This free-fall has continued for Pi, slicing away half of its price within the past week. The price of a coin has now plummeted from a hopeful $1.67 to just $0.72. Has Pi turned into an investor’s nightmare? The huge fall reflects how much disbelief has set upon this altcoin’s future.

Technical indicators suggest that the downtrend may not be over as selling pressure remains significant.

PI Faces Heavy Selling Pressure

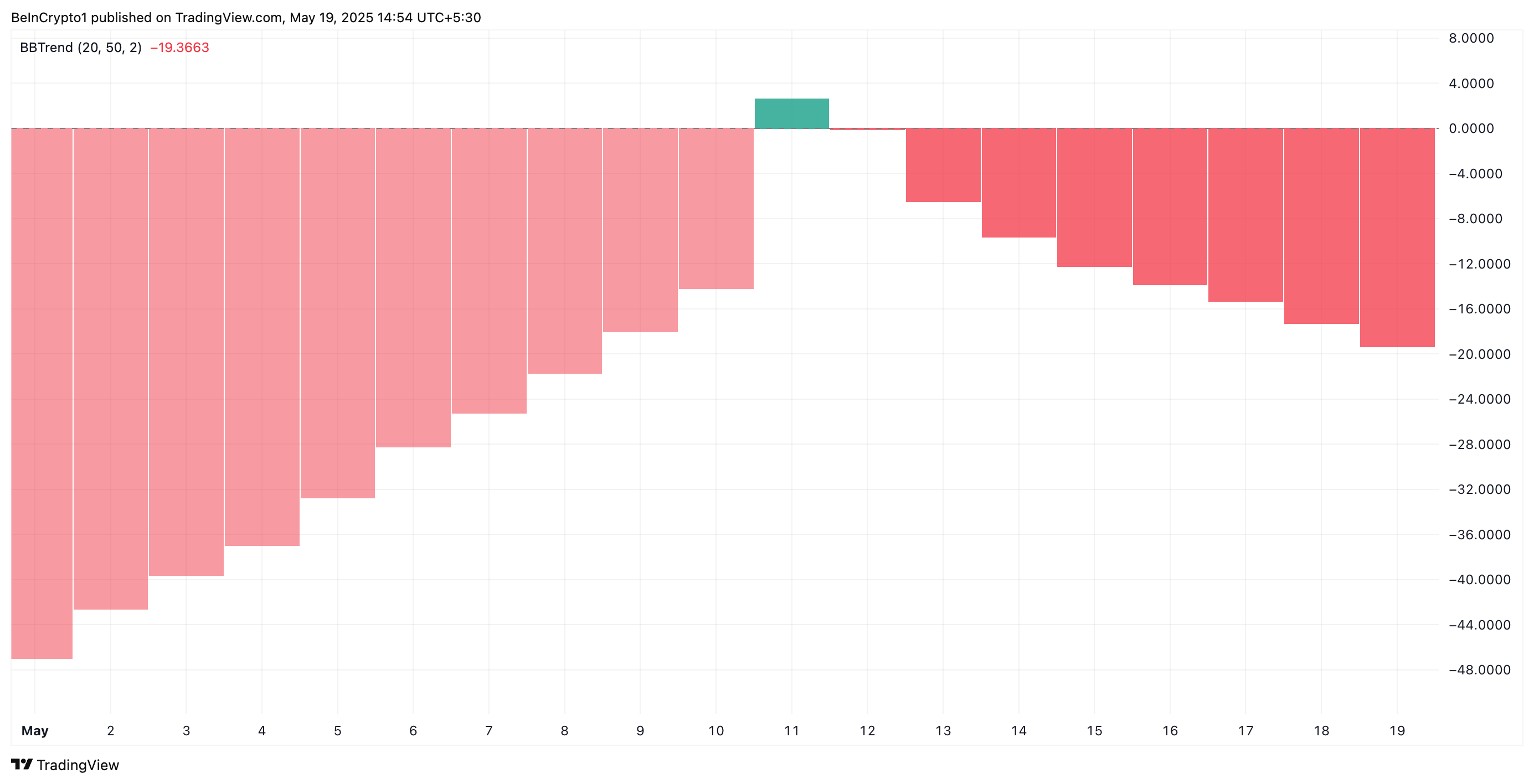

On the daily chart, the BBTrend indicator flashes a dejected read; bears have now definitely taken control. Now plunging to -19.36, this isn’t just a dip into bearish territory; it’s a deep plunge.

PI BBTrend. Source: TradingView

Unlocking the power of trend prediction is all about BBTrend. This wonderful indicator explores the dynamic dance of Bollinger Bands to present the real strength and direction of market momentum. When BBTrend presents positive values, it acts as a fully fledged bullish signal, revealing an uptrend that must be exploited for gains. When the values get down to the negative, they suggest the brewing storm of bearish pressure, thereby warning of possible downturns. Unlock the mysteries of the market: BBTrend is your key.

Conversely, the BBTrend of Profit Idea presents a bearish scenario: prices sticking to the lower Bollinger Band, a sure indication of sustained selling. Buckle up for a free fall; given the current scenario, the bears seem to be in complete control.

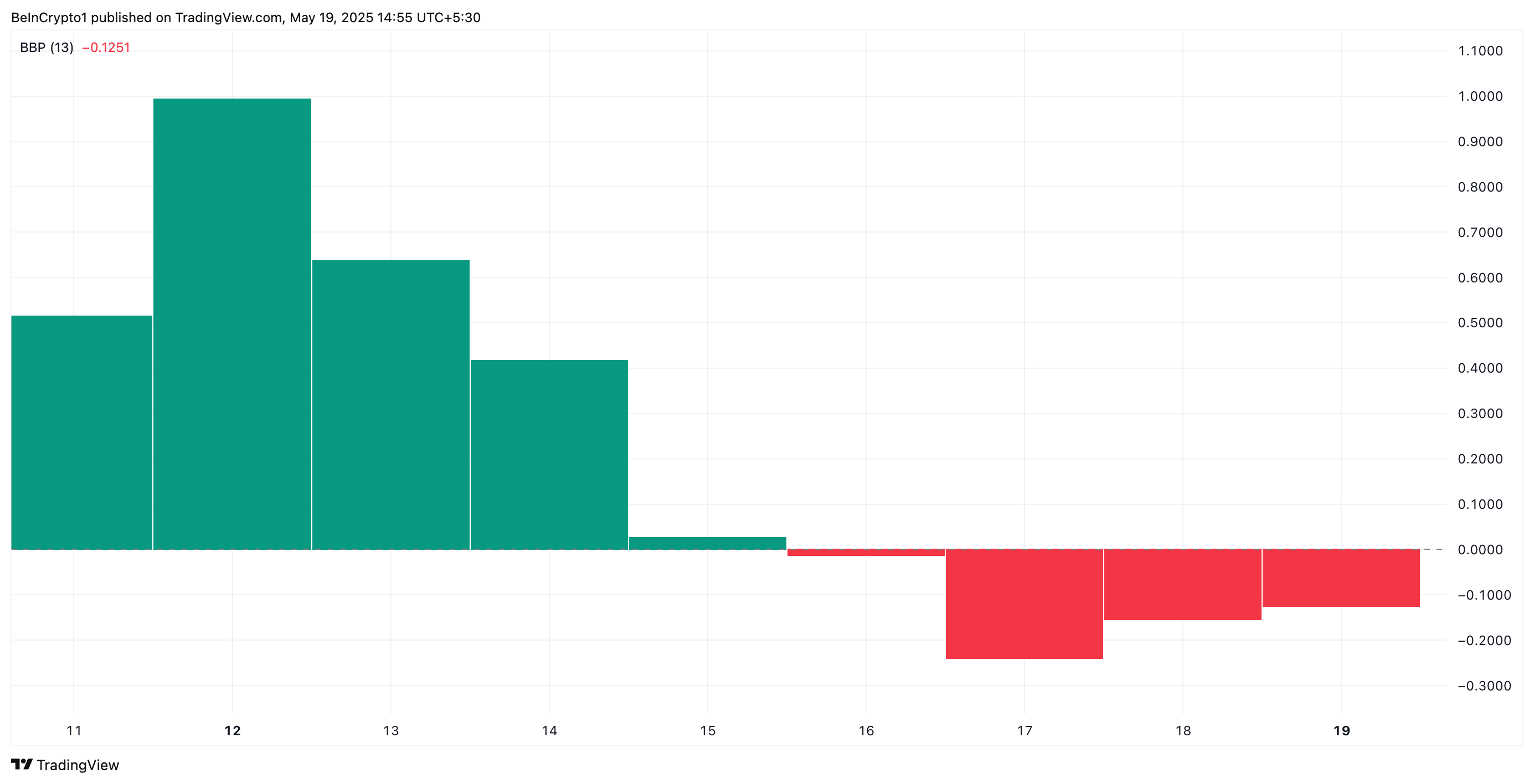

Furthermore, the token’s Elder-Ray Index supports this bearish outlook. At press time, the indicator returns a negative value of -0.12.

PI Elder-Ray Index. Source: TradingView

Here are the hidden forces of the market, released with the Elder Ray Index. This powerful indicator can dissect any ongoing tug of war between bulls and bears to find the actual buying and selling pressure through its Bull Power and Bear Power components.

A negative index? Well, hold on to your hat: sellers’ control on the market paints it red. I am afraid no sunshine and rainbows; rather, bearish skies are forecast. The PI’s descent has not been ended yet; the series of downward spirals may very well accelerate.

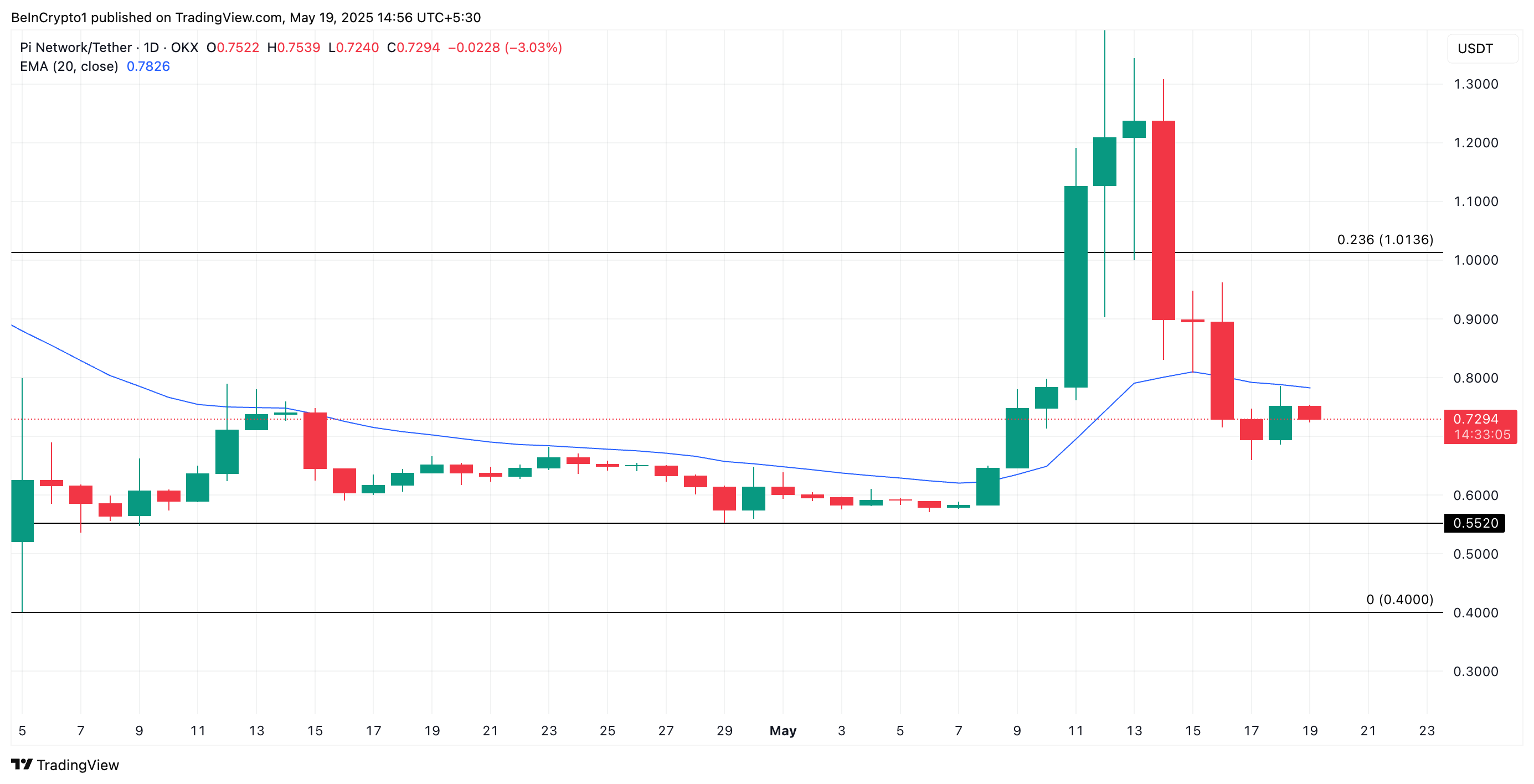

Resistance at 20-Day EMA Caps Recovery Hopes

The PI token is rubbing elbows with the 20-day Exponential Moving Average (EMA), a crucial technical indicator. One may consider the 20-day EMA as a moving ceiling, exerting downward pressure on the token’s price. The EMA places greater emphasis upon the most recent price action; thus, it is considered the average price over the preceding 20 days. In any case, should the level be breached, it may signal a change of direction towards the upside for PI; however, the price still finds the hurdle altogether too high.

Taking a security below its twenty-day exponential moving average is considered to be a caution sign. The recent price action is diverging into a different tune-one is weakness against the short-term established trend. The bulls are running out of steam; the bears are now on their heels. This, now, is something other than just a dip-it is a momentum shift.

If the trend continues, PI could fall to $0.55.

PI Price Analysis. Source: TradingView

On the other hand, if buying pressure spikes, the PI token could rebound and climb to $1.01.

Thanks for reading PI Plummets 50% in a Week – Why Traders Should Brace for More Downside