The following is a guest post and analysis from Vincent Maliepaard, Marketing Director at Sentora.

With Bitcoin’s valuation crossing well beyond the $2-trillion mark, having over 50 million wallets of this digital gold is indeed galling for any opposition. But here’s the catch: unlike your dusty dollars sitting and earning just a pittance in the bank, Bitcoin charges you no interest just for holding it. Until now. Enter these two juicy new avenues aimed at changing the game by giving Bitcoin holders for the first time a chance to earn some passive rewards.

- Native Bitcoin “staking”– lock BTC in the Babylon protocol and earn fees.

Unlock the earning potential of your Bitcoin. Discover two pathways to generate consistent returns. Ready to explore how?

From Proof‑of‑Stake to Proof‑of‑Bitcoin

Imagine Bitcoin actually earning money for you. That will become a reality with the mainnet launch of Babylon in late 2024. Lock the BTC on Bitcoin’s blockchain and delegate it to Bitcoin-Secured Networks, which are to be considered hardworking partners. These networks will make your contribution in BTC fees and your rewards generate yield, currently elevated at around 1-2%. Let your Bitcoin work for you.

Following its launch last year, Babylon has been a great black hole for bitcoins-well over $4 billion worth have been sucked in, transforming the protocol into a staking supernova.

Key features

- No wrapping or bridges:BTC never leaves its native chain.

- Main risks:a protocol bug or “slashing” if a delegated validator misbehaves.

- Drawback:staked coins stay immobile until an unbonding timer expires.

Liquid staking: LBTC puts mobility back on the menu

Mugged by crypto lock-ups holding your assets hostage? Liquid staking is your getaway. Instead of your tokens locked in staking, you have free assets on your hands that can be traded and that represent your stake AND the future rewards. This is a true emancipation for your funds!

An example of such a liquid staking token for Bitcoin isLBTC from Lombard Finance

- 1:1 minting:stake BTC through Lombard’s Babylon contracts and receive LBTC on an EVM chain. (

Lombard

) *Seven‑day exit:burn LBTC to trigger the same unbond period as native Babylon staking,

about a week

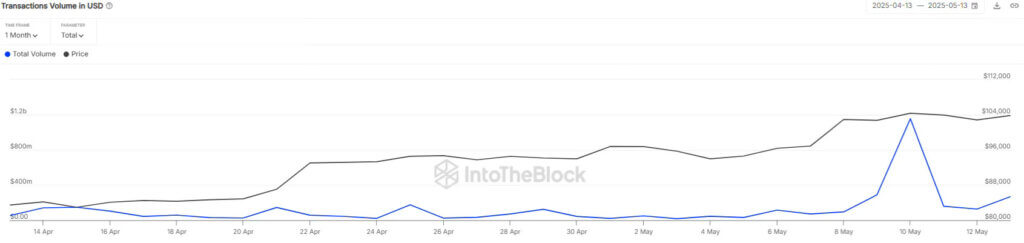

. Nonetheless, users can easily exit LBTC by trading it on DEXs. Phantom liquidity is not the thing here! The on-chain volume is thirsty for a refill of energy, flowing steadily at more than $200 million every day. Carry out big exits, like $30 million, without slippage. It is not liquidity; it’s portfolio-grade power.

- Custody trade‑off:holders must trust Lombard’s mint‑and‑burn smart contracts and the Babylon validator set.

LBTC is an asset that will not only make you staking rewards but also unleash the dormant potentials of your Bitcoins. Think of it as a financial transformer: Lock your BTC, mint LBTC, and then put that LBTC to work. Lend it in DeFi, trade it on a DEX, or use it as collateral-all while your original Bitcoin is still earning yield. That’s extreme capital efficiency.

Vaulting the yield curve

The Promise Is Real: Juicing Your Bitcoin with LSTs. But for a common investor, it might feel like deciphering some ancient script trying to recruit those returns from DeFi. It’s a labyrinth of protocols and strategies, and knowing where the risk lies or where the reward lies is the key to coming out with loot or just sucking into that mess.

Just putting it down in the basics: Your money is hardly on Autopilot. Tides change with the market to affect returns. To keep that APY juicy, you gotta have nimble fingers, changing the strats or making moves just to stay green.

But maybe there could have been a better way. Lombard rolls out a number of vaults that ease up the Bitcoin yield-generating process. Check out the new Sentora DeFi vault and see just how easy it is to maximize your Bitcoin earnings.

Created by IntoTheBlock and Trident Digital with a onetwo punch of power, Sentora has just launched aBTC Yield Vaulton Lombard that is rapidly drawing attention. Forget the garden variety staking returns. This vault takes in either wBTC or LBTC and pays out a targeted APY of about 6% – which is a juicy premium to the crypto holders.

How it earns the spread

Imagine a vault actually moving with trends off the market. It is like a self-driving portfolio with its algorithm shifting gears depending upon real-time conditions. No need for manual intervention and this would save you and your vault managers the daily chores. How does it do this? Imagine it as a wedding for strategies, all interplaying in some harmony. Just a few of the instruments in our orchestra are:

- Over‑collateralised lending– lends BTC‑derived assets on lending markets like Aave for interest.

- Pendle yield trading– splits and sells future yield streams, front‑loading extra return.

- Delta‑neutral borrows– borrows other assets such as stablecoins to deploy in delta-neutral high yield strategies

Each strategy is powered in real-time by Sentora’s DeFi risk engine-the very same one used extensively by Wall Street. It’s like autopilot for your portfolio: the engine automatically rebalances anything that strays outside your defined safety zone.

Risk‑reward snapshots

-

Native staking:tight risk surface, modest return. Ideal for cold‑storage purists who can tolerate lock‑ups. LBTC: Unlock base yield while keeping your tokens in play. Accept smart contract and bridge risks for boosted DeFi opportunities.

-

Sentora Vault:broader risk because multiple DeFi venues are involved, but mitigated by automated risk management and hedges.

What to watch next

Over price spikes, Bitcoin is evolving as a yield-generating asset. DeFi breakthroughs now enable holders to generate any returns they want based on their risk profile. The rise in Liquid Bitcoin (LBTC) volume suggests the opening of the floodgates for institutional players, presumably for a thrilling new Bitcoin staking innovation.

Thanks for reading Understanding Bitcoin yield: staking liquid staking tokens and vaulted strategies