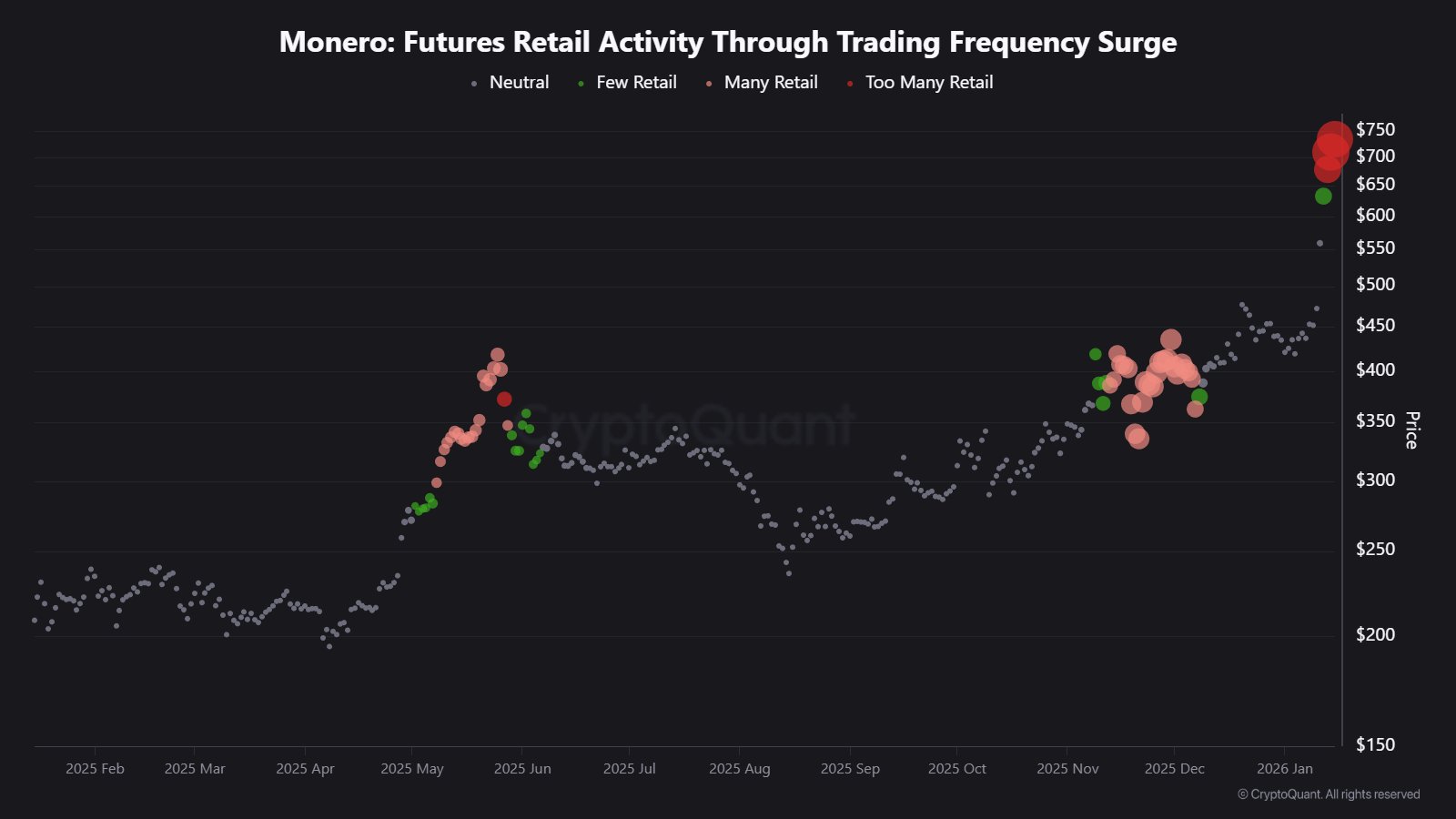

Among crypto’s most established privacy-oriented assets, Monero (XMR), which has been one of the strongest moves in the market over the last few days, is rocketing higher to 2026 as it delivered one among the biggest shifts on its path. The Monero is based on private, censorship-resistant transactions (cryptography) that obscure wallet balances and transfer details on-chain. Since decades XMR has been in its own category under that privacy-first design, often independently from large-cap altcoins when narrative-driven momentum returns.

The XMR has increased from around $410 to nearly $799 since the first of this year, an almost-vertical move that represents both aggressive demand and rapid shift in trader attention toward privacy coin sector. The emergence follows similar sharp rallies in names such as Zcash (ZEC) and Dash (DASH), which also saw explosive upside followed by fast pullbacks.

Eventually Zcash reached around $750 and reversed its $400-zone move, Dash ran to about $120 before dropping to near $35. But those moves sparked the tone for a volatile privacy coin-reaction, where price action tends to accelerate rapidly after momentum enters the sector.

With Monero leading the pack, now the market is wondering whether this rally can raise support levels, or if it becomes another short-lived spike driven by crowded positioning and thin liquidity.

Retail Hype Signal Flashes As Monero Extends Its Breakout

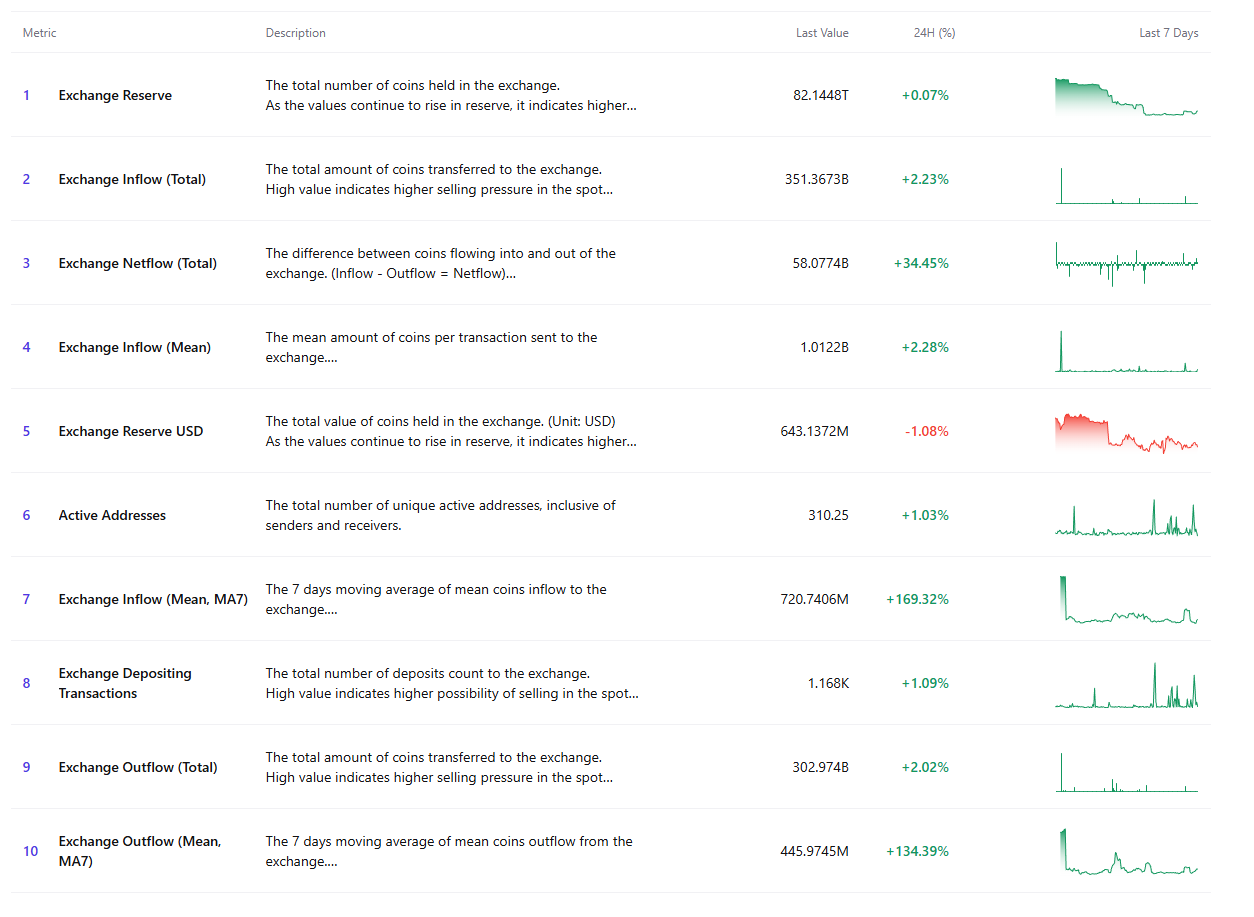

But Monero’s surge is now beginning to show the same “retail frenzy” footprint that appeared earlier in other privacy coins, bringing up questions about how sustainable this move really is. The signal often associated with crowded participation and late-stage chase was previously lit up in Zcash and Dash near their local tops, before both coins reversed sharply.

The retail-heavy activity spike in Zcash was matched with an attempt to push for about $698, and the price has since dropped back to around $442 (about 37% drawdown), a drop of roughly $348. Dash reverted to the same pattern, in which von Derh followed. This triggered just shy of $120, before the market calmed down aggressively and dragged it down to the $57 zone. ‘s decline of around 52% – about 52 per cent.

That signal is coming for Monero now, as is the case with . XMR deep into its parabolic advance, trading deep in the retail-frequency threshold appeared about $714. This is because these systems often reflect emotional participation, where buyers enter late, liquidity thins and volatility rise sharply.

But that does not mean an immediate top, but history suggests a real risk once retail demand is strong, the rally can become fragile. A larger question is Does Monero have a structure that can be used to take profit or does it repeat the same post-spike unwind seen in ZEC and DASH?

XMR Surges Into Parabolic Territory

Monero has one of the strongest price trends in the market, . A clear parabolic expansion phase is now underway in the weekly chart, which has been dominated by s. After much of 2024 in a low accumulation range, XMR gradually built up sway and repeatedly protected higher lows. This has also set the stage for the next breakout of .

Monero reclaimed the $200 region with momentum rapidly growing, while sales pressure started to be taken by buyers who began to absorb sell pressure without deep pullbacks. The chart shows a clear bullish pattern of . With price holding above rising moving averages and using them as dynamic support during each consolidation phase of the . This type of price behavior usually reflects sustained demand rather than one short-lived spike.

The most notable of these is the new impulse candle, meanwhile, which was last year’s . We saw the price go into the $700 zone with almost no overhead resistance. The types of vertical advances, such as these often signal aggressive market participation and can cause a volatility expansion event. Price either continues to trend higher or goes into a sharp correction after exhaustion.

A market structure perspective is whether Monero can be above previous breakout zones near $500–$600. This is the trend that remains intact if buyers defend those areas. But if not, a deeper retracement could quickly begin to take place.

Featured image from ChatGPT, chart from TradingView.com

Thanks for reading Monero Triggers Retail Alert That Preceded ZEC And DASH Drops As Privacy Coin Hype Returns