Dashing 12%, SUI tempers fate into a high-stakes gamble. This bullish run might be a siren call luring traders into liquidation at the price point critical enough to drive the market down. So, is this the rally or the rumble before going into a freefall?

The recent rally is a double-edged sword with potential consequences for short traders.

SUI Traders Face Losses

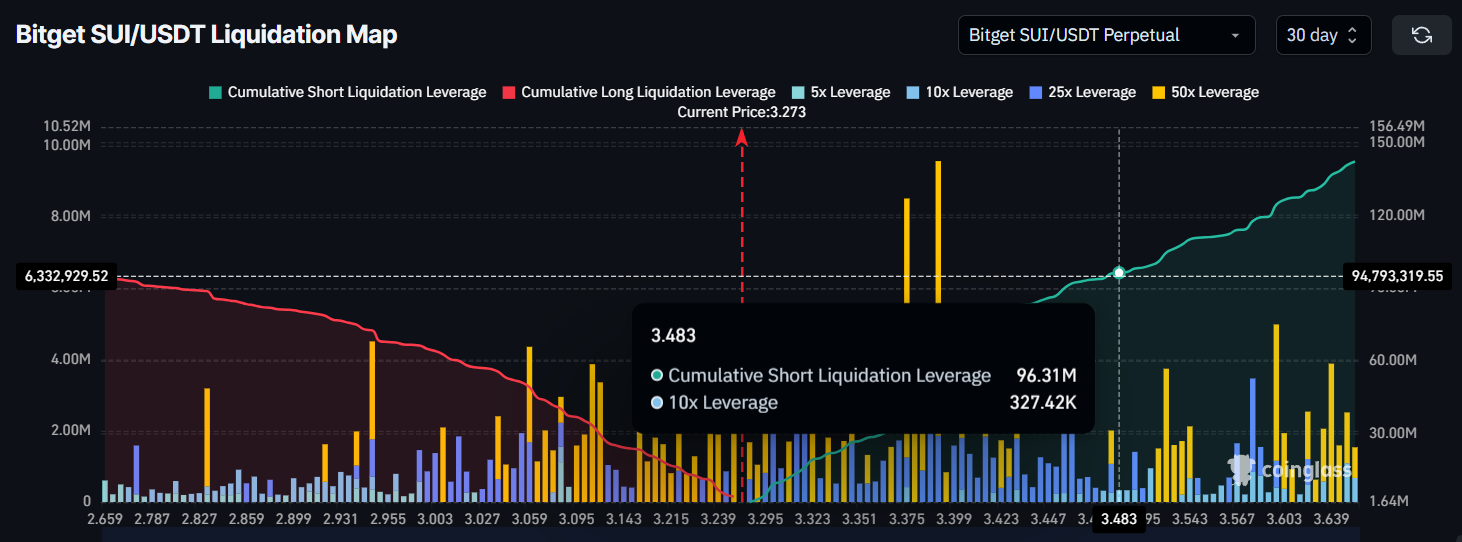

Sui’s price is already dancing on a knife-edge. From here, a drop to a bottom at $3.48 could set off a cascade of liquidations, basically worth $96 million, with short traders who are betting against it getting wiped out with extreme prejudice. The bears are about to receive their share of heat.

If SUI breaks out of this ceiling, prepare for a short squeeze of epic proportions! Mass liquidations will wipe out short positions, and an unholy scramble will ensue as traders frantically hunt down any remaining buy-back.”

Would you want assistance with rewriting the above text?

An amazing volatility display has just been brought to us by SUI. Short sellers, beware: Betting against this could be akin to financial quicksand. A sudden eruption in price would set off the mass exodus, turning short positions into rocket fuel for an even crazier street. The SUI saga is also a reminder that one can lose or gain a fortune in a matter of seconds in crypto.

Consequently, this situation might fuel the price frenzy, leaving bulls and bears alike dangling precariously over a volatile precipice.

SUI Liquidation Map. Source: Coinglass

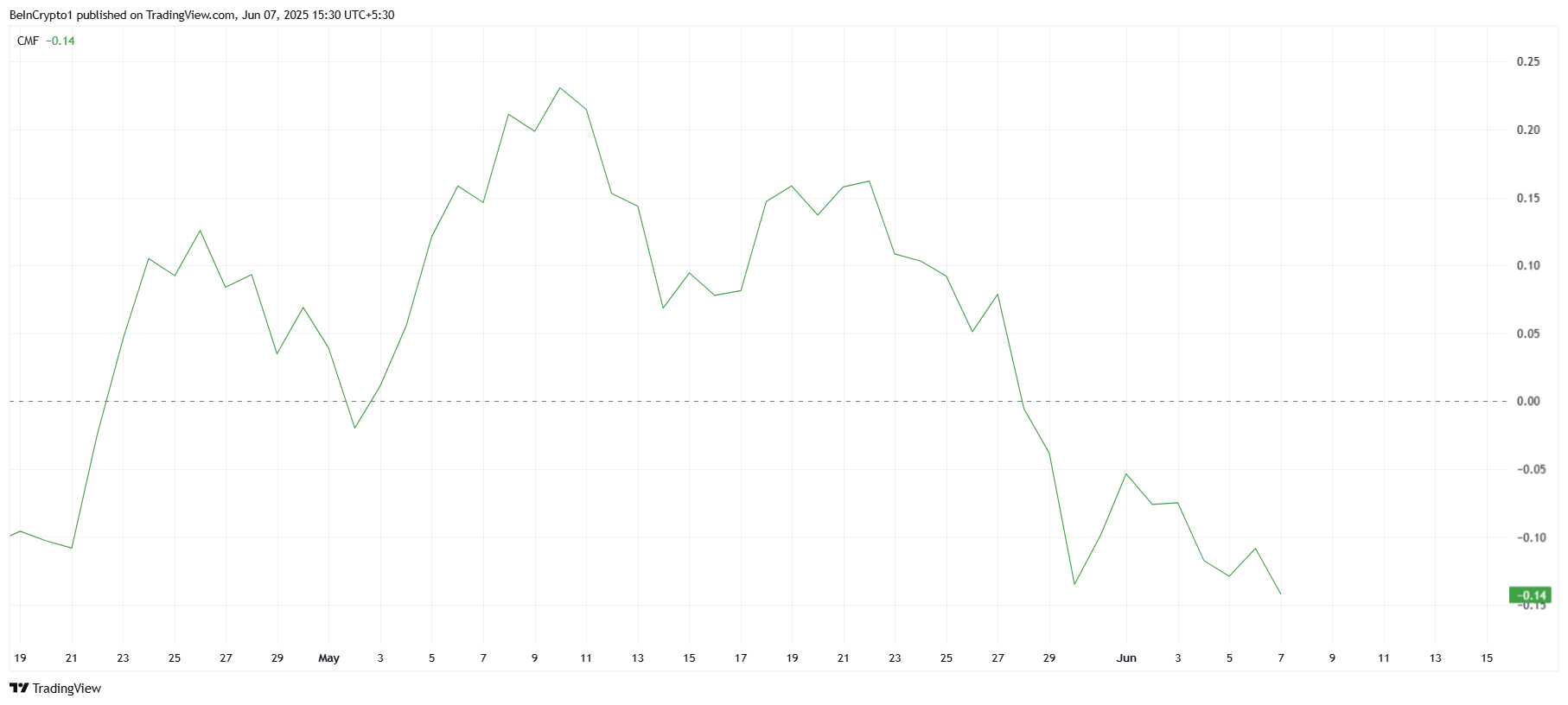

SUI’s recent 12% surge is a mirage. Beneath the surface, the Chaikin Money Flow (CMF) whispers a different story: investment dollars are fleeing, not flooding in. The negative CMF momentum casts a shadow on the rally, suggesting a market unconvinced of SUI’s staying power. Is this a fleeting pump before the inevitable dump? The CMF hints it might be.

The recent gains appear to be driven more by short covering rather than a broad-based surge in buying interest.

SUI prices teeter on the edge of a precipice. Hold on tight if the exodus continues. With buyers nowhere to be found and the blood of capital, as measured by the sinking CMF, draining away, the recent surge of SUI may just end up as another momentary shimmer. Either a miracle occurs wherein buyers gallop in to save the day, or gravity wins its cause.

If these outflows persist, they could lead to a price reversal, diminishing the optimism generated by the recent gains.

SUI CMF. Source: TradingView

SUI Price Attempts Surge

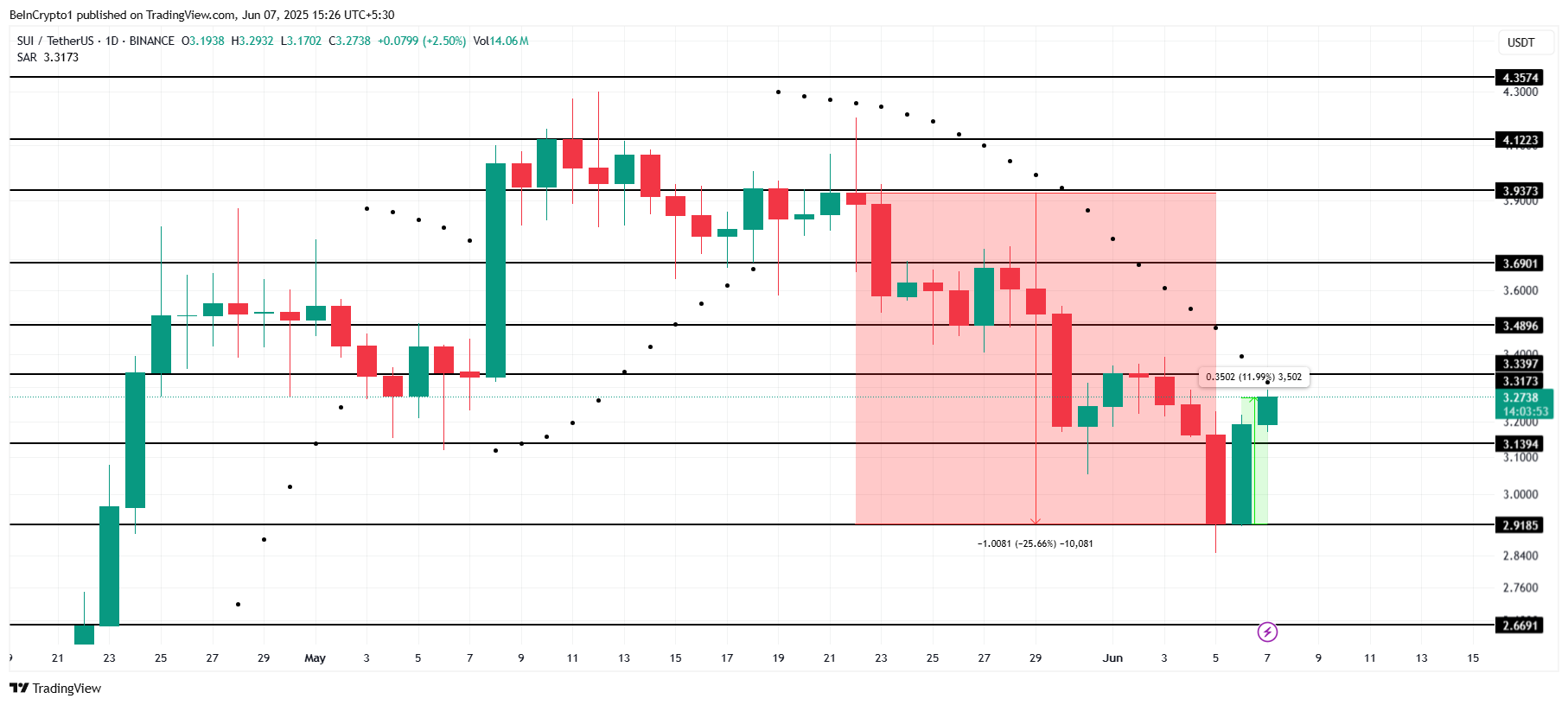

SUI is on a run! SUI has gained 12 percent in 24 hours while being priced at $3.27. However, stands that resistance at a rude $3.33. This barrier would stand in SUI’s way a few times before, so all eyes are on it to see if it can get past.

Given the ongoing outflows, it seems unlikely that SUI will break through this resistance level in the near term.

Rallying at $3.33, SUI sits on a knife edge. As SUI found resistance there, any attempt for desirous bulls to go forward would bring a crash with almost no time to witness the rush activity of $3.98 to $3.56 Treymania. Watch out falling down there could be not far $3.13 and even $2.91. Without that push, SUI would find itself stuck in a frustrating consolidation purgatory.

SUI Price Analysis. Source: TradingView

Look at the Parabolic SAR or Parabolic Stop and Reverse-and notice how it sits very interestingly poised. Keep your eye on it; if it dips under the candlesticks, it is likely to initiate a heavy bull charge.

At $3.33, SUI balances on the edge of a knife. Smash through that ceiling resistance and watch it soar to $3.48. Exceeding that price target is not only good news for themselves; it would become a nightmare for short sellers. Get ready for a cascade of liquidations propelling SUI higher.

Thanks for reading SUI will Trigger a $96 Million Liquidation if Price Reaches This Level