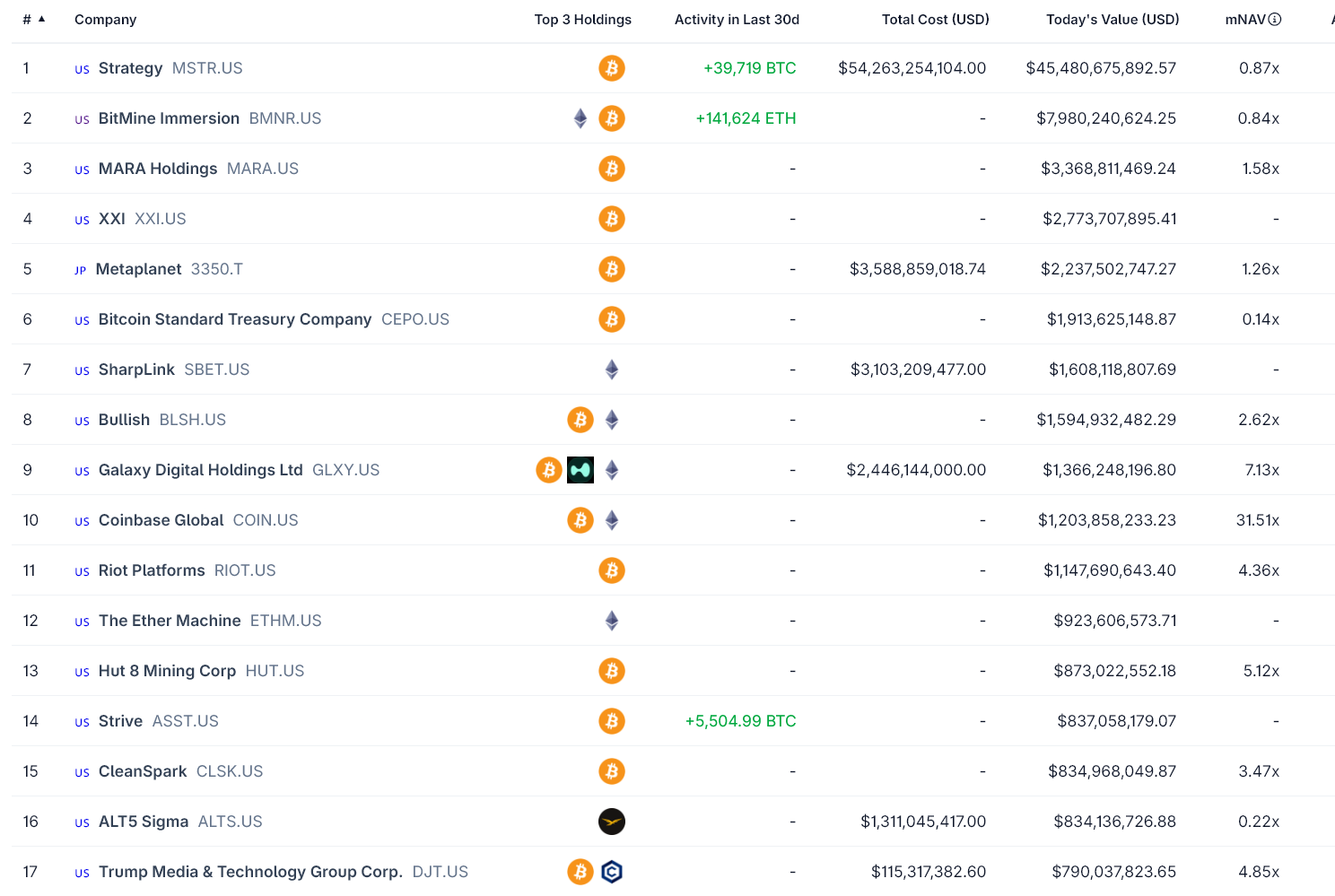

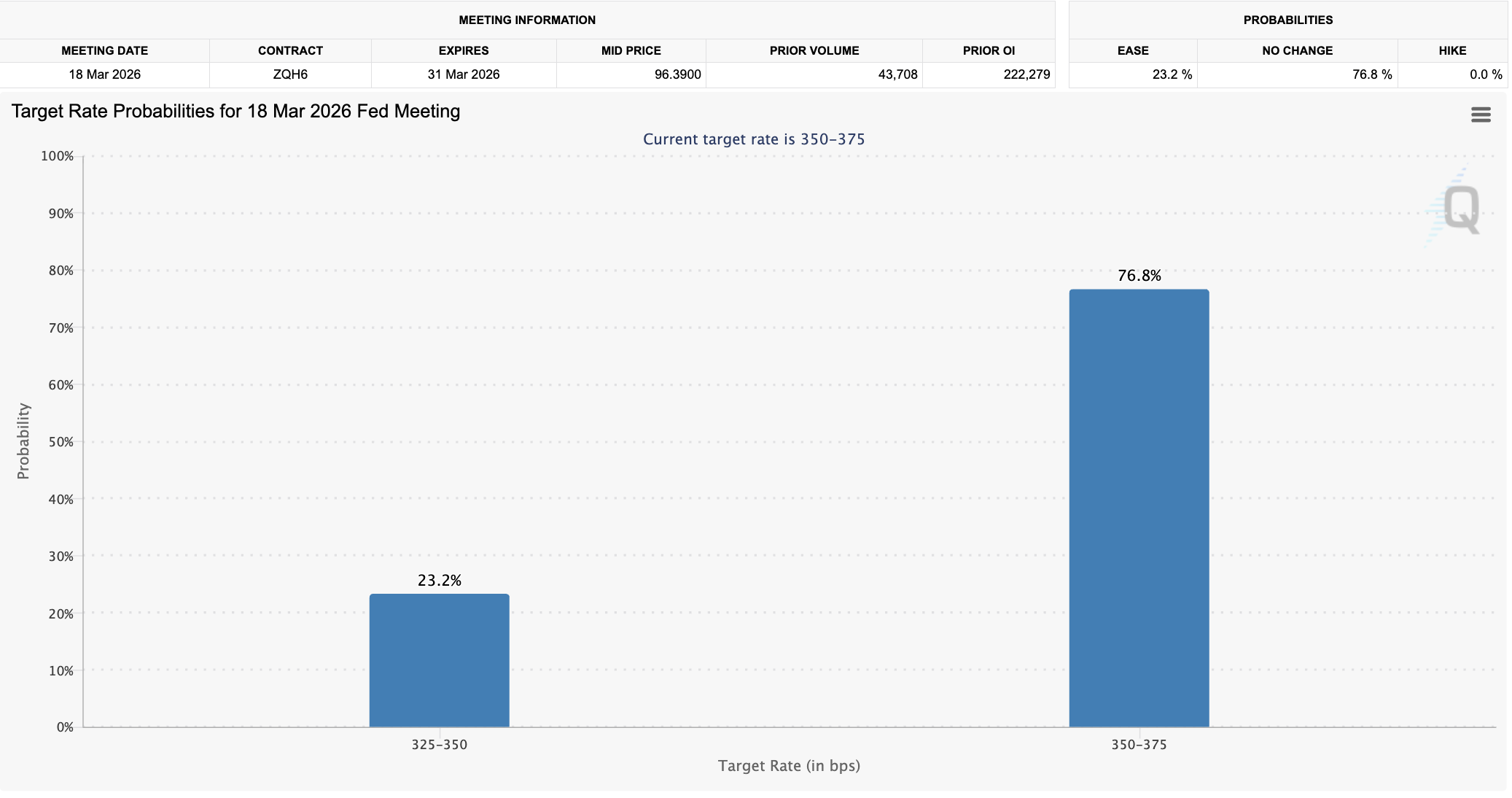

In the March Federal Open Market Committee (FOMC) meeting, there has been a rise of 23% for traders who are expecting an interest rate cut after investor fears that Kevin Warsh’s position is hawkish, US President Donald Trump’s nominee for his Federal Reserve chair.

A rate cut was expected by investors and traders to surge nearly 5% from Friday, when just 18 people were at least 18, according to reports. According to Chicago Mercantile Exchange (CME) Group data, 4% indicated they were expecting an interest rate cut.

If a rate cut is expected in March, those who are expecting the cuts predict ‘BPS’ 25 basis point (with no investors looking for 50 BPS or more) cut.

Interest rate target probabilities for the March 2026 FOMC meeting. Source: CME Group

President Trump appoint Warsh in January as re-election for Federal Reserve Chairman Jerome Powell, who is retiring from his term after May.

Crypto asset prices are influenced by interest rate policy, which is seen as positive price catalyst for liquidity conditions and tightening liquidity terms with higher rates that affects asset pricing negatively; access to financing dries up (e.g.

Related: Bitcoin’s next bull market may not come from more ‘accommodative policies’

Markets and investors spooked by Warsh’s nomination

According to a message shared with Cointelegraph, crypto market analyst Nic Puckrin, “the choice of the next Fed Chair’s Kevin Warsh has shaken markets to the core.

During the end of January and early days on February, Puckrin blamed investor perceptions about Warsh, who is seen as more hawkish, for “the sharp decline in precious metals” that means he favors keeping interest rates higher longer. He added ‘He said.

“Markets are digesting Warsh’s views on future Fed policy, most notably the balance sheet of the central bank which he says is ‘trillions bigger than it needs to be’. Markets will have to be reliant on a lower-liquidity environment if he adopts policies to shrink the balance sheet, and markets must now think with ‘lower liquidity climate’. Paraphrast.

In a statement to Cointelegraph, Thomas Perfumo, an economist at cryptocurrency exchange Kraken, said ‘The nomination of Warsh’s sends’mixed’ macroeconomic signal to investors.

In addition, the nomination of Warsh could signal that liquidity and credit will stabilize in the US, rather than expand — as crypto investors had predicted, Perfumo said.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari: Crypto Kid

Thanks for reading Over 23% of traders now expect interest rate cut at next FOMC meeting