Solana’s been locked in a tug-of-war since June, caught between stubborn resistance at $158.80 and a steadfast support level of $141.97. Think of it as a coiled spring, attempts to break free in either direction so far proving futile. Will it explode upwards, or snap back down? Only time will tell which side wins this battle.

However, this period of price stagnation has presented a buying opportunity for long-term holders (LTHs), who are taking full advantage.

Solana Long-Term Holders Shrug Off Weak Price Action

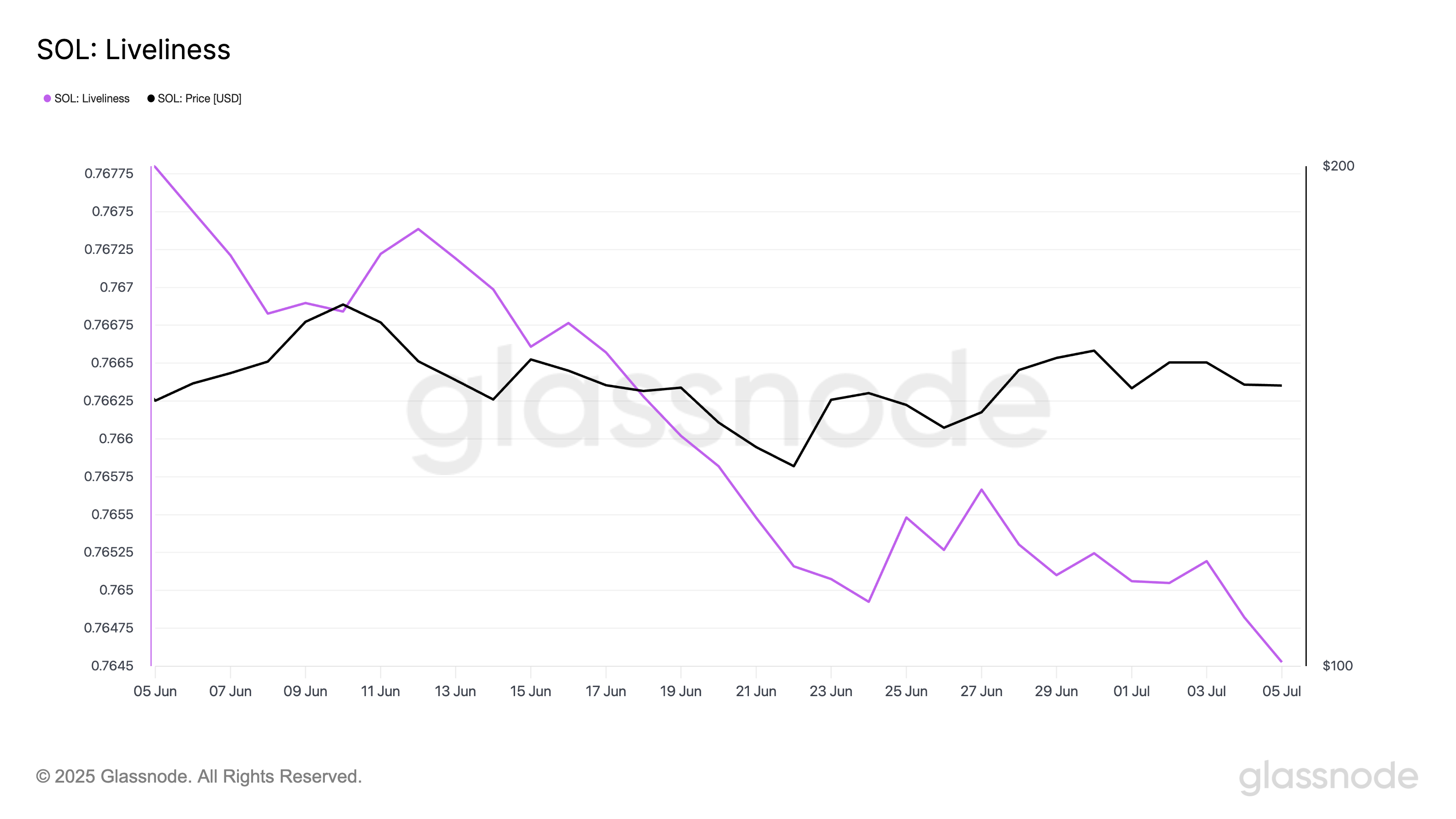

Solana’s heartbeat is slowing. Liveliness, the on-chain gauge of dormant tokens awakening and circulating, has slumped from a 90-day peak on June 4th to a one-month nadir of 0.764. This suggests Solana’s long-term holders are gripping their tokens tighter than ever, a stark contrast to the feverish activity seen earlier this summer. Is this a sign of unwavering conviction, or a prelude to a coiled spring?

SOL Liveliness. Source: Glassnode

Liveliness is crypto’s slumbering giant awakening. It tracks the movement of veteran tokens by comparing “coin days destroyed” to “coin days accumulated” think of it as measuring how much dust old coins are kicking up. A rising Liveliness score means dormant tokens are stirring, possibly heading for exchanges. This often signals long-term holders cashing in after a period of hodling, potentially impacting market dynamics.

Converesly, when Liveliness declines, it indicates that LTHs are moving their assets off exchanges and opting to hold.

SOL’s unwavering HODLers are betting big, shrugging off sluggish performance and anticipating a swift upswing. Their steadfast grip suggests a powerful surge is brewing, fueled by unwavering belief in SOL’s imminent potential.

“Beneath the surface, smart money is quietly stacking chips. This strategic accumulation could be the kindling that ignites a powerful rally when the winds of market sentiment finally shift.”

Solana Holders Remain “Hopeful”

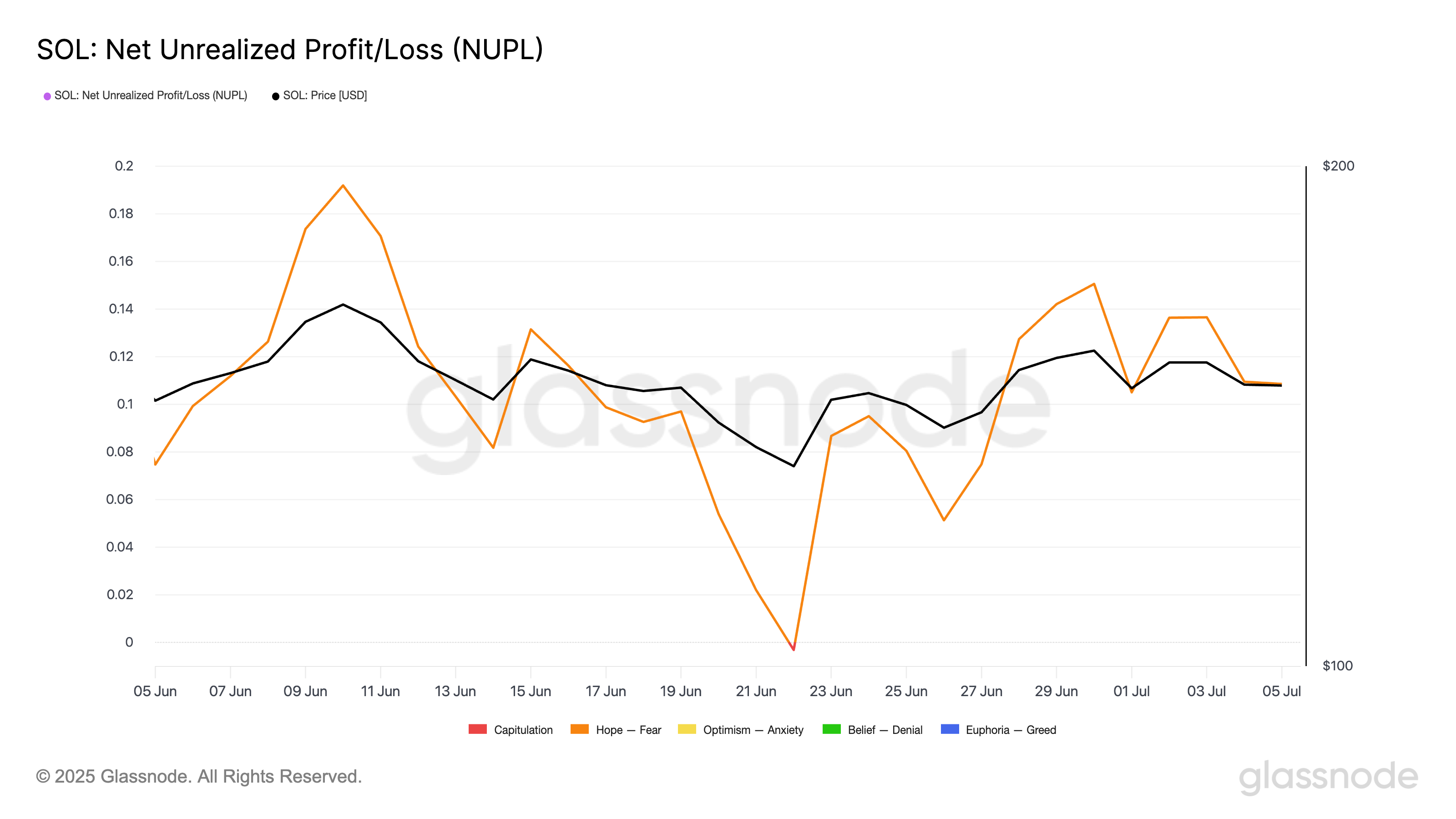

But the real kicker? Solana’s Net Unrealized Profit/Loss (NUPL) is flashing green, practically screaming “bull run ahead!” Glassnode’s data reveals we’ve been chilling in the “hope” zone for a month now, and currently, we’re sitting pretty at 0.108. Buckle up, folks; hope might just turn into reality.

SOL NUPL. Source: Glassnode

Imagine a vast, silent ledger where every Bitcoin transaction whispers a secret: profit or loss? That’s essentially what the NUPL, or Net Unrealized Profit/Loss, unveils. It’s a temperature gauge for the crypto market, revealing whether investors, on average, are swimming in green or drowning in red based on the last time their coins danced across the blockchain. Think of it as a collective mood ring – showing how likely holders are to HODL tight or cash out and run.

The “Hope” zone: Investors, wallets flush with gains, are perched on a precipice. Greed hasn’t yet eclipsed optimism; they’re betting on the rally, clinging to assets, eyes fixed on a still-rising horizon. The big sell-off? Not today. They’re HODLing, fueled by the promise of even greater heights.

This trend signals cautious optimism among SOL coin holders and often marks the early stages of a potential bullish trend.

SOL Bulls Eye $170 as Long-Term Holders Tighten Their Grip

Solana flirts with $150, currently priced at $148.06. Will history repeat itself? All eyes are on long-term holders – if they double down on their SOL stash, a surge past the $158.80 resistance becomes a thrilling possibility.

A succesful breach of this long-term resistance zone could lay the groundwork for a rally toward $170.

SOL Price Analysis. Source: TradingView

But beware: should the bears tighten their grip, SOL risks a plunge below its $141.97 safety net. A breach here could trigger a freefall towards $123.49.

Thanks for reading Solana Long-Term Holders Bet on a Breakout Despite Sideways Price Action