A strong surge in USDC is underway. Or does it? For Tether’s USDT still continues to reign as the premier stablecoin while Circle’s USDC is beginning to show its true teeth. So buckle up for 2025; this year is expected to see a huge rise in volumes and market shares for USDC. The race is on.

Dive inside Kaiko’s latest USDC report and learn about the fate of this stablecoin in the battle for market dominance. Data-driven insights reveal whether USDC can hold its standing or if its competitors will snatch away its crown.

Can USDC Overtake USDT on Centralized Exchanges?

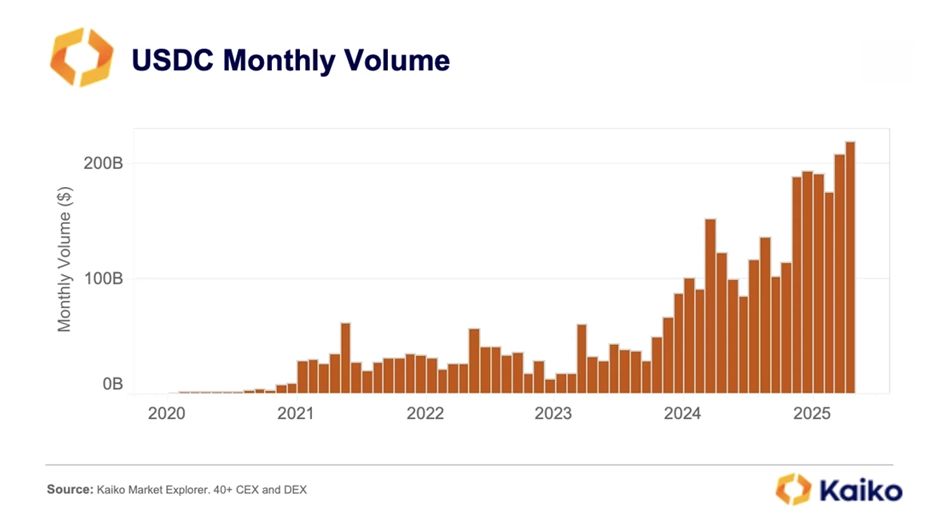

USDC has just set a record. Kaiko Research reveals April 2024 trading volume was a massive $219 billion more than twice January 2024’s $106.5 billion. Is it the calm before the storm, or is it the sound of a new era dawning?

USDC Monthly Volume. Source: Kaiko.

Binance did not simply hold the distinction of being the biggest crypto exchange worldwide; it was the very force behind USDC’s prospective global entry into the ranks of the truly pan-nationalistic currency. A landmark arrangement with Circle towards the end of 2024 catapulted Binance right into the 100-ton superhero category in the USDC universe: a great 57% share of USDC global trading volume was under this one entity alone.

USDC’s Binance Blitz: From underdog to rising star, USDC’s grip on Binance’s stablecoin market has doubled since last year, surging from a modest 10% to claim nearly 20% of the pie.

In contrast, USDT’s market share on Binance decreased from 75% at the end of 2024 to approximately 60% today.

The spike in volume and market share in USDC might be attributed to its power couple, an alliance with Binance which gave it access to a large user base.

Instead of merely going with the stablecoin trend, USDC pretty much surfed a big wave of regulatory approval that the advent of MiCA in Europe gave a green light to, thus causing accelerated demand for compliant digital currencies.

According to Kaiko, Binance hit the jackpot: ostensibly Circle paid $60 million upfront with another lottery of bonuses as a sweetener for the deal while polishing Binance’s image under highly stringent MiCA regulations in Europe.

Side by side, the attractiveness of dollar stablecoins varies in terms of their volume trading- with USDC in the clear lead when the argument is redundancy.

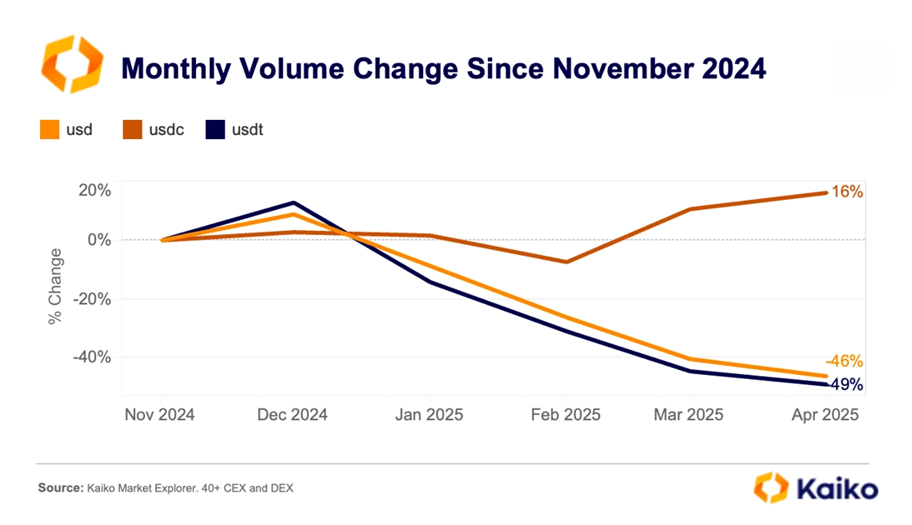

USDC, USDT Monthly Volume Change Since November 2024. Source: Kaiko.

Since November 2024, USDT’s monthly volume has dropped by 49%. In contrast, USDC’s volume has increased by 16%.

Risk aversion or a disinterested retail crowd, perhaps just a lack of speculative fire, are the words that Kaito used to make a stark observation about the crypto business. The general withdrawal that is happening in USD trades is reflected in the sharp fall of USDT trading volume on CEXs. “Kaito observes a fundamental market force at work-that is, the crypto-markets are unwaveringly risk-averse at this time.”

USDC might be gaining some ground, but USDT remains the king. Just as of May 2025, the colossal $152 billion market cap of Tether dwarfed that of USDC, and was 2.3 times larger than its own valuation three years prior. Stablecoins are in a race; however, USDT still leads heavily.

Meanwhile, USDC’s market cap is $60 billion, only 12% higher than its July 2022 level.

Tether’s USDT is the fundamental stablecoin and the greatest profit-making engine of the 21st century. The figure was $13 billion for USDT in 2024, whereas it was $155 million for Circle. But the bigger story is: USDT does more than merely compete on the exchanges-it helps out in cross-border payments and shows that it can hold its own in decentralized finance.

USDC and USDT dominate the stablecoin industry-for now. But the things are changing drastically. Some heavyweight entrants are coming for the title. PayPal, World Liberty Financial, Fidelity, Ripple, BlackRock, and Meta all want a piece of the stablecoin cake. The entire stablecoin industry is about to go through immense change.

Thanks for reading USDC Volume Hits New High – Is Tether’s Stablecoin Market Share at Risk?