The $0.33 mark is a battleground. Volume surges as traders eye the prize. Is this a launching pad or a false dawn? All eyes are on where it goes next. Improved indicators suggest… but in this game, nothing is certain.

Accumulation Phase Leads to Breakout Toward Fibonacci Targets

SEI is coiling for a potential breakout! Ambitcoin’s daily SEI/USDT chart reveals a compelling narrative: after months of hibernation, SEI has sprung back to life from its $0.1325–$0.1646 support zone, a launchpad forged during a March-June buying spree. This wasn’t just sideways movement; it was a strategic accumulation. Now, SEI is carving a staircase of higher lows, currently consolidating above $0.27. Is this the calm before a bullish storm? The charts suggest a powerful continuation pattern is brewing.

Source: X

Ambitious eyes are locked on Ambitcoin as technical tea leaves suggest a potential doubling in value. Analysts pinpoint two tantalizing targets: first, a surge to $0.4644, fueled by Fibonacci extensions. But the real prize? A leap to $0.6419, a breathtaking 102% climb powered by overcoming past resistance. Is Ambitcoin poised for a moonshot?

SEI’s bulls are still running, but $0.2453 is the line in the sand. Lose that, and the bullish party keeps raging. A crash below $0.1115? Then, all bets are off. Zoom out, though, and the charts whisper a story of momentum, echoing past victories from inverse head-and-shoulders patterns and wedge breakouts. The trend is your friend…for now.

Rising Volume Confirms Breakout as SEI Clears $0.30

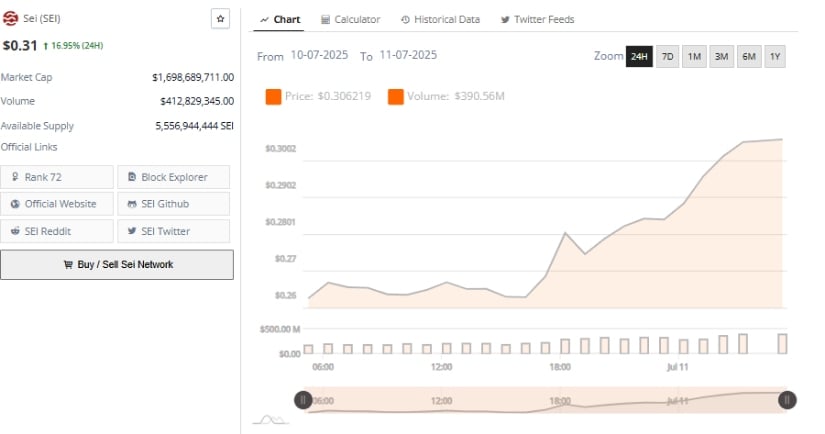

SEI’s price chart just screamed “wake-up call” to the crypto market. After a long nap around $0.26–$0.27, SEI exploded past $0.30 on July 10th, fueled by a massive influx of buyers. Fast forward to July 11th, and the price is up nearly 17% to around $0.31. Forget the snooze button; this rally is a jolt of energy after a period of calm, and the charts are hinting that this might be just the beginning.

Source: BraveNewCoin

SEI’s breakout isn’t just talk – it’s backed by a roaring $412.82 million trading volume. This surge ignited during its meteoric price climb and has stubbornly persisted even as it consolidated above $0.30, proving this rally has legs. Now boasting a $1.69 billion market cap, SEI is flexing its muscles as a serious contender in the Layer-1 arena.

SEI’s bulls have dug in. The $0.29-$0.31 zone is now a launchpad, not a ceiling. Holding this ground could fuel a rocket to the $0.35-$0.37 target zone soon. But beware: a slip below $0.27 could trigger a brief stall before the next surge.

Indicators on TradingView Suggest Sustained Momentum

SEI’s chart is flashing green, trading at $0.3279, a 7.33% surge today alone! The bulls have charged past the upper Bollinger Band at $0.3273, a move that screams “overbought” to some, but whispers “powerful uptrend” to others. This rally ignited from the $0.2740 zone – a Bollinger Band line that had been SEI’s steadfast floor during a period of consolidation, suggesting solid footing for this bullish breakout.

Source: TradingView

“Bulls are charging! The MACD is flashing green – a potent buy signal. The MACD line’s surge past the signal line, deep in positive territory, confirms the upward trend. And the histogram? It’s exploding, a visual testament to the accelerating bullish momentum.”

SEI bulls, hold the line! If we maintain altitude, $0.3607 is back in our sights – a chance to conquer its old peak. Beyond that? We’re charting a course for $0.4644 and potentially beyond in the weeks ahead. Crucially, keeping SEI buoyant above $0.2740 is vital to fuel the ascent and keep this rally burning bright.

Thanks for reading SEI Price Prediction: Bullish Setup Targets $064 as Uptrend Gains Strength