Injective’s Bull Run Hits Speed Bump: ETF Hype Fades, Price Dips. After a meteoric rise fueled by exchange-traded fund buzz, Injective (INJ) has cooled off. The cryptocurrency shed nearly 5% in the last 24 hours, suggesting sellers are cashing in after the recent surge. Is this a temporary setback or the start of a deeper correction?

Summary

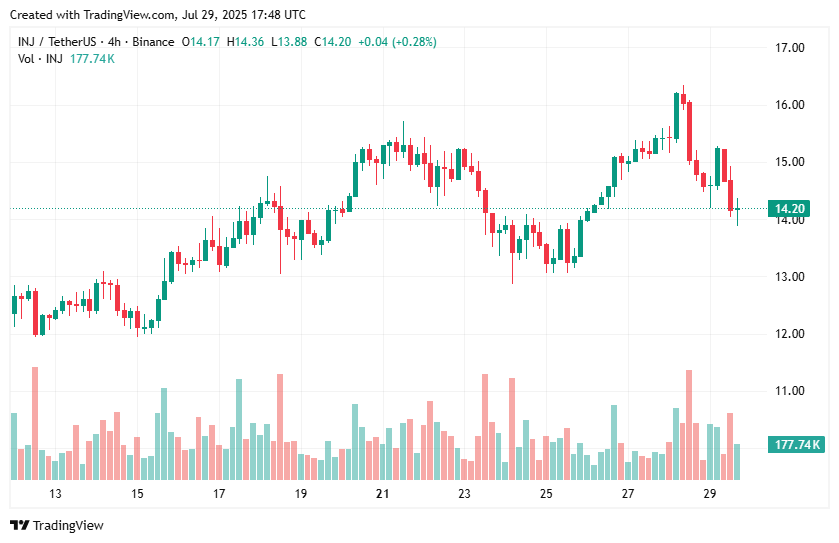

- Injective price retreated slightly on July 29, falling about 5% as INJ touched lows of $13.88. Injective ignited a rally on Monday, fueled by speculation of a potential Canary Capital Staked Injective ETF listing, as Cboe threw its hat into the ring.

“With the market buzzing about potential regulatory green lights for staked crypto ETFs, INJ is catching institutional eyes, possibly paving the way for similar products tied to Ethereum and Solana.”

The price of Injective (INJ) soared from lows of $14.48 to above $16.35.

“Injective (INJ) once boasted boundless potential, but recent market turbulence has clipped its wings. After surrendering gains amidst widespread downturns, the altcoin has deepened its descent, scraping against a chilling $13.88 floor.”

Injective price teeters on the edge: Currently around $14.31, according to crypto.news market data, Injective risks plunging below its July 28 intraday low as downward pressures buffet the broader crypto market.

You might also like:

Could this be Avalanche’s buy-the-dip moment?

Why did Injective surge?

Injective surged as Wall Street giant Cboe petitioned the SEC to list Canary Capital’s Staked Injective ETF, signaling traditional finance’s growing appetite for the decentralized finance space.

Canary’s staked Injective ETF has officially taken flight, joining the ranks of heavyweight staked crypto ETFs like Ethereum (ETH) and Solana (SOL). More than just another launch, this signals a surge of institutional interest in Injective – a trend cemented by Canary’s prior establishment of a Delaware trust specifically for the INJ ETF. The institutions are coming.

INJ’s price surged on the filing announcement, mirroring typical market hype. But, as the dust settled, the familiar “buy the rumor, sell the news” pattern emerged, triggering a wave of profit-taking and tempering the initial excitement.

INJ teeters on a knife’s edge. While losses remain minimal, the price dances precariously close to a pivotal point. A decisive break below spells trouble, opening the door for a descent toward $13.20.

Injective price 4-hour chart on TradingView

Despite the declines, analysts have pointed to Injective protocol’s price as signaling a bullish pennant on higher time frames.

Injective longs liquidated

Data from Coinglass shows a total of over $982,000 in Injective positions have been liquidated in the past 24 hours.

“$895K+ long positions vaporized in a flash, dwarfing the mere $87K short squeeze casualties. This brutal long liquidation triggered a chilling drop in open interest, leaving bullish dreams shattered.”

Injective’s open interest has cooled off, plunging 10.4% to roughly $167 million, suggesting a potential shift in market sentiment. Derivatives volume is also feeling the chill, dropping 16% to $413 million, signaling reduced trading activity.

You might also like:

Injective launches SBET, the first onchain Digital Asset Treasury

Thanks for reading Injective price pares gains after ETF-driven spike