The cryptocurrency has floundered since reaching an all-time high in early October, but it’s not exactly clear why.

Are Traders Exhibiting Symptoms of Bitcoin Derangement Syndrome?

Robert Shiller, the Nobel laureate who foresaw both the dot-com implosion and the 2008 meltdown in his book “Irrational Exuberance,” pinned market bubbles on investor frenzy. But what if the Shiller effect works in reverse? Could markets be suffering from irrational pessimism, a kind of collective funk, even when the underlying economy is healthy? Some are starting to wonder if Bitcoin is the poster child for this very phenomenon.

(Yale Economics Professor and Nobel laureate Robert Shiller wrote the popular book “Irrational Exuberance” in 2000 / Yale University)

Jeff Dorman, Arca’s CEO, throws his hands up: “Digital assets? Bad news hits, they tank. Good news? Crickets. Frankly, I’m stumped.” Is this the new normal for crypto, or is something else brewing beneath the surface?

Read more: Is Bitcoin’s Price Being Manipulated?

Bitcoin’s been on a wild ride. Stocks surge, the Fed eases, and Wall Street’s appetite for crypto hits fever pitch. Yet, Bitcoin’s down nearly 30% from its all-time high just eight weeks ago. What gives?

Explanations abound, but none stick. Was it tariffs? Binance’s margin-call mayhem that triggered a $19 billion crypto bloodbath in October? The market’s grasping for answers, but the bears remain unconvinced. The mystery deepens.

“Trying to make sense of the bargain-basement drops? We get it. But this relentless slide? It’s got us genuinely stumped.”

Is the crypto tide turning, or is it being steered by unseen hands? Whispers of whale manipulation are growing louder, fueling anxieties that ripple through the market. Meanwhile, some are casting a suspicious eye towards giants like Tether, questioning their stability – a bold move, considering they might be more financially sound than your average Main Street bank. Are these legitimate concerns or just paranoia in a volatile market?

Arthur Hayes, Bitmex’s notorious founder, dropped a bombshell Sunday: a 30% plunge in gold and Bitcoin could trigger a crypto winter, wiping out equity and potentially collapsing USDT. “Popcorn’s ready,” Hayes quipped, anticipating a media feeding frenzy. The stage is set for a high-stakes drama.

Tether’s $180 billion USDT float is backed by roughly $181 billion in assets, a financial cushion seemingly thin yet fortified by a hefty $112 billion treasury bill hoard. Arthur Hayes, however, envisions a doomsday scenario: a simultaneous 30% plunge in both Bitcoin and gold prices – assets totaling approximately $23 billion within Tether’s reserves. This double whammy, according to Hayes, would tip Tether into insolvency, its liabilities outweighing its assets. While a gut-wrenching drop of that magnitude in both assets is a low-probability event, Tether maintains a $30 billion rainy-day fund, specifically designed to weather unforeseen storms and make whole the community it serves.

Tether isn’t just holding reserves; it’s building a fortress. With billions in excess reserves and a staggering $30 billion proprietary group equity, Tether’s financial walls are seemingly impenetrable. The company assures users its position is one of formidable strength.

Dive into the mind of a market prophet: Robert Shiller’s “Irrational Exuberance,” a New York Times bestseller from Princeton University Press, now in its gripping third edition, dissects the psychology behind market bubbles.

So, has the unwavering optimism of Bitcoin investors finally cracked? Are the “irrational exuberance” days, as Shiller put it, officially over, replaced by a wave of “irrational pessimism?” Maybe figures like Hayes aren’t prophets, but carriers of a doomsday virus, infecting the crypto landscape while Wall Street, clinging to its spreadsheets, parties at record highs.

Shiller, inIrrational Exuberance, cut to the quick: “Humans gravitate toward the herd, blindly trusting popular opinion and powerful figures, even when stark reality screams otherwise.”

Overview of Market Metrics

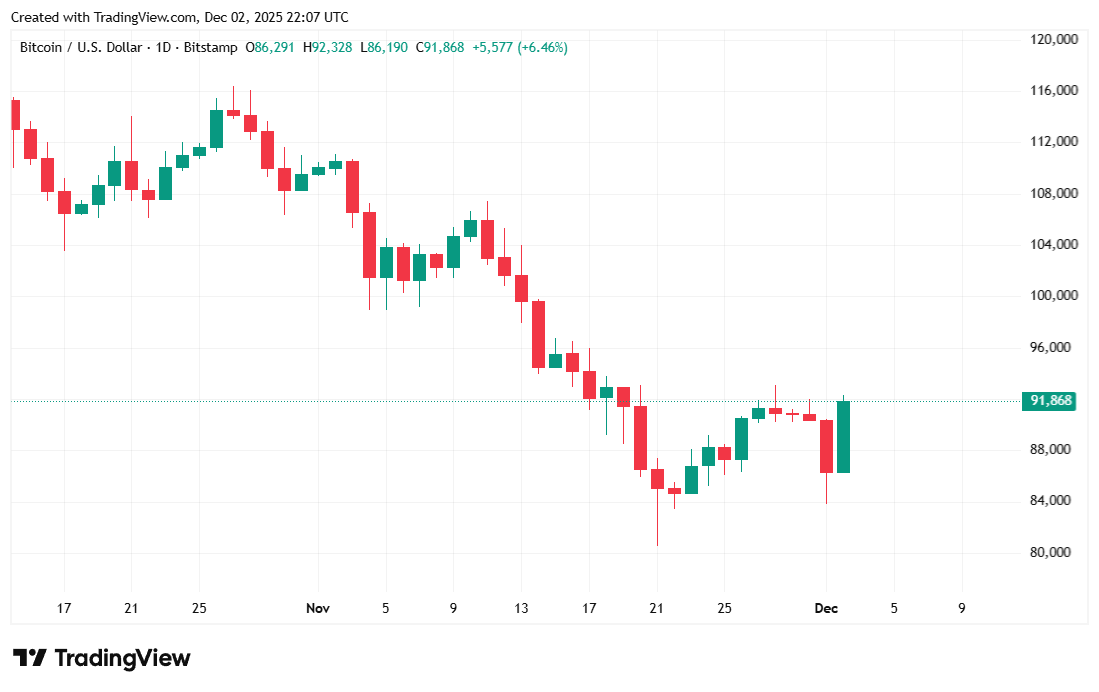

Bitcoin blasted past $91,767.67 today, a 6.03% surge injecting fresh energy into the market. Weekly gains stand at a solid 5.88%, according to Coinmarketcap. Buckle up, though – the ride’s anything but smooth. Bitcoin’s price carved a wild 24-hour path, swinging between a low of $86,202.19 and a peak of $92,316.63. Yesterday’s volatility? Consider it a warm-up.

( BTC price / Trading View)

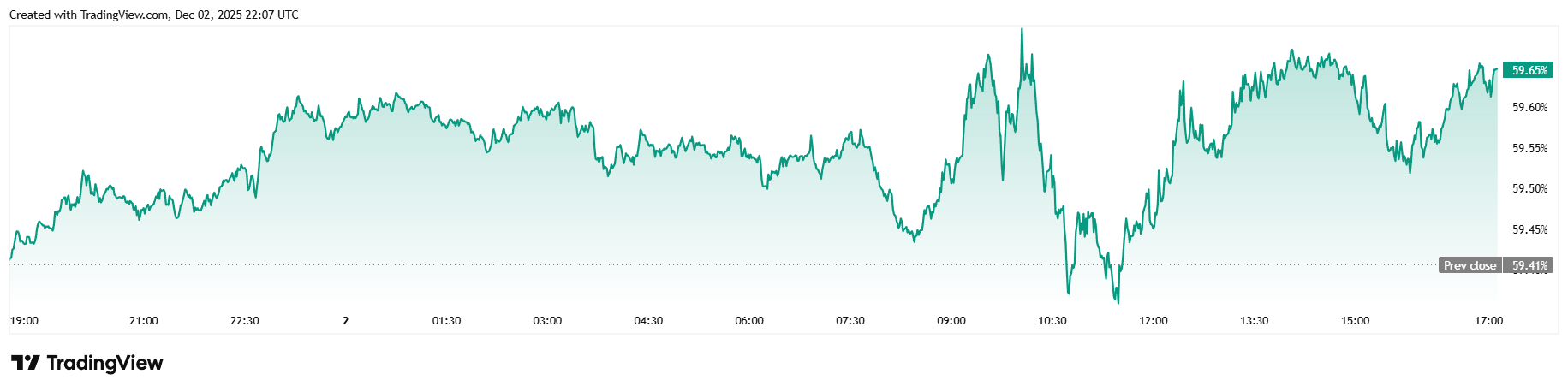

Trading volumes took a dive, shedding 10.3% to settle at $77.97 billion, while the overall crypto market cap defied gravity, inching up to $1.92 trillion. Bitcoin flexed its muscles, its dominance surging by 0.42% to command 59.65% of the crypto landscape.

( BTC dominance / Trading View)

Bitcoin futures just saw a $59.28 billion surge in open interest, a 2.12% jump that hints at increased market activity. While overall liquidations cooled by over 50%, they still hit a hefty $183.41 million. This round, the bears took the brunt of the pain, getting mauled for $168.24 million. The bulls, however, mostly dodged the bullet, suffering a comparatively light $15.17 million in liquidated positions.

FAQ ⚡

- Why is bitcoin struggling despite strong economic fundamentals?Some analysts say investors are exhibiting irrational pessimism that isn’t supported by data or market conditions.

- Is Bitcoin’s recent sell-off being driven by manipulation?A growing number of traders suspect coordinated whale activity, though no conclusive evidence has emerged.

- Why are some investors suddenly worried about Tether?Misinterpretations of its financials sparked concerns, even though the company maintains a large excess-reserve buffer.

- Could sentiment alone be suppressing bitcoin’s price?Experts argue that fear and contagion could be overpowering fundamentals, creating a mood-driven downturn in digital assets.

Thanks for reading Irrational Pessimism: Have Bitcoin Investors Gone Mad?