The wave of forced liquidations swept through crypto markets led to losses over the past 24 hours, total losses for one trader was nearly $220 million on an ether position as a new wave (or more than $22 million) surged in its bids. 6 billion.

It is the biggest liquidation ever sparked on decentralized derivatives exchange Hyperliquid, where an $ETH-USD position of $222 was placed. CoinGlass data shows that 65 million was erased from their .

In the last 24 hours, it was a day of thin liquidity and came as ether slid down to 17% sharply alongside bitcoin and other large tokens.

The total number of traders liquidated over the past day was 434,945 with losses largely due to long positions. about $2. of 42 billion of the $2, a who has been quoted as saying. Bulls accounted for an estimated total of 58 billion from bullish bets, and shorts just $163 million from short.

It was the most devastating blow to Hyperliquid, with $1. Over 40% of total losses across exchanges were lost in liquidations – almost all from long positions 09 billion in lichidations (i.e. After that, Bybit was $574. Binance reported about $258 million in liquidations, 8 million of which were sold to and 8million in lichidations.

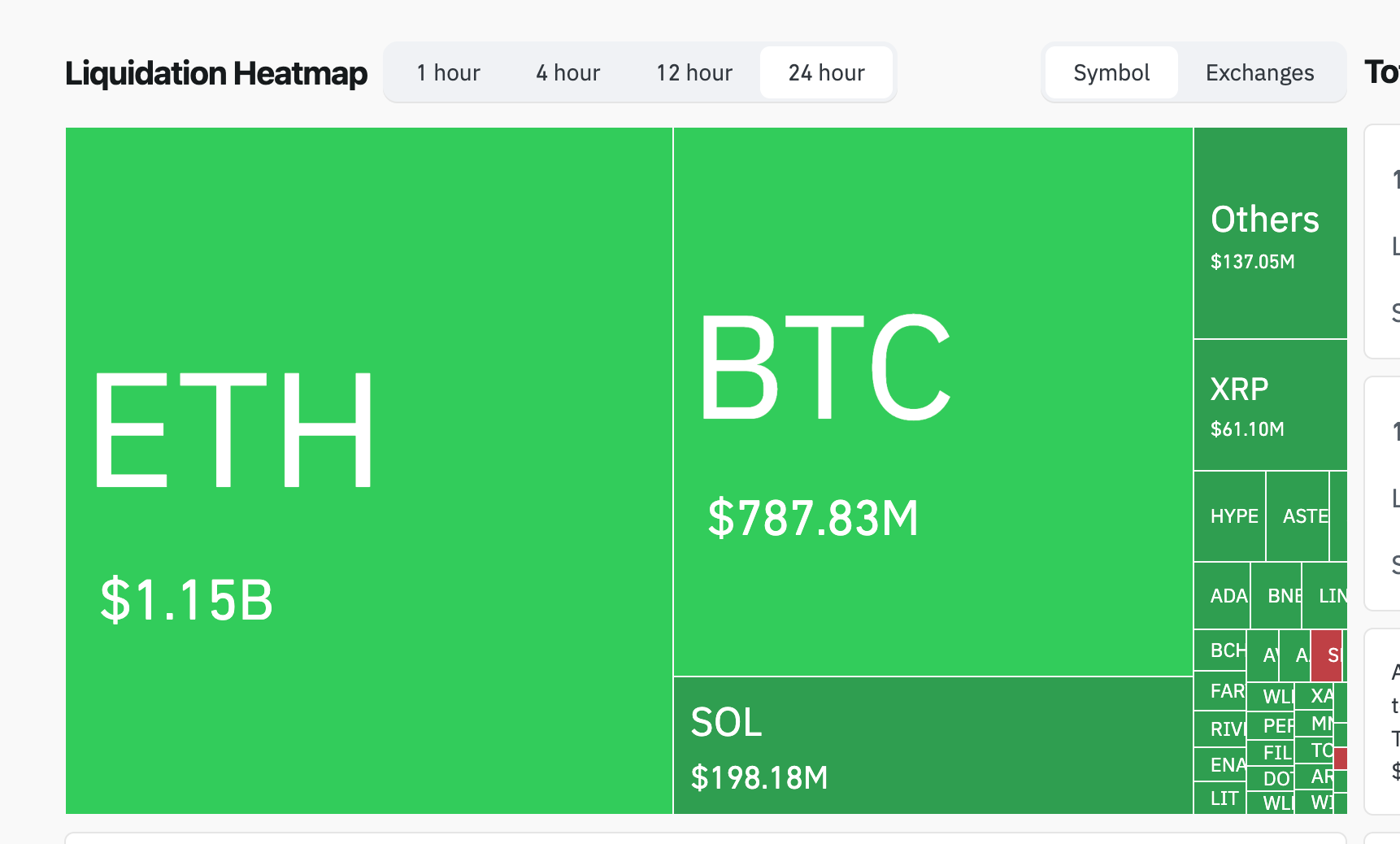

But Ether was the one that took over $1 for the sell-off, and he bore the brunt of the sale-down. In $ETH, 15 billion in positions liquidated over the last 24 hours were sold to s. After Bitcoin, it was about $788 million followed by Solana with close to $200 million erased according to liquidation heatmap data.

(Coinglass)

Liquidations occur when leveraged positions are forcibly closed because of a price increase beyond trader’s margin limit. This usually leads to major losses and can trigger cascade effects during volatile moves.

Traders use liquidation data to measure market sentiment and position. panic bottoms are often signaled by large long liquidations, while short liquidation may precede a squeeze.

In liquidations, bikes also identify overcrowded trades and potential reversals. In conjunction with the data of open interest and funding rate, liquidation metrics can offer strategic entry/exit points for exits (especially in overleveraged markets that are prone to sudden flushes or rallies) when combined with these two criteria.

During periods of low liquidity, the move to “liquidation-driven” moves have become more common; relatively small price declines can be cascaded through derivatives markets.

Thanks for reading Single trader just lost $220 million as ether plunged 10%