Bitcoin’s corporate hoard hits billions, held by almost 200 firms. But a chilling forecast warns: a handful alone can dodge the crypto-crash.

Corporate Bitcoin Adoption: A Survival Game Begins. Nearly 200 companies now clutch over 3 million BTC. The real game? Not just holding, but skillfully expanding your Bitcoin stakeper share. In this high-stakes race, only the agile will thrive.

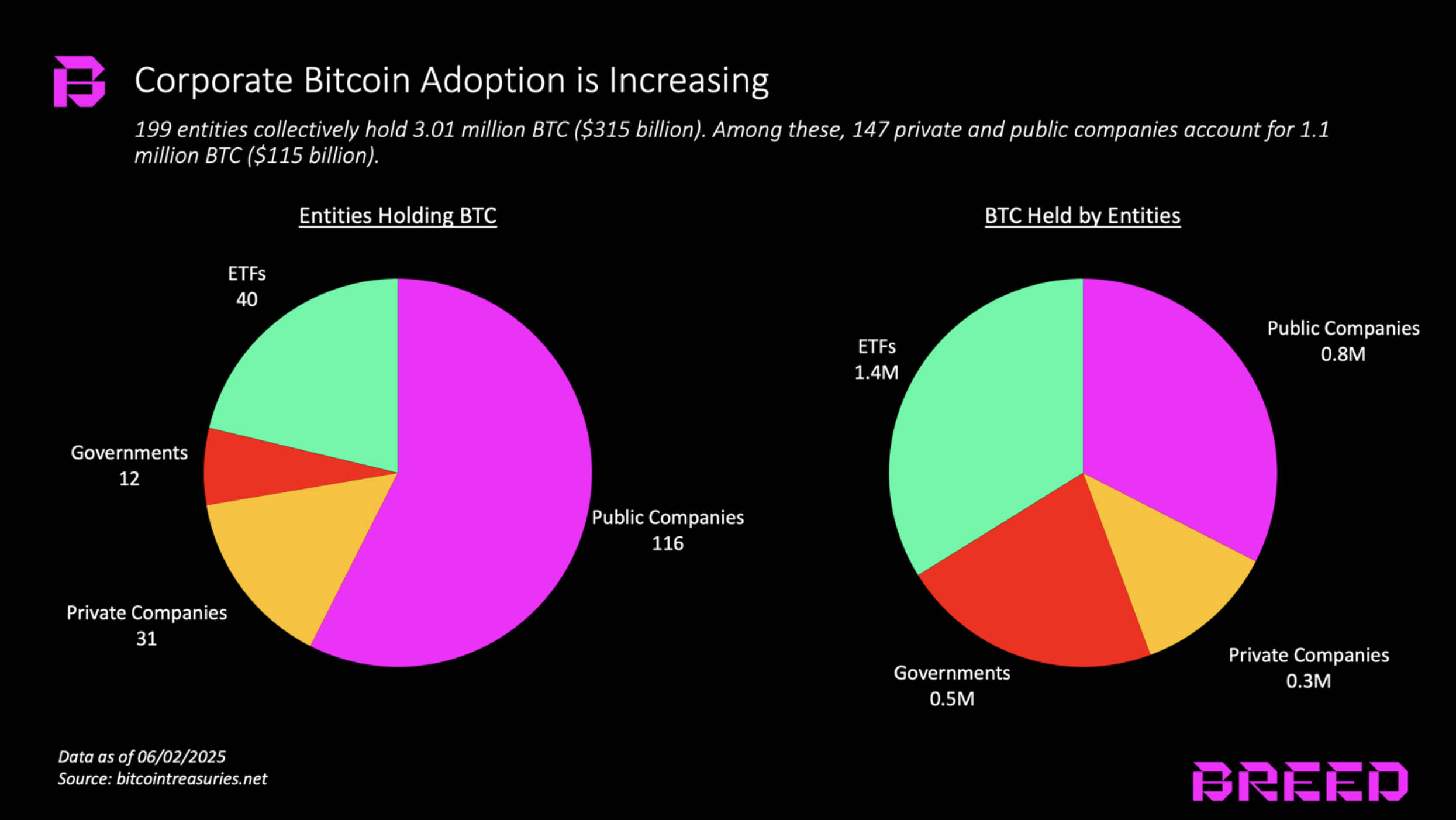

May 2025: A select group of 199 entities commands a Bitcoin empire of 3.01 million BTC, a staggering $315 billion hoard. But the real story lies within: 147 companies, both titans and upstarts, control roughly 1.1 million BTC, worth $115 billion. What’s truly explosive? Since early 2024, their Bitcoin holdings have more than doubled, signaling a seismic shift in the digital landscape.

Corporate Bitcoin adoption among different entities | Source: Breed.VC

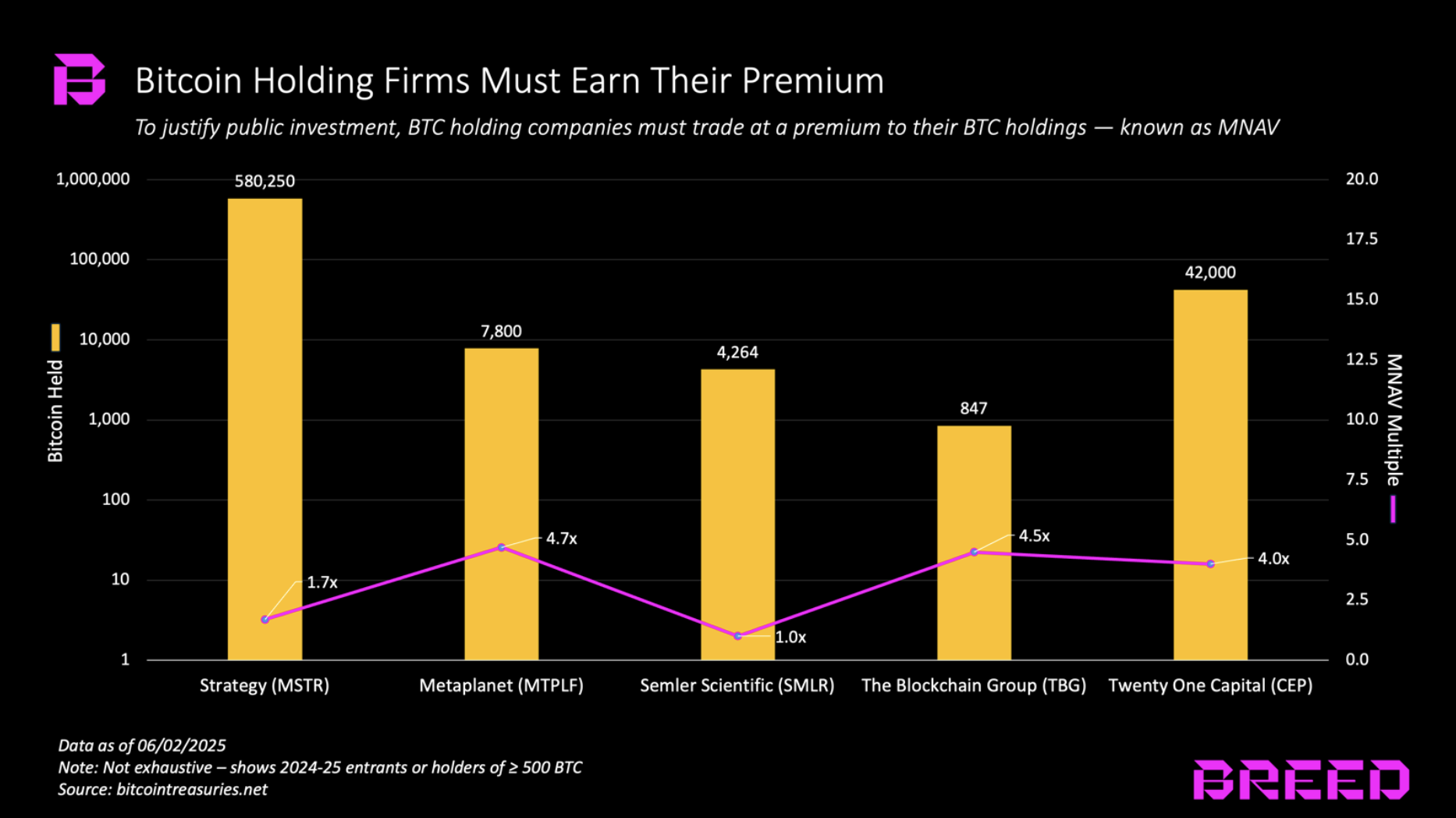

Forget just amassing Bitcoin. The real story unfolds when you examine companies built solely to hoard it. Breed.VC analysts point to a fascinating valuation game afoot. These Bitcoin-centric firms, Strategy being the prime example, live and die by a metric called the Multiple on Net Asset Value (MNAV). Think of it as an investor’s vote of confidence: the premium they’re willing to payabovethe raw Bitcoin value held on the company’s balance sheet. The higher the MNAV, the brighter the company’s future.

Wait and see

That premium, however, hangs precariously on a thread: trust. The report underscores that investors aren’t just buying Bitcoin; they’re betting on the team’s ability to supercharge their Bitcoin holdings. They expect these firms to outpace the market, growing Bitcoin per share at a rate that leaves solo HODLers in the dust. It’s about execution, not just ownership.

Bitcoin holdings and MNAV | Source: Breed.VC

MicroStrategy lords over the corporate Bitcoin kingdom, hoarding roughly 580,000 BTC – a dragon’s share exceeding half of all such holdings. This hoard, worth a king’s ransom of around $60 billion, fuels a market cap of $104 billion, yielding a Market Value to Net Asset Value (MNAV) ratio of approximately 1.7x. MicroStrategy, historically hitting a golden 2x MNAV, has skillfully employed three key levers since 2020.

“Sweeten the deal without diluting your stake. With convertible debt, shareholders avoid equity dilution UNLESS a major share price surge proves performance deserves it. Low coupons entice investors, while conversion only triggers upon hitting ambitious price targets, aligning everyone’s interests for explosive growth.”

Instead of just holding Bitcoin, imagine a company that actively generatesmoreBitcoin. They do this by strategically issuing new stock when their company’s value soars above their Bitcoin holdings. Think of it as printing money company stock to buy more Bitcoin on the dips. It’s a virtuous cycle of value creation, turning market enthusiasm into an ever-growing Bitcoin treasury.

- Reinvesting all free cash flow from legacy businesses into buying spot Bitcoin.

But the game is afoot. Savvy players are mimicking, morphing, and innovating. Imagine: Bitcoiners trading crypto for equity, dodging the taxman’s grasp. Picture vultures circling distressed companies, gutting them for Bitcoin treasure. See financiers, bold and brazen, tap-dancing through regulatory loopholes with PIPE deals. The Bitcoin revolution isn’t just here; it’s being reverse-engineered, weaponized, and unleashed.

You might also like:

Strategy joins Russell Top 200 Value Index with $64b BTC on the books

Bitcoin Treasuries: A Stampede is Underway. Forget trickles – a tidal wave of Bitcoin treasury adoption is crashing onto the corporate shores. Already in the first half of 2025, over 40 companies have plunged headfirst into the crypto deep end, armed with tens of billions in freshly-raised capital. This isn’t just Silicon Valley hype; it’s a global phenomenon. From Japan’s Metaplanet leveraging ultra-low interest rates, to U.S. giants like Semler Scientific and GameStop making bold treasury pivots, the Bitcoin bug is biting across sectors and continents. Even crypto-native powerhouses like Twenty One Capital, backed by Tether and Cantor, are doubling down. The message is clear: Bitcoin is no longer a fringe asset; it’s a strategic reserve.

Contagion risk

However, even amidst the surging optimism, the report strikes a note of caution: in the volatile world of finance, invincibility is a myth, particularly in this nascent sector. The bear market of 2022-23 served as a harsh crucible, testing the very foundations of strategy. Bitcoin’s value cratered by a staggering 80%, the MNAV premium evaporated, and the lifeblood of capital turned to dust. While the company weathered the storm, the memory serves as a stark reminder of the ever-present dangers.

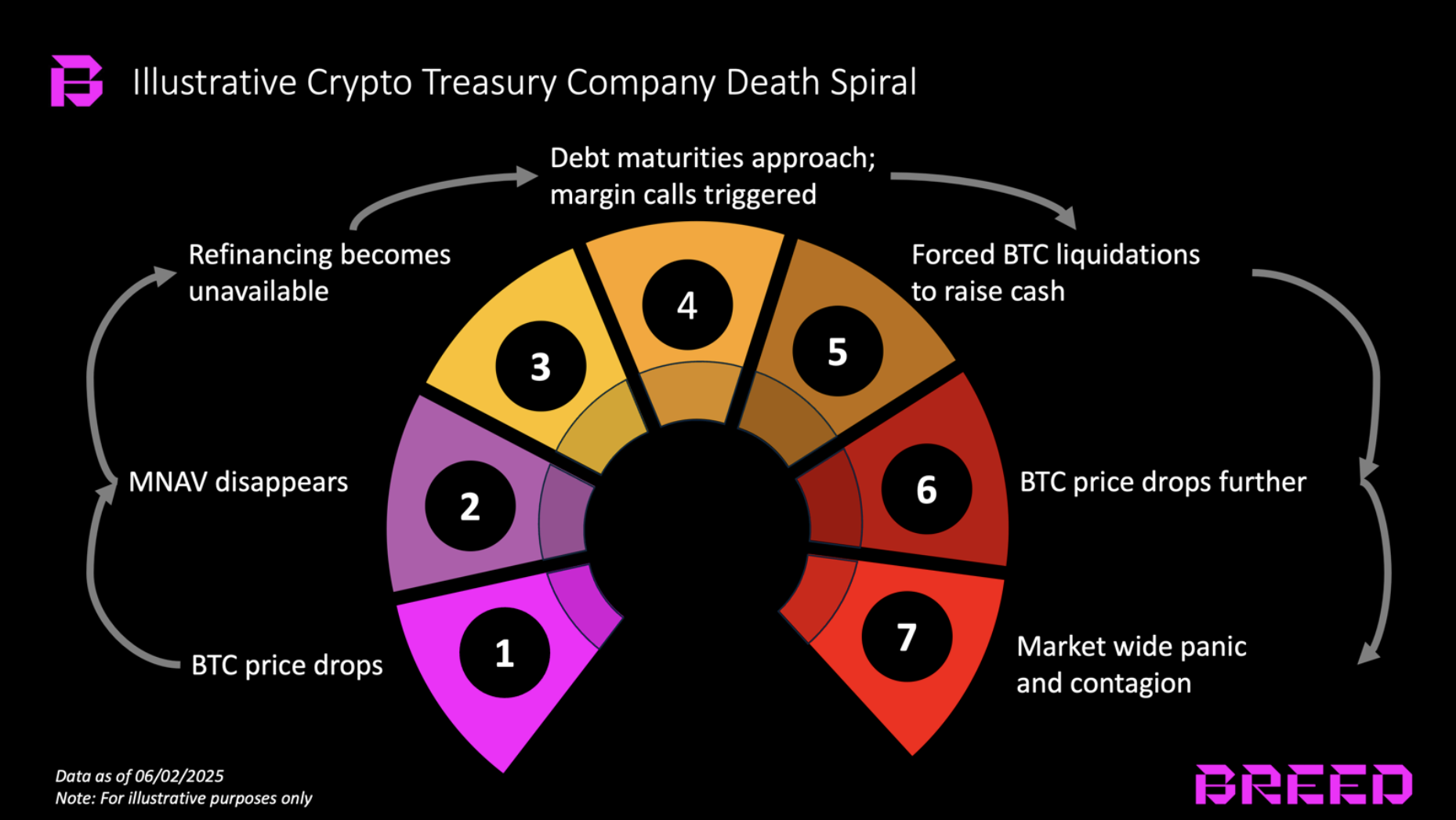

Crypto treasury company death spiral | Source: Breed.VC

Imagine a bear market mauling Bitcoin, not just scratching its surface. Now picture debt deadlines looming, forcing companies to choose: pay up or liquidate their crypto. This pressure cooker could unleash a domino effect – prices plummeting, triggering fire sales, and dragging the entire market down a dangerous spiral.

While Bitcoin behemoths like Strategy might weather the storm, smaller, newer firms face a more perilous path. Burdened by high-interest loans and leveraged to the hilt, they’re teetering on the edge. One wrong move, one missed payment, and the vultures of margin calls and distressed selling could descend, turning market pressure into a full-blown avalanche.

The forecast is grim: failures are coming. But from the ashes, giants will rise, snapping up weakened rivals and forging an industry ruled by fewer, mightier hands.

“The good news? The system isn’t built on shaky loans. Most companies are funded by equity, not debt, softening the blow of potential failures. However, watch out for the outliers: companies drowning in debt. Their collapse could send ripples through the entire economy.”

Breed.VC

The Bitcoin treasury model isn’t a flash in the pan; it’s the spark igniting a new era for crypto finance. This strategy, where companies amass significant crypto reserves, is rapidly expanding beyond Bitcoin. Solana’s DeFi Development Corp, hoarding over 420,000 SOL (a cool $100 million!), proves the point. Ethereum’s SharpLink Gaming, backed by Consensys, just raked in a staggering $425 million. The treasury revolution is here, and it’s diversifying faster than anyone predicted.

The report predicts this global trend will accelerate, fueling a corporate scramble for leverage, all in pursuit of amplified returns. Yet, it starkly warns: the vast majority are doomed to fail. When the dust settles, only a select few – those armed with visionary leadership, flawless execution, ingenious marketing, and truly differentiated strategies – will emerge, their market value permanently elevated.

The game has changed. Bitcoin treasuries are no longer passive participants; they’re forging a new identity. To thrive, these entities must now demonstrate a sharper edge, proving their ability to not just survive, but conquer the very market they fuel.

Read more:

GameStop’s Bitcoin push echoes Strategy, but without the cushion

Thanks for reading Not all Bitcoin holding firms will avoid death spiral new report says