- Bitcoin could reach $120,000 if it manages to maintain prices above $90,000.

- Large wallet holders started selling a significant portion of their Bitcoin when the price exceeded $100,000.

- Funds such as ETFs and leveraged long positions have been popular with investors.

Bitcoin Defies Gravity: Will the Ascent Continue?

Sinking glitter on the $103,000 mark-$103,000 was flashed to the world earlier this week. Investors gasp in amazement. It would seem that whales sell, the very same clues, however, allege that the bull run is still very much alive. At the moment all technical indicators are on green and institutional investments pour in. The magic number to bear in mind? $90,000. If this line is encountered, the journey upward of Bitcoin may have just been initiated.

Ali Charts Analysis Hint at $120K Peak

“Bitcoin maybe ready with a bull run,” says Martinez. He advised investors: “Past the noise, the on-chain data says that the CVDD metric has exceeded the ‘HOT’ zone deep into accumulation. So, if Bitcoin stays above $90,000, this means, in the next cycle peak, maybe there will be a rally to $120,000. Hold on tight! Are you prepared for lift-off?”

The next #Bitcoin $BTC market top could be at $120,000 as long as the $90,000 support holds! pic.twitter.com/1NAZaImvzH

Ali (@ali_charts) May 17, 2025

Martinez says that Bitcoin’s price moves in step with the cycles of past booms and busts. If the same upbeat economic and technical rhythm continues to play, the rally should continue.

He also mentioned that whales have been taking more profits from the market recently.

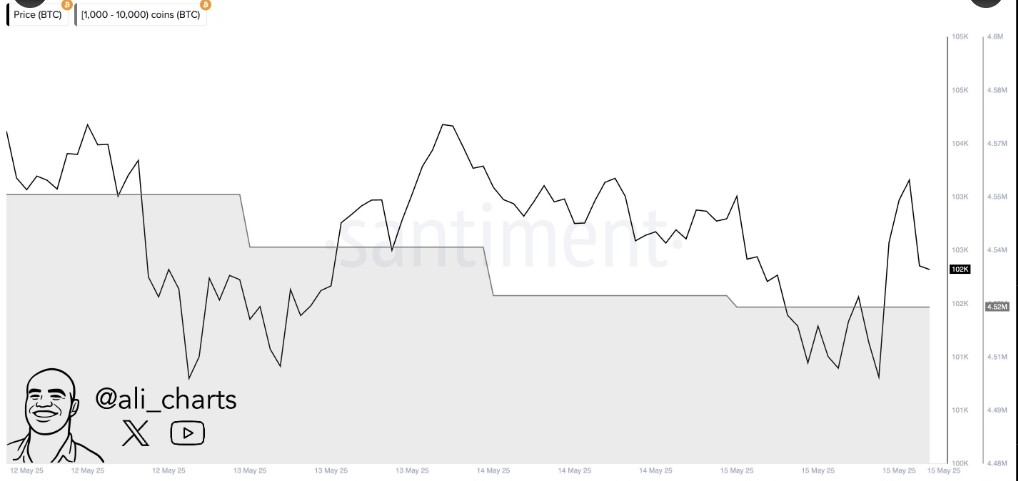

This is how whales dumped a monstrous 30,000 BTC in just 72 hours! Those sellers were from wallets containing between 1,000 and 10,000 BTC; therefore, they decided to unload after Bitcoin neared $100,000. Is this a sign for a downwards price avalanche?

Source: X

ETF Inflows Climb While Leverage Falls

Bitcoin Battles Back: Institutions Double Down Despite Dips

Few would consider this for the faint hearted. While the retail investor panicked during the Bitcoin sell-off, institutional investors viewed the situation as an opportunity. On May 14th alone, $319.56 million flowed in through U.S. spot Bitcoin ETFs, wiping out May 13’s $96 million outflows with great determination. This is not some toe-dip but a full-fledged plunge. The large players are increasing their Bitcoin exposure via ETFs, indicating a long-term outlook that outweighs short-term volatility. The message beams loud and clear: institutional appetite for Bitcoin continues to ravenously grow.

Source: SoSoValue

Hold on. The crystal ball of Bitcoin futures presents the flickering ghost of doubt. Once, there stood a hugely extravagant premium of 7% for two-month Bitcoin futures, only to have that gainful ego deflate and deflate to a more modest 5%, thereby indicating that some of these bulls have begun to think twice for their stampede. When was the last time we observed this premium pulling back? It was around the very moment when Bitcoin was gliding around $84,500. Could it be that the traders are positioning themselves for a breather, some lateral shuffling, before the next big preserver? Or is it just that volatility is taking a short-lived nap? Only time shall tell if this is going to be just another stopover or a fork defining rendezvous.

Technical Analysts Maintain Bullish Structure Outlook

The bulls keep charging on Bitcoin, says van de Poppe, somehow drawing that line in the sand at $98,000. Should $98,000 manage to hold as support, the price could realistically continue its climb. Van de Poppe has his eyes set on the $110,000–$115,000 zone, the prime accumulation area. A hard obstacle stood in the surge’s way; namely, a clear double-bottom formation below $81,000. Will Bitcoin break through here and test larger heights?

The view remains unchanged on #Bitcoin.

As long as it stays above $98K, we’ll be fine for further continuation upwards. Last consolidation before we’ll break ATHs and start having fun. pic.twitter.com/l9mQSvPrcq Michaël van de Poppe (@CryptoMichNL) May 16, 2025

Bitcoin is due for a probable break-out! The analyst Javon Marks pinned down a bull flag formation just short of the all-time high level, suggesting an upside breakout toward uncharted territory. But the story never ends with Bitcoin. According to Marks, when BTC sees its major runs, it opens gates for altcoins to imitate explosive patterns witnessed in previous bull markets, potentially sparking altcoin season.

That outrageous price forecast of $1 million per Bitcoin in 2026 has just been made concrete by Arthur Hayes, the BitMEX founder. His expectation is not just another layup hopium; he sees the possibility of global loss of trust in U.S. Treasuries that would push capital flight unto a crypto bonanza. It is one heck of a digital gold rush, and instead of claw picks, investors are wielding their crypto wallets to snatch a share in the Bitcoin bonanza.

Arthur Hayes (@CryptoHayes) believes bitcoin is going to $1 million in the next 4 years. pic.twitter.com/FUGnrs6M9h

Anthony Pompliano 🌪 (@APompliano) May 15, 2025

There was Arthur Hayes who regards Bitcoin as a ‘safe harbor’ in an ‘angry market.’ As conventional investments were having a bad time, he predicted a mad rush to being termed the ‘crypto king’ for holding value. Now at $103,663, with gains of 1.7% today, investors seem to put a lot of hope on it. Is it the beginning of the reign of Bitcoin?

Thanks for reading Renowned Crypto Analyst Targets Bitcoin Price at $120K as Technical Indicators Flash Bullish