But CyberCapital founder and CIO Justin Bons has outlined an unsettling, bluntly optimistic vision about the direction of Bitcoin over the next 10 years. A detailed note shared on X by Bons said that Bitcoin “is moving towards total collapse in the next seven to 11 years, due” it will be because of the way the network protects itself and continues fall of block rewards.”

Reduced Miner Payouts To Cause Complete Bitcoin Collapse?

Bitcoin is known for its halving cycle, which reduces the block rewards given to miners by about half every 210,000 blocks (about four years). The reason for this incident is that Bitcoin’s network security will fail and cause the top cryptocurrency to collapse completely, Bons’ critique argues.

Bons says Bitcoin is ‘going towards a point where it can no longer reliably fund the miners who protect the network, setting off.’ A chain of risks that becomes harder to ignore with each cycle as each halving cuts the block rewards further has been cut by Buttons.

The rise of hashrate is a very safe network for the Bitcoin network, many Bitcoin proponents will argue that it remains highly secure. But, Justin Bons said that “hashrate can rise even when real security is weakening because advances in mining hardware make it cheaper to produce hashes” (along with the cost of making them)? In fact, it’s the most important thing to know how much money is being made by miners as that figure represents profitability and cost an attacker would have to match or exceed.

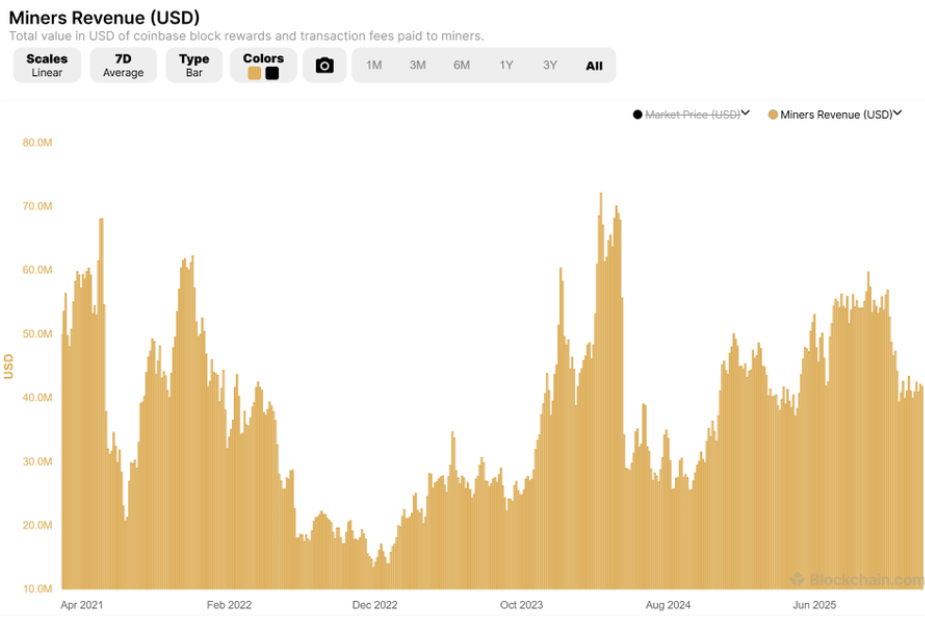

The economy of Bitcoin, in contrast, has a security that is already lower than it was several years ago when it received charts tracking block rewards and miner revenue show that the security of bitcoin’s security is low. But he says keeping security at current levels would require transaction fees so high that users would simply stop using the network or “the price of Bitcoin to double every four years at a rate that would quickly outpace the size of the global economy”.

Bitcoin Miner Revenue. Source: @Justin_Bons on X

Prediction: Bitcoin To Plunge In Two To Three Halvings

Bitcoin’s halving schedule is directly linked to the seven to 11-year timeframe Bons set out for its collapse by bitcoin. But the industry expert said that “the cost of attacking the Bitcoin network for a long time could be in territory which makes such attacks economically viable under two or three further half-halvings.”

In case miner payouts are low enough, Bons says the rewards from multiple exchanges or protocols could be greater than the cost of carrying out the attack if it was carried out. This is most realistically possible, as it involves double-spend attacks against exchanges.

A. attacker with 51% of the total mining power could deposit Bitcoin, sell it for another asset, withdraw those funds and then roll back the blockchain to recover the original coins from bitcoins that were originally generated by them.

His other highlights are the figures that indicate, for years, a trend has been downwards in Bitcoin’s security budget relative to its total market value. As Bitcoin increases in size, this means that it does not automatically become safer as it grows larger, such as by .

Bitcoin Security Budget as % of Market Cap. Source: @Justin_Bons

But this leaves Bitcoin at an eventual break-point for a breaking point, as it is with s. This means that either the network increases its fixed 21 million supply cap to reinstate miner incentives, a move which would likely split up mining from here, or the whole Bitcoin ecosystem accepts double-spend attacks.

Featured image from Unsplash, chart from TradingView

bitcoinist***** Editorial Process focuses on providing “very researched, correct and unbiased” material for the most part. The standards of are strict sourcing, and each page is carefully reviewed by our team of leading technology experts and experienced editors. This process ensures that our content is integrity, relevance and value for our readers. ****

Thanks for reading Industry Expert Predicts Complete Bitcoin Collapse – Here’s The Timeframe