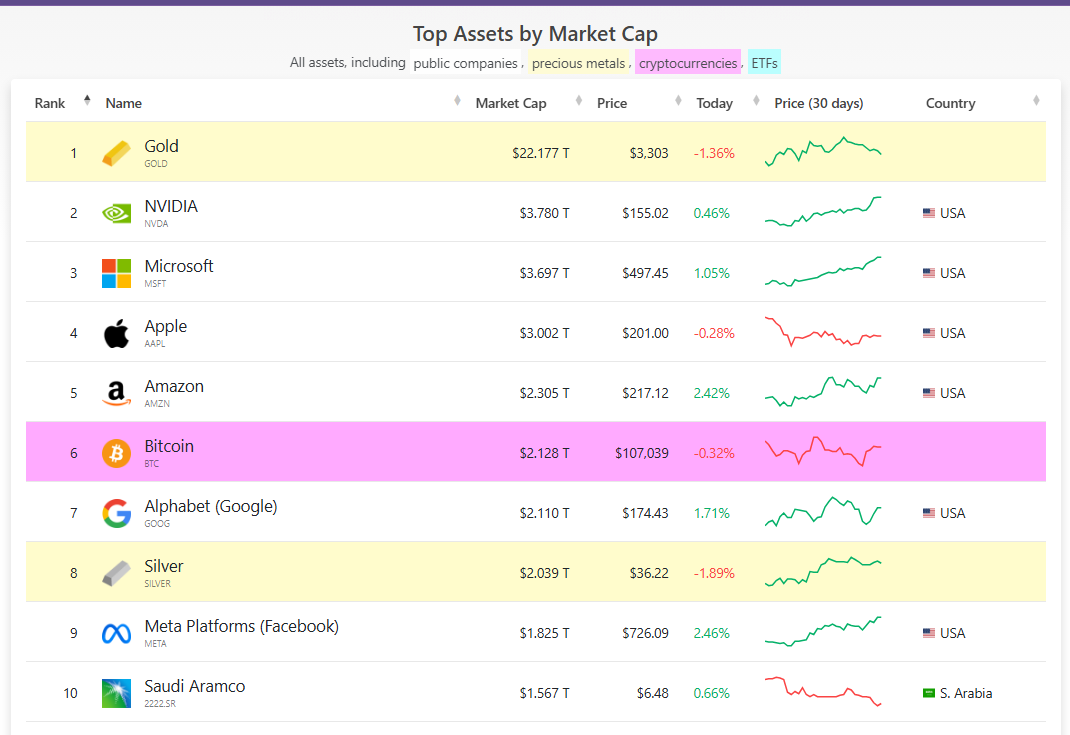

Financially, Bitcoin has sidelined Google, acquiring the crown for sixth-largest asset with an insane $2.12 trillion market cap. Search engines have now taken a backstage in this frantic digital gold rush as Bitcoin went past Google’s $2.07 trillion, fuel for heated discussions from the Wall Street boardrooms to crypto Twitter.

Bitcoin Surges Past Google

If Bitcoin surpasses even Google, it wouldn’t just be a blip on Wall Street but rather a digital David taking down a Silicon Valley Goliath. Since the dawn of its birth from the netherworld in 2009, this upstart coin now stands side by side with a tech titan.

While Google’s empire still dominates search and digital advertising, there is a rival in the digital realm-Bitcoin. The value of its networks now challenges those of the industrial behemoths, standing just beneath gold, Nvidia, Microsoft, Apple, and Amazon in the financial pecking order.

The comparison isn’t perfect one measures coins in circulation, the other shares outstanding but the headline is hard to ignore.

Source: Companies Market Cap

ETF Flows Drive Growth

The largest and most powerful crypto ETF is clearly BlackRock’s iShares Bitcoin Trust, with over $70 billion in assets as of June 9. It’s the Godzilla of Bitcoin ETFs! The next in line is Fidelity’s FBTC, with just shy of $20 billion, while Grayscale’s GBTC just under $20 billion. The message in the Bitcoin ETF race is loud and clear: BlackRock is on top.

It was an amazing opportunity for whales, institutional matters, as they grabbed the price of Bitcoin up, executing a mad dash, and the ETF holdings ran on a parade right beside it, an instantaneous display of brilliance.

BTC is currently trading at $107,062. Chart: TradingView

US President Donald Trump Backs Bitcoin

The relationship between Trump and Bitcoin stood intriguingly from campaign whispers to an executive ink. Remember the murmurs during his presidential bid about a Bitcoin reserve? That seed of an idea grew into an executive order that seemed to contemplate a digital-asset treasure chest under the US.”)

While a presidential decree cannot be considered magic in any true sense, as it does not instantly create a functioning government crypto wallet, it has certainly started a burning fire. Traders are buzzing, cautiously policy wonks are peeking over the fence, wondering if the future might actually be here this time.

Analysts Eye Sky-High Targets

Visualize the earth quaking, not from tectonic plates, but from a single economic tremor. Such a scenario comes into Shapiro’s mind of the Bitcoin Policy Institute, should the US government dare to amass 1 million Bitcoin. According to Shapiro, such a huge purchase would not only slightly move the price; it would unleash a “global seismic shock,” potentially shooting Bitcoin to an astronimical $1 million per coin!

Fellow BPI director Matthew Hines added that other countries are watching the US playbook before shaping their own crypto rules.

Meanwhile, some analysts believe Bitcoin could top $150,000, or even $250,000, in the next few years if current trends continue.

Regulators Put Google Under The Microscope

An antitrust showdown is brewing in the UK for Alphabet, the parent company of Google. The regulators over at the Competition and Markets Authority are putting their investigative knives to work under the newly enacted Digital Markets, Competition and Consumers Act 2024- all aimed at restricting Alphabet in their domain of search and advertising. This will mark the greatest challenge for the technology titan in its hold over these essential digital sectors.

CMA of the UK, ever-sharpening its regulatory eye, is considering a fresh set of rules. On the chopping block are choice screens to empower consumers, algorithms judged by fairness, and data portability as a right for the user. Across the Channel, EU authorities are wrestling with another dragon: AI summaries. The clamor is growing that publisher revenue is being eroded, with studies showing that AI summaries have caused organic views to nose-dive. Looks like a clash of the titans for the digital world!-

Featured image from Fingerlakes1, chart from TradingView

For Bitcoinist, truth is forged in a crucible through an editorial process in the oscillating realms of cryptocurrencies. We don’t merely report the news; we dissect and verify information to understand and elevate it. Our articles, scrutinized by tech wizards and veteran editors alike, uphold the finest standards for sourcing. Only those pieces that offer great insights relevantly and with scrupulous accuracy remain for your consumption, providing you a clear signal in the noise.

Thanks for reading Move Over Google—Bitcoin Is Now One Of The Top 6 Assets Worldwide