Once this meme coin had made the big industries thrive in Solana, the coin was declining. From the moon rocket, it turns to its steep descent, away from everybody’s ever-so-glowing hopes.

The Solana token’s rate is bleeding. After a splendid month of May, the native coin of the network has seen a sharp decline of almost 18% in just four days. The cause; a meme-coin meltdown scorched Solana’s ecosystem, leaving SOL investors hemorrhaging.

The solar meme coin mania transformed from a rocket to skyscraper real fast. Dogwifhat, SPX6900, and Popcat-that once had combined valuations and market clout of $15 billion-broke and shut their doors, losing bills within moments to the shiba’s fur. It is working outside the Solana story; there is a big market-wide tremor. Geopolitical anxieties and technical tremors are shaking the crypto foundations, leaving investors wondering if Solana is churned under the specs of its meme coin engine.

Solana’s correction deepens

Solana nosedived towards $153.90 — that is 17.6% beneath the peak of July 2024: no less than after the day would it gain or lose $177 again?

Solana meme coins took a beating. What once was a $15 billion party mid-month is now a $10 billion hangover.

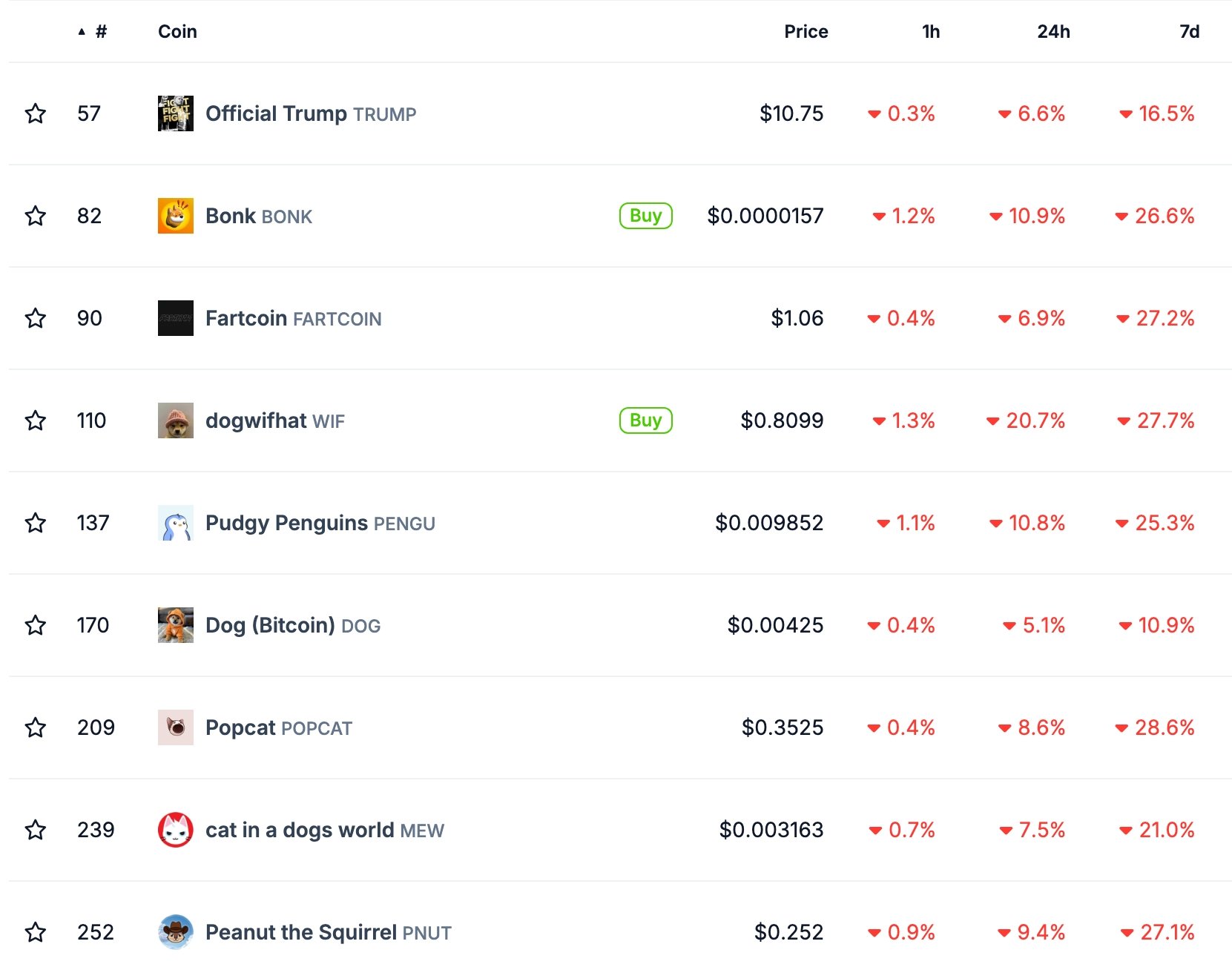

Dogwifhat simultaneously took a hit of minus 20% in its flight up parallel with SPX6900 (SPX) crashing 18%, just like we stated. The Solana meme coin bloodbath is still ongoing, with Fartcoin (FARTCOIN), Pudgy Penguins, and Popcat all falling with more than 20-plus-percent drops within a similar untamed 24 hours.

Solana meme coins chart | Source: CoinGecko

Solana’s meme coin mutiny has thus sent shockwaves through the ecosystem. The DEX field is feeling the heat-recent days witnessed a nose-dive in trading volumes. Daily volumes are now down to $2.4 billion on Solana DEXes, which is a pale shadow compared to Ethereum at $2.98 billion and Binance Smart Chain at $12.1 billion. Is it just a brief pause, or a red flag for a deeper issue with the Solana blockchain?

The meme coin mania on Solana is coming to a stop: these coins enjoyed an almost meteoric rise since the lows in April, with some surging even beyond 100%; now, traders are cashing in, dropping the once sky-high assets into free fall.

SOL price technical analysis

The selloff in Solana is grabbing all the attention! On May 23, 2022, Solana reached $185. Less than five days later, it has dropped to $154. Ouch! A volatile chart with Solana having crashed through the 38.2% Fibonacci Retracement level. So what is next for this popular crypto?

Solana price chart | Source: crypto.news

The crypto was hardly able to hold its support at $159.45 as it went south with a terrible violation of the double-top neckline at $184.25. This is not just a dip; rather, this is a warning. The double-top is a classic treacherous omen of bearish foreboding appearing to wreak havoc on the hopes of investors.

Losing altitude, Solana has been held back. The 50-day EMA has caved in, and momentum indicators like the RSI and MACD are flashing red. Is this just a halt or an actual plummet?

Buckle up: here we go downward with the coin. First stop, mark of $140; 8.5% off from here. Think about it being a 23.6% retracement pit stop on its way down. Now, any surprise push past $185 (the double-top zone) and the downside collapse is gone. Forget $200; bulls might just run with it. But, alakazam, more redness is expected till then.

Read more:

Shiba Inu price crashes as whales sell, burn rate slows

Thanks for reading Solana slides to monthly low as memecoin frenzy fizzles