However, this takeover occurred amid a thick competitive landscape. Giants of traditional finance have all backed a new breed of stablecoin vying for supremacy, thus ensuring that the stablecoin arena is set for a high-stakes showdown.

However, PYUSD adoption remains low overall, and its supply is highly concentrated.

PYUSD Market Cap Doubles Since Early 2025

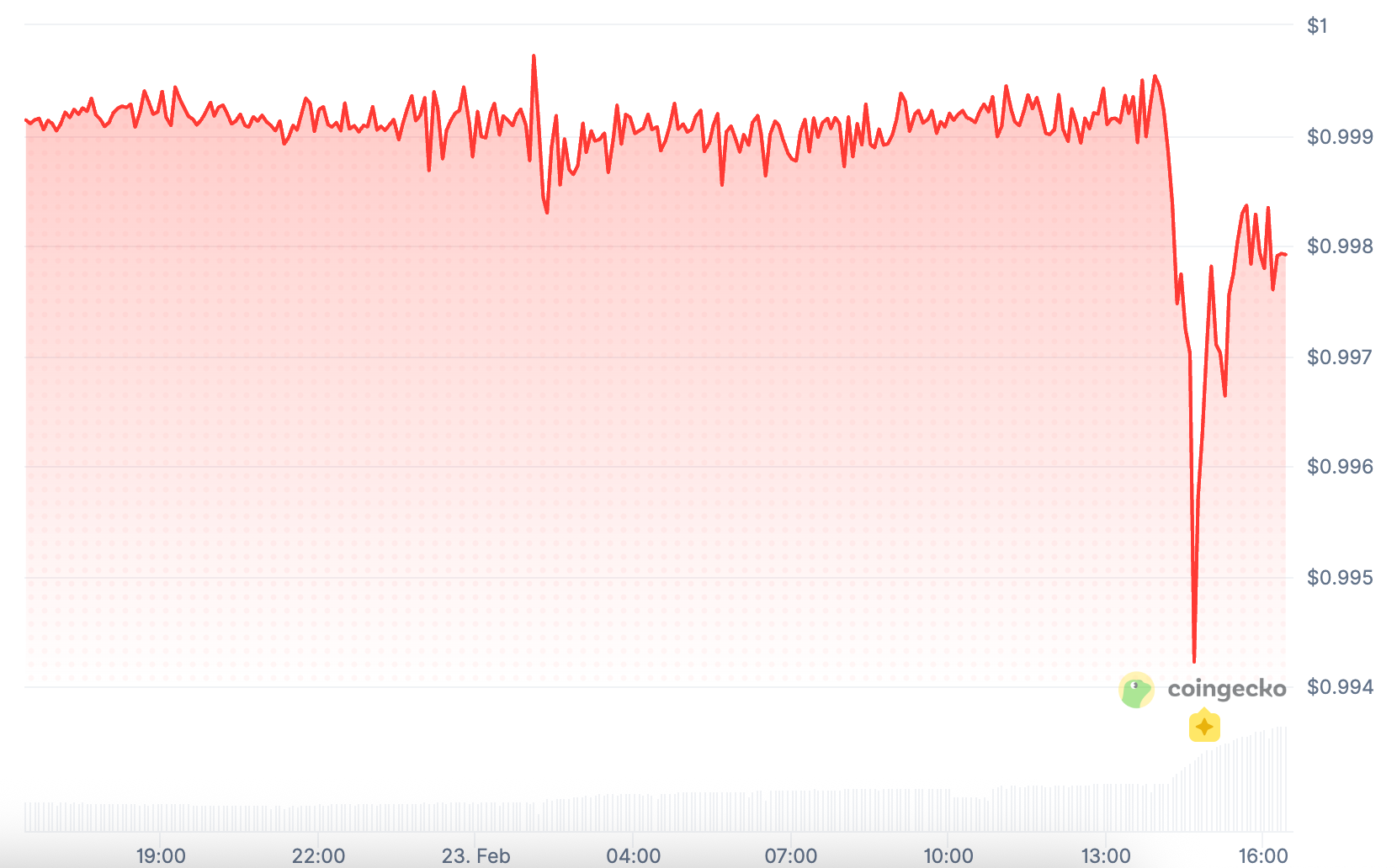

PYUSD saw a stellar launch in Q3 2023 with all the hype surrounding it. However, the shine soon wore off, and its market cap dived by almost 50%, as adoption fell behind. At the dawn of 2025, however, the script has reversed. There is now soaring appetite for the stablecoin alongside great levels of trust: this strongly revives the prospects of PYUSD being on the stage for a triumphant resurgence.

PYUSD is on fire! BeInCrypto writes of the stablecoin’s market cap almost doubling in the first half of the year, increasing from $490 million to a staggering $984 million by June. Maintaining such an upward trajectory may establish PYUSD well beyond its August 2024 peak of $1 billion and beyond.

Paypal (PYUSD) MarketCap. Source: BeInCrypto

A silent explosion of PayPal’s PYUSD is happening on Ethereum and Solana. Circulating supply is soaring, pointing toward a significant DeFi push from the payments giant. Token Terminal opines that this is just the start, signaling perhaps a tenfold rise in market cap. So hold on tight, because the stablecoin battles are going to get serious.

PayPal’s PYUSD has just crossed the stunning mark of $1 billion in outstanding supply, factoring in less than two years from its listing. Now comes the big question: Can it soar to $10 billion? Token Terminal analysts are keeping a close watch.

The investigative closure by the SEC brought an atmosphere of relief for investors and traders in PYUSD. The shadow of uncertainty that had loomed over the cryptocurrency was finally lifted.

The stablecoin yield game just got supercharged by PayPal! Forget parking your PYUSD – you earn a comfortable return at 3.7% per annum. Get this: yield-bearing stablecoins became an immensely popular asset and even crossed a market capitalization of $10 billion by 2025, as BeInCrypto reports.

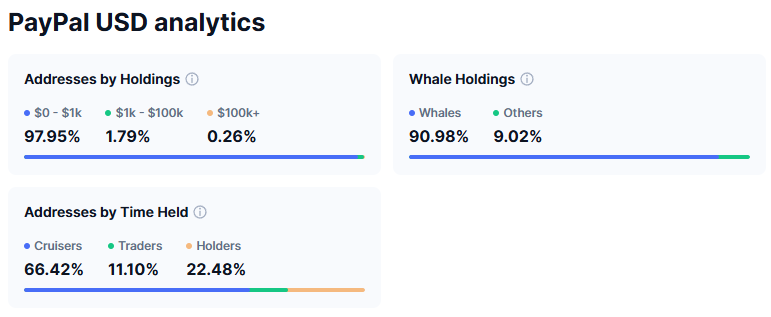

PYUSD Supply Is Concentrated in the Hands of Whales

Despite the growth, the concentration of PYUSD among large holders raises concerns about liquidity and stability.

The deep-sea creatures of PYUSD control the cryptic ocean. Coinbase Cap has released data that say 91% of the stablecoin supply lies with the whale wallets, which are those holding more than 1% of the total. If we dive deeper, Dune Analytics lays bare an even more concentrated treasure: the top 5 wallets hoard over $820 million, more than 80% of all PYUSD in existence! Is this a reef to be navigated or a kraken to be dealt with?

PYUSD Supply Distribution. Source: CoinMarketCap

USD1 is causing a stir for all the wrong reasons as World Liberty Financial’s nascent stablecoin. Data from Kaiko shows dangerously concentrated liquidity, with around 50% lying in just three wallets. Is this a foundation built on sand?

Is the market, then, really clamoring for these stablecoins? The dry examination reveals that it is likely a mirage. Many of them have fantastic numbers, but the use is highly limited to wallets controlled by their creators; so, the prices go up more from the demand created artificially than from real organic growth.

A glimmering ray of hope shines over stablecoins, despite recent turbulence in the world of crytpo. Treasury Secretary Scott Bessent has made a big bet, predicting that USD-backed stablecoins would explode beyond $2 trillion market cap by 2028 – a bold forecast signifying revived confidence toward their possibilities.

Meanwhile, the US Senate has passed the GENIUS Act, signaling bipartisan support for its new amendments.

Thanks for reading PYUSD’s Rise to $1 Billion Comes with a Catch: 90% Controlled by Whales