Michael Saylor dropped a truth bomb on X, May 24, 2025: two charts showcasing asset returns over the last quarter and year. The verdict? Bitcoin reigns supreme. His mic-drop caption? “The only thing better than Bitcoin is more Bitcoin.”

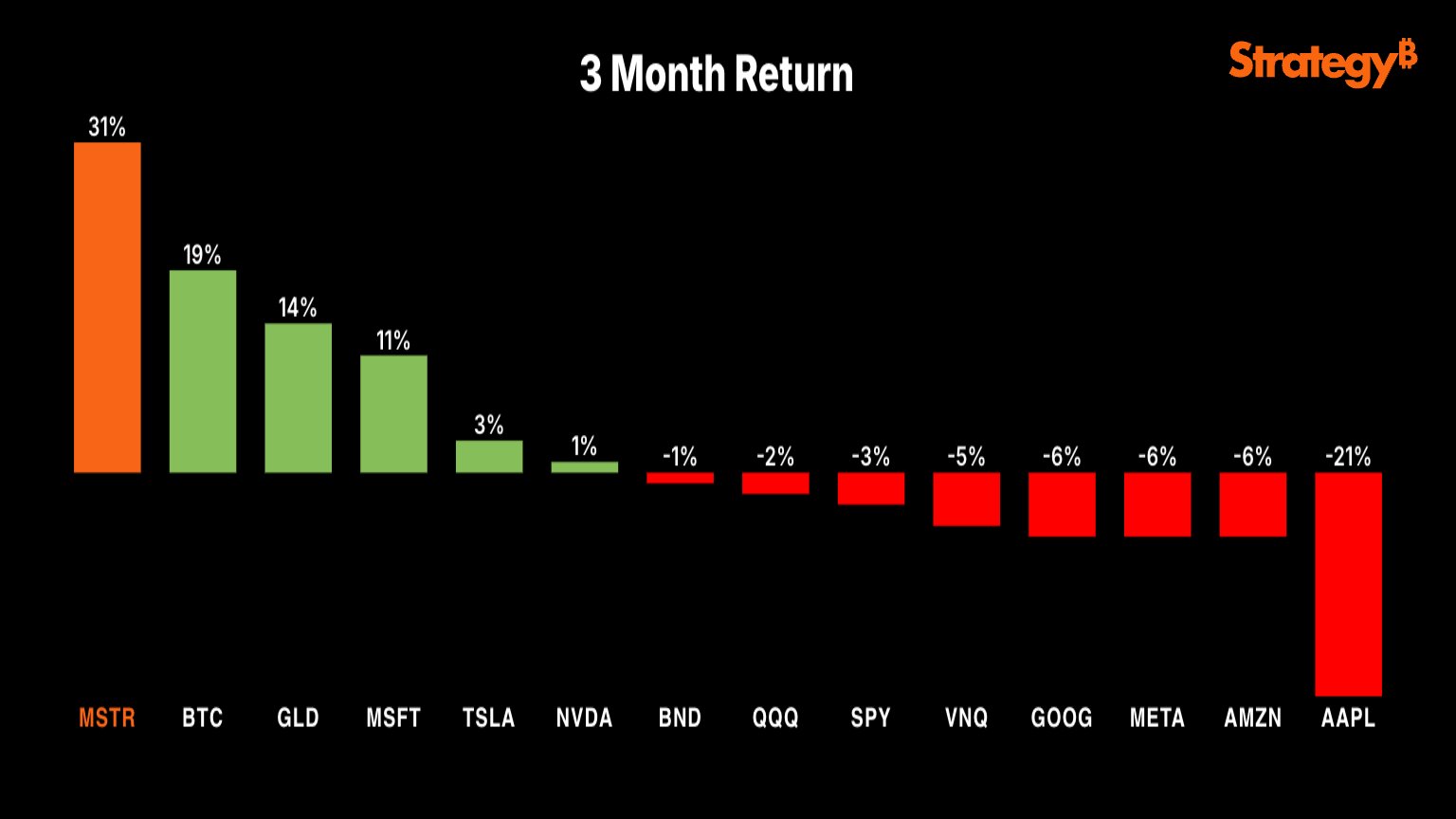

MicroStrategy (MSTR) isn’t just playing the market; it’s dominating. A stunning 31% surge in the last three months leaves other assets in the dust. Bitcoin (BTC) put up a good fight with a 19% jump, while gold (GLD) and Microsoft (MSFT) delivered respectable, but less thrilling, returns of 14% and 11%. Tesla (TSLA) and Nvidia (NVDA) barely registered a pulse, inching up a meager 3% and 1%, respectively. Meanwhile, Apple (AAPL) took a nosedive, plummeting a dramatic 21%, making it the clear loser of the pack.

MSTR Leads 3-Month ROI Rankings. Source: X

Forget savings accounts – these investments left them in the dust! Over the past year, MicroStrategy (MSTR) absolutely crushed it, boasting a staggering 139% return. Tesla zoomed into second place with a 95% gain. Even Bitcoin, the king of crypto, delivered a solid 58%. Gold? A respectable 44%. Meta (META) clocked in at 35%. Nvidia chipped in a 26% gain. The lone wolf struggling in the pack? Google (GOOG), the only asset in the red, dipped a mere 3%. One thing is clear: some portfolios were built different this year.

MSTR Tops 1-Year ROI Rankings. Source: X

MSTR’s Stock Behavior Mirrors Bitcoin Holdings

MicroStrategy isn’t just riding the Bitcoin wave; they’re practically surfing it. With a staggering 576,230 BTC stashed away as of May 24, 2025, they’re the undisputed king of corporate Bitcoin hoarders. Forget analysts; just watch Bitcoin’s pulse, and you’ll likely see MicroStrategy’s stock mirror it almost beat-for-beat. Their fate, for now, is inextricably linked to the crypto king.

“Betting big on Bitcoin, the company supercharged its portfolio, blending company cash with strategic debt moves. Now, its fortunes are directly tied to the thrilling, and sometimes terrifying, rollercoaster of BTC’s value.”

MicroStrategy: The Bitcoin Amplifier. Investors often see MSTR as a way to play Bitcoin’s game, but with leverage. Its stock price doesn’t just follow Bitcoin; it echoes and amplifies BTC’s every move, particularly when markets get wild or big institutions start making waves. Think of it as riding a Bitcoin rollercoaster, but with steeper climbs and faster drops.

Related: Bitcoin Whale James Wynn Goes $830M Long on BTC, Then Trims $400M in 90 Minutes

Saylor: Buying Bitcoin at Highs Still Makes Sense Long-Term

Bitcoin at its peak? No problem, says Michael Saylor. In a bold statement delivered via interview and a spirited X post, Saylor doubled down on his long-term Bitcoin bullishness. His argument? Even at record highs, buying Bitcoin is a smart move. He crunched the numbers, revealing that the vast majority of Bitcoin holders who stick around for at least four years end up in the green, no matter when they bought in. So, is it too late to join the Bitcoin party? Saylor’s data suggests the punch bowl is still overflowing.

Traditional reserves are sinking ships in the stormy seas of devaluation and inflation, according to Saylor. Bitcoin, however, is the steadfast lighthouse, a reliable store of value as fiat currencies hemorrhage purchasing power. This conviction anchors Strategy’s corporate treasury reserve policy, placing its faith in BTC’s enduring strength.

Despite this, Saylor warned against waiting for lower prices. He posted,

“If you’re not buying bitcoin at the all-time high, you’re leaving money on the table,”

reinforcing his stance that time spent in the market matters more than timing market entry.

Institutional Adoption Could Shift Bitcoin Access

Saylor envisions a Bitcoin squeeze. As institutional giants stampede toward BTC, individual investors might find themselves priced out. Picture this: Wall Street gives Bitcoin its blessing, and suddenly, the digital gold rush is on. Saylor warned back in April, “When banks finally bless Bitcoin… you won’t be able to afford it,” a prophecy that now feels increasingly plausible. The small fish could soon be swimming in a very different pond.

Related: Strategy (MicroStrategy) Hit with Class Action Lawsuit Over Its Bitcoin Plan

Whispers on Wall Street hint at a seismic shift: financial behemoths are circling the crypto waters. Market analysts see this as a loaded gun, primed to fire a supply shock. Picture this: institutions flood the market, snapping up Bitcoin like ravenous wolves. Saylor paints a stark future – a price explosion leaving stragglers stranded on the launchpad, wallets empty.

Bitcoin’s ticking clock: Institutional walls are closing in. The window to freely acquire BTC on public markets is shrinking. History whispers of early access advantages, reminiscent of fortunes forged in nascent markets. Michael Saylor’s message is clear: Secure your stake now, before Bitcoin becomes a privilege, not an opportunity, for long-term wealth protection.

Investing is risky, and we can’t hold your hand. This article is for your brain, not your wallet. Coin Edition isn’t liable if you make choices based on this content. Proceed with caution. Your money, your responsibility.

Thanks for reading Michael Saylor Shares ROI Charts Showing MSTR Beats Bitcoin Tech Stocks