In December SEC Chair Paul Atkins told Fox Business that he expects US financial markets to move on-chain “in two years of dollars” in the coming months. This is somewhere in between the words of prophecy and policy directive, especially from the architect behind “Project Crypto” – the Commission’s formal program to enable tokenized market infrastructure.

But when applied to $67, what is the meaning of “on-chain”? $7 trillion in public equity, $30. Treasury 3 trillion, $12. How many repo exposures are 6 trillion in a day? What parts can realistically move first?

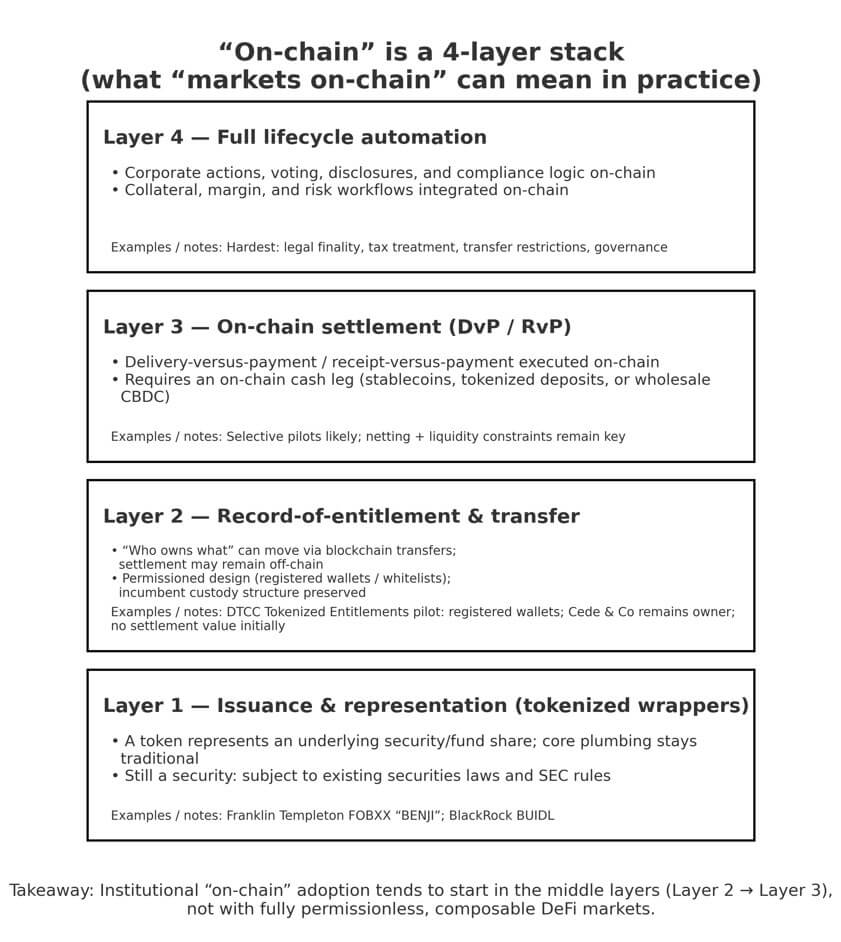

The correct answer is a precision-stuffing one. But it’s not just one thing “On-chain” isn’t a single thing; most of what Atkins describes sits in the middle layers, but not the DeFi-native endpoints that crypto Twitter imagines to be.

Four flavors of on-chain

Define matters The gap between tokenized wrappers and full lifecycle automation determines what is plausible in two years versus 20 years, so definition matters.

The Layer one is issuance and representation a token stands in for anunderlying security; the plumbing remains traditional, but it does not change. think digitalized share certificates, think digitized. In Atkins, he explicitly defines tokenization as “smart contracts” of securities that remain subject to SEC rules rather than parallel asset classes.

Layer two Record-of–entitlement, and transfer the “who owns what” ledger moves through blockchain; however settlement still occurs via incumbent clearinghouses but settlement is done by asynchronously distributed layer. The Dec of DTCC’s . This model is authorized by 11 no-action letter from the SEC Trading & Markets.

Depository Trust Company has now issued approved blockchains to participants with “Tokenized Entitlements” for the use of a definable blockchain. However, the offer is a limited option for registered wallets. Clede & Co. Cede, pictured, and co-founder of the company’s . The defendant is still legal; he has no original collateral and settlement title, and no initial value of money or debt is assigned.

Translation: on-chain custody and 24/7 transfer without replacing NSCC netting tomorrow.

In Layer three, on-chain settlement with an on a chain cash leg (which includes delivery-versus-payment by stablecoins or tokenised deposits and/or wholesale central bank digital currency) is required. Atkins discussed DvP and the theoretical possibility of T+0, but he also admitted that clearinghouse design is centred on netting.

Real-time gross settlement changes liquidity needs, margin models, and intraday credit lines. That’s harder than a software upgrade.

The full lifecycle on-chain solution, which covers corporate actions, voting, disclosures and collateral posting as well as margin calls, is called Layer four (a complete life cycle on chain solution) that operates through smart contracts. This is the last state of which governs governance, legal finality and taxation are enacted as well as transfer restrictions.

It’s also the furthest from current SEC authority and market-structure incentives.

Atkins’ two-year timeline maps most cleanly to layers two and three, not a wholesale migration to composable DeFi markets.

Sizing the addressable universe

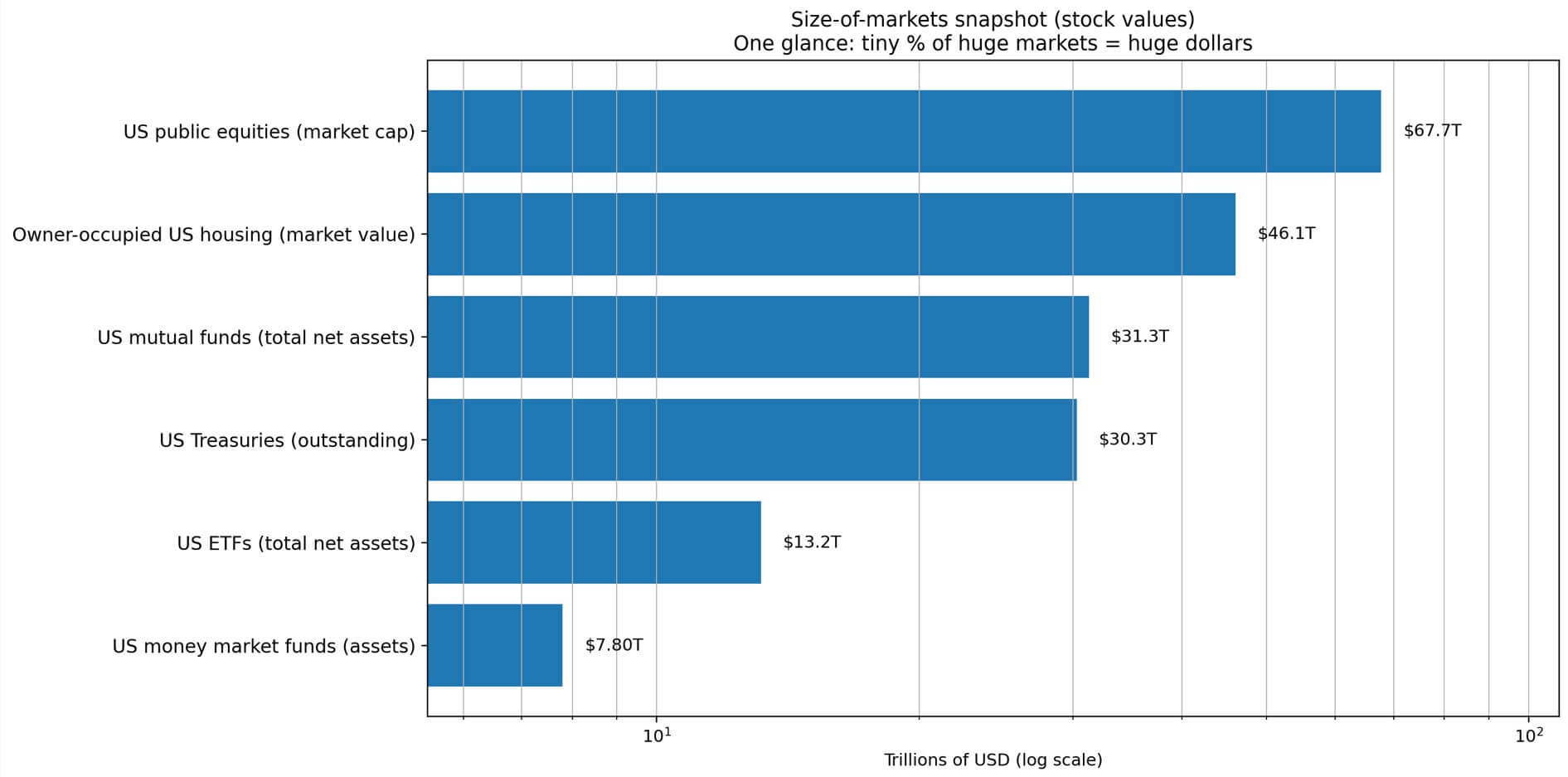

The prize is enormous, even if adoption starts small, because tiny percentages of giant markets are giant.

A $67 market cap of US public equities was high on the market for US publicly squiries. According to SIFMA, at the end of 2025, 7 trillion was smashed. A trading intensity of 17 per cent compared to . The average daily trading value of 2025 is estimated at around $798 billion, with 6 billion shares per day.

The total equity market cap, if it is converted to tokenized entitlements, is $677 billion (1 percent) of the cap cap on equity markets. 50% of daily trading value is $4 billion in gross settlement throughput per day, assuming blockchain could remove the netting that currently collapses billions in trade into far smaller net obligations.

Flowers are larger than treasuries, which include Treassury. Market $30. The total volume of s is 3 trillion as of the third quarter of 2025, with an average daily trading volume at $1 per day. 04.7 trillion, or 047 billion) .

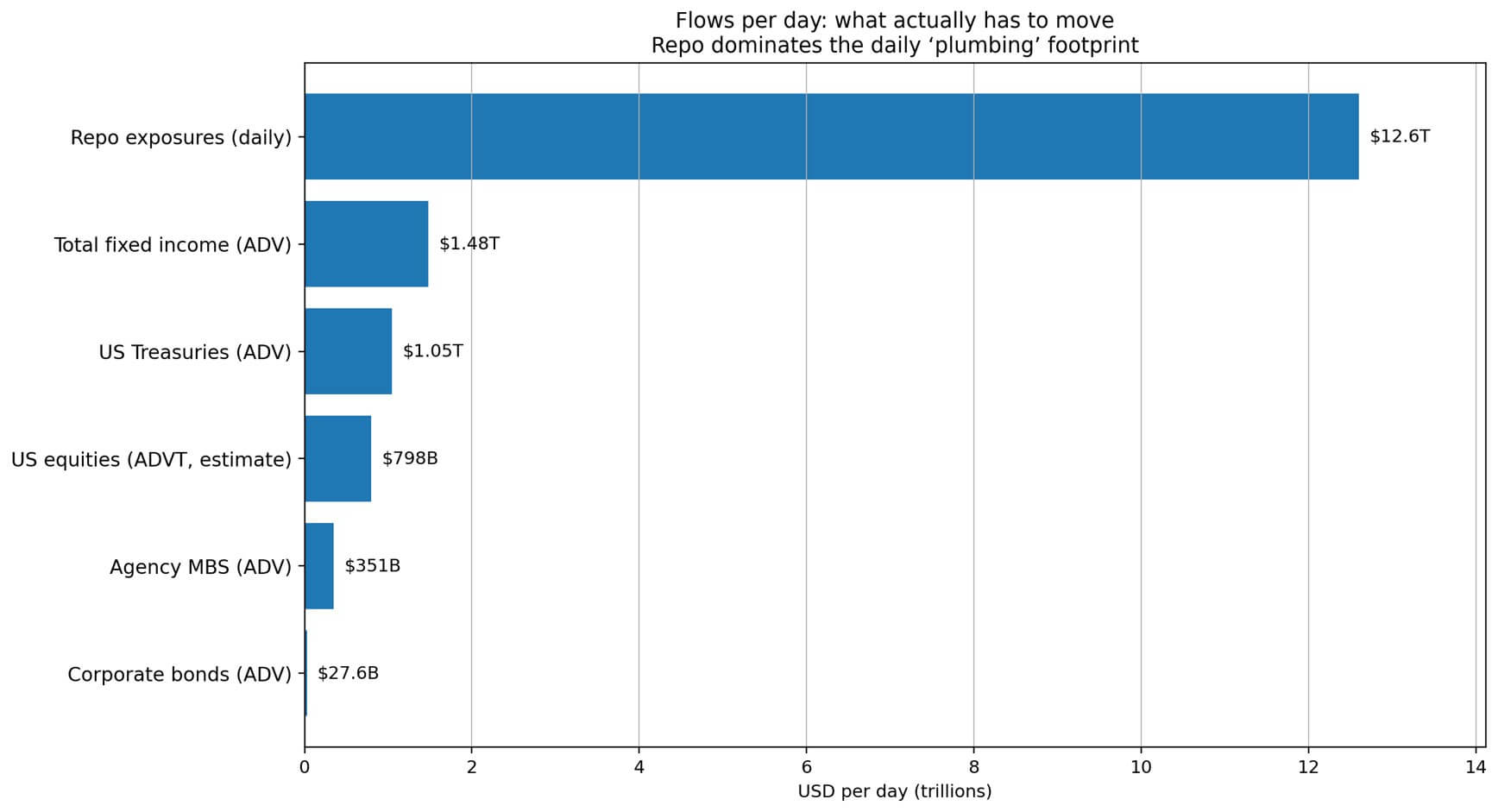

The real monster is repo the Office of Financial Research estimates average daily repor exposures of $12 per day. The third quarter of 2025, spanning cleared, tri-party and bilateral arrangements totaled 6 trillion in the three quarters of 20, 25, including six trillion (including both cleared/tri-partie) agreements.

The argument becomes legible if the pitch of tokenization is de-risking settlement and improving collateral mobility. In the case of institutions that see operational and transparency wins, two percent of daily repo exposure is $252 billion — a plausible early wedge.

Corporate credit and securitized products add another dimension.

$11 – Corporate bonds outstanding total $11,2. 5 trillion, with an average daily trading volume of $27. Approximately 6 billion is the equivalent of . Securities with agency mortgages traded $351 backed securities. In 2025, a daily volume of 2 billion is generated; non-agency MBS and asset-backed securities combined for another $3. Paraphrasing 74 billion a day.

Total fixed-income trading amounted to $1. A daily rate of 478 trillion is 2025 for . Such markets already operate through custody chains, and clearing infrastructure that tokenization could streamline without regulatory surgery.

The other starting point for entry is fund shares, which are a different place to start. $7 is in money market funds, according to . as of the early January 2026, 8 trillion in assets. The $31 million is for mutual funds, including . ETFs are $13 and 3 trillion, with a total of 3 billion. 17 trillion – .

These are located at the product wrapper layer of Tokenized fund shares, which do not need to be rearchitecting clearinghouses as they sit at a back-up for their respective funds. The FOBXX, which is a fund for on-chain money by Franklin Templeton, has been an asset of BlackRock’s BUIDL that was nearly $3 billion last year.

Tokenized Treasuries tracked by RWA.xyz total $9.25 billion, making them a leading on-chain real-world asset category.

There are two types of real estate, according to . US housing owned by owner-occupied owners was $46 million a market value for the home. A third-quarter of 2025 was a quarter of 09 trillion in the year. But in two years, property law and administrative reality move slower than software; still, county deed registries won’t tokenize at scale (as well as the slowdown of land law or administrative life) while they are still on the pace of counties.

The financialized segment, which includes REITs, mortgage securities and securitized real estate exposure, already lives in the securities plumbing and can move earlier.

What moves first: a ladder of regulatory friction

This level of resistance is not the same for all on-chain adoption, as does most people who are adopted by a different person. This is the path of least friction, which begins with products that behave like cash and ends with registries embedded in local government administration.

Tokenized cash products and short-dated bills are already happening.

Similarly, Tokenized Treasuries at $9. Unlike other real-world assets on-chain, 25 billion is a meaningful scale. But if distribution is growing through broker-dealer and custody channels, then a five-to-twenty-times expansion of $40 billion to $180 billion over two years (from $40billion to 180B) becomes possible, especially as stablecoin settlement infrastructure matures.

Collateral mobility follows close behind. Repo’s $12.6 trillion daily footprint makes it the most credible target for tokenization’s delivery-versus-payment pitch.

Even if only 0 is enough to . A quarter to two per cent of repo exposures are reverted to the on-chain representation, $63 billion to $252 billion in transactions where tokenized collateral reduces settlement risk and operational overhead.

The next step is permissioned transfer of mainstream securities entitlements.

DTCC’s pilot authorizes tokenized entitlements for Russell 1000 equities, Treasuries, and major-index ETFs, held via registered wallets on approved blockchains.

If participants consider this a balance sheet and operations upgrade (including 24/7 movement, programmable transfer logic, better transparency), etc.) for the participants, then “0” is said to be true “If you think that it’s an improvement in your operation or other functions of our organization? In two years, 1% to 9% of the US equity market cap could become “on-chain eligible entitlements” as they are more than half an age. So, that’s $67 per . The tokenized claims are a total of 7 billion to $677 Billion, even after settlement value gets allocated.

On the friction ladder, more occupants settle for Equities and netting redesign sit on the same level as equity settlement. Changing liquidity requirements, margin calculations and intraday credit exposure is also made by moving to T+0 or real-time gross settlement.

Central counterparty clearing exists because netting reduces the amount of cash that must move.

Eliminating netting is the discovery of new sources of intraday liquidity or accepting that gross settlement applies only to one subset of flows.

Private credit and private markets are also highly notional, with estimates of up to $1. 7 trillion to $2, . 28 trillion – . But they are slower to standardize, yet due to transfer restrictions, servicing complexity and bespoke deal terms.

Tokenization helps with fractional ownership and secondary liquidity, but regulatory clarity around exemptions and custody models still lags.

Last rank is registries of real-world . Tokenizing a property deed doesn’t make it exempt from local recording statutes or title insurance requirements. Even if the financial exposure is on-chain through securitization, the legal infrastructure for ownership claims won’t be in place.

Smaller than the hype, larger than zero

Most tokenized securities will be on-chain but not open to the public.

Even in public blockchain, DTCC’s pilot model is allowed to be approved (registered wallets, allowlisted participants and institutional custody) as well as the permission of its own version “DTC” has been granted for their pilot models. In the transparency and operational efficiency sense Atkins described that That’s still “on-chain” in what he calls as an example of this. It’s just not “anyone can give liquidity” to . Paraphrast.

The DeFi-addressable wedge is biggest where the asset already behaves like cash.

In crypto market infrastructure, collateral is already secured against tokenized bills and money markets fund shares; BlackRock’s BUIDL can be seen as an example of this.

Using $308 billion supply, Stablecoins provide the layer of bridging (the “on-chain settlement asset base” that makes delivery/payment possible without an exclusive CBDC) and delivered via wholesale payment. dollars before stocks went on-chain,’ said .

An accurate sizing method for this would be using tokenized cash products as the starting numerator, haircuts to transfer restrictions and custody models; and an estimate of the fraction that can interact with smart contracts.

If tokenized Treasuries and money market fund products reach $100 billion to $200 billion, and 20% to 50% can be posted into permissioned or semi-permissione smart smart contracts, that means $20 billion–100 billion of plausible on-chain collateral.

This is enough to matter for repo workflows, margin posting, and institutional DeFi.

What this means in practice

Atkins didn’t offer a detailed roadmap, but the pieces are visible.

The SEC issued DTCC no-action letter in December 2025 for pilot tokenised entitlements to pilot. Money market funds are scaling up to Tokenized Treasuries and money market fund. A chain cash layer is provided by a Stablecoin supply that provides an on-chain cash Layer. A typical day flow of repo markets is the dwarf equities, and collateral mobility is where tokenization’s risk-reduction argument is strongest in terms of collateral Mobility.

But the two-year timeline doesn’t include all security moving to Ethereum. In the middle layers, it’s about critical mass layer two entitlements that live on-chain but settle through familiar infrastructure; and layer three experiments where delivery-versus-payment happens on a chain for certain asset classes and counterparties.

Even at 1% adoption across Treasuries, money market funds, and equities entitlements, that’s over a trillion dollars in on-chain representation.

US isn’t alone with . A Digital Securities Sandbox was opened in the UK by . Hong Kong issued HK$10 billion in digital green bonds to the government of Hong kong. The EU’s DLT Pilot Regime sets out a framework for controlled experimentation in issuance, trading and settlement on distributed ledgers.

This is a global market-infrastructure modernization cycle, not a speculative overhang.

The quarterly metrics of DTCC’s tokenized entitlements (including total value, daily transfers, registered wallets and approved chains) are useful for tracking purposes.

This includes repo transparency data from the Office of Financial Research, tokenized Treasury and money market assets under management; stablecoin supply as a proxy for settlement capacity.

Those numbers will show whether “on-chain in a couple of years” was policy or aspiration.

Thanks for reading SEC Chair predicts 2-year timeline to put US fully on chain but the real $126 trillion opportunity isnt equities