- *Solana moves sideways within key support and resistance levels at $164 and $185, respectively.*

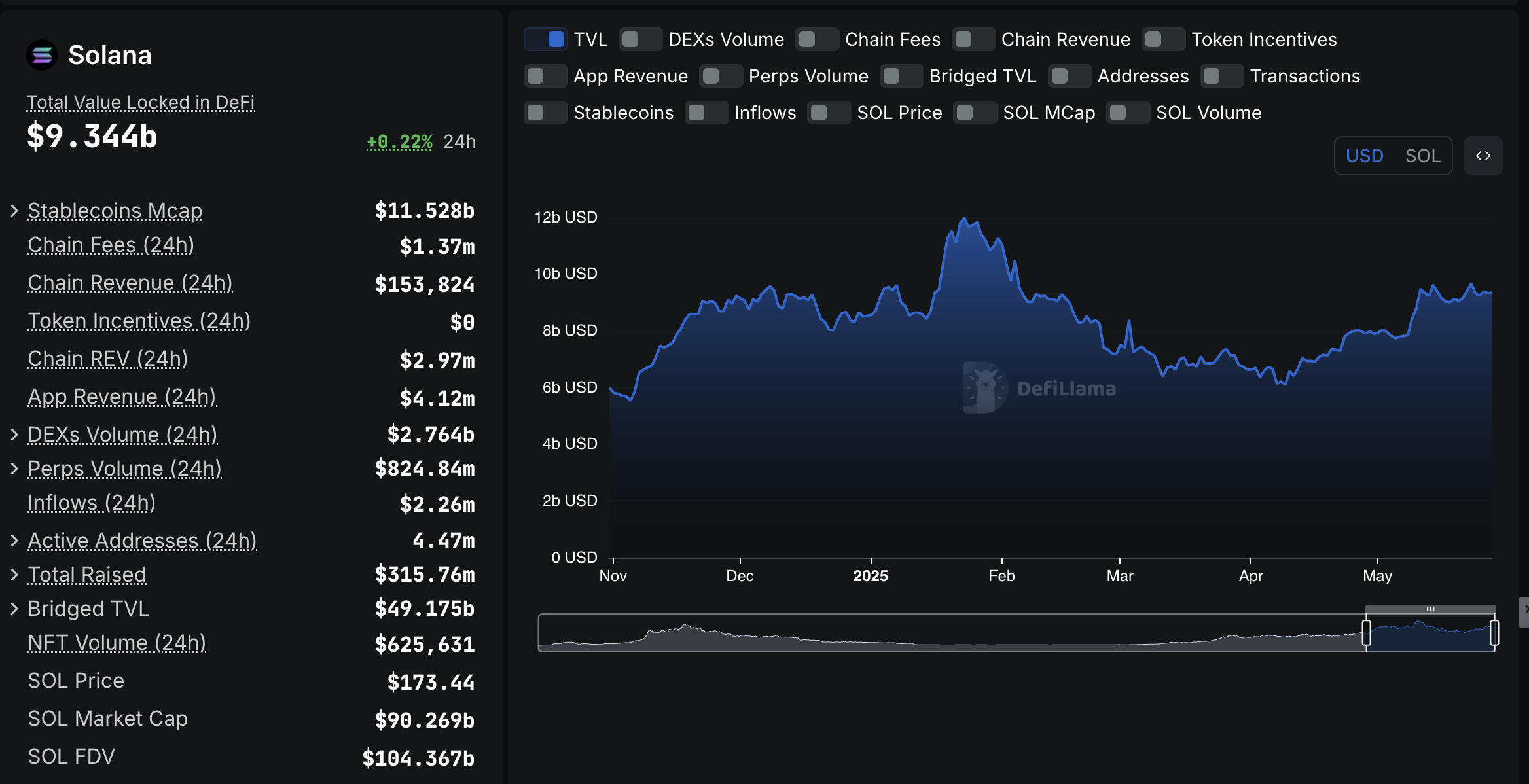

- *Solana’s DeFi TVL has increased by28% since April 1 to $9.34 billion, signaling confidence in the protocol.*

- *SOL futures Open Interest rises to $7.35 billion, upholding risk-on sentiment and heightened market participation.*

- *Solana’s technical outlook presents mixed signals, with the MACD and RSI indicators trending downward.*

It is a tug-of-war of gains for Solana since one price floor is laid down at around $174. Solana, having been plunged with its breathtaking down-move to $95.55 on April 7, has since been gaining momentum with a bullish aura in cryptocurrencies. But the main highlight is the blooming DeFi ecosystem of Solana with value, with futures traders piling in; perhaps this standoff is just teasing the breakout.

Solana DeFi TVL steadies above $9 billion

Solana: DeFi’s insane accelerator. Enough of glacial snail-paced transactions and fees that choke you to death. Solana goes ahead and gives that DeFi lightning speed that has never existed before, and with almost zero charges. Stake your SOL, secure the network, and earn from it. Solana is not just present in the DeFi ecosystem; it is in a key position to realize its taste.

With DeFiLlama, we see the series events unveiling more and more crypto wealth being stashed in smart contracts on this chain. Yielding the great numbers, it went from $6.63 billion one April 1st to an astounding $9.34 billion, this is a 28% surge in the TVL. This is a bullish signal being screamed with great enthusiasm about confidence in decentralization finance.

Diamond hands actually work in getting a strong grip on something! As investors stash their digital assets in DeFi vaults for long-duration holding, exchange supplies are waning, and the pressure for an incessant sell-off is relaxing. Yes, the surge in the DeFi TVL? It is not mere numbers; it is a resounding vote of confidence for the future of crypto.

Solana DeFi TVL stats | Source: DefiLlama

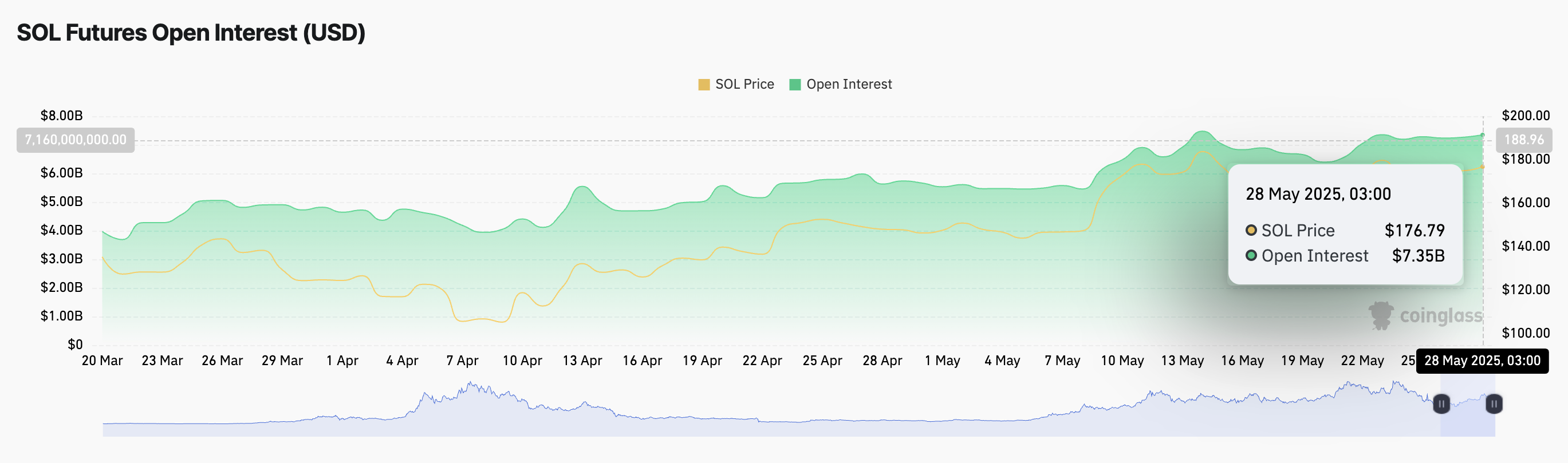

Derivatives market on Solana heating up. Not subtlely shifting; it’s a fair surge in upward sentiment. Open interest in SOL futures has been consolidating around the hefty $7.35 billion mark by CoinGlass. It’s not really holding; in fact, it’s setting a launching pad after going up from $6.4 billion since the 20th of May. That says quite a lot: traders aren’t just watching Solana; they’re really putting blocks for its future.

Open Interest (OI), aggregating the number of futures or options contracts still in existence in the market, has witnessed a sharp surge alongside a never-before-seen $9.4 billion trading activity. Another way to put it would be that the market is talking. This surge implies volumes of activity accompanied by a confident trading rushing toward high prices. These traders are not merely shifting their existing bets; they’re investing fresh money, convinced that the price rally still has some distance to go.

Solana futures contracts Open Interest | Source: CoinGlass

Technical Outlook: Can Solana bulls defend key support level?

The price of Solana is in a tug-of-war situation. Bulls are defending the $164 line where the 200-day exponential moving average stands strong as their shield. But $185 is forming an equally hard resistance. The past rally sorely needed to contest it and failed, so now investors wonder if Solana has enough strength to breach this level.

The 18th of May: A red MACD was generated. The blue line begrudgingly laid down its arms to the red signal line, thus confirming the sell signal. Bears are storming. Eyes are now set on the mean line (0.00) as the target. Lower red histogram bars are screaming out one thing-downward momentum is building.

The bullish Solana fire is sputtering. The RSI, a key momentum indicator, is following a worrisome downtrend towards a crucial 50 midline. A break below this line in the sand could kick off a free-fall in selling pressure, and Solana’s price could go sharply south. Keep an eye on this level; this is where bulls and bears will fight out the next chapter for Solana.

SOL/USD daily chart

SOL is dancing on the edge of the blade! Keep a close eye on how this craftsman behaves near that rising trendline. A trip from here could mean an unrestricted fury. Should it break, look to these critical support zones: first of all, at $164-the lifeline of the 200-day EMA. Beneath that stands a sturdier defense at around $159, where the 50-day and 100-day EMAs are joining forces. And, if all else fails, the $140 demand zone acts as the last line of defense, having proven itself back in early May. Hold tight!

Given a SuperTrend buy signal, SOL is ripe for an explosive movement. In simple terms, the indicator flashing green spells an all-clear signal for bulls. Acting like a buoy for this trend-following tool, it could favorably propel SOL upward, especially for traders using it as a trailing stop-loss mechanism. Breach the high of $185, and the resistance zone near $200, recalled from early April, turns into the new stage for price tussle. Watch out; perhaps SOL is preparing for another juggernaut move.

Thanks for reading Solana DeFi TVL futures open interest remain elevated as SOL price consolidates