Layer1 Coins One Spot Painting the Crypto Market Green. While Bitcoin and Ethereum Are Falling Apart,Layer1 blockchains, being the basic ones, are now going against the trend and spiking, with the L1 index gaining 4% in the last 24 hours.

With the price surge, the surface appeared dazzling. Nevertheless, some considered the source of the flow to be practically no more than a house of cards set on shaky sand.

Traders Bet Against PI Despite Price Rise

In this sea of red, PI is flashing green, defying the downward crypto currents of the day. So watch out, traders: dodgy whispers echo through the blockchain, suggesting this sideways surge might be just an illusion.

Such a rare instance of a 4% surge in Alphamin is raising eyebrows. Although the price has spiked, the volume of trade fell another 38%, implying the rally provided little support from the wider market and may not last long.

IP Price Analysis. Source: Santiment

Rising prices on an asset with immaterial trading activity? Red sign. That sort of sign tells me that the ascent is not supported by the mass enthusiasm but by a shrinking circle of believers. It’s a lonely climb in the picture, so to speak, suggesting the price hike may thus be built on shaky grounds, lacking the robust backing of the wider market.

Such conditions make the coin’s rally unsustainable, increasing the risk of a reversal or pullback.

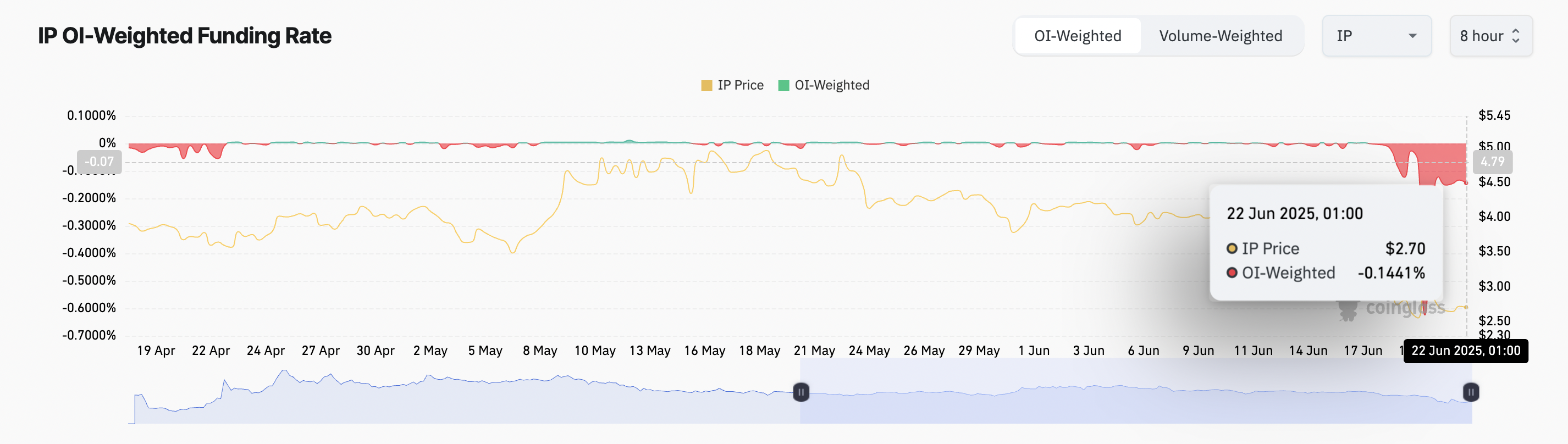

Pitching gasoline into the flame is the fact that the IP’s funding rate is stuck under the negative label, around 14bps below. This means that there are heaps of traders in the futures market making hay shorting the asset-line. A symphony of bearish notes permeates the crypto landscape.

IP Funding Rate. Source: Coinglass

Imagine a typical rope-pulling scenario where the price of a cryptocurrency is the rope. Now visualize two opposing teams: the “Longs,” who expect a rise in price and the “Shorts,” who anticipate the opposite. For the sake of fair play and for keeping the contract price within an arm’s reach of the spot price, funding rates exist-to offer just that little periodic “push” to each team. When Shorts become bullish and overpower the Longs, they actually end up paying the Longs-the funding rate goes negative. It’s like a giant neon sign waving above the market saying, “Prices will definitely go down!”

Negative funding rates for IP is one warning sign flashing red: traders are against its meteoric price rallies. This implies the bears who’ve been holding down IP for weeks are about to pounce for a potential price crash.

Can IP Rebound? Token Eyes $3.17 If Demand Returns

IP hangs precariously, trading at $2.75. It shall be priced down by this freefall of $1.59, which presents an important support level. If there is a lack in buying interest, or if the price breaks through the cushion, IP could march on to $1 or lower, which is quite undesirable.

IP Price Analysis. Source: TradingView

But this grasp would loosen at some point. The entry of new buyers could harbinger the zenith of bearish trend and drive IP towards euphorically $3.17; eclipsing that zenith would present an avenue leading to $4.41.

Thanks for reading Story (IP) Defies Market Slump With 4% Jump – What’s Next?