have enough strength to uphold a rally. Now, Hedera is drifting close to $0.145, indicating the possibility of support being set up. However, with hardly any whisper of a trading volume, buy orders might just be waiting in the wings, ready to strike as soon as a clear momentum appears.

Weekly Indicators Point to Weak Momentum but Highlight Long-Term Support

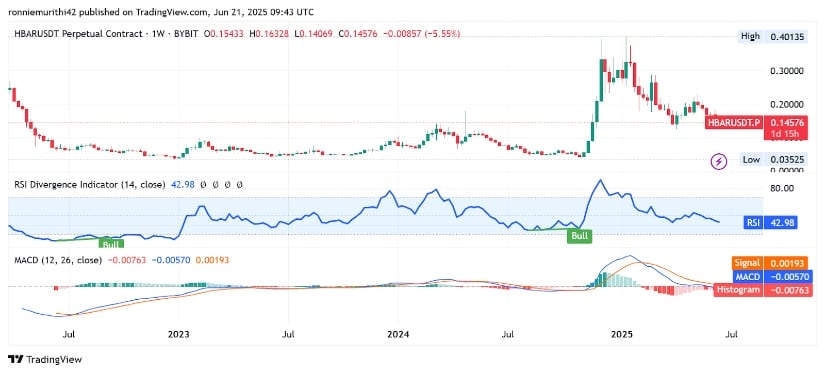

The HBAR/USDT chart has truly told a story of highs and lows since 2022. Think about it: HBAR was sleeping at a mere price level of between $0.05 and $0.08 for ages until early 2025, when it woke up to the sound of fireworks, blessing itself with a glorious $0.40.

Like Icarus, a dizzying plunge followed the climb, a little above 60% drop, dusting its way to a current price level of $0.14576. The weekly candle presents a bleak scene:_percentage dip. It is the latest measure of a ballad of fading bullish hopes and everlower peaks.” Is it just a pause before another surge, or is it the beginning of a long winter?

Source: TradingView

The RSI signal now speaks of a waning momentum on 42.98. After breaching the neutral territory of 50, less steam seems to be powering the bulls in their magical ride. A year to remember was early 2025, where the RSI had sailed past the 70 mark, flaunting a flagrant overbought exuberance. The fire, thus, is out, slowly and steadily coming down to earth. The land of oversold seems far, yet the change is certain.

The bullish divergence that led into the late 2023 rally simply hasn’t appeared. Momentum is indecisive, potentially heading for sideways chopping or more downward pressure should no further catalyst seize the market by storm. The RSI hasn’t so much as breathlessly offered a promise of a rebound this time around.

MACD indicates problems. The lines have crossed in a bearish manner. The momentum is clearly negative, with the indicator showing an extensive red histogram. Ever since the market’s zenith in 2025, things have truly been going south, and the MACD backs this downward saga. Hence, the existing pullback should hold on until either the histogram starts showing signs of recovery or the MACD lines reunite bullishly. In essence: prepare yourself.

Hedera Price Prediction: Recovery Outlook Hinges on Volume Support

Prices for HBAR hover around the $0.145 mark; crypto-watchers keep on waiting, expecting clues of a bottom. The comeback, if there ever will be one, will find its gestation in a frenzy of open interest and trading volume: signs that buyers have begun stepping up to the plate. And while there has been analveolar clickimprovement, the sound it makes is certainly not the roar to bank on. If these little steps turn into confident strides, the next launch ramp for HBAR could be getting built.

The knife-edge HBAR. With the long term perspective showing a solid base under the 2023-25 structure, short-term momentum crumbles. Critical support zones are under attack and the coming few trading sessions shall be decisive. Watch the volumes; if there is enough buying pressure, then a recovery can be started making HBAR aim back at the familiar resistance. However, if there is no recovery here, the breakdown may be imminent – trade with caution.

Thanks for reading Hedera Price Prediction Highlights Path to Recovery After 60% Pullback From Peak