- TRON’s DeFi ecosystem thrives on lending protocols and bridges, enabling seamless asset flow and passive yield opportunities.

- Despite reduced whale activity, retail users and stablecoin adoption continue driving network growth and utility.

Statistically transient buzzword goes by and again comes another. TRON (TRX) has quietly morphed into a powerhouse. Think of it less as just another blockchain and more as the humming interstate for stablecoins and cross-chain DeFi. But this isn’t just about raw transaction volume; intriguing undercurrents are flowing. Whale activity is always followed with interest-watching-the-whales; their movements actually tell stories. And look at that: The system of TRON is no longer just used; it’s becoming essential.

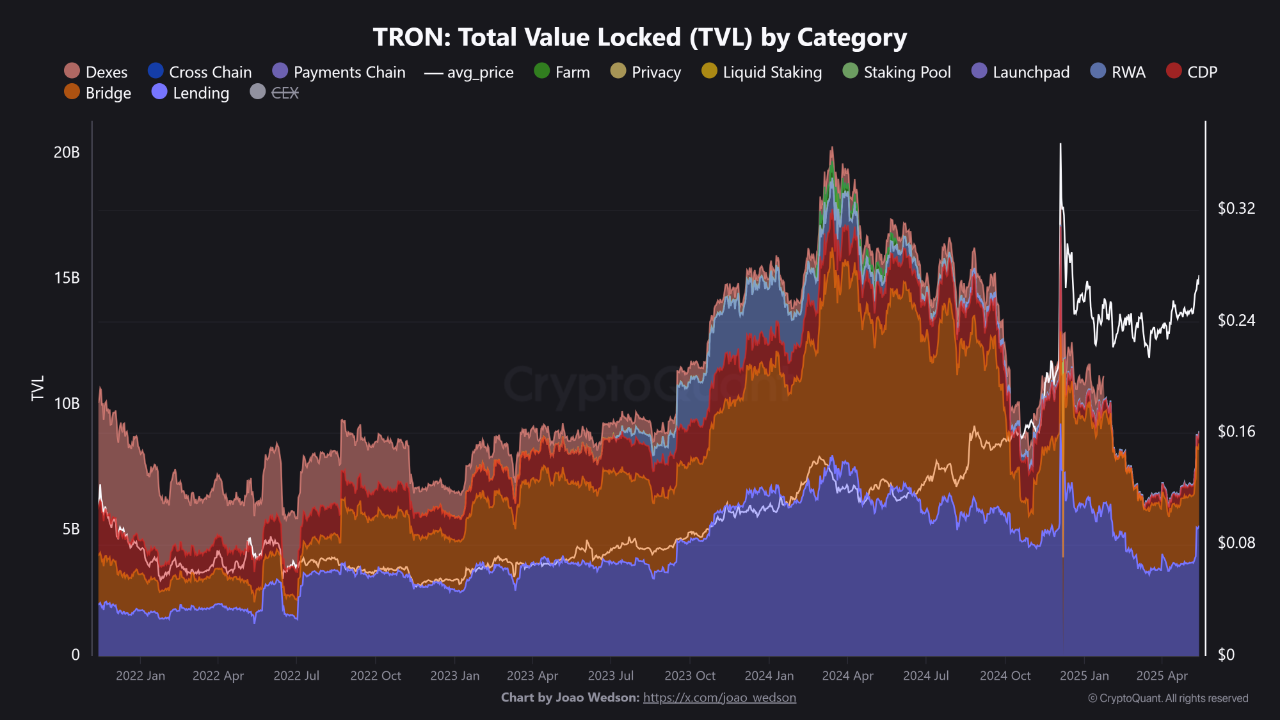

An active engine lies behind the surface of this network’s impressive TVL- not just idle funds. CEO Joao Wedson of Alphractal revealed via CryptoQuant that its vitality lies within a symbiotic relationship: lending protocols and cross-chain bridges. JustLend DAO is at the forefront of this lending ecosystem, channeling energy into the momentum of the finances.

Envision a digital marketplace where savers can park their USDTs and earn some sweet revenues, while borrowers can disengage the crypto cash that is tied in with their collateral.

Bridge are the lifeblood. Think of these as digital arteries connecting TRON with other blockchains, allowing assets to flow in and out at all times. This is no mere stablecoin depot; it’s a thriving ecosystem bursting with energy.

Source: CryptoQuant

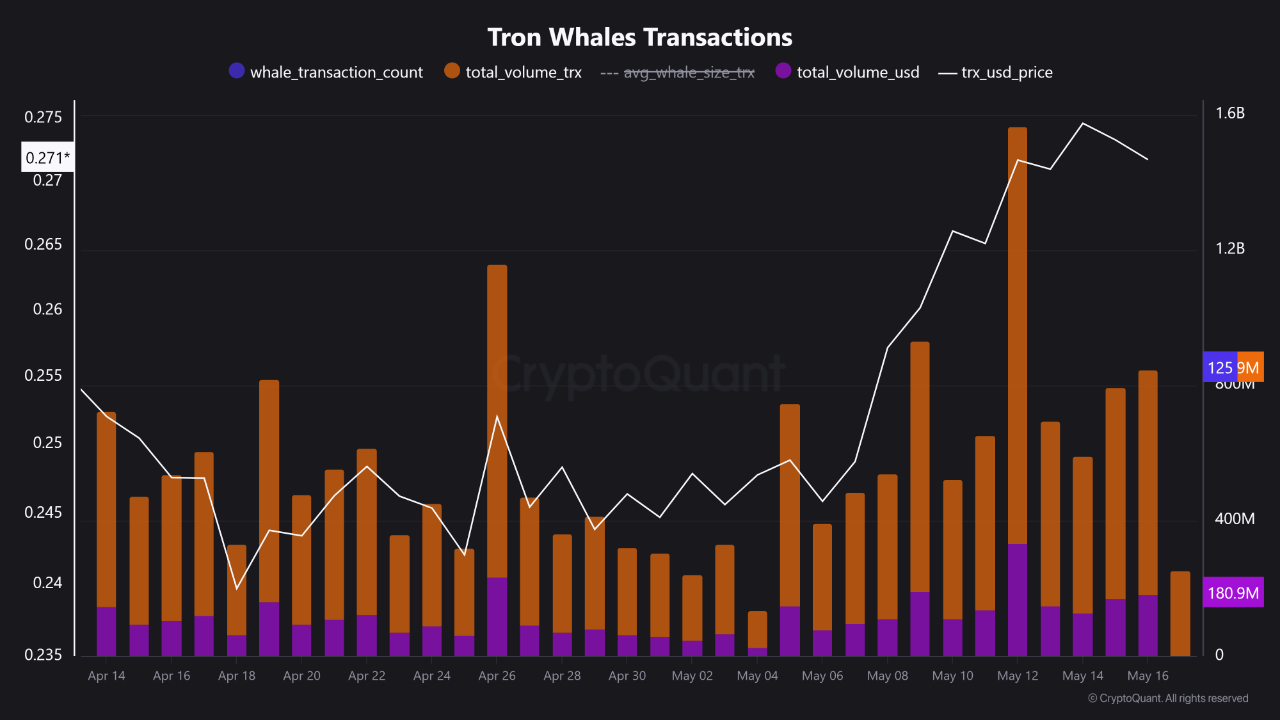

TRON Whale Activity Slows, Retail Momentum Takes the Lead

But wait-the plot thickens! While some signals blink green, the TRON blockchain tells a completely different story. Through on-chain analysis, crypto analyst Crazzyblockk found that, since early May, whale activity has drastically declined. The TRON titans now seem observiously asleep, with big transactions down in both TRX and USD value. Is this a calm-before-the-storm kind of set-up for another big feeding frenzy, or is something else going on with the ecosystem on said TRON?

Source: CryptoQuant

The twist is this: transaction sizes are shrinking. Are some of these whales, flush with profits or overcome by doubts, slowly trimming their sails? Is this the beginning of a cautious pullback or just a pause to breathe and frown at the tides?

TRX went against expectations, climbing to $0.271, not because of whale movements but on the back of the retailers’ collective force. Picture this: instead of one powerful hand driving the price, a groundswell of small buyers is fast afilling the supply; a small bit of legwork hints that control is changing hands in the crypto space.

TRON (TRX) is presently being traded about $0.2717. With a mere 0.89% increase in the last 24 hours, TRX has been largely neutral in the recent past, leaving that speculative question of breakout on the minds of investors.

TRON DAO has gone one step further in DeFi by making Chainlink Data Feeds available in place of the traditional oracle. Having a dated map is no different from having an outdated set of directions, right? The users on TRON have just been privileged to such an upgrade. Dispatches with state-a-set-high accuracy and cleanliness-of-transparency-to-application say that applications for DeFi on the network can receive honest information that cannot be juggled with traffic congestion either. Chainlink speaks of smooth and punctual transactions along with valid data for TRON.

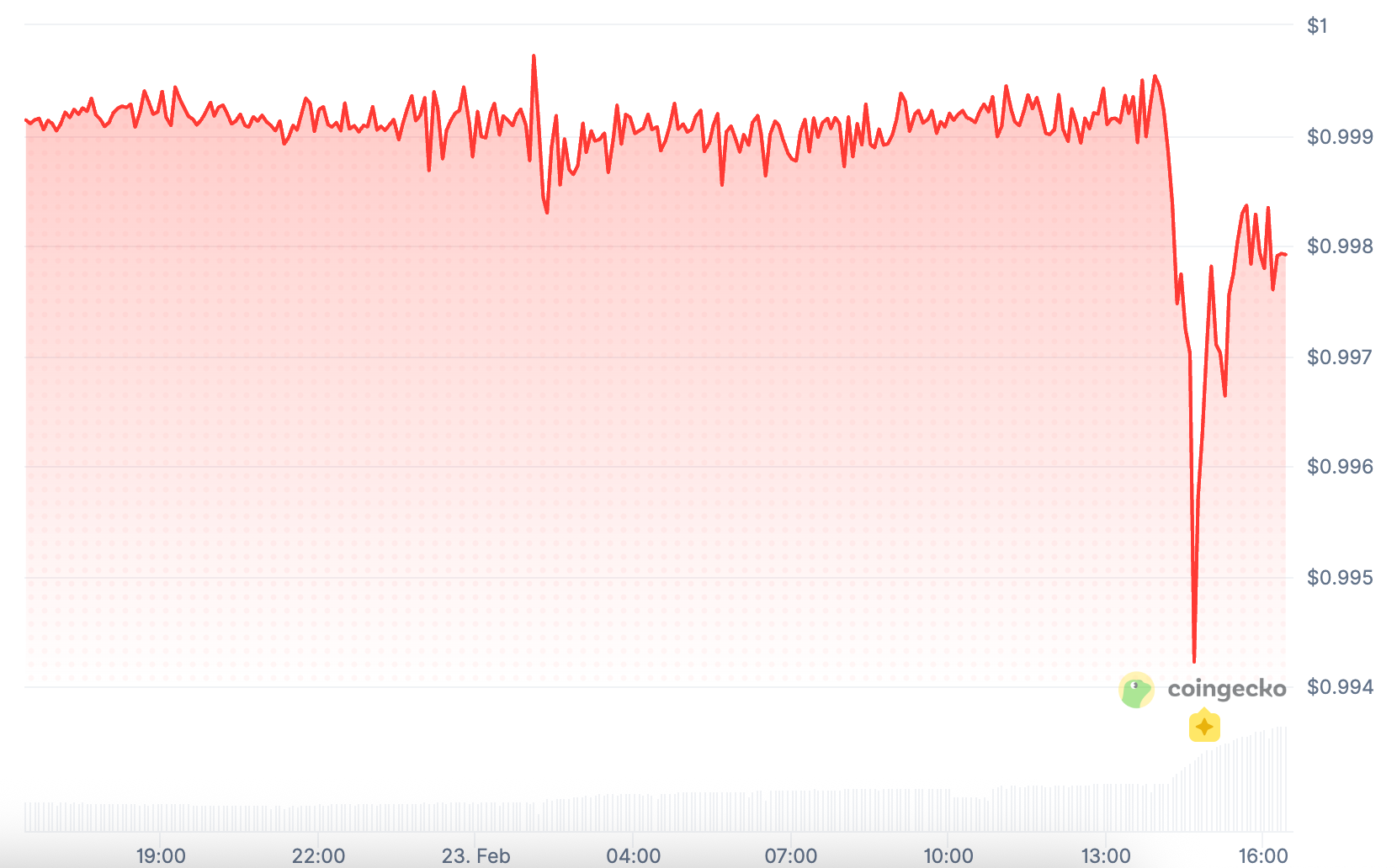

USDT reign over TRON has been impressive enough to assure the title of the ultimate stablecoin on TRON. Say no to sluggish transactions and exorbitant fees; on the contrary, TRON transacts on lightning speed for the smallest fee possible. With a network of bridges, it links up a wide, globally connected network. It is the express lane for anyone who needs to move value across borders smoothly and affordably.

Thanks for reading TRON Sees More Action as Stablecoins Power Its Network