These coming weeks will be dramatic! Market cap with an insatiable appetite of $3.36 trillion sits only 15% below from the all-time high. The safe stablecoin, Tether (USDT), gave that rare buy signal this May, connoting investors may pour money into the market soon. You better strap in for a bumpy ride!

Unlock for a sight: While Tether feverishly prints USDT, a shaky hold on the crypto market may stay with it. The USDT dominance figure plummeted down in May, implying a move in that front.

USDT Trends Suggest Crypto Bull Run Could Continue

According to data from CoinMarketCap, Tether’s market capitalization has reached a new all-time high, surpassing $151 billion.

Hold your horses, crypto folks! The massive injection of USDT, to the tune of a billion made by Tether yesterday, has reignited all speculation and heated market discussions. Coming to the figure, $2.5 billion USDT were minted in May, but the real story is the Indian Summer for Tether as an asset: this since January witnessed a boom of $13 billion in market cap for USDT, almost a 10% tally in the stablecoin’s dominion! How does this tidal wave of Tether spurt, spread over Btcoing, altcosins, and a future of digital finance? The game has begun.

Tether’s Market Capitalization. Source: CoinMarketCap

Axel Adler Jr. reports a $6 billion tidal wave of freshly minted USDT flooding the crypto market in the last 20 days. Tether’s dominance swells, now boasting a colossal $150 billion market cap.

Being the commander with about 62.4% of the entire market, USDT is not just a stablecoin. Here’s where the real storyline begins: TRON has dethroned Ethereum as the distribution champion for USDT. Now, over $73 billion USDT resides in TRON to consolidate its reign.

These swelling market capitalizations of USDT are not just marketing figures; they represent sidelined capital lurching onto the crypto markets. Envision it as a war chest full of dry powder. Even if prices suffer setbacks because of USDT, it may well put the rapid rebound in the markets. Thus, any downtrend could be viewed as a profitable buying opportunity. This is essentially an untold story of the market, ready to be written at any given instance.

We are now seeing USDT dominance fading – which in itself is a strong indicator of bulls re-entering the crypto space. Forget about the technical indicators; what this tells us is the grip the USDT has on the cryptocurrency market. Fading away means the risk-on attitude has raised: investors have started to let go of their stablecoin safety nets in favor of riskier, potentially lucrative assets.

Data from TradingView shows that USDT.D has dropped from 6% in April to 4.6% at press time.

Tether Dominance and Ethereum Dominance. Source: TradingView

USDT.D goes down with a strong declaration: Investors have been leaving the sidelines, trading away their safe USDT for the thrill of Ethereum and altcoins. This emigration really speaks bullishly. Risk-on-the-table, amplified opens for gain yet beyond that stablecoin shelter.

Trend interesting was observed by Axel Adler Jr.: as Bitcoin loses dominance and Ethereum gains traction, the pendulum of USDT incidence appears to be swaying toward the newly embraced altcoins.

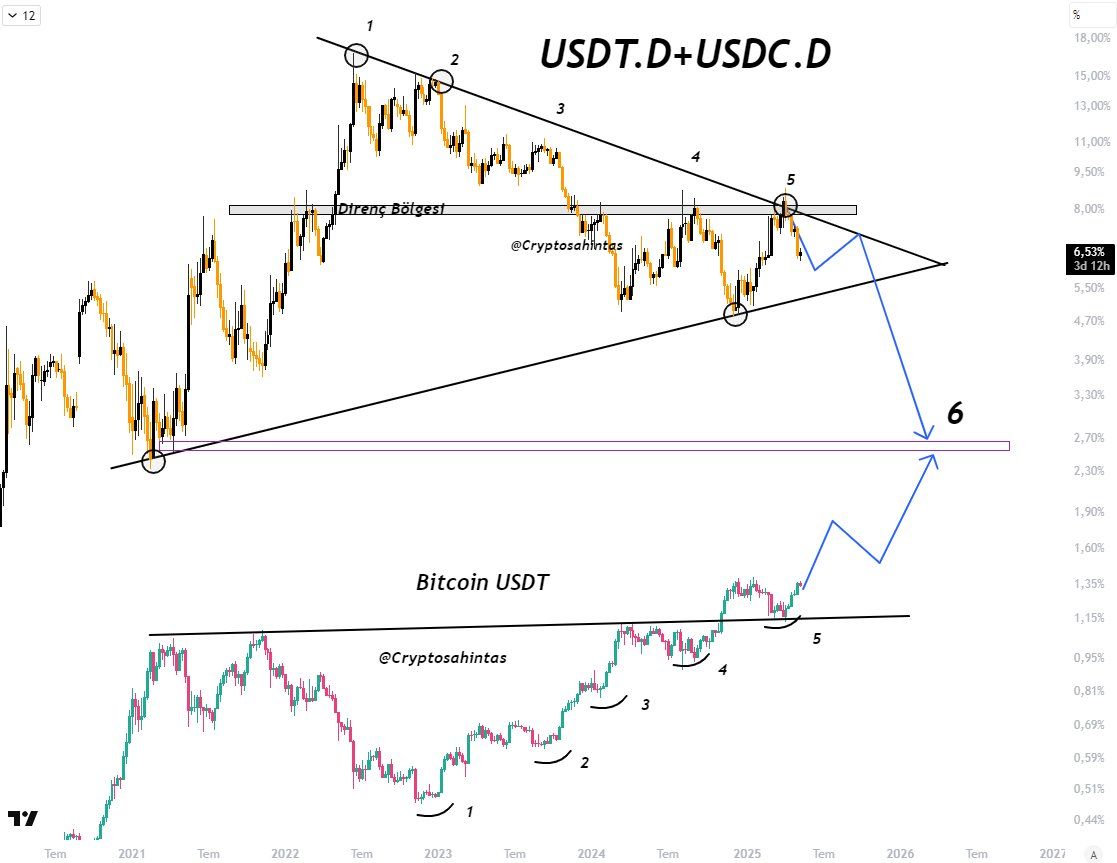

Worsening things, Cryptosahintas checked out the USDC.D and USDT.D indices through some serious tea-leaf reading. His forecast was this: further decline in their combined ratio possibly unleashing a tidal wave of bullish energy for Bitcoin.

Combination of USDT.D And USDC.D Compared to Bitcoin Price. Source: Cryptosahintas

“Tether’s grip is loosening! Crypto analyst Cryptosahintas foresees Bitcoin blasting off as capital trickles into higher-octane plays.”

The swelling coffers of USDT and the shrinking grip on a Wedlock’s throne do not merely constitute market gossip. It is an overture to a possible crypto bull stampede.

With USDT’s swelling coffers and a shrinking grip on the crypto throne, there’s bound to be some overture to a crypto bull stampede.

Imagine that Tether holds the key to Bitcoin’s fate. However, history would present a counter-part to this theory. Earlier this year, Tether swelled from $137 billion to $144 billion between January and April, yet Bitcoin plummeted from an optimistic $110,000 to a worrying sub-$75,000. This disconnect gives rise to a frustrating time warp that exists in crypto markets, turning any sort of real-time analysis into a high-stakes guessing game.

Thanks for reading How USDT’s Rising Supply Falling Dominance Could Fuel Next Crypto Surge