Shiba Inu’s bark has quieted. After hitting a high of $0.0000176 on May 12th, the meme coin darling has seen its price tumble a substantial 33%, leaving investors wondering if the dog days are truly over.

SHIB holders are feeling the bite. On-chain data paints a bleak picture: a sea of unrealized losses washing over a significant portion of the Shiba Inu faithful. Is this the final surrender? For investors, it begs the question: where do we go from here?

SHIB Bleeds as 87% of Addresses Now ‘Out of the Money’

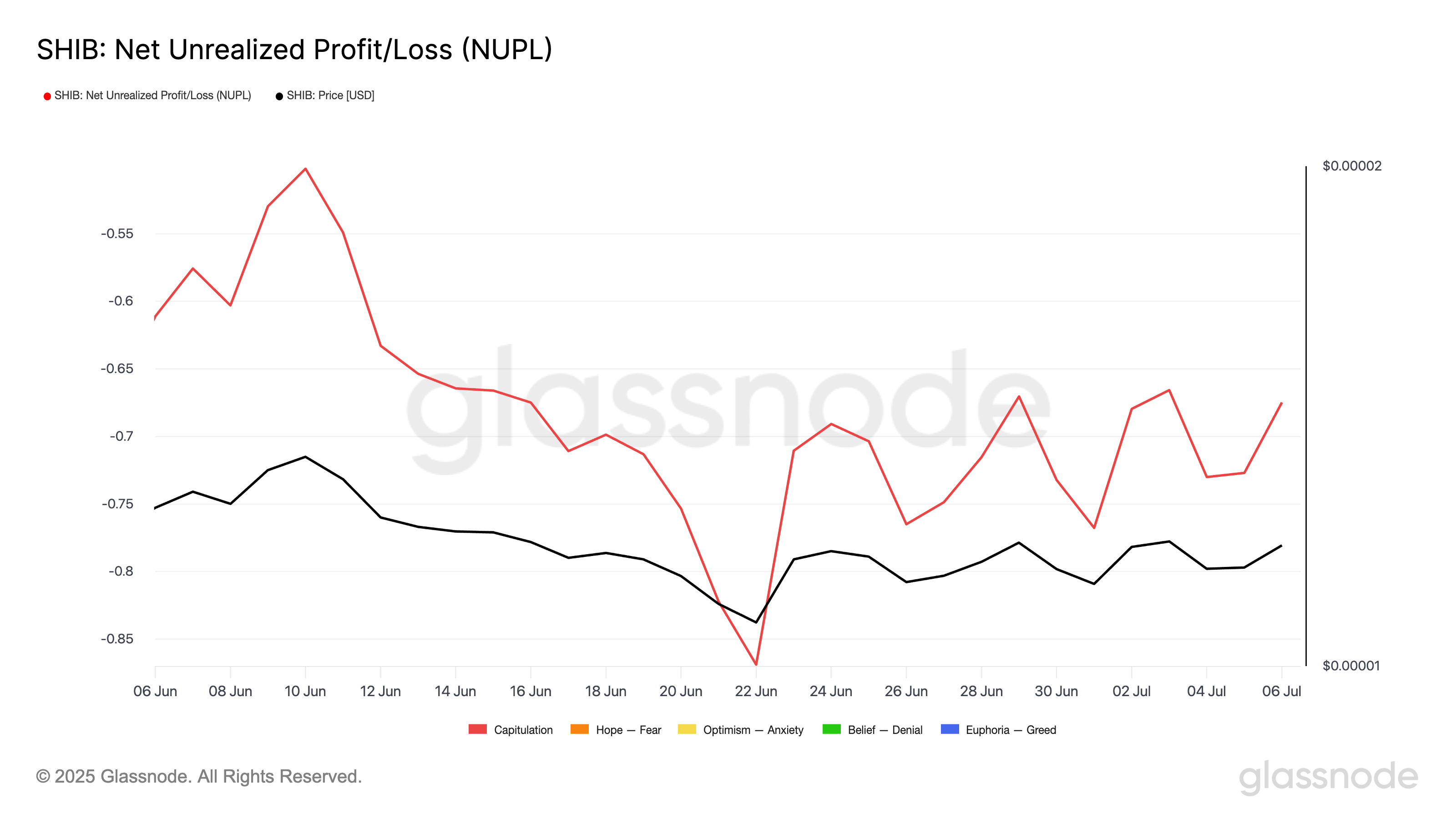

According to Glassnode, SHIB’s Net Unrealized Profit/Loss (NUPL) metric shows that the meme coin is firmly in the capitulation zone.

SHIB Net Unrealized Profit/Loss. Source: Glassnode

Imagine peering into the collective heart of the market: NUPL, or Net Unrealized Profit/Loss, acts as your stethoscope. It gauges the market’s emotional state by comparing the total paper profits to the total paper losses held across all investors, then sizes it up against the asset’s overall value. Are holders riding high on gains, or are they underwater, gripped by fear? NUPL reveals whether the market, as a whole, is basking in profit or drowning in loss.

Glassnode says we’re in capitulation territory when an asset’s NUPL dips below zero. Translation? The market’s drowning in unrealized losses, outweighing any gains. Think of it as a sea of red where most investors are underwater, desperately clinging to their holdings or hitting the eject button in a panic-induced sell-off. It’s the financial equivalent of a pressure cooker, forcing tough decisions and testing the resolve of even the most seasoned veterans.

Shiba Inu’s fortunes have taken a turn, leaving the vast majority of its investors underwater. IntoTheBlock’s Global In/Out of the Money indicator paints a stark picture: a staggering 87.34% of SHIB holders are currently seeing red, a testament to the prevailing bearish winds.

SHIB Global In/Out of the Money. Source: IntoTheBlock

Imagine your crypto wallet as a treasure chest. Now, picture the gold inside costing you more than it’s currently worth on the market. That’s essentially what it means for an address to be “out of the money.” If you were to sell right now, you’d be selling at a loss – a sobering thought for any investor.

SHIB Capitulates But Is a Price Bottom Closer Than It Looks?

NUPL dips negative? Buckle up. Historically, this chilling sign points to thetwilightof a bear market. Think of it as the final shivers before the dawn – a bottom forming, poised for a powerful price resurrection. Why the reversal of fortune? Two compelling forces are usually at play.

Buried beneath a sea of red, Shiba Inu holders often find themselves stubbornly clinging to their digital assets. Why sell at a loss when the promise of a rebound shimmers on the horizon? This steadfast refusal to sell, born from a desire to break even, acts as a crucial buffer against further price drops. Like a dam holding back a flood, this inactivity can stabilize the price, creating a foundation for future growth. As the wild price swings mellow and SHIB finds its footing, a sense of calm descends upon the market. This, in turn, can entice new investors, injecting fresh capital and potentially igniting the spark that sends Shiba Inu soaring once more.

Think of market capitulation as a cleansing fire. It scorches away the tentative investors, leaving behind the steely resolve of “diamond hands” those who see opportunity in the ashes. As the market bleeds, these resilient players step in, their capital acting as a crucial lifeline, setting the stage for a potential phoenix-like rise.

Will SHIB Reclaim Higher Ground Above $0.000012?

Shiba Inu teeters at $0.00001180. Will the pack rally? Stifled selling and renewed buying could unleash the Shiba beast, tearing past immediate resistance at $0.0000198. Shatter that price ceiling, and $0.00001362 becomes the next battleground.

SHIB Price Analysis. Source: TradingView

However, if bearish pressure strengthens and the decline continues, SHIB’s price could fall to $0.00001105.

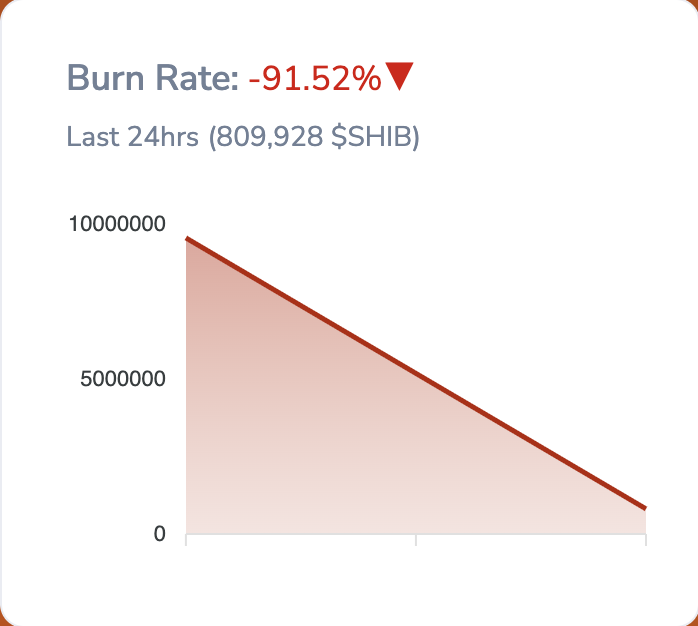

SHIB’s burning embers are fading fast, casting a shadow on its immediate future. A staggering 92% plunge in the burn rate over the last 24 hours signals trouble. With fewer tokens vanishing into the digital bonfire, SHIB’s path to a price surge becomes a steep uphill climb, especially if fresh demand fails to ignite.

SHIB Burn Rate. Source: Shib Burn

If burn activity fails to recover soon, it could delay SHIB’s attempt to reclaim higher price levels.

Thanks for reading Shiba Inu Faces Capitulation—What’s Next as 87% of Holders Sit in Loss?