This mix creates a setup where dips may show up briefly, but the broader structure stays intact.

Momentum Shows Pull-Back Risk While Buyer Strength Still Holds

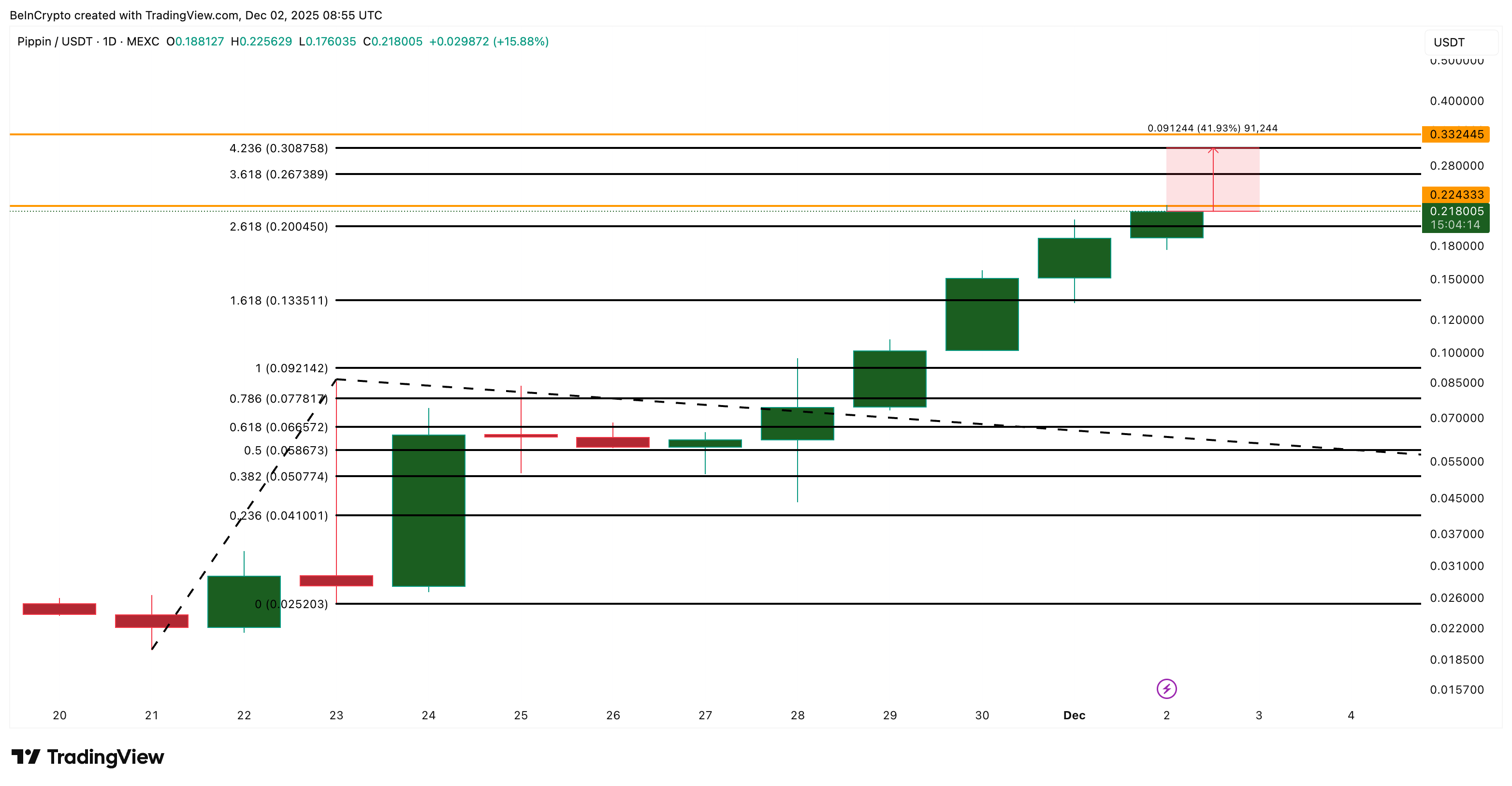

The two-day PIPPIN price chart shows why this move may pause but not break.

PIPPIN’s RSI is flashing red! The momentum gauge is pegged in overbought territory, screaming for a breather. Remember January 11? RSI hit these heights, PIPPIN slammed into resistance at $0.33, and then… pullback city. Traders are watching, waiting to see if history repeats itself. Is this the peak before the plunge?

That heart-stopping plunge? Not this time. Forget the freefall flashbacks. While price carved a lower peak, RSI mirrored the move, confirming the trend. No deceptive bearish divergence here. Price and momentum are singing the same tune: a simple breather, a much-needed cool-down from that scorching 90+ RSI. Think pullback, not panic.

PIPPIN Price History: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

CMF gives the opposite signal. CMF (Chaikin Money Flow) tracks whether large wallets are adding or removing tokens.

While PIPPIN’s price action traced a bearish descent, carving lower highs between January 11th and December 1st, a secret strength emerged. The Chaikin Money Flow (CMF) painted a contrasting picture, scaling to higher peaks during the same period. This bullish divergence whispers of unseen forces at play: whales quietly accumulating, their buying pressure defying the surface-level downtrend and hinting at a potential price surge.

Since September 6th, PIPPIN’s two-day Chaikin Money Flow (CMF) has stubbornly remained above zero, hinting at consistent buying pressure. This bullish persistence often foreshadows rapid trend reversals, even amidst temporary dips. Unlike the previous crash, where CMF plummeted below zero, current big money flow paints a far more optimistic picture for PIPPIN’s recovery.

Bullish Divergence Appears: TradingView

Together, the two signals show why PIPPIN may cool briefly but still stay in a strong uptrend.

PIPPIN Price Levels: Where Cool-Down Ends And The Next Push Starts

PIPPIN flirts with $0.21, but a stubborn ceiling looms just above at $0.22, where Fibonacci’s invisible hand halted its ascent. Will it break free? Eyes are peeled for a resurgence, with $0.30 and then $0.33 – January’s peak – beckoning like hidden treasure. Conquer $0.33, and PIPPIN could enter uncharted territory, a short-term price discovery phase where the only limit is the sky.

If a pull-back forms, the structure stays healthy above $0.13.

The trend weakens below $0.13, and a fall under $0.09 would invalidate the current rally setup.

PIPPIN Price Analysis: TradingView

The market’s whispering its secrets: RSI hints at a breather, but don’t be fooled. Despite December’s icy dip, the CMF screams of unwavering buyer enthusiasm. Meanwhile, PIPPIN’s critical safety nets remain miles below, daring the bears to even try.

So the PIPPIN price rally may cool, but large money action could heat it up real soon.

Hot rally, cold reality? Experts predict the “PIPPIN” surge might fizzle. But don’t count out a comeback.

Read the full story to uncover the factors fueling the potential cooldown and the surprising reasons a “reheat” remains a real possibility.

Thanks for reading This ‘PIPPIN’g Hot Rally Could Cool Down: Here’s Why a Reheat Isn’t Off the Table