XRP researcher Ripple Bull Winkle has stressed that new XRP ETFs will require millions of XRP to meet demand.

“Wake up before it’s too late,” the analyst cautioned, his words a stark warning echoing through the crypto sphere. While you were watching the price ticker, whales were quietly amassing XRP. The clock is ticking. He predicts the coming wave of XRP ETFs will trigger a supply shock, leaving latecomers stranded on the shore. The scarcity might already be here.

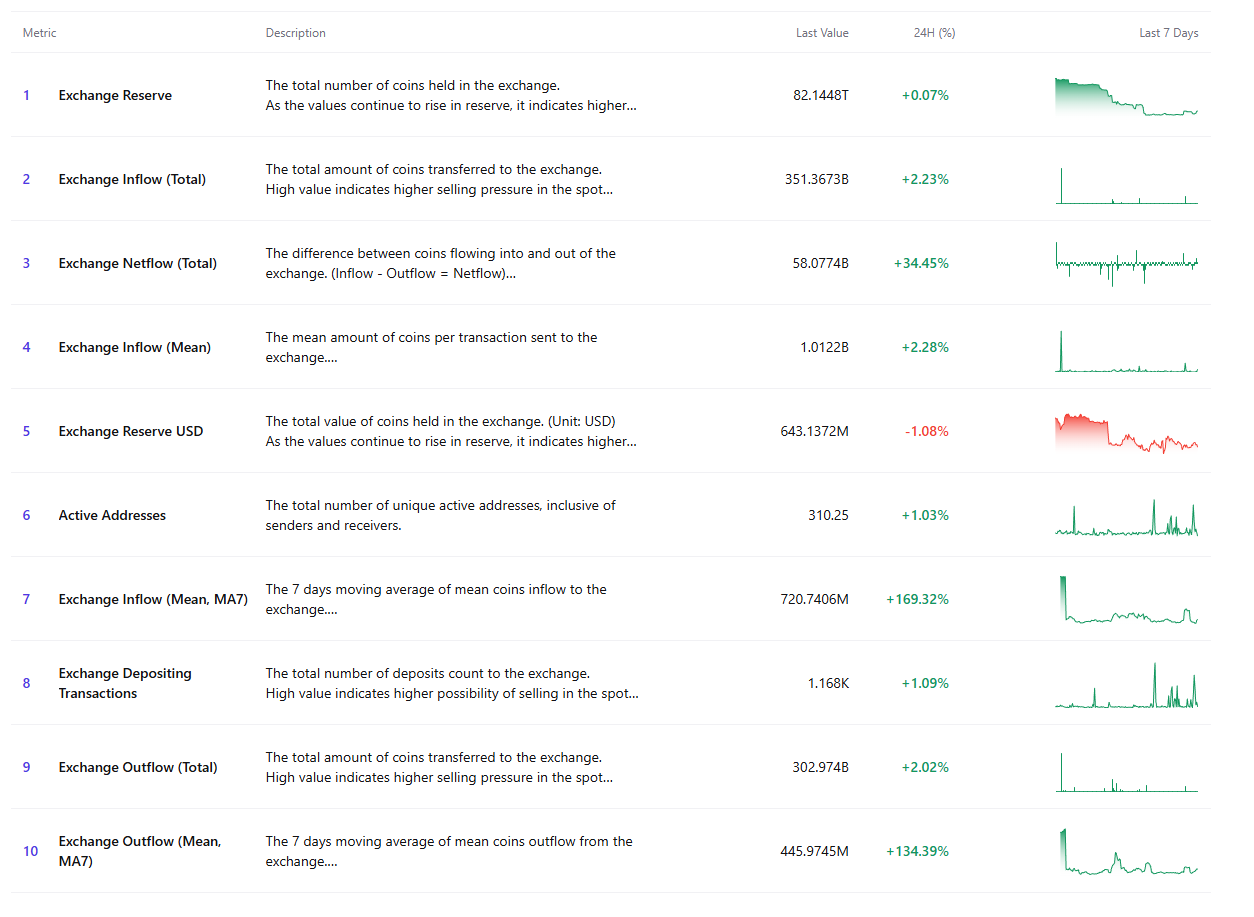

Market Under Pressure, But ETFs Are Quietly Eating Into XRP Supply

Forget the fireworks, XRP’s building a silent storm. Crypto analyst Bull Winkle, in his latest video, suggests XRP isn’t chasing Bitcoin’s spotlight. Instead, it’s coiling like a spring, gaining power in the shadows. Winkle argues XRP thrives not when Bitcoin explodes, but when it takes a breather, hinting at a potential breakout fueled by pent-up energy.

Retail investors, spooked by market turbulence, have largely fled the XRP arena, leaving institutions to quietly amass holdings. This institutional accumulation, while smaller players retreat, is why XRP’s price action feels strangely resilient, almost detached, even as short-term dips occur. The charts tell a story of diverging strategies, where fear-driven exits pave the way for strategic long-term positions.

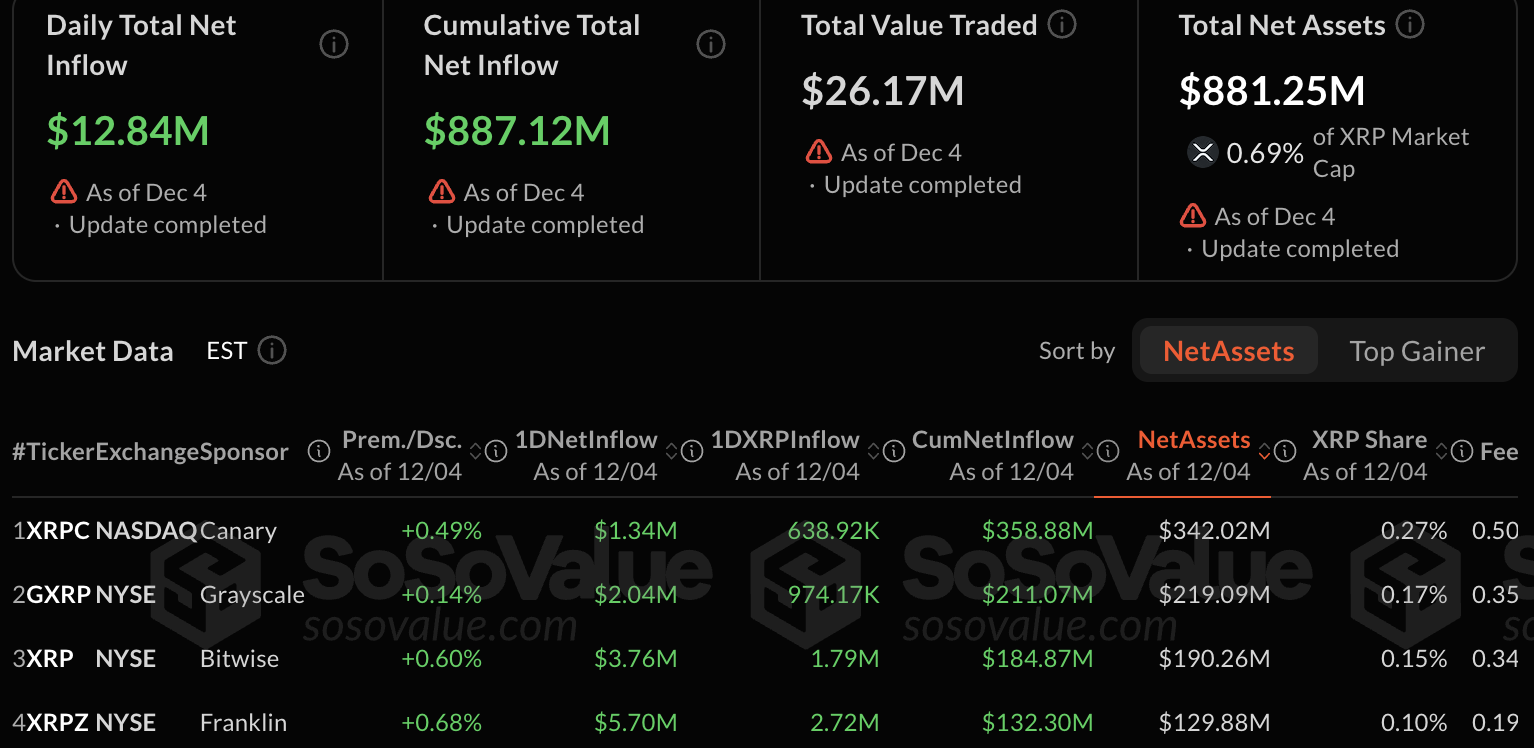

Canary Capital dropped a bombshell: The XRP ETF has amassed a staggering $342 million in XRP, fueled by relentless inflows every single trading day since its explosive November debut.

Canary Capital isn’t alone in spotting XRP’s potential. Joining the flock are industry heavyweights like Grayscale, Bitwise, and Franklin, all witnessing impressive capital surges into their XRP holdings since launch. This growing interest signals a potential turning point for the digital asset.

XRP ETFs are making waves, with Grayscale leading the charge, pulling in a cool $211 million into its GXRP fund. Bitwise isn’t far behind, raking in $184.87 million. Even Franklin Templeton is riding the wave, attracting $132.3 million since its launch. The digital asset ETF arena is heating up!

Cumulatively, XRP ETFs have seen investments totaling $887.12 million, with total assets worth over $881.25 million.

XRP ETF data

“Bull Winkle’s ears perked up. The scent of opportunity? ETF and institutional involvement screams that Wall Street thinks XRP is ridiculously undervalued.”

XRP is about to get a double dose of ETF excitement this month with 21Shares and WisdomTree joining the party. Think of it as two new rivers feeding the XRP ocean. These ETFs will quietly scoop up huge amounts of XRP behind the scenes to back those inflows. The real kicker? This accumulation frenzy won’t show up on exchanges until it explodes into visible liquidity.

The Countdown to Real Price Discovery

According to the researcher, retail investors are repeatedly asking the wrong question: “Why isn’t XRP’s price moving?”

He explains that the action is happening behind the scenes. Institutions are buying, ETFs are preparing, and liquidity is shrinking.

Watch out! When the ETF race for XRP heats up, get ready for a rocket. By then, retail investors, gripped by FOMO, will likely jump in – but history shows that’s often after the biggest gains have already been snatched.

Other Analysts Agree

But Rector isn’t alone in challenging XRP’s supply narrative. He posits that the real, tradable XRP supply hovers below 10 billion a stark contrast to the widely reported 60 billion. Could the market be misinterpreting XRP’s true scarcity?

But here’s the kicker: Crypto analyst Jake Claver suggests ETFs are sucking XRP dry from the shadows of OTC/dark pools. With whispers of only a measly 1–2 billion XRP left hidden away, Claver’s warning is stark: this liquidity crunch could ignite a price rocket, leaving demand in the dust. Prepare for potential fireworks.

Thanks for reading Researcher Says Public Won’t Understand What Just Happened to XRP Until It’s Too Late