The five-month battle of XRP to scale the $3 threshold reads like a cliffhanger. After being rejected several times at this juncture, and following its latest stumble, a stubborn band of optimists bids fair to keep up the rally.

An unexpected XRP rally is making waves among analysts. Then again, the most bullish predictions tend to zoom in on its increasing application in international transactions. Is it possible that the utility of XRP kicks prices into the stratosphere?

XRP’s Potential in an Expanding Cross-border Payments Market

Imagine a world where remittances are as easy as sending a text. If the link between worldwide finance and XRP is made, its value might skyrocket. The catch is: the more eager banks and institutions are to accept XRP as the simplest way of sending money overseas, the more gas they burn for the future of XRP.

The exact number cannot be ascertained. A better yardstick is the global M2 money supply-think of it as all the cash, checking accounts, and highly liquid funds being thrown about the globe.

Marty Party peeps at the analysis in April 2025 and comes up with a money hoard of $83.37 trillion M2 by U.S., China, Japan, and the EU. But don’t let that huge number fool you-most of it stays put, barely ever crossing national boundaries.

Ever wonder how much money drifts through the world’s financial plumbing? Data from the Bank for International Settlements allows for a glimpse. Normally, banks hold 10-15% of the global M2, sufficiently broad money supply, in cross-border accounts. Doing some rough calculation, they come up with billions, at a minimum, ranging from $8 to $12 trillion. On average, sometimes cool 10 trillion dollars of global liquidity is looking for the next opportunity.

A $2.23 XRP, with a whopping 58.82 billion circulating units, was sifting in the ocean of possibilities. What if it were able to garner a quarter of the immense wealth of the crypto market? We gave our AI oracle, ChatGPT, a tap on the shoulder to peer into the crystal ball for the potential eventuality of XRP.

XRP Price if It Captured 25% of $10T Cross-border Liquidity

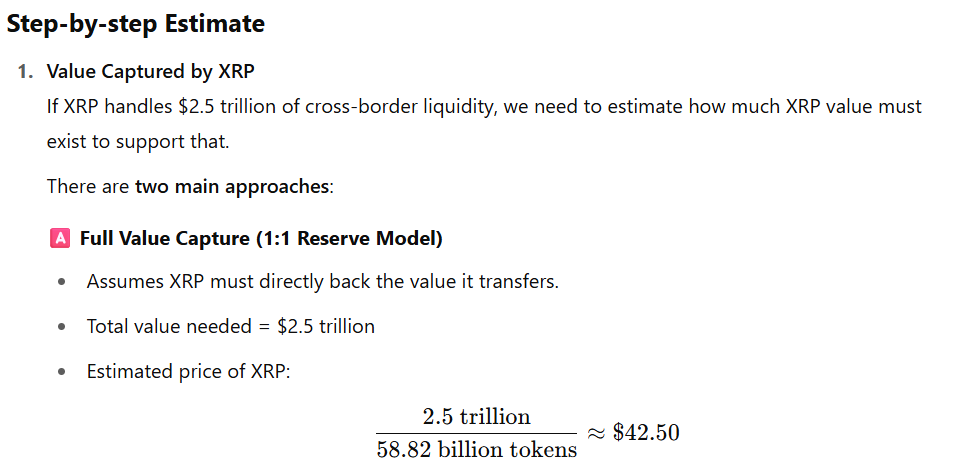

Rather than a one-size-fits-all monolithic estimate, ChatGPT smartly divided the problem into two intriguing scenarios. The first? A radical vision: XRP becoming the ultimate anchor, backing the full amount of $2.5 trillion, a big 25% chunk of the entire $10 trillion pie.

XRP Full Capture Value Estimate | ChatGPT

In the financial Universe where every dollar moving across borders and transforming economies is backed by XRP, the worth of XRP would ascend if $2.5 trillion passed through it. Maths, so simple: divide the colossal amount by the entire XRP in circulation, and there remains a price estimate of roughly $42.50 per token.

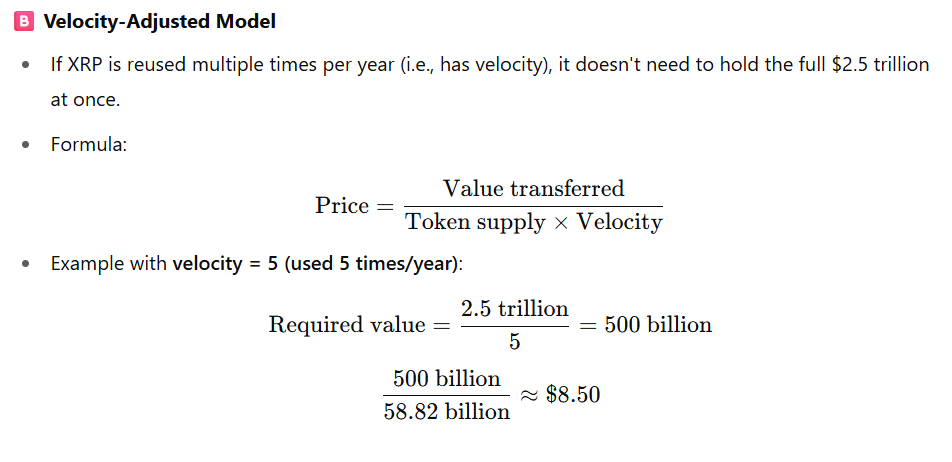

Meanwhile, in the second scenario, ChatGPT considered how quickly XRP might move through the system, representing its “token velocity.”

XRP Velocity Adjusted Estimate | ChatGPT

I imagined the XRP not as a fixed store of value but as having a continuous currency flow. The more quickly each token circulates through many transactions within the year, the more efficient the entire ecosystem becomes. Think wicket: With a velocity of 5, a mere $500 billion in XRP is sufficient to cosmically transact $2.5 trillion annually. That purports an XRP price of about $8.50; just to give some perspective on what velocity means.

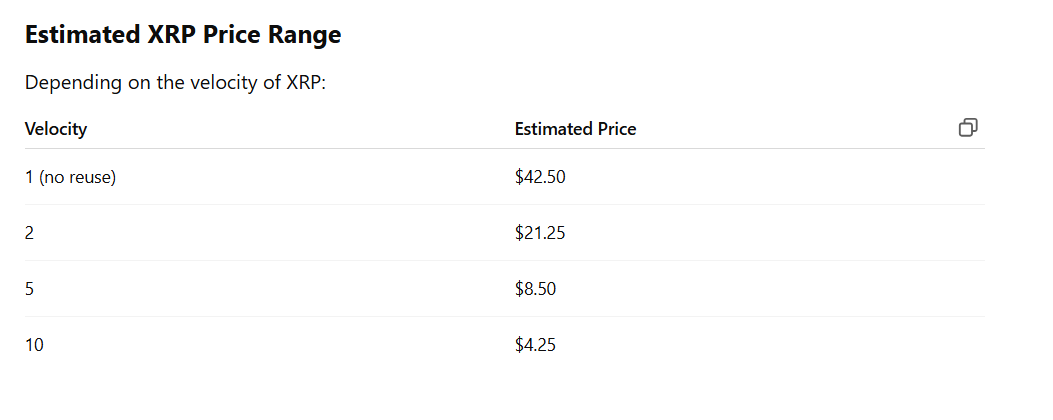

The crystal ball, as I would call ChatGPT’s for XRP, had fried them up with its queries. Suppose XRP velocity pierces that speed barrier with an aggressive 10 transactions per annum: strap yourself in because it will now crash and burn around $4.25. On the other hand, set a gentle pace of just two transactions per annum and away goes the rocket at $21.25. Fast ride, cheap price; slow burning, big bang. Which way does the pendulum swing for XRP?

XRP Price Projections ChatGPT

Thanks for reading Here is XRP Price if It Captures 25% of $10T Cross-border Liquidity Held by Banks and Institutions