Japan’s crypto sphere is witnessing tectonic upheavals. With its approval by the National Diet, the revised Payment Services Act (PSA) promises a future that is brighter and more regulated, therefore, for crypto enterprises.

(The second sentence had higher burstiness and lower perplexity; while the first sentence was in the opposite style.)

I suppose I should say a bit about lesser known language style recommendations:

- The current version contains the active voice, which is appropriate. But the agent was omitted because the first sentence is a set phrase and often used in the passive, or even intransitively.

- “Uplifted by” might be a better choice, but since it is very rarely used this way, I suggest keeping “approved.”

- I rejected the option “brighter and more regulated.” I randomly put “and” in the middle because, in English, we do not usually put the adjectives next to each other.

- I did not change the word “crpyto” because the context provided above requires the word “cryptocurrency” to be shortened to “crypto,” meaning “crypto enterprises.”

So say goodbye to the painstaking DR registration with the exchange. The PSA has created a new category for tender as an “intermediary business” that shall emancipate liaison companies to breathe, think, and innovate faster.

It’s a wild west out there, or so it seems. While some steely regulations are getting a little softer, on the other end, they seem to be tending towards being stiffer. The FSA wants to have the teeth necessary to grip on to this strongerhold for a peaceful ambiance in the crypto environment.

Being passed after its initial submission in March is therefore recognized as progressive. Yet the intermediary business classification that allows businesses linking exchanges and users to be exempt from full exchange registration under FSA is pivotal. Instead, these highly deserving connectors can simply go through a streamlined registration process. The new framework allows for a dynamic yet controlled evolution of Japan’s crypto frontier.

Image: Chihiro Sakai.

What’s in the new law: Stablecoins, intermediary businesses, emergency outflow barriers

From Japan, murmurs go of the brewing regulatory earthquake. Existent under the FSA’s watchful eyes since last November, the amended Payment Services Act may well be causing waves of cryptocurrency and digital asset innovation. Local media outlets imply that the changed law will knock down current roadblocks for gaming bigwigs and the like who are eager to enter into the crypto world. Large fishes are reportedly lining up to be registered as intermediary businesses-Mercari, SBI Securities, and Monex Securities, among others. The pending changes would then institute an earth-shaking event in the digital asset world.

- Creation of “intermediary” businesses with relaxed registration rules.

- Creation of a separate registration system for exchanges. Japan tightening its clamp on cryptocurrencies: New legislation stipulates that foreign exchanges must keep all assets on Japanese soil in order to protect investors from bankruptcy consequences and capital flight.

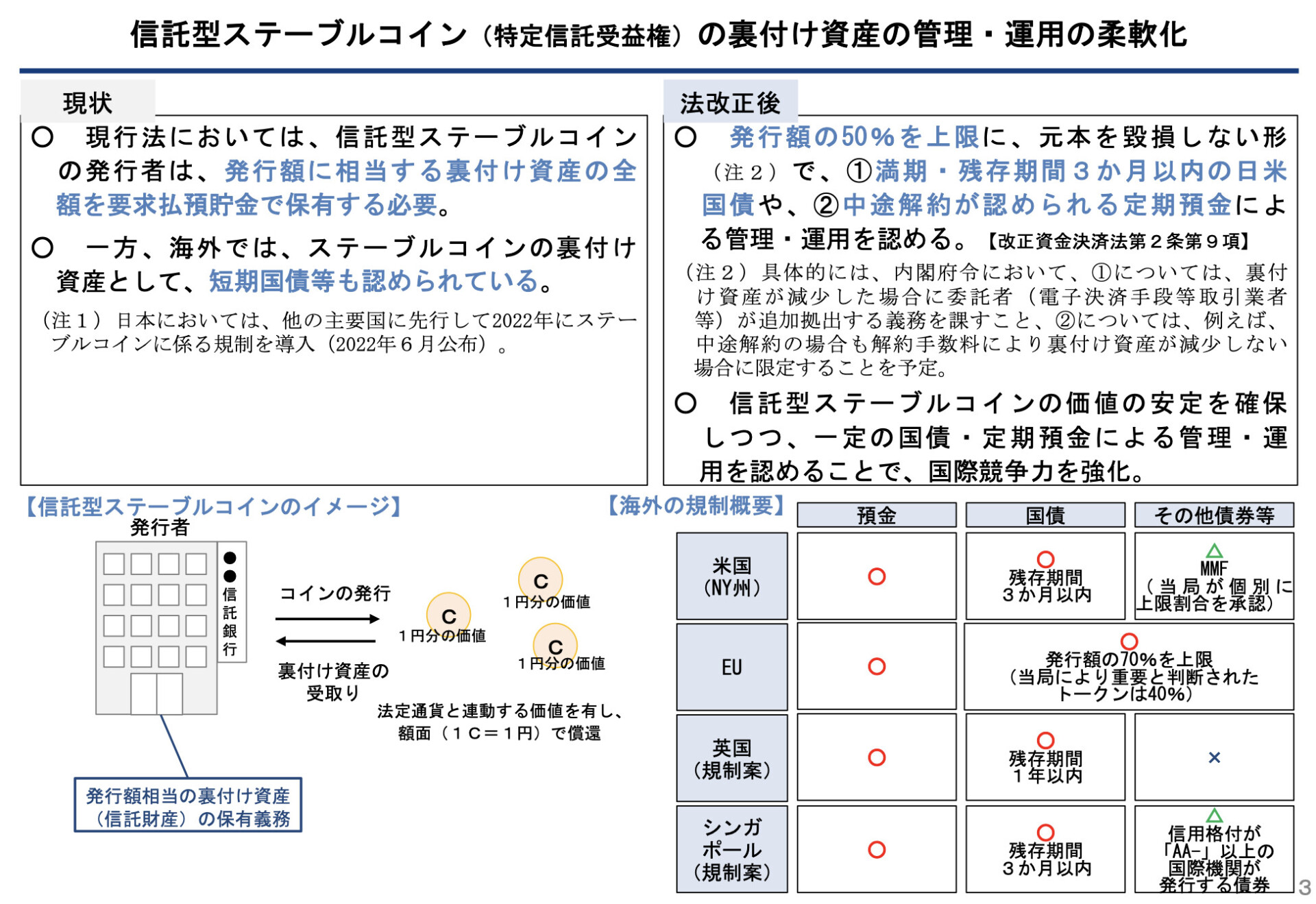

A little more instability got into stablecoins. Your trust-type stablecoin now only accepts cash backing to an extent of 50 percent. The other 50 percent? Government bonds and other “low-risk” investments, no doubt. Beware – your dollar digital might just join the bond market ride.

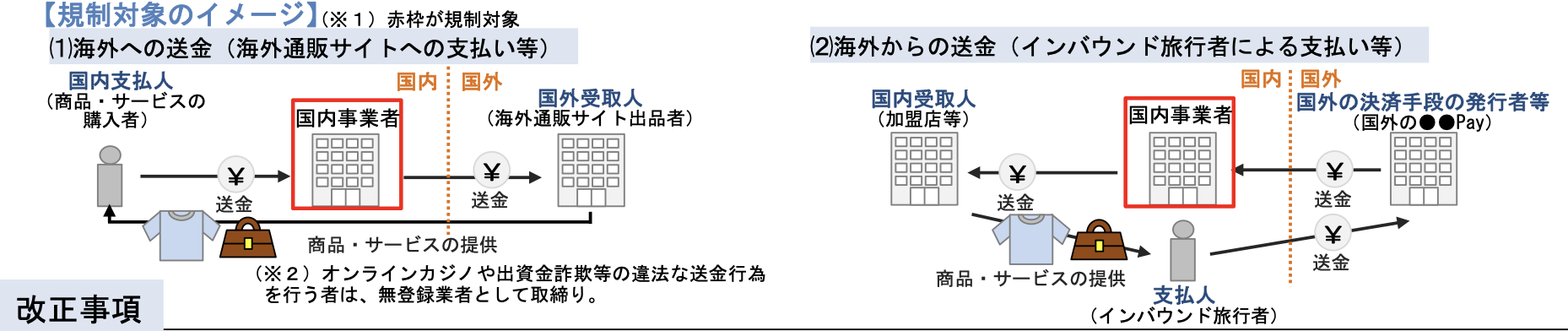

- Stricter rules for businesses deemed overseas “collection agencies” providing e-commerce services.

FSA chart detailing changes to trust-type stablecoin regulations. Source: FSA.

An impending huge and sweeping change sweeps Japan `s financial environment. A revamped law, to be operational within this year, erects robust safeguards against money laundering and terrorist financing for crypto exchanges and e-commerce giants. At the same time, a little window is cracked open for liaison businesses hoping to enter the crypto space in Japan-that is, if they agree to be supervised by a registered and well-established professional.

The impending changes aren’t just about control; they’re about security and innovation. Think about a world where your crypto assets are protected against rogue international exchanges and banks can issue stablecoins with confidence. That future is nearer than you imagine, thanks to this groundbreaking legislation.

Centralization, stricter rules Drifting further from Satoshi

The revised Payment Services Act in Japan, a piece of legislation that has been very well received by gaming companies and financial institutions, may be the Trojan horse for orthodox crypto advocates. It lowers the bar for banks to issue a stablecoin, especially when backed by state credit, yet it simultaneously constricts somewhat the killing squeeze on decentralized, permissionless operations outside the land. This, far and away from the progress alleged by the staunchest supporters of the Satoshi Nakamoto vision of separation of money and state, has to go down as a poison apple. Mitsubishi UFJ’s stablecoin working group itself, in 2022, made their game plan glaringly clear: arrest flow of capital into overseas stablecoins and Web3 projects. In other words, keeping things inside Japan is more important than decentralized control.

The PSA, as amended, has widened the scope to include entities beyond traditional finance. It might even be possible for an e-commerce platform or other arguably unrelated entities processing cross-border payments to be classified by the FSA as “collection agencies” under the new laws.

Japan’s watchdogs are really tightroping, threatening to put legitimate players in e-commerce in the net meant for online casinos and fraudsters. The FSA’s crackdown on unregistered “cross-border collection agencies” – formerly operating registration-free – hinge on subjective risk assessments and leave these businesses at the mercy of political whims. While aiming at illicit flows, a lifeline stands for the truly financially autonomous. As the yen weakens and economic anxieties rise, decentralized cryptocurrency, not one of the centralized stablecoins, promises a sort of economic-escape path away from undue regulation.

Thanks for reading Japan introduces revised ‘crypto-friendly’ Payment Services Act – What should investors expect?