Thus, Solana’s sun-ripened rally appears to be cooling. But don’t write it off just yet. While SOL surged nearly 30% last month, hitting almost $184, the recent gains have been but a modest 0.78%. However, underneath, Solana continues to be the DEX powerhouse, flaunting its muscle with a staggering $27.9 billion in weekly volumes-the likes of which other chains can only dream about. Could it be a lull before we see the next leap, or is it the onset of a plateau?

Solana’s ecosystem is energetic, with applications accruing high fees. But wait, the rally may be losing altitude. According to technical whispers via the RSI, Ichimoku Cloud, and EMA lines, we may have to take a breather thus consolidating or correcting on the way.

Solana Leads DEX Market With $27.9 Billion Weekly Volume and Surging App Activity

Venture capitalists are understandably excited about blockchain but remain careful.

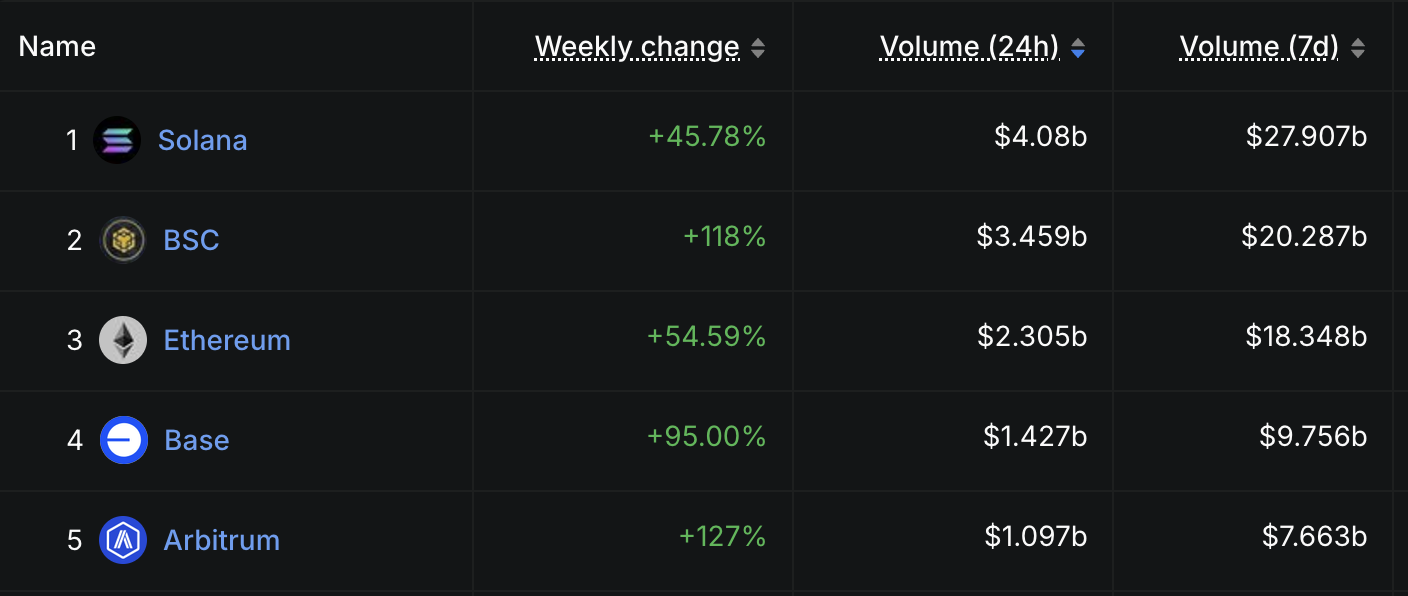

Over the past seven days alone, Solana recorded $27.9 billion in DEX volume surpassing BNB Chain, Ethereum, Base, and Arbitrum.

Top Chains by DEX Volume. Source: DeFiLlama.

TheSolanaDEXs are in full tilt! Weekly volumes scaled an enormous 45.78%, painting the picture of another on-chain energy after an almost sluggish March and April. The sleeping colossus stirs!

This surge is no small jump; it’s another rocket rise in an unfolding saga. Trading volumes have held steady defying gravity ever since, above $20 billion for a solid month now.

Top Apps and Chains by Fees and Revenue. Source: DeFiLlama.

Solana is no more just a growing trend; it is throwing a gala! In contradiction to trends, four of the top ten highest-drawing applications and chains over the past week are stationed on Solana. From seasoned card-carrying members to new-age innovators, this dynamic cocktail is proof that the Solana ecosystem is buzzing with energy rather than just getting by.

An upstart from Solana, Believe App, is not merely making waves – it has made a tsunami. In just one day, the newcomer minted $3.68 million in fees, far more than DeFi giants such as PancakeSwap, Uniswap, and Tron. The crypto community is wondering: Is this the birth of a new king?

Momentum Cools for SOL as Indicators Turn Neutral

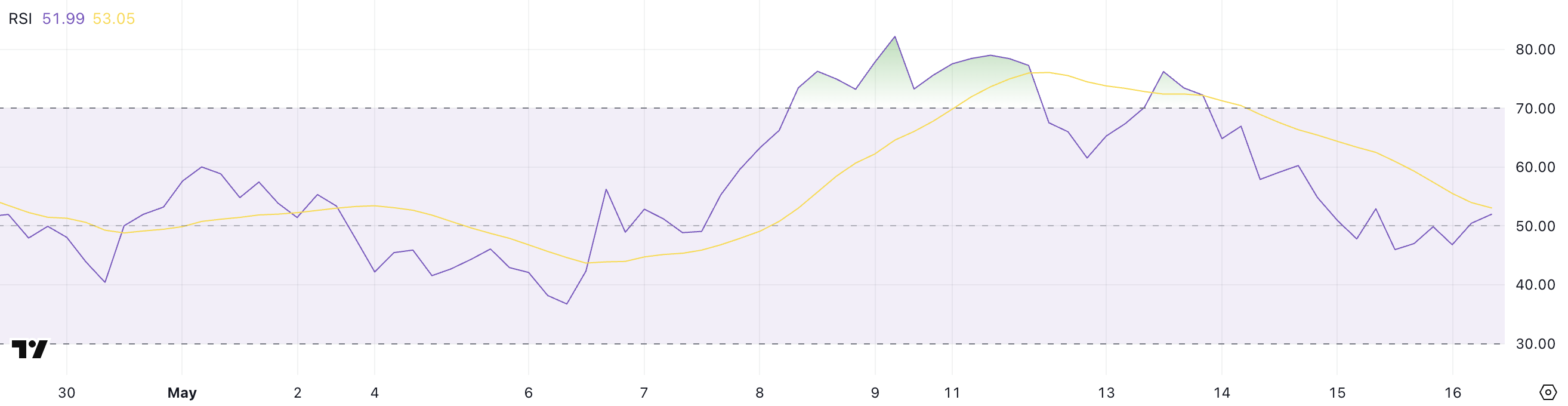

The bullish rally of Solana is losing its traction. The lesser-known momentum indicator, RSI, has dipped from a bullish 66.5 to a weak 51.99 in the span of just 72 hours – an unusual manifestation of bullish weakness.

The RSI has been inert in a range, mumbling between 44 and 50. It can be thought of as the market exhaling after flirting with overbought conditions, now sniffing for its next direction.

This shift suggests that traders are more cautious, and recent gains may be cooling off.

SOL RSI. Source: TradingView.

The RSI is currently at 51.99, putting it in a precarious position between two extremes. Forget clear skies; here is the eye of the storm. Above 70, buyers have their sirens hoisted; while below 30, there are bargain hunters. This mid-range unclear middle is a moment where Solana’s momentum is anybody’s guess. Is there energy coming in for a breakout, or is it barely hanging on for a breakdown? The market sits at a pause, wondering.

“The RSI at a surge beyond 60? This could very well mean that the bulls are back in charge! But, beware that if it trips below 45, it may truly signify more bad weather ahead for prices.”

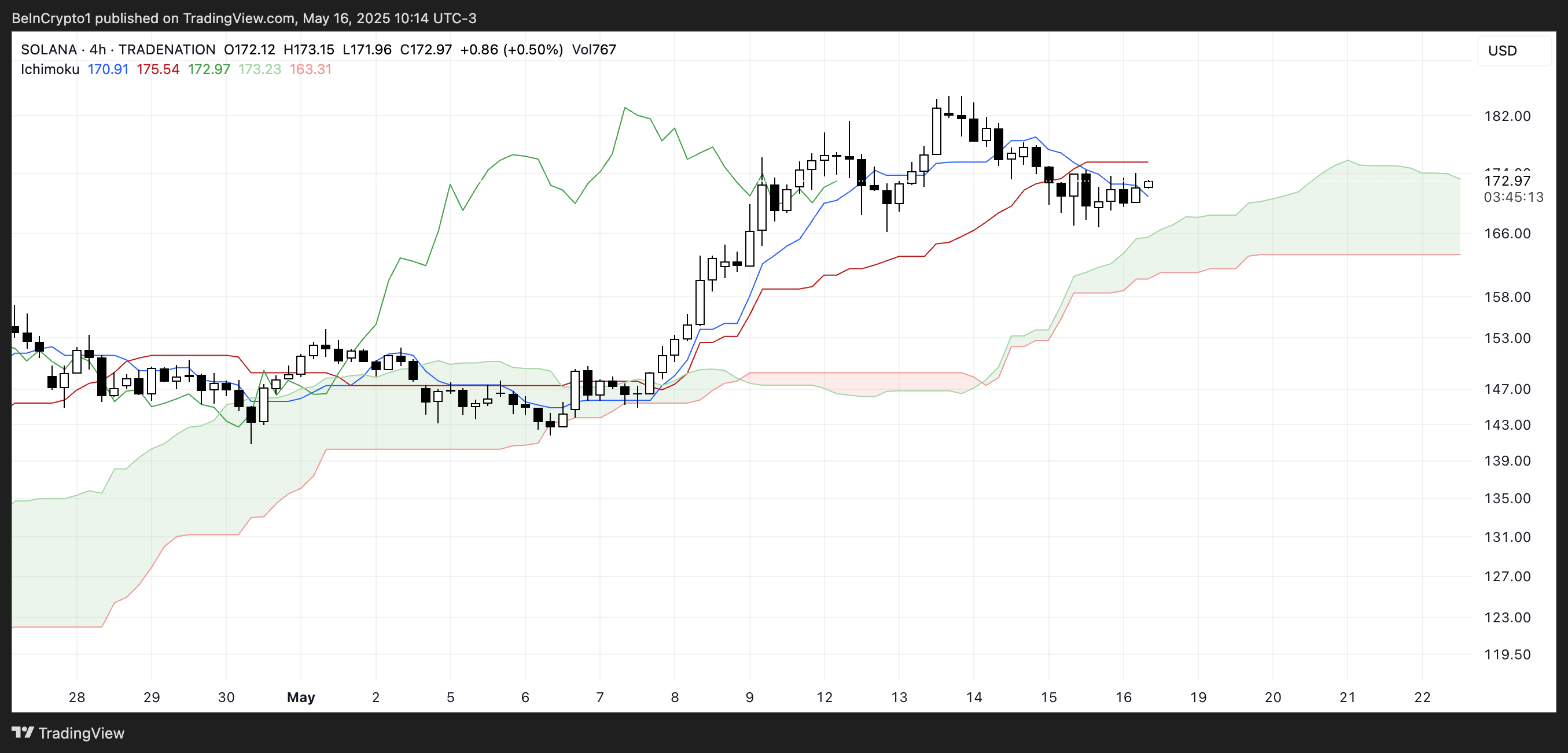

Solana’s Ichimoku Cloud chart shows a period of consolidation following a strong uptrend, with key signals now suggesting indecision.

The price moves in a tug of war around the Kijun-sen (red) and Tenkan-sen. The lines have lost whatever pizzazz and directionality they once possessed, signaling the ebbing momentum.

The Chikou Span, which we lovingly call the green shadow of ours, still loitered atop the price candles, giving signals that the bulls have not yet surrendered completely. But, well, tell me, could it get any closer? It was almost right down on the shoulders of the candles-they were losing their steam.

SOL Ichimoku Cloud. Source: TradingView.

The Kumo Cloud is discarded away, greenish in tint, pointing at bullish strength. Widely splayed leading edges form a sturdy floor under the price, ready to catch any downward drift.

Candles form hesitant tangos around the Kijun; the music fades away, for the leap beyond the Tenkan-sen cannot be forged. Short-term murmurings flow from the market:Caution.

Closing above the blue line will bring the momentum, yet a drift into the cloud would imply a backing or a bitter reversal.

Solana’s Bullish EMA Structure Faces Momentum Slowdown

The bulls are still dominant on Solana, so to speak. The EMA lines are green, with short-term averages leading. But there is a word of caution: the pack is making its way closer. That once-wide gap between the lines is shrinking as a sign that Solana’s upward sprint may be losing steam. Is just catching its breath or is the finish line in sight?

Solana’s rally hit a roadblock, thrashing headlong against a stubborn resistance. Though a second attempt may open the gates for a melée toward $200, the bulls’ muted reaction has cast a doubt over the staying power of the current uptrend. Just a short break or could it signal some deeper-level weakness in the making?

SOL Price Analysis. Source: TradingView.

Solana is precarious on the knife edge. Recent support held, and the Ichimoku Cloud suggests a cooling off, echoed by RSI warnings. Should it fall from grace now, a rapid descent is in store for it below that glorious floor.

Although the bullish horns remain tilting somewhat upwards, the markets are balanced atop a knife-edge. The next act now rests on a power struggle: will the bulls charge back to take control or will the bears drag the market deep below?

Thanks for reading Solana (SOL) Momentum Slow – Is $200 Still in Sight?