Another noteworthy review of the current market scenario came from founder Ari Paul, who founded Bitcoin investment company BlockTower Capital. Paul said ‘I see two major scenarios as very likely for the crypto market and has developed his investment position in line with this.

But in the first case, Paul said, it may be “final wave” for crypto assets that has hit a new peak — this is what was seen as the last wave of s. This is where Bitcoin and Crypto are now recognized worldwide from this point of view; they have even been marketed by heads of state. It’s not a big challenge to adoption, however, as it is the virtually limited regulatory pressure under the current administration.

Paul argues that “the adoption of organic demand and consumption are still limited”, suggesting that many countries, institutions or companies have tried cryptocurrency but not fully met their requirements in its current form. This view is cited as an example, for example El Salvador’s adoption of Bitcoin and subsequent withdrawal (e.g.

Paul said ‘In this case, we could be in a similar phase to the internet industry in 2000. Many companies from that period did not survive the internet, but many of those companies didn’t survive. The term “cryptocurrency” can be a transformative and valuable concept; but it does not mean all protocols or token will survive. He also noted that even larger liquidations could be made, and prices would drop to much lower levels if the market was heavily liquidated.

The current pullback is a correction in’more time frame’, as it is seen by in the second case. Paul also argued that in the context of late-stage capitalism and “financial nihilism” Bitcoin and cryptocurrencies could still be attractive for speculative capital. During this framework, he said investors will still look for alternatives to fiat currency systems, increasing the use of projects developed in niche areas and that there may be a “turning point” (which would change the narrative at some point) which could happen. He also said that cryptocurrency is still an area where “could be the target of coordinated rises for rich and powerful companies” could come to ‘couple up with it.

There have been some big sell-offs recently, both in terms of leverage and market sentiment, Paul said. But despite this, the industry’s fundamental dynamics (infrastructure improvements, product building and gradual recovery) still remain in its core structure, infrastructure improvements or product development.

A reasonable portfolio weighting in crypto could be a sense, Ari Paul said, because “there is an upside potential of symmetrically positive,” adding that even if both scenarios really have 50% probability, then the right approach to Portfolio weights would make sense.

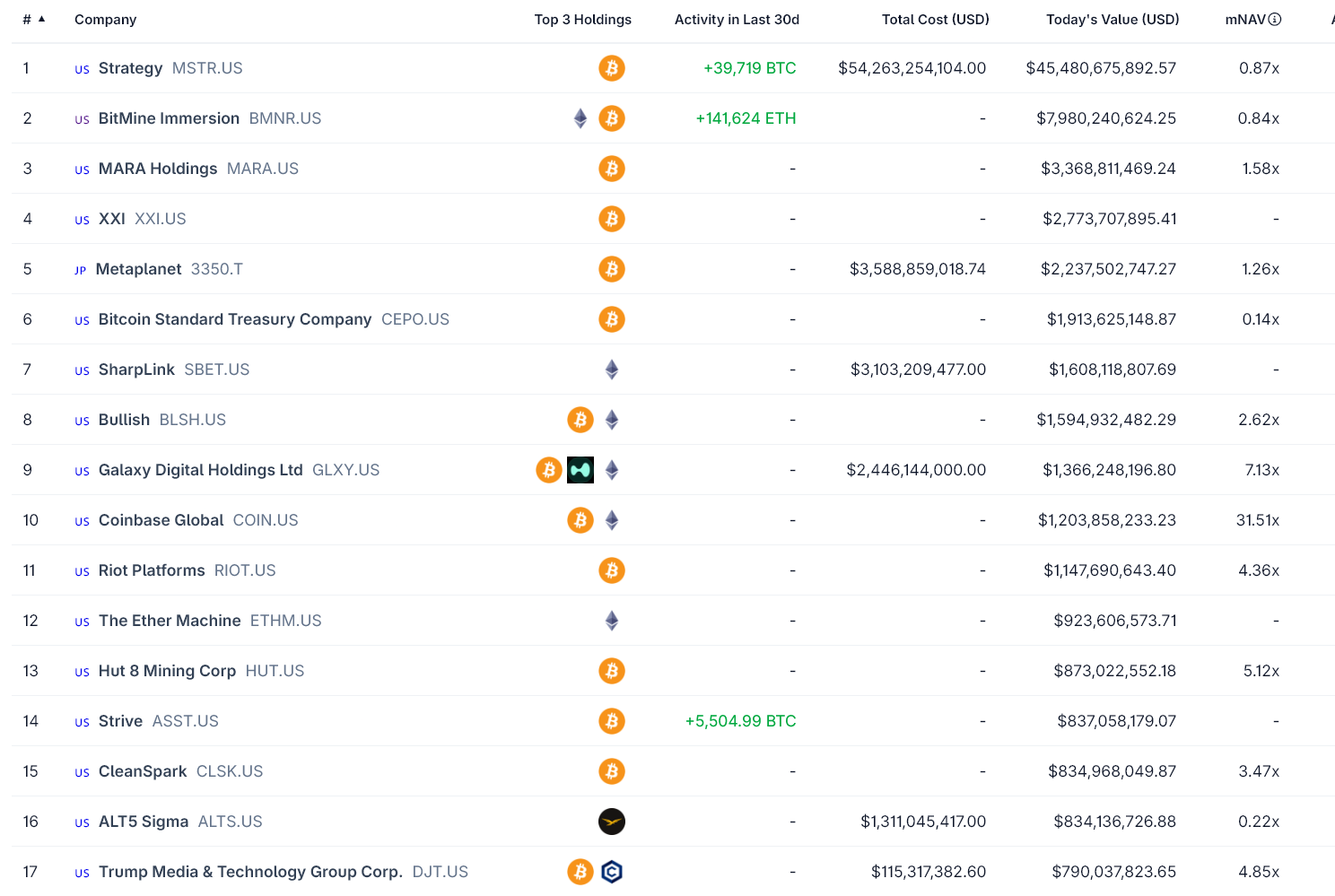

For example, if large institutional players such as MicroStrategy (MSTR) were liquidated, Bitcoin would fall to the $15,000–$40,000 range; but new all-time highs (ATHs) could be seen again with the strengthening of macroeconomic conditions and fundamental dynamics.

*This is not investment advice.

Thanks for reading Renowned Founder Claims There Are Only Two Possible Scenarios for Bitcoin Price: “With a 50% Chance…”