Today, UNI is going from strength to strength, gaining over 10%. Everything else around it was bleeding. The DeFi darling fulfilled its promise of resilience and offered the few bright spots in an otherwise gloomy landscape.

As most major cryptocurrencies consolidate, UNI has extended its recent rally, reaching a new four-month high and reigniting bullish momentum.

UNI Rallies 40% to Four-Month High

The explosion into the scene of the UNI token by Uniswap occurred on June 10, 2020, when it shot up 40% to a four-month high of $8.66. If somebody ever had to compare it, it would be like a rocket launch! While it has softened a bit to $8.38, don’t be a fool to regard this. In just one day, it has realized a 17% increase. The bulls are charging, and the name UNI is at their front.

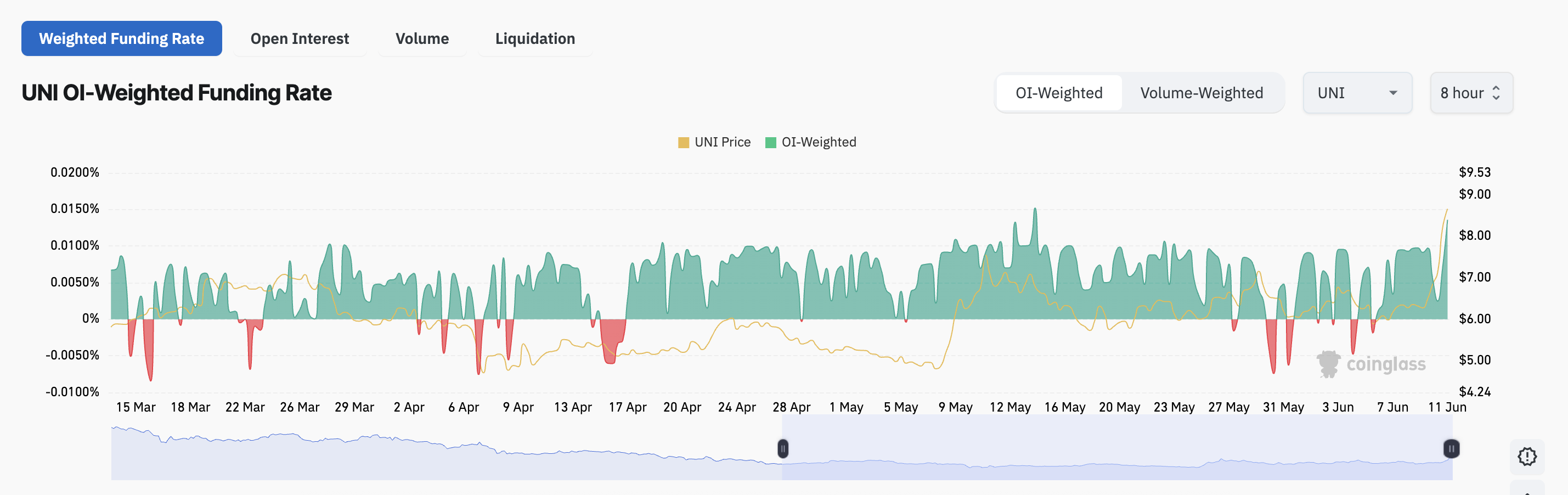

Fueling this upward surge? Consider: The funding rate is a major yardstick. It has surged until it hit a high for the month at 0.013% with Coinglass reporting, and the very indicator tells of a ravenous appetite for longs in the perpetual futures markets, implying that the traders are scared of betting heavily on the continued upward movement.

UNI Funding Rate. Source: Coinglass

Imagine trading in perpetual futures as a kind of tug-o-war between traders in a very fast-paced environment. The “funding rate” is the rope that keeps the futures price from drifting away too much from the actual asset value. So, imagine it as a balancing act: if the market tilts bullish. long positions pay short positions. The positive funding rate stands as a loud message from the market, “This asset is going up to the moon!” The longs are paying, meaning leveraged bullish bets are in very high demand.

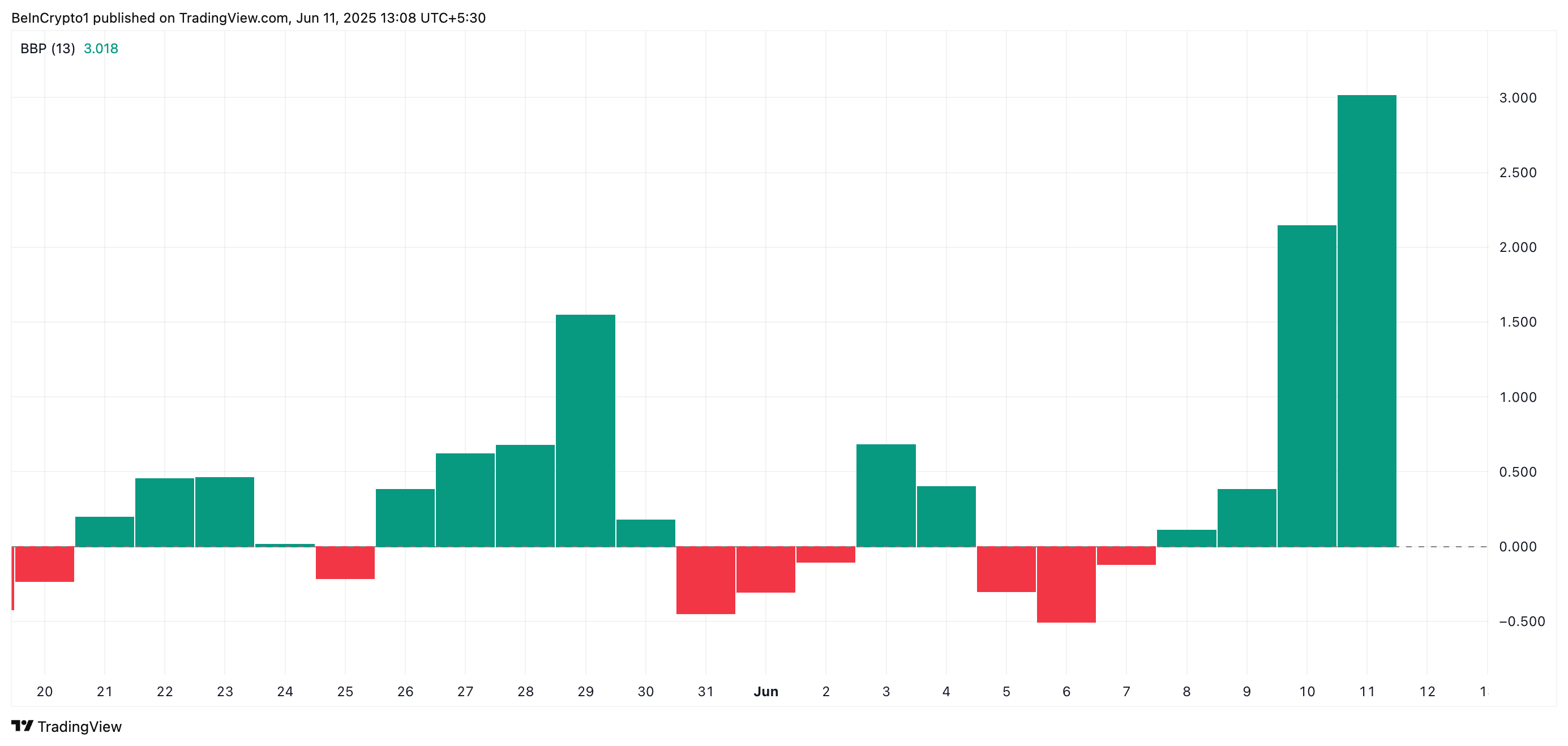

The Elder Ray Index from UNI suppose to add water to the fire and shout “BUY!” Tulip just showed the brightest green histogram bar of the last one month on the daily chart, a clear sign of increased buying pressure. Sitting at a bullish 3.01, the Index echoes what many in the market are feeling: UNI is going into the run.

UNI Elder-Ray Index. Source: TradingView

The back-and-forth nature of the market between bulls and bears is made apparent by this indicator. Imagine a beautiful setting of green histogram bars coming to life, declaring the victorious rally of bulls. This bullish dominance thus places UNI on the upside to be further ridden, at least for now.

Bullish Case for UNI Grows

It is ready for liftoff! With the surge of buying interest, the token might precede to ascend toward the $9.46 barrier that could be positioned as a strong launching pad. If it manages to break across such resistance, we might witness UNI ascending to $10.25, revisiting those heights that were never seen since February 17th. Time for lift-off!

However, this bullish dream could crumble with the swift entry of profit-taking. A fresh wave of selloffs threatens to bring UNI back down at $8.07, thus wiping out the gains it has so painfully made.

UNI Price Analysis. Source: TradingView

If this support fails to hold, the altcoin could face a steeper drop toward the $7.08 region.

Thanks for reading Uniswap Surges 40% to Four-Month High Defies Market Pullback