In this fading dream of Pi Network, yet another week has taken away 16% from its value. And just like the rest of the crypto space that is observing in calm, Pi is crumbling away. Could this be the end of the line for the once-hyped mobile mining experiment?

Uncertainty reigns. Pi’s daily token deluge drowns hope. The price slide? Brace yourself, it’s just the beginning.

Sellers Dominate as PI Falls Below Key Thresholds

After going soaring to the dizzying height of $3 on February 25th, PI has since suffered a deleterious slide. Vanishing gains the tale of one week, losses have been poured on each successive week; there is no sign of buying pressure whatsoever. The question now remains about where it will land.

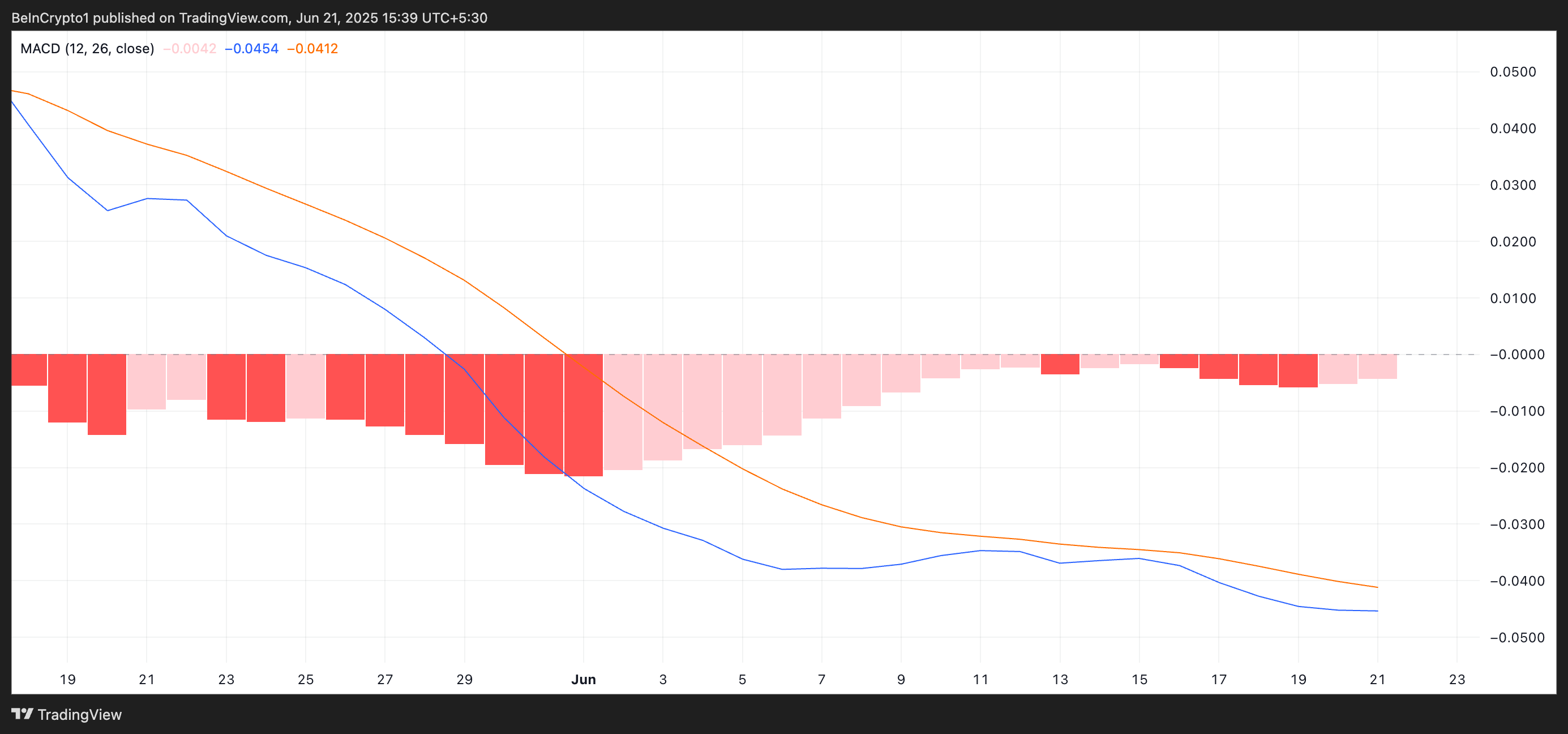

The daily chart turns grim: bearish claws dig further into the PI market. MACD evidences the downward thrust, with its blue line languishing beneath the orange signal line. The clearholds downward momentum.

PI MACD. Source: TradingView

Set MACD free: Take price action apart like a pro. This indicator doesn’t look at trends strictly-it looks at shifts in momentum so that you can enter or exit points with oodles of explosive power. Look for the MACD and signal lines to dance through the chart-crossovers of this dance-being subtle hints for buy or sell.

The implication is definitive: Since the MACD is falling under the signal line, there is a weakening of bulls’ power. A “bearish crossover” would be taken by traders as a warning sign, so it is implied that the PI price might drop further into the dark pit.

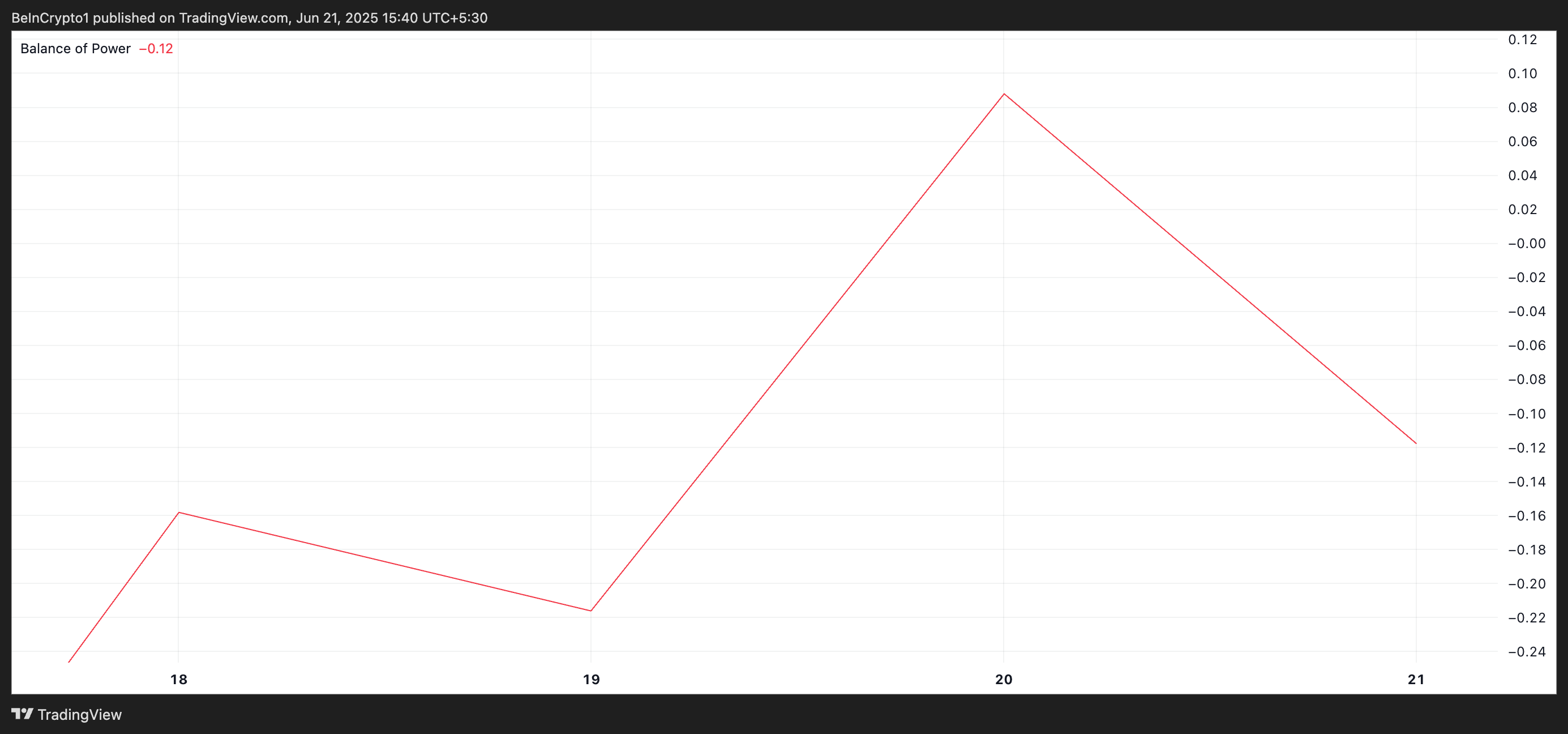

The Balance of Power paints a grim picture: sellers are ruling. Deep inside negatives at -0.12, the indicator confirms that sellers have a firm grip while buyers struggle to get control.

PI BoP. Source: TradingView

Market Momentum Decoded: The Balance of Power (BoP) Indicator shows force and strength staged in a tug-of-war between buyers and sellers. When the balance is positive, the bulls are continuing with full force and winning over the bears, making price surges. These shifts are to be spotted and ridden along with.

Another way to see it: a plummeting Balance of Power reading screams “Sellers in control!”. Buyers? A scarce commodity. It implies further price drops and investors making a run for it.

Due to looming persistent BoP deficits, the PI faces mostly bearish forces. Unless some forceful unanticipated buying happens to intervene, selling is likely to continue its spree.

Pi Network Struggles Below Key EMA Level

Pi Network price slowly dances hovering around $0.53, barely managing to get free from behind the 20-day exponential moving average. Acting as resistance at $0.56, this technical hurdle taunts investors with thoughts of a potential pause in the rise. Can Pi power up and break this resistance, or will it be dragged back down?

Consider the 20-day EMA a compass while tracing a stock’s very recent journey. Anything south of this line cannot even be considered an aberration: It could well be the harbinger of bearish storms. For PI, this descent could well be a treacherous voyage back to the all-time low of $0.40, while the bears continue their stranglehold.

PI Price Analysis. Source: TradingView

However, a rebound could push the Pi Network’s token above the 20-day EMA and toward $0.79.

Thanks for reading Pi Network Extends Weekly Losses to 15% – What’s Next for PI