While **Solana price is still trending higher overall, the near-term risks are building up and close-time risks remain. SOL has forged an upward trend since the beginning of the month, a pattern that often precedes reversal. *****

Despite strong investor participation, the setup suggests a potential dip that could undermine recent bullish efforts.

Solana Holders Counter Each Other

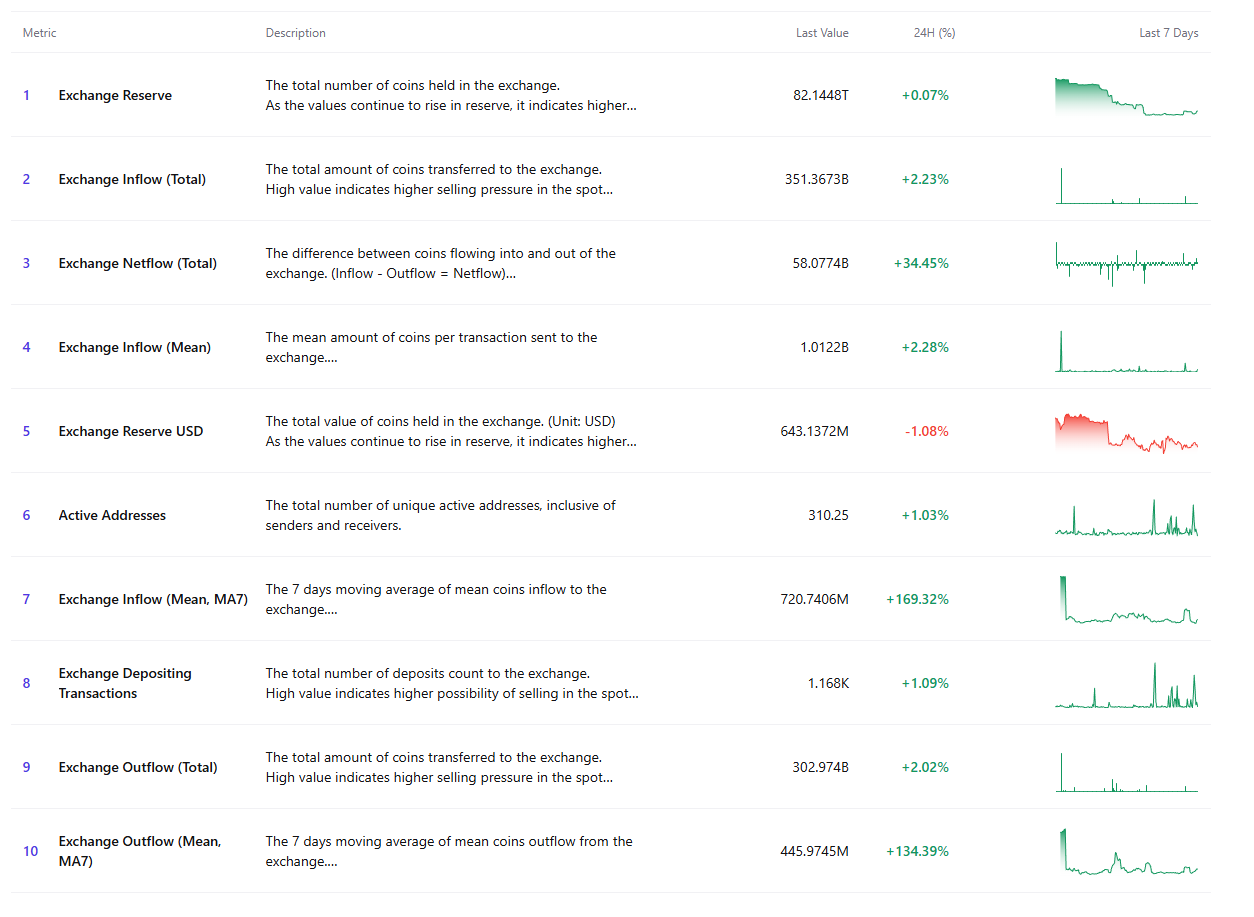

network growth, with strong network expansion of on-chain activity. Since the first of the month, so many addresses conducting transactions on Solana have jumped sharply. At its peak, over 8 million new addresses joined the network in one 24-hour span.

This increase signals high demand for SOL by s. These new addressers usually provide fresh capital, increasing liquidity and network use. But such growth reflects Solana’s growing ecosystem appeal, driven by DeFi activity, memecoins and high-throughput apps that attracted new participants.

Solana New Addresses. Source: Glassnode

macro momentum tells a different story, even though the network adoption is increasing, but macro acceleration has. Price action is increasingly influenced by existing holders, according to exchange position change data. But the impact of new capital inflows has been weakened, as long-term participants have bought pressure from buying it.

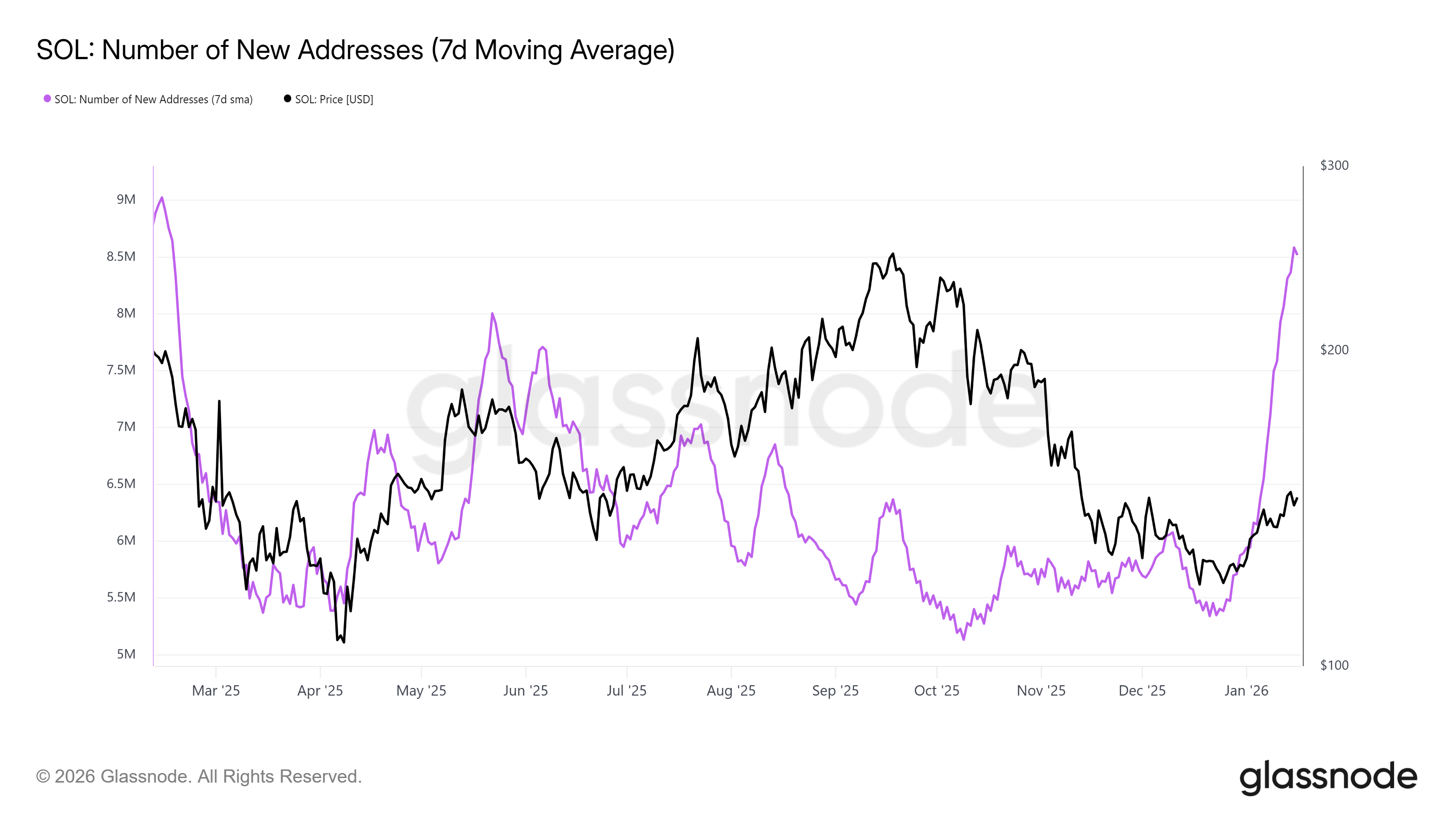

Selling pressure is starting to dominate as buying momentum fades, and selling pressure begins to take over. This shift suggests that a large SOL holders are taking advantage of less exposure or preparation to sell. In the case of legacy supply and new demand, price weakness often follows, thereby increasing the risk that a collapse from the current structure will be removed.

Solana Exchange Position Change. Source: Glassnode

SOL Price Is Looking at a Correction

When writing, solana price trades near $144 at the time of writing; it moves within an ascending wedge formed in recent days. It is a bearish continuation pattern that projects ‘a possible 9 of these patterns are likely to be the same. The downside target is near $129 if the structure resolves to be lower, with 5% decline, meaning that “the key of this problem” has been placed on a downward trend.

Its projected drop matches with weakening momentum indicators. An official break-up would likely push SOL toward $136 first. But losing that support would reveal $130, where buyers may try to attempt not to lower the price amid broader market caution.

Solana Price Analysis. Source: TradingView

The bearish scenario, however, isn’t guaranteed. SOL could recover from the wedge’s lower trend line if investor sentiment improves and selling pressure eases up, as well as rebounding from its low trendline. a move over $146 would signal renewed strength. And solana would have to be pushed toward $151, further upside, which invalidated the bearish outlook.

Thanks for reading Solana Price Faces Crash Risk Despite 8 Million New Investors